How to do GST Audit Assessment

State GST Department Government of Kerala

Introduction

State GST Department is one of the most important departments entrusted with the responsibility of tax administration. The department deals with business houses, companies, dealers, Chartered Accountants, Cost accountants, Lawyers, tax practitioners, transporters, truckers, multiple stakeholders and people. As there are

lakshs of stakeholders dealt by the officers in the field and various other offices of the department, it builds huge pressure on all officers to deliver as per the expectations of all these stakeholders.

The Department administers Kerala Value Added Tax, Kerala General Sales Tax Act, Central Sales Tax Act, Luxury Tax Act, Money lending Act and Agriculture Income Tax Act and Goods and Services Act. It is a well known fact that the functioning of any department essentially depends on the capabilities and skills of human resource working in the department. The Department has developed a system of structured capacity building program. Through such continuous capacity building measures the officers in the department are getting trained and

are acquiring skills to achieve the main stated objective of revenue generation.

To support these efforts, the Department has taken initiative to develop How to do ……….series on various topics. This series covers all important themes so that all the officers will understand the importance of the particular subject and they will use the knowledge for improving the performance. It will also ensure uniformity in their

practice of laws and processes.

In this series, one of the important areas covered is ‘How to do …? Audit Assessment. This booklet will give some pointers and guidance to the officers. It is expected that officers at their individual level will do further reading and ensure the actions as per the law. The Officers may give their suggestions to improve the notes.

How to do…? Audit Assessment

Introduction:

Audit under GST is the process of examination of records, returns and other documents maintained by a taxable person. As per Rule 101 read with section 65 (1) of SGST Rules and SGST Act , the Commissioner or any officer authorised by him, by way of a general or a specific order may undertake audit of any registered person for such period at such frequency and in such manner as may be prescribed. The phrase Audit includes inspection, which includes access to the premises, collection and verification of books and records, and or assessment there on as a result of inspection.

The GST audit is an integral part of a GST compliance system. Auditing of the Tax payer is a vital link in the chain of tax administration. The main purpose of GST audit is to verify the correctness of turnover declared, taxes paid, refund claimed and input tax credit availed and to assess the compliance with the provisions of GST. To maintain a check and examine whether correct GST is being paid and the refund is claimed, certain taxable persons will be subject to audit under GST.

The objective of a GST audit is to close the gap between the tax declared by the taxpayer and the tax legally due. Broad audit coverage should have the dual purpose of maximizing revenue collection and ensuring voluntary compliance by providing a reasonable chance that defaulters will be identified and undeclared tax and interest, and penalties thereon collected.

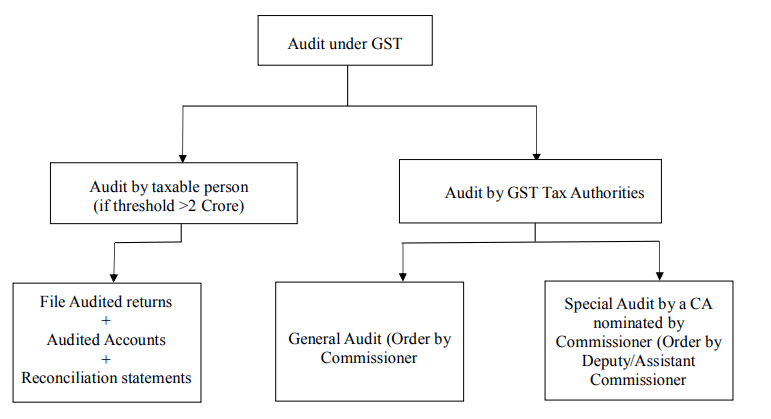

Types of Audit in GST

Audit by tax authorities

I Objectives of GST audit

The overall objective of audit is to bridge the gap between tax legally due to state and tax actually paid by tax payers. In other words, maximisation of Tax Revenue and improvement in self tax compliance by GST taxpayers. To achieve this, the following action is required.

a) Establishing:

1. That sufficient, complete and accurate record of the activities of the business are maintained by the taxpayers to enable the GST liability to be correctly determined

2. That the assets and liabilities recorded actually exist

3. That all the transactions of sales and purchase are recorded

4. That the valuation is being correctly applied

b) Ensuring that the taxpayer understands clearly the operation of the tax laws and the requirements of the system as it affects his business.

c) Assessing the degree to which revenue risks are present and, if there are any, what measures need to be taken to counter them.

d) Checking the accuracy of the GST return(s) filed and tax due paid thereon.

e) Ensuring that any further tax or refund due is correctly identified and accounted for.

f) Being alert for any possibility of fraud, determining the appropriate action required.

g) Drawing the GST taxpayer’s attention to any unsatisfactory features discovered and either noting them in the visit report for attention next time or, if of a serious nature, arranging a further visit in the near future to ensure that they have been corrected.

h) Ensuring that any unsatisfactory features discovered on an earlier visit have been corrected.

II Selection of Files for Audit

Following parameters can be adopted for selection of GST taxpayers for audit:

Taxpayers maintaining excess IPT continuously during the year

Taxpayers showing fall in taxable turnover in spite of increase in purchase continuously for two return periods.

Taxpayers showing low gross profit which is not in tune with the line of business.

Taxpayers whose Sale/Purchase ratio is less than 1.0 over last 12 months.

Taxpayers conceding substantial quantities of closing stock as compared to purchase and sales.

Works Contractors.

Manufacturing units showing G.P less than 10%

Taxpayers showing substantial changes in trade practices – eg:-excessive stock transfer, material decline in interstate purchases, material increase in exports/sales to exporters.

Taxpayers having Complex transactions such as Exports, Consignment sales,Branch transfers, Transit sales etc.

Based on Third party information like, Banks, Income Tax, Service Tax, Central GST, Manufactures, other Government departments etc.

Based on local intelligence or serious complaints from public

Taxpayers dealing in evasion prone commodities showing less growth by 10% from average growth rate in that area of circle jurisdiction.

Return defaulters and cancelled taxpayers having active transactions as per GSTN data.

III Preparation for Audit

Once the case is selected for Audit and an Authorisation by the Dy.Commissioner (Audit Assessment), nominating the Audit officers have been issued, the officers will have to prepare for the Audit. The officers referred to in subsection (1) of Section 65 may conduct audit at the place of business of the registered person or in their office as per section 65(2).

Section 65(3) insists that the registered person shall be informed by way of a notice not less than fifteen working days prior to the conduct of audit. The audit shall be completed within a period of three months from the date of

commencement of the audit. It means the date on which the records and other documents, called for by the tax authorities are made available by the registered person or the actual institution of audit at the place of

business whichever is later .

If the Commissioner is satisfied that the audit in respect of such registered person cannot be completed within three months, he may for the reasons to be recorded in writing, extend the period by a further period not

exceeding six months .

Risk analysis need to be done and the risk factors have to be identified. This includes scrutiny of data available in GST backend such as Invoice Verification, e-waybills mismatch found between GSTR 1, 3B and GSTR2A Closing stock statements annual return, audit statement, credit note, debit note, refund received, ITC claimed etc. The Compliance level of the taxpayer viz., belated filing and non filing of the returns and statutory documents to be verified. The taxpayer details should be checked for branches, commodities dealt with, present status, audit objections, Methods of Tax Payment opted by the taxpayer etc. The assessment records including Registration File, Assessments completed, Crime files/ OR files, notices issued, penalty imposed, Refund Application Pending/Granted etc. should be obtained from the respective office. Tax performance of the taxpayer for the past five years should also be analysed.

A Taxpayer Folder shall be prepared with as many as possible information/ inputs gathered from the available sources including external agencies. Gather all available information. This ensures that as detailed information as

possible and can be used for the actual audit, the information collected needs to be confirmed . Review all gathered information. This helps to identify whether or not the audit scope should be redefined. As this is the final step prior to the actual audit, the auditor must ensure that all key issues are addressed and that a risk hypothesis has been developed. As the auditor will now begin to develop a position, any necessary adjustments to the audit scope should be made.

Acquire basic knowledge about the nature of the trade or industry. In the case of a manufacturing concern, the officer should study the manufacturing activities involved, the raw materials used, the input – output

ratio etc. Necessary data for this may be gathered from the Department of Industries and Commerce, Rubber Board, Taxpayer community, Publications, Internet etc.

The officer should have a general awareness about the major suppliers to the taxpayer and his major buyers/clients, the peculiarity of the commodities dealt with by him viz., General Demand, Price and Gross Profit ratio prevailing in the market, Whether B2B or B2C Sales, Whether the Commodities dealt with are prone to misclassification / evasion, , Proceedings pursuant to previous Audit Visits, Pattern of Suppression detected by enforcement agencies during the previous years, Export Documents submitted etc.

Similarly Separate action plan should be devised for traders, manufacturers and Works Contractors, service providers. Construction sites can be visited to ascertain the progress in work / completion, number of units of Flats/ Villas etc.

Pre Visit discussion with the team members and the designated officer should be conducted in order to identify the core areas to be focused during the Audit Visit.

Separate action plan for the Principal Business Place and Branches/Godowns shall be devised based on the careful consideration of the materials in hand and the resources available. It has also to be decided as to whether the visit needs to be confined only to the principal place of business.

IV Drawing up an Audit Plan

The first step in creating an audit program is to develop an audit plan. Audit Plan is the most important stage before taking up audit verification. At this stage, the auditor is in a position to take a reasonable view regarding potential risk areas, abnormal trends and unusual developments, which needs detailed verification. The important steps comprised in an audit plan are as follows.

(1) Determine audit subject : to identify the area to be audited.

(2) Define audit objective: Identify the purpose of the audit .

(3) Set audit scope : Identify the specific systems, function or unit of the organization to be included in the review.

(4) Perform pre-audit planning:- Conduct a risk assessment, which is critical in setting the final scope of a risk based audit. It is a good practice because the results can help the IS audit team to justify the engagement and further refine the scope and preplanning focus. Interview the auditee to inquire about activities or areas of concern that should be included in the scope of the engagement. Identify regulatory compliance requirements.

Once the subject, objective and scope are defined, the audit team can identify the resources that will be needed to perform the audit .

(5) Determine steps for data gathering :- At this stage of the audit process, the audit team should have enough information to identify and select the audit approach or strategy and started developing the audit programme.

Some of the specific activities in this step are;

a) Identify and obtain departmental policies , standards and guidelines for review.

b) Identify any regulatory complaints requirements.

c) Identify a list of individuals to interview

d) Identify methods to perform the evaluation (including tools)

e) Develop audit tools and methoedology to test and verfy controls

f) Develop test scripts

g) Identify criteria for evaluating the test.

h) Define a methodology to evaluate the test and its results are accurate

Audit Plan is not a routine list of checks which can generally be exercised, but is an exact formulation of issues selected for detailed scrutiny in respectof a particular assesee on the aforesaid desk review and risk analysis base

on the above. As far as possible Audit Plan should be a clear plan of action and should be reduced to a format. It should be consistent with the scale of operation of an assesse and the reasons for selection.

How the issues are pin-pointed for an audit plan is illustrated below:-

(a) Under-valuation of taxable goods by excluding any specific component of gross amount charged.

(b) Suspected discounts.

(c) Misclassification between taxable and non taxable goods.

(d) Admissibility aspect in respect of capital goods for which ITC was availed.

(e) Discrepancy/deficiencies in billings evident from materials received from enforcement or otherwise.

(f) Low gross profit which is not in tune with the line of business.

(g)IPT/OPT ratio which is more or less equals to 1 for the last two years

(h) E-waybill transactions not accounted/ Unusual cancelation of e-waybills.

(i)Purchase or sales invoices not accounted.

(j)Unusual movement pattern of goods as per E-waybill/delivery chalan vis – a vis return particulars

(k) Variations between annual return with audited statements

(l) Information received from external agencies including Banks.

V Procedure for the conduct of Audit Visit

The procedures to be followed in conducting audit visit is prescribed in S.65 & 66 read with Rule.101 of CGST Act & Rules.

Obtain authorization for conducting Audit Visit from the Designated Officer

Issue Form GST ADT-01 notice to the taxpayer concerned intimating the date for audit, which should not be a date within fifteen days from the date of acknowledgment of the notice. Records to be produced at the time of

Audit visit should be specifically mentioned in the notice.

Visit taxpayer on the appointed date and conduct inspection and verification of Records.

On completion of the audit the proper officer shall inform the findings of audit to the registered person in accordance with the provisions of sub section 6 of Section 65 in Form GST ADT-02.

The audit officer should submit a report to the designated officer on the audit conducted at the business place of the dealer.

The designated officer should take appropriate decision whether to proceed under S.65 or not.

The audit conducted under sub section(1) results in detection of tax paid or short paid or erroneously refunded ,or input tax credit wrongly availed or utilised ,the proper officer may initiate action undersection 73 or section 74.

VI Conduct of Audit Visit

As per rule 101(2) read with section 65 ,the proper officer shall issue a notice in FORM GST ADT-01 minimum fifteen days prior to the commencement of audit in accordance with the provisions of the Act .

The actual procedure to be followed during audit visit may vary from trade to trade and from industry to industry and in service sectors depending on the purpose of the visit, size of the business, manufacturing process involved,

services provided, complexity of the accounts kept, reputation of the tapayer etc, which the officers may finalise, in consultation with the Dy. Commissioner (Audit Assmt.). But there are certain general points to be borne in mind while conducting audit visits. The proper officer authorised to conduct audit of the records and the books of the registered person shall, with the assistance of the team of officers and officials accompanying him, verify the documents on the basis of which the books of accounts are maintained and the returns and statements furnished under the provisions of the Act and the rules made thereunder, the correctness of turnover ,exemptions and deductions claimed ,the rate of tax applied in respect of the supply of goods or services or both, the input tax credit availed and utilised, refund claimed, and other relevent issues and record the observations in his audit notes

Note sheets and check notes: Keeping good note sheets is an essential component of an effective GST audit. If the auditor is to recollect what he has done at an audit, it is not sufficient to write up the notes at a later stage.

Once this practice is adopted it soon becomes a routine .Start each visit with the dealers details, date, where the visit took place, the time it started and subsequently finished and who was interviewed. Record precisely what has

been checked, nothing more and nothing less. Record any problems, in particular anything that appears fraudulent

Interview: . Perform a detailed and structured initial interview with the taxpayer. Record the information obtained from the taxpayer in the interview, and subsequently from the taxpayer’s records, in the note sheets.

Use the prepared basic questions as the start point for the interview and all other questions should come from these answers. The accounts will only show the auditor what the taxpayer wants him to see and what has been declared, any abnormalities will be highlighted from the interview. The audit team must conduct itself in a professional manner without giving any scope for complaints of harassment. Its conduct must be courteous and fair.

(a) The visiting officers should first contact the person in authority (director, manager, partner, proprietor etc.)

(b) The person contacted should be asked to confirm whether the taxpayer’s information available with the officer, is correct.

(c)Reasonable opportunity must be provided to taxpayer to produce relevant records and answer Audit team queries.

(d) The officer should ascertain, the problems, if any, faced by the taxpayer in complying with the provisions of law and should attempt to help the dealer with genuine problems.

Care should be taken not to answer hypothetical questions or to enter into arguments.

The officer should not also give answers on issues, if he is not sure about the correct answer. In such cases the officer should arrange to give answers in due course.

(e) The person in authority should be asked to nominate a person responsible for the maintenance of accounts and filing of returns to furnish the audit officers with the required information .

(f) The officer should ascertain the activities involved and inspect the business premises, Factory, warehouse etc to establish the equipment/ capital goods in use and the out puts produced by the taxpayer.

(g) Details available with the officer should be cross verified with reference to the records maintained by the taxpayer to see whether the statements already furnished tally with the accounts kept.

(h) The officer should examine whether goods have been utilised for nonbusiness purpose and if so whether liability to reverse tax has been conceded

(i) The officers should also examine whether the deduction claimed as discounts is actually permissible.

(j) The audit team should verify the invoice to see whether the rates applied are correct, whether the taxpayer is keeping parallel set of tax invoices, tampering with/., whether there is non disclosure of place of business/godown, whether there is false claim of exempted sales, exports, Interstate sales, Interstate stock transfer (OUT)etc.

(k) All auditing checks should be completed on the basis of test-checking and sampling techniques. The test checks should commence in the risk areas by selecting a particular tax period.

(l) If the results are satisfactory, move on to the next area for testing; if unsatisfactory, the checks should be extended to identify the full and accurate extent of tax evasion, so that an assessment is soundly based, and will stand the test of review/ appeal. Select any transaction by sampling method and trace its movement from the beginning through various sub systems. The auditor should verify this transaction in the same sequence as it had moved. By this method the auditor can get a feel of the various processes and their inter linkages.

(m)The team may take extracts from the accounts or other records which, in the opinion of the officer, are to be included in the taxpayers folder. Auditors can also authenticate the accounts / records / documents evidencing the

transactions by putting theirsignature so as to ensure that the records / evidence is not destroyed or altered.

Details of accounts / records / documents authenticated should be recorded in the note sheet.

(n) The officer should verify whether the taxpayer is adopting any dubious methods for evading tax which, in the opinion of the officer, would necessitate a further detailed investigation or inspection. In such cases the officer should not seek any clarification from the taxpayer (as evidences may be lost) nor should he mention anything in the reports. This should be kept confidential for further confidential investigation or for making any surprise inspection. However, such matters should be reported in writing to the immediate superior and the Dy. Commissioner (Audit Asst) .

(o) The Audit officer should also inspect the stock of goods, verify the receipt, and consumption of raw materials, records relating to placing and receipt of orders for goods etc.

(p) Any other useful information concerning the taxpayer should be noted.

(q) On conclusion of audit the Audit officer should again meet the person in authority and thank him for the cooperation. He should also be informed of the defects noted during audit and the steps to be taken for rectification.

Indications about malpractices, forgery etc noticed should not, however, be given, since further verification or investigation may be adversely affected.

(r) Where there is a lack of cooperation, failure to provide information or any unusual circumstances, like suspicion of huge stock variation etc. the auditor should consider about referring the case to Intelligence wing.

Important areas of Audit

1. Auditing of inputs:

a. Obtain records of all taxable purchases from Normal GST taxpayers.

b. Obtain records of all taxable purchases from registered taxpayers other than normal GST taxpayers (composition tax payers) and un registered dealers.

c. Obtain records of all out of state inward supplies

d. Obtain records of all imports from outside the country

e. Obtain records of all non-taxable supplies

f. Obtain records of all branch transfers/consignment notes.

g. Identify all input figures (value & tax) from the taxpayer account. Compare the figures with the GST return.

h. Identify source documents – Original tax invoices, and debit and credit notes. Check entries in records to source document on a sample basis.

i. Check stock on hand and capital goods for evidence that goods shown in purchase records are on hand.

j. Check manufacturing records to establish that goods in purchase records have gone into production.

k. Check cash records for evidence of payments

l. Check bank statements.

m. Check GSTR 3B in relation to GSTR 1 and GSTR 2A.

n. Check particulars of invoice

o. Reversal of input tax credit for non payment in 180 days

p. Review e- wybill and match with invoices.

The above checks are not exhaustive and officers should complete any additional audit checks considered to be relevant

2. Auditing of outputs:

A process of audit checks the adequacy & effectiveness of the process of controls established by procedures, work instructions, flowcharts, training & process specifications. By its very nature auditing implies an action such as transforming inputs into outputs.

a. Obtain records of all taxable outward supplies at each tax rate

b. Obtain records of all zero-rate outward supplies, international exports and

inter-state outward supplies.

c. Obtain records of all exempted outward supplies.

d. Obtain records of all branch transfers / consignments notes

e. Compare the outward supply figures in GST accounts with that in returns.

f. Check the outward supply price – check whether freight, pre-sale expenditure is forming part of the output or not .

g. Verify the deductions from value of supply like discounts, rebates.

h. Identify source documents – tax invoices, debit & credit notes- Check entries in records to source documents on a sample basis – selected periods/ selected items.

i. Check manufacturing records such as daily stock register stocks records and delivery records.

j. Require production of own use goods record. Verify content and accuracy.

k. Establish the basis of discounts and promotional offers.

l. Check records of consignment sales and branch transfers. Suppression of these transactions will increase the amount of input tax that can be claimed.

m. Check liability of all items claimed to be exempted

n. Check Bank accounts and ensure that the details in the basic records agree with the deposits, transfer and withdrawals.

The above checks are not exhaustive and officers should complete any additional audit checks considered to be relevant.

3. Auditing of stock:

a. Stock taking can be resorted to in cases of taxpayers dealing in retail shops or traders of evasion prone goods like plywood, timber, electrical goods, marble, Tiles, Iron &Steel and glass etc.

b. Stock taking need not be resorted to in all audits. Stock taking may not be feasible in audits of a manufacturing company or a big distributor or a limited company with many branches.

c. Excess in stock would indicate purchase made without proper bills. ie, purchase suppression and any deficit in physical stock is attributable to the possible suppression of output or outward supply of goods.

4. Auditing of final accounts

Indicative list of items to be examined in the Trial Balance / Profit and Loss Account / Balance Sheet / Audit Report.

The perusal of the Trial Balance could achieve the following:

a. Familiarization with chart of accounts/account code and understand as to what extent the information is detailed and integrated with other subsystems; few sample Journal Vouchers may also be seen to understand the information mentioned therein.

b. Understand the grouping of sub accounts under main accounts for the purposes of summarization into Profit and Loss account and the Balance Sheet.

c. Identification of accounts, which have a prima facie relevance for tax payment (may be direct or indirect). These accounts may have to be seen in detail at later stage of audit depending upon the result of subsequent

audit processes;

d. Understand the tax accounting system in so far as it pertains to Tax payment and treatment of ITC;

During the study of the Trial Balance/ Profit and Loss Account the following areas could be studied in detail,-

a. All income accounts in the Profit and Loss Account:

Normally, the Profit and Loss Account would show a consolidated entry for business income from all sources. According to accounting standards, nonbusiness income such as interest income or dividend income is required to

be shown separately.

To begin with, Audit Officer should call for the groupings of business income shown in the Profit and Loss Account. The said groupings would show the different heads under which the incomes have been accounted for. They

should carefully study the nature of business income – some of which may have accrued from the outward supply of taxable goods and the balance from the outward supply of non-taxable goods. The exact nature of these may be determined from the supporting documents such as Vouchers, bills or contracts. etc.

Expense Accounts:

Scrutiny of expense accounts would enable the Audit Officer to identify major expenditure heads. like freight, salaries, utility expenses, business promotional expenses, wages with reference to muster rolls. In specific terms,

such scrutiny may be useful to identify any escaped turnover and business viability

Similarly, the perusal of the Balance Sheet could reveal, accounting principles/policy and notes on accounts and sale of fixed assets.

On completion of the Audit Visit, the Audit Officer should submit a report on audit to the Dy. Commissioner (Audit Assmt) concerned and the Dy. Commissioner should take appropriate decision whether to proceed under or not.

FINDINGS OF AUDIT

On conclusion of an audit,the officer will inform the taxable person within 30 days of

a. the findings

b. their reasons ,and

c. the taxable persons’ rights and obligations

If the audit results in detection of unpaid/short paid tax or wrong refund or wrong input tax credit availed, then demand and recovery actions will be initiated.

VII Audit Assessment

All cases audited may not lead to assessment. The procedure in completing the assessment resulting from Audit is dealt with by Sections 60,61, 62,63 and 64 of SGST Act 2017 read with Rules 98,99 and 100 of SGST Rules 2017.

Audit assessment will be justified in the following situations:

Where the details furnished in the return are found to be incorrect, either because output tax reported is too low or because input tax claimed is too high.

Where the taxpayer cannot produce records to substantiate the outward supplies, inward supplies, closing stock, or claims of input tax, exemption or refund.

1. Deduction is claimed in respect of discount where discount had not actually been given or where the discount is not allowable.

2. Exemption has been wrongly claimed or where taxable outward supplies are misclassified as non-taxable outward supplies or outward supply of goods/services taxable at higher rate are miclassified as that of goods/service taxable at lower rate.

3. Goods are appropriated for non-business purposes; but no reverse tax is admitted.

4. Purchase suppression or sales suppression is detected.

The procedure prescribed under section 65 read with Rule 101 shall be strictly followed in completing the assessments.

The natural justice shall be strictly complied with. Any assessment shall be preceded with pre-assessment notices clearly specifying the irregularities or defects noticed and the manner in which the assessment is proposed to be completed. The officer should ensure that the notice is duly served on the taxpayer properly. In case the notice cannot be served in person or by post either in the business address or in the residential address, it should be served by affixture in the last known address of the taxpayer.

The reply if any filed by the taxpayer shall be judiciously considered and if necessary the proposal should be amended if the officer finds some/all of the taxpayers assertions are justified; and speaking orders should be issued accordingly

If no response is received after 15 days on serving such notice the proposal should be finalized on the basis of the material available on records and orders should be issued.

Interest U/s.50 of the KVAT Act, on the under declared tax should be calculated for each return period at the rate of 1% for each month or part of the month, from the due date to the date of order.

While finalizing such assessments the officers should ensure that when best judgment assessment is done for more than one return period after the expiry of the year in which the return period falls, the assessment should be made by a single order. What is contemplated is not an annual assessment; but a single order narrating assessment for each return period. However only a single demand notice need be issued for the demand created in the block assessment order.

SPECIAL AUDT

Rule 102 read with section 66 of the CGST Rules and Act stipulates that at any stage of scrutiny, inquiry, investigation or any other proceedings before him, any officer not below the rank of Assistant Commissioner, having regard to the nature and complexity of the case and the interest of revenue, is of the opinion that the value has

not been correctly declared or the credit availed is not within the normal limits, he may, with the prior approval of the Commissioner, direct such registered person by the communication in writing to get his records including books of account examined and audited by the chartered accountant or a cost accountant as may be nominated by

the Commissioner.

The Assistant Commissioner may initiate the special audit, considering the nature and complexity of the case and interest of revenue. If he is of the opinion during any stage of scrutiny/inquiry/investigation that the value has not been correctly declared or the wrong credit has been availed then special audit can be initiated. It can be

conducted even if the tax payer’s books have already been audited before. The special audit will be carried out by a chartered accountant or a cost accountant nominated by the Commissioner. The audit report will be submitted within 90 days. This may be further extended by the tax officer for 90 days on an application made by the taxable person or the auditor. https://taxheal.com

The taxable person will be given an opportunity of being heard in findings of the special audit. If the audit results in detection of unpaid /short paid tax or wrong refund or input tax credit wrongly availed then demand and recovery actions will be initiated.

NOTICES FOR AUDIT BY TAX AUTHORITIES

Form GST A[See rule 101(5)]DT – 01

[See rule 101(2)]

Reference No.: Date:

To,

————————–

GSTIN …………………………………….

Name ………………………………………

Address ……………………………………

Period – F.Y.(s) – ……………………………..

Notice for conducting audit

Whereas it has been decided to undertake audit of your books of account and records for the financial year(s)……….. to in accordance with the provisions of section 65. I propose to conduct the said audit at my office/at your place of business on …..

And whereas you are required to:-

afford the undersigned the necessary facility to verify the books of account and records or other documents as may be required in this context, and

furnish such information as may be required and render assistance for timely completion of the audit.

You are hereby directed to attend in person or through an authorised representative on

………………….. (date) at……………………………(place) before the undersigned and to produce your books of account and records for the aforesaid financial year(s) as required for audit.

In case of failure to comply with this notice, it would be presumed that you are not in possession of such books of account and proceedings as deemed fit may be initiated as per the provisions of the Act and the rules made thereunder against you without making any further correspondence in this regard.

Signature …

Name

Designation ……………………….

Form GST ADT – 02

[See rule 101(5)]

Reference No.: Date:

To,

————————–

GSTIN ………………………………..

Name ……………………………………

Address ………………………………….

Audit Report No. ……….. dated ……..

Audit Report under section 65(6)

Your books of account and records for the F.Y ……has been examined and this Audit

Report is prepared on the basis of information available / documents furnished by you and the findings are as under:

| Short payment of | Integrated tax | Central tax | State /UT tax | Cess |

| Tax | ||||

| Interest | ||||

| Any other amount |

[Upload pdf file containing audit observation]

You are directed to discharge your statutory liabilities in this regard as per the provisions of the Act and the rules made thereunder, failing which proceedings as deemed fit may be initiated against you under the provisions of the Act.

Signature …

Name

Designation ……………………….

NOTICES FOR SPECIAL AUDIT

Form GST ADT – 03

[See rule 102(1)]

Reference No.: Date:

To,

—————————————————-

GSTIN …………………………………….

Name ………………………………………

Address ……………………………………

Tax period – F.Y.(s) – ……………………………..

Communication to the registered person for conduct of special audit under section 66

Whereas the proceedings of scrutiny of return /enquiry/investigation/ are going on;

And whereas it is felt necessary to get your books of account and records examined and audited by. (name), chartered accountant / cost accountant nominated by the Commissioner;

You are hereby directed to get your books of account and records audited by the said chartered accountant / cost accountant.

Signature …

Name

Designation ……………………….

Form GST ADT – 04

[See rule 102(2)]

Reference No.: Date:

To,

————————————————

GSTIN ………………………………..

Name ……………………………………

Address ………………………………….

Information of Findings upon Special Audit

Your books of account and records for the F.Y.…………… has been examined by – ————

— (chartered accountant/cost accountant) and this Audit Report is prepared on the basis of information available / documents furnished by you and the findings/discrepancies are as under:

| Short payment of | Integrated tax | Central tax | State /UT tax | Cess |

| Tax | ||||

| Interest | ||||

| Any other amount |

[Upload pdf file containing audit observation]

You are directed to discharge your statutory liabilities in this regard as per the provisions of the Act and the rules made thereunder, failing which proceedings as deemed fit may be initiated against you under the provisions of the Act.

Signature …

Name

Designation ……………………….

Disclaimer: All officers are advised to go through the GST laws and Rules for their statutory compliances. These are guidelines for officers to understand the processes and important aspects to be kept in mind while conducting the Audit assessment.

Acknowledgment

This booklet will give guidance to all officers regarding the audit assessment. It is expected that the officers will read GST laws and Rules and gather more knowledge to conduct an effective audit assessment.

I appreciate the works done by Smt S Lena Asst Commissioner and Shri Mansur M I Dy Commissioner Int Audit and others for the use during VAT regime. Later the note is customized for the use in GST regime by Smt Jayakumari STO GST Cell. I also appreciate the contribution of other officers for giving suggestions and guidance for preparation of this document.

Dr Rajan Khobragade

Prl Secretary & Commissioner

State GST Department.

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal