How to register on Traces as Deductor

1 Brief Steps for Deductor Registration and Login.

2. Important Information on Deductor Registration and Login.

3. Pictorial Guide for Deductor Registration and Login

Brief Steps for Deductor Registration and Login

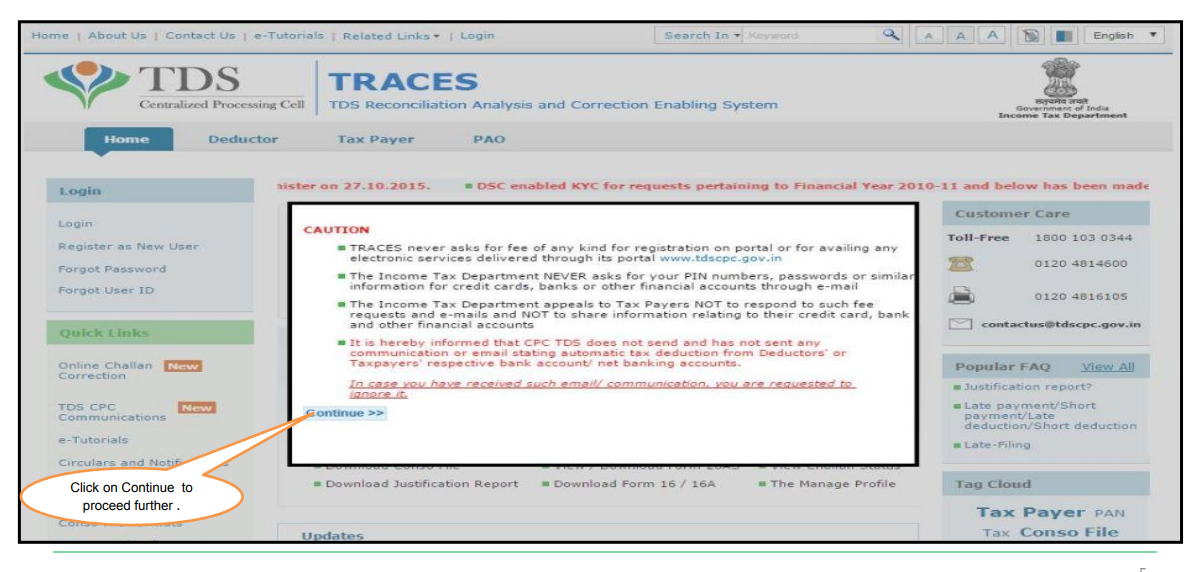

Type in url www.tdscpc.gov.in in the address bar of the browser to access the TRACES website , TRACES homepage will appear , click on “Continue” to proceed further.

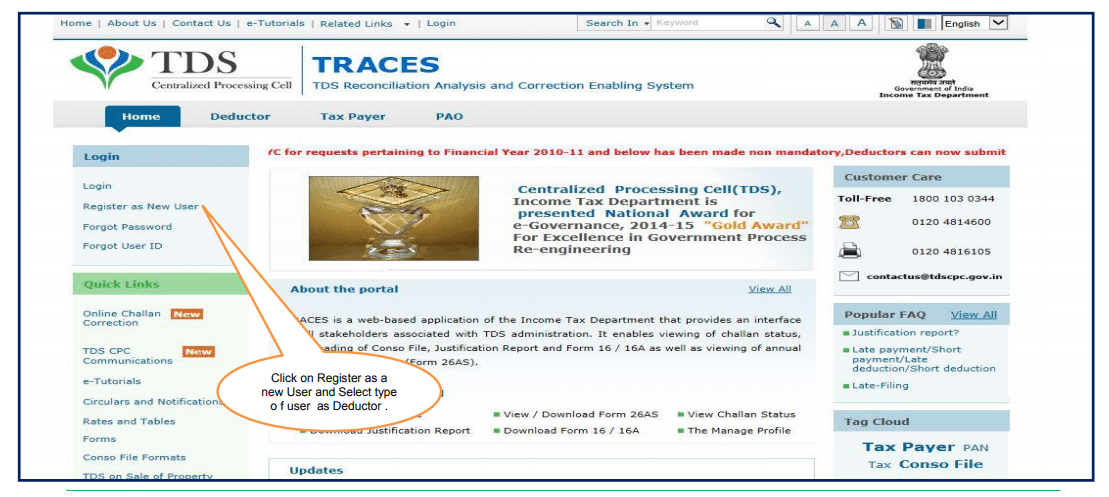

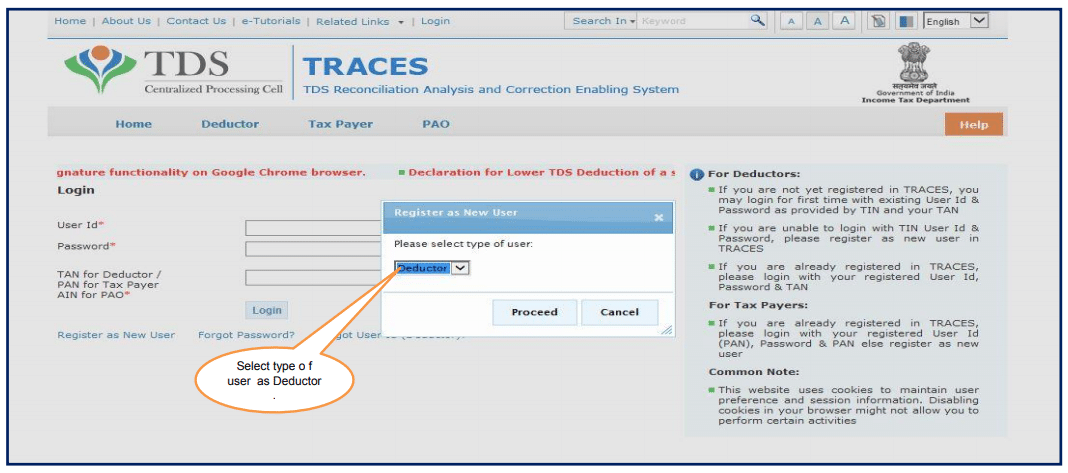

Click on “Register as New User” tab, Select “Deductor” as the type of user and click on “Proceed”.

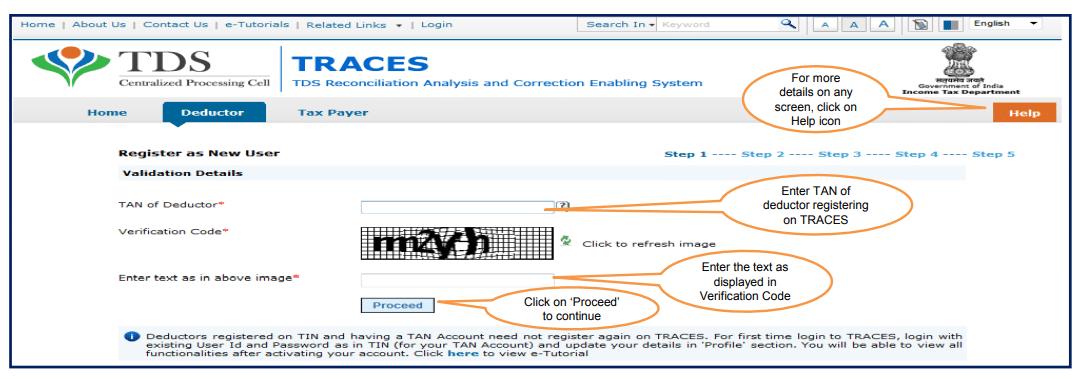

Step 1 : Provide “TAN Number” in the respective allocated tab followed by capcha code to proceed further.

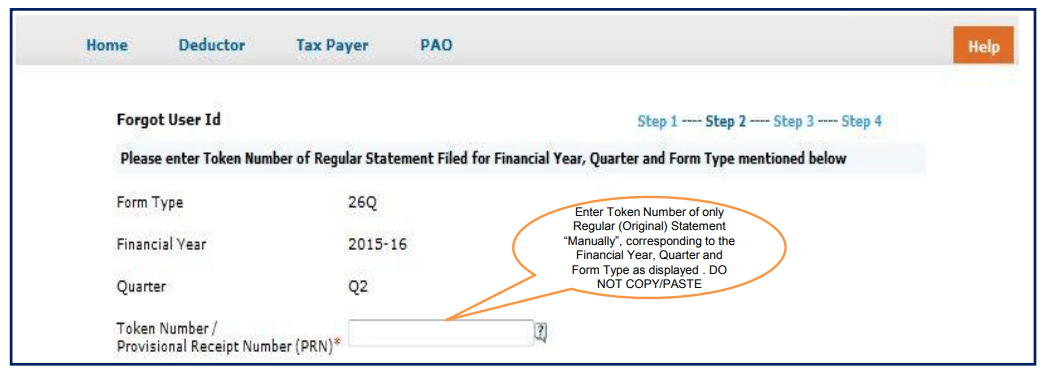

Step 2: Financial Year, Form type and Quarter for which KYC required will be auto populated. Enter Token Number of the Regular (Original) Statement only, corresponding to the Financial Year, Quarter and Form Type displayed. Enter CIN/ PAN details pertaining to the Financial Year, Quarter and Form Type displayed on the screen on the basis of latest correction statement filed by you. Please DO NOT copy /paste the data .

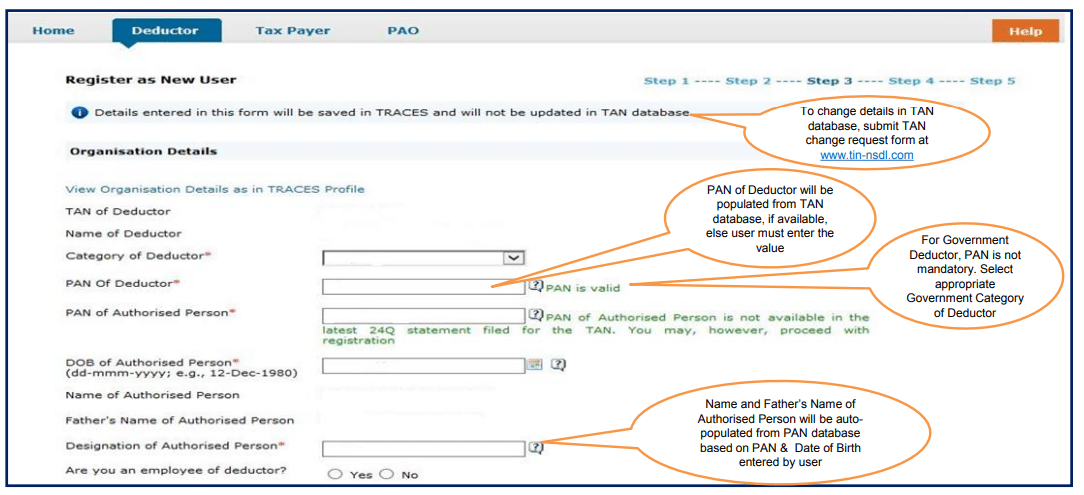

Step 3 : Deductor is required to fill Organization details such as “Category of Deductor, PAN of deductor, PAN of Authorised person and Date of Birth of Authorised person etc. to proceed further. For Government Deductor, PAN is NOT mandatory”.

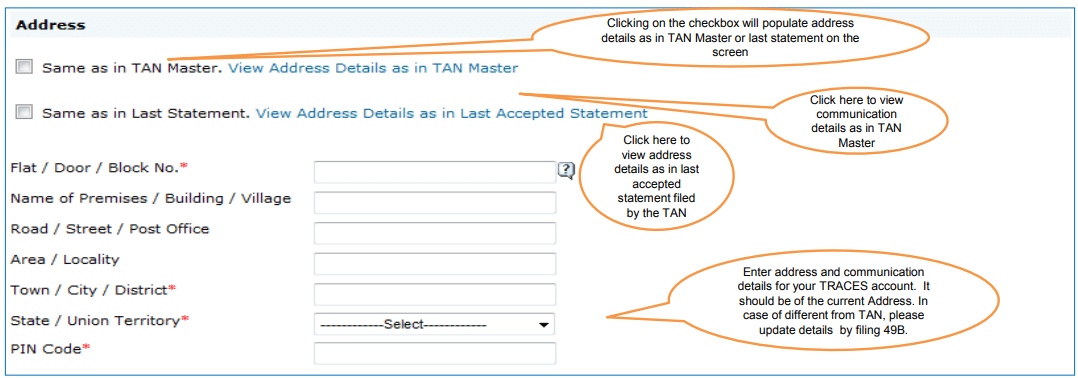

At Step 3, you will get option to choose Communication Address Details as per TAN Master or as per Last

Statement Filed.

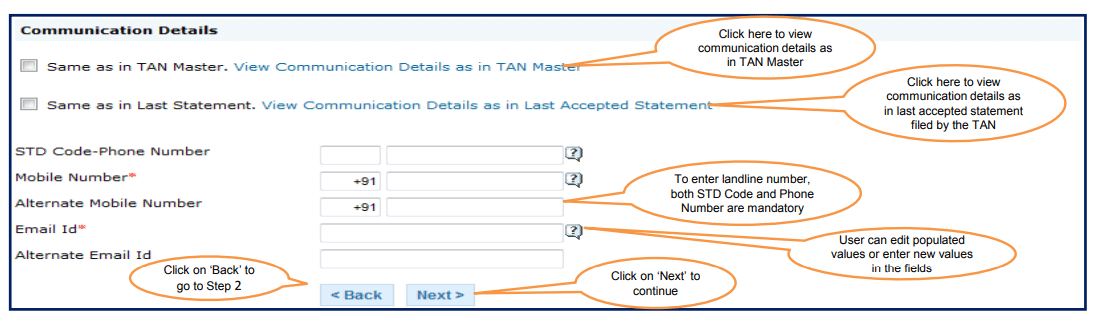

At Step 3, you will also get option to fill Mobile number/Alternate Mobile Number/Email ID/ Alternate Email ID.

Please Note: Fill in the correct Primary Mobile number and E-mail ID to receive the activation link and codes ,

as user needs to activate the account within 48 hrs of Registration.

Step 4: Deductor is required to create his/her User Id (Check the Availability while creating the user ID) along with the password to proceed further.

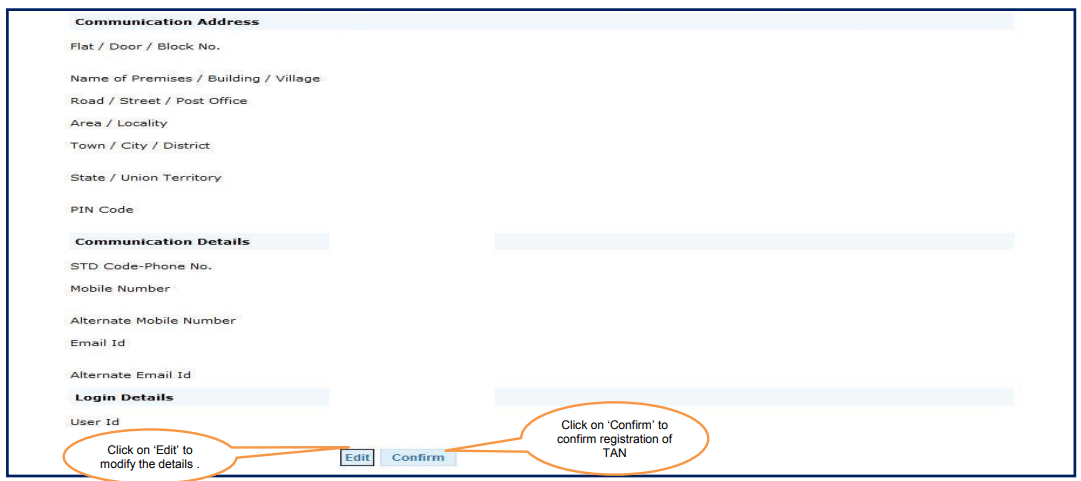

Step 5 : Deductor details can be seen on the Confirmation Screen , Deductor can still edit the details if required or else can click on “Confirm” for successful registration on TRACES website.

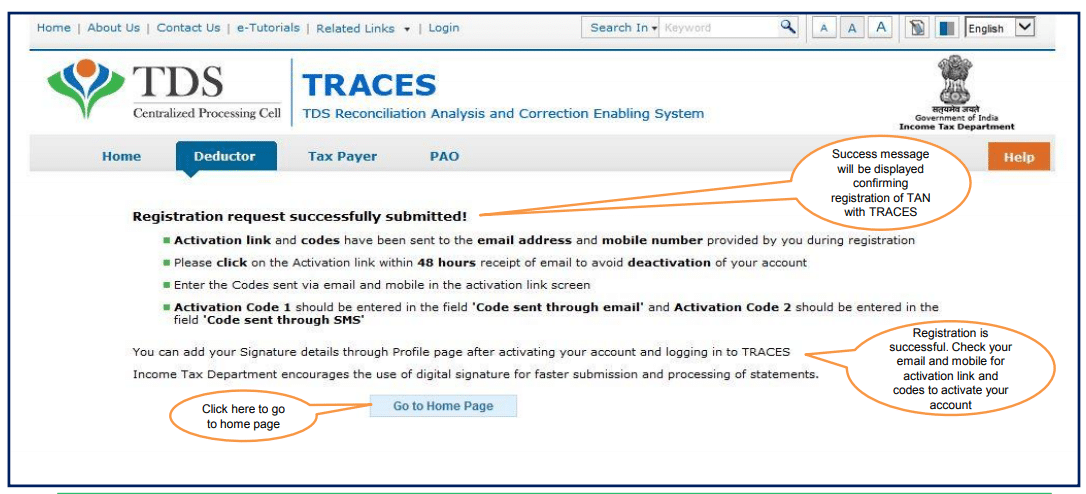

After completion of all above steps, “Registration request successfully submitted ” message will appear on the screen . Deductor will receive activation link followed by activation code on registered “Email ID and Mobile number” , which can be used for activation of account.

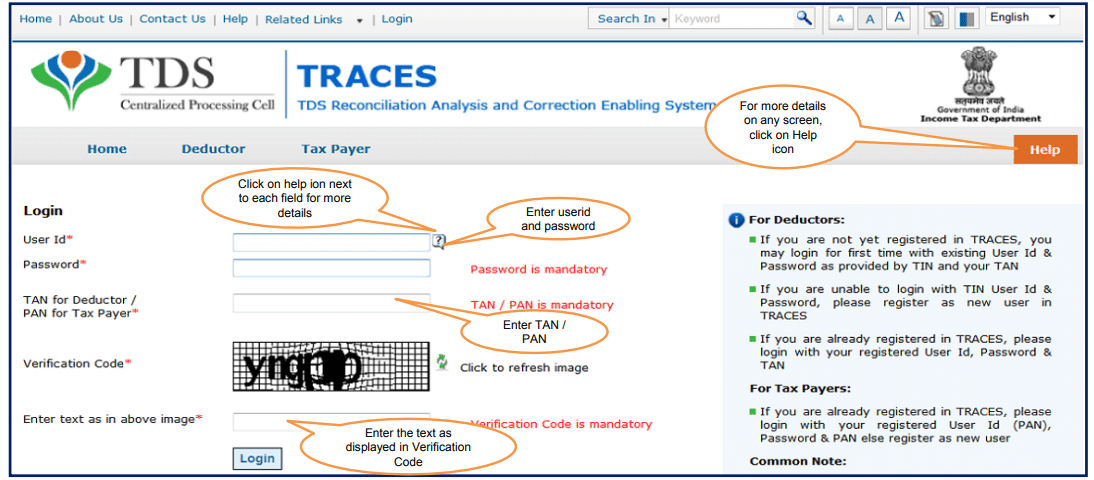

After successfully activation of account within 48 hrs of registration , user will be able to Login on TRACES website by entering the User id , Password , TAN of the Deductor and the verification code.

Important Information on Deductor Registration and Login

A TAN can be registered on TRACES only Once.

Deductor must ensure that a Non – Nil statement was already filed and should be processed at the time of registration on TRACES. Nil Statement are those statement where there is reporting of BIN/Challan with “0 “amount in the statement.

This e-tutorial will provide guidance to fill correct KYC details while doing Registration on all Steps. Enter Token Number of the Regular (Original) Statement only, corresponding to the Financial Year, Quarter and Form Type displayed. Please DO NOT copy/paste the data.

Enter CIN/ PAN details pertaining to the Financial Year, Quarter and Form Type displayed on the screen on the basis of latest correction statement filed by you

This e-tutorial will provide guidance to choose compatible browser while accessing TRACES web portal . Recommended Browser versions are listed below :

Internet Explorer Version – 8, 9, 10

Chrome Version – 23 and above

Mozilla Firefox Version – 17 and above

After successfully registration and activating the account, deductor would be able to access all the functionalities available for Deductors. e.g. ( view profile, downloading, online and offline correction etc.).

Pictorial Guide for Deductor Registration and Login

Website to register as Deductor of TDS

Type in url www.tdscpc.gov.in in the address bar of the browser to access the TRACES website , TRACES

homepage will appear , click on “Continue” to proceed further.

Click on “Register as New User” tab.

Select “Deductor” as the type of user and click on “Proceed”.

Step -1

Step 1 : Provide “TAN Number” in the respective allocated tab followed by capcha code to proceed further.

Following could be the reasons for getting an error ‘Invalid Details’ or ‘Your TAN is not available in the TAN master’ error:

-You have not filed any statement in last eight quarters

-You have filled only Nil statement

Statement filed is not processed by TRACES

Invalid TAN

Step 2

Financial Year, Form type and Quarter for which KYC is required will be auto populated.

Enter Token Number of the Regular (Original) Statement only, along with CIN/BIN details and PAN details

pertaining to the Financial Year, Quarter and Form Type displayed on the screen.

Guidelines for Clearing the KYC

• Authentication code is generated after KYC information details validation, which remains valid for the same calendar day for same form type, financial year and quarter.

• Token Number must be of the regular statement of the FY, Quarter and Form Type displayed on the screen.

• CIN/BIN details must be entered for the challan/book entry mentioned in the statement corresponding to the FY, Quarter and Form Type mentioned above.

• Government deductor can enter only Date of Deposit and Transfer Voucher amount mentioned in the relevant Statement.

• Amount should be entered in two decimal places (e.g., 1234.56).

• Only Valid PAN(s) reported in the TDS/TCS statement corresponding to the CIN/BIN details in Part1 must be entered in Part 2 of the KYC. Guide available on the screen can be referred for valid combinations.

• Maximum of 3 distinct valid PANs and corresponding amount must be entered.

• If there are less than three such combinations in the challan, user must enter all (either two or one).

• CD Record no. is mandatory only in case of challan is mentioned more than once in the statement.

Examples of Unique PAN and Amount combination:

Condition 1 : – If statement contains 3 deductee rows with same PAN AAAAA0000N and corresponding amount against deductees are :

1000.00, 1000.00 and 2000.00, then deductor need to fill details like :

a) AAAAA0000N 1000.00

b) AAAAA0000N 2000.00

Condition 2: – If statement contains 4 deductee rows with PAN AAAAA0000N and corresponding amount against deductees are : 1000.00,

1000.00 , 1500.00 and 2000.00, then deductor need to fill details like :

a) AAAAA0000N 1000.00

b) AAAAA0000N 1500.00

c) AAAAA0000N 2000.00

Note: For Further guidance please refer Guide 1 and Guide 2 available on TRACES portal.

Step 3

Deductor is required to fill in the Organization details

Step 3: Important Notes

•PAN status should be active at the time of registration.

• PAN status can be checked at Income Tax Department website (www.incometaxindia.gov.in).

• In case of individual and proprietor, PAN of deductor and PAN of authorized person may be same. In all other cases PAN of deductor and

PAN of authorized person may be different.

• Only an individual can be the authorized person. Accordingly the 4th character of PAN should be “P”

Step 3 (Contd.): Deductor needs to select the Address from TAN Master or Latest Statement Filed.

•Details entered here will be saved only in TRACES and will not be updated in TAN database.

•To change details in TAN database, submit TAN change request form at www.tin-nsdl.com

Step 3 (Contd.): Deductor needs to select the Communication details from TAN Master or Latest Statement Filed .

• Details entered here will be saved only in TRACES and will not be updated in TAN database.

• To change details in TAN database, submit TAN change request form at www.tin-nsdl.com .

• In case incorrect communication detail and address detail are submitted , wait for 48 hours. Once ,account gets deactivated, try to register again as new user with correct details

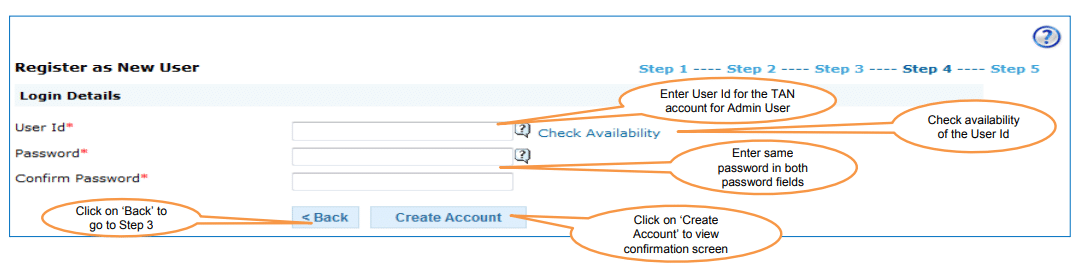

Step 4:

Deductor is required to create his/her User ID (Check the Availability while creating the User ID) along with the Password to proceed further.

• Password should contain a minimum of 8 alpha numeric characters with at least one letter in upper case.

• While entering Password Special characters allowed: space, „, &, “, comma, ;

(This is not mandatory to use special characters but user can use it to make strong password)

• In case getting an error „ Invalid Password‟ even meeting the criteria available in help. User should check the browser

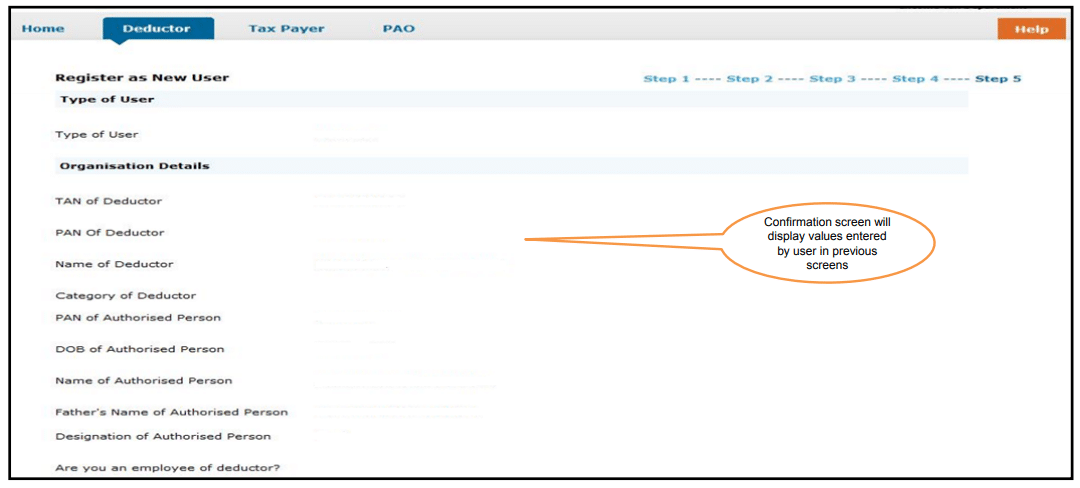

Step 5

Deductor details can be seen on the Confirmation Screen.

Step 5 (Contd.) : Deductor details can be seen on the Confirmation Screen.

“Registration Successfully submitted” message will appear on the screen.

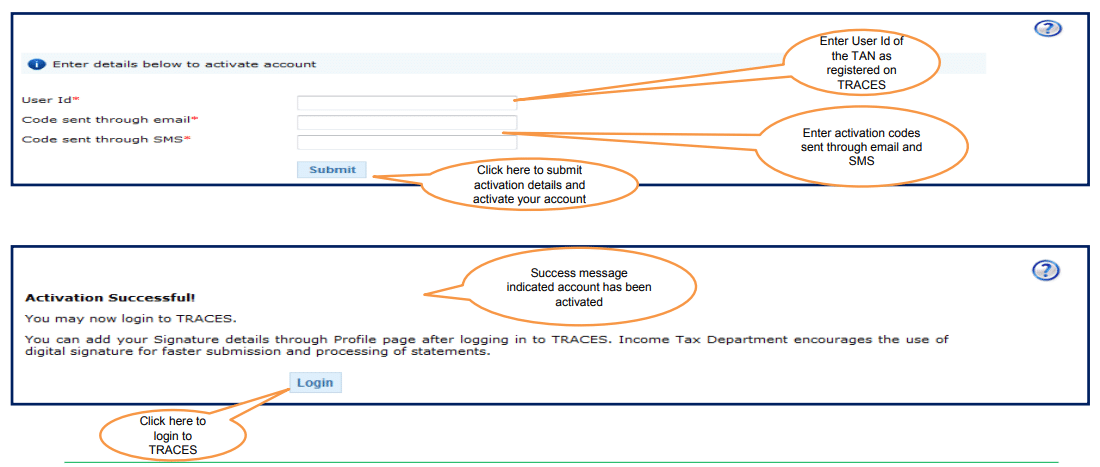

Important Notes for Account Activation

• Account activation must be completed within 48 hours of registration else account will be deactivated and you will have to register again on TRACES

• In case SMS/ email is advertently deleted and 48 hours deadline to activate account has NOT passed, please enter TAN details in Step-1 of deductor Registration Form and click on “Submit”. System will display an alert message to resend the Activation link and codes. Click on „Ok‟, the activation link and codes will be resent to your email id and mobile number

•Please check your “ Spam box” of Registered e-mail id for activation link

This page will be displayed when user clicks on the activation link sent through email.

Deductors Login Screen.

Helpline for How to register on Traces as Deductor

Please Note:

1) For Feedback : You can share your feedback on contactus@tdscpc.gov.in

2) For any Query : You can raise your concern on “Request for Resolution” as Online Grievance on

TRACES Website.

3) For any query related to website: You can raise your concern on below mentioned numbers

Toll Free Number – 1800103 0344

Land Line Number – 0120 4814600

Study Material on TDS under Income Tax Act

Tax Deductor registration on Incometaxindiaefiling.gov.in

[Video] ; TDS on Provision for Audit Fees : Income Tax News [Part37]

[ Video ] Check Your TDS : Income Tax News [Part 25] : TaxHeal.com

Income Tax TDS Certificates : Free Study Material

How to Charge TDS on GST Portion of Tax Invoice

194IB -TDS on Rent w.e.f 01.06.2017 in case of Individual and HUF not liable for Audit

Paying rent over 50000 per month ? Deduct TDS

Income Tax advisory for tenants in India : deduct and pay TDS on rent u/s 194IB

Pension : Who will issued TDS statement ( Form 16)

Can I file single TDS/TCS statement for every branch of Company

Format of Request Letter for copy of Provisional Receipt of TDS return

TDS on Rent of Property : Section 194IB: FAQs : Form 26QC ; Form 16C