How to responde Income Tax Notice asking Personal Expenses details

Taxpayer received Income Tax Notice asking personal expenses details of his household expenses. This is because the Income Tax Department believes Taxpayer declared household withdrawal is too low compared to what they expect for someone with taxpayer income level.

Receiving an income tax notice can be a daunting experience for any taxpayer. One type of notice that often raises concerns is the notice related to personal expenses. This article aims to shed light on such notices, explaining why they are issued, what information is typically requested, and how taxpayers can respond effectively.

Draft Income Tax Notice Asking details of Personal Expenses

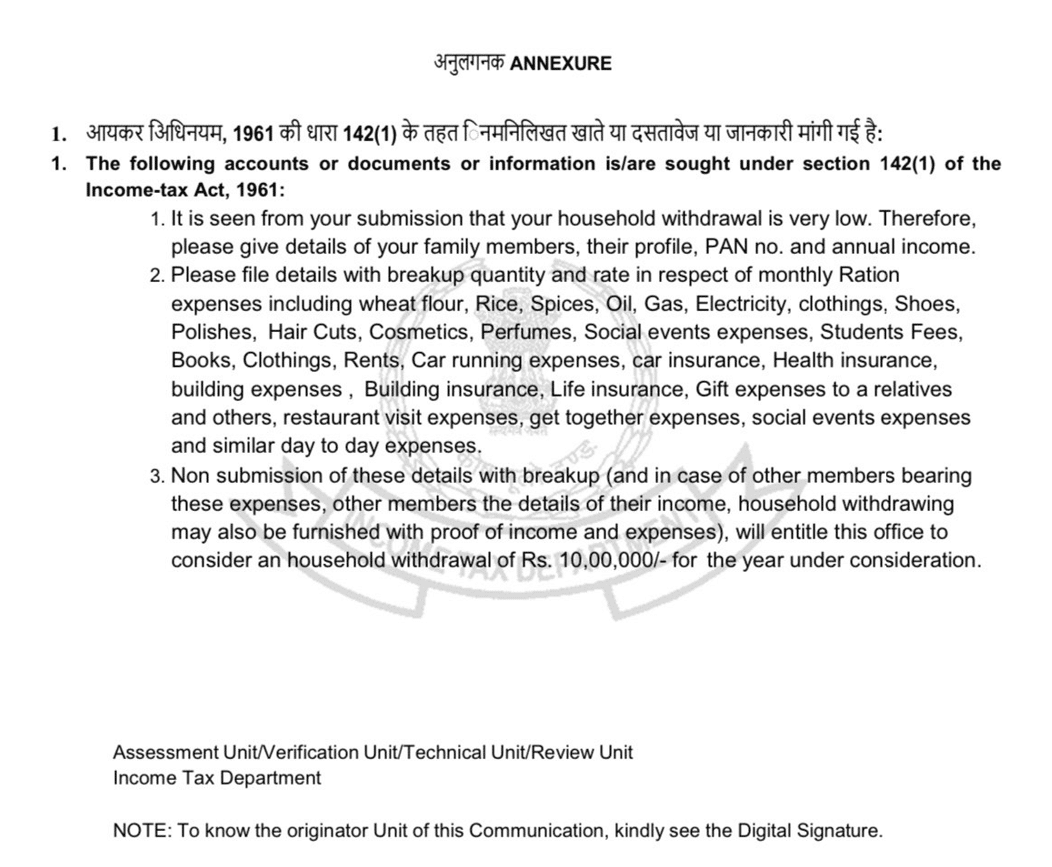

अनुलगनक ANNEXURE

1. आयकर अधिनियम, 1961 की धारा 142(1) के तहत निम्नलिखित खाते या दस्तावेज या जानकारी मांगी गई है:

1. The following accounts or documents or information is/are sought under section 142(1) of the Income-tax Act, 1961:

It is seen from your submission that your household withdrawal is very low. Therefore, please give details of your family members, their profile, PAN no. and annual income.

Please file details with breakup quantity and rate in respect of monthly Ration expenses including wheat flour, Rice, Spices, Oil, Gas, Electricity, clothings, Shoes, Polishes, Hair Cuts, Cosmetics, Perfumes, Social events expenses, Students Fees, Books, Clothings, Rents, Car running expenses, car insurance, Health insurance, building expenses, Building insurance, Life insurance, Gift expenses to a relatives and others, restaurant visit expenses, get together expenses, social events expenses and similar day to day expenses.

Non submission of these details with breakup (and in case of other members bearing these expenses, other members the details of their income, household withdrawing may also be furnished with proof of income and expenses), will entitle this office to consider an household withdrawal of Rs. 10,00,000/- for the year under consideration.

Assessment Unit/Verification Unit/Technical Unit/Review Unit

Income Tax Department

NOTE: To know the originator Unit of this Communication, kindly see the Digital Signature.

Why This Type of Income Tax Notice is received

This income tax notice is asking for detailed information about your household expenses because the Income Tax Department believes your declared household withdrawal is suspiciously low. They’re essentially saying that based on their assessment, they expect a typical household like yours to have spent more money than you’ve reported.

Here’s a breakdown of why you might have received this notice:

- Discrepancy between income and expenditure: The tax department might have observed a mismatch between your declared income and your reported expenses. If your income suggests you can afford a higher standard of living than your expenses reflect, it raises a red flag.

- Low declared household withdrawal: You mentioned a “low household withdrawal” in your tax submission. This likely triggered the notice, as it indicates you’ve spent less than expected on daily living costs.

- Potential underreporting of income: In some cases, such notices are sent when the tax department suspects underreporting of income. By scrutinizing your expenses, they may try to uncover any hidden income sources.

- Random scrutiny: Sometimes, taxpayers are selected for scrutiny randomly as part of the department’s routine compliance checks.

The notice aims to gather more information about your spending habits to ensure you’ve accurately reported your income and expenses. They want details about your family members, their income, and a breakdown of various household expenses.

It’s important to respond to this notice promptly and provide the requested information with supporting documentation. Failure to do so may lead to the tax department assuming a higher household withdrawal, potentially resulting in higher tax liability.

Example

- Your declared income: You’ve reported an annual income of ₹15 lakhs.

- Your declared household withdrawal: In your tax return / Profit and Loss Account, you mentioned

- withdrawing ₹2 lakhs from your bank account for household expenses throughout the year or

- There is no cash withdrawal or less cash withdrawal from your Bank).

- The tax department’s assessment: Based on their data and algorithms, the tax department estimates that a typical household with a ₹15 lakh income in your city usually spends around ₹6-8 lakhs per year on living costs.

This significant difference between your declared withdrawal and their estimated expenditure raises a red flag. They might suspect that:

- You have other sources of income: Perhaps you have rental income, income from investments, or other sources you haven’t declared, allowing you to spend more than your declared withdrawal.

- You’re underreporting your expenses: Maybe you’re not accurately tracking all your expenses, or you’re intentionally underreporting them to reduce your tax liability.

- You have significant non-cash expenses: It’s possible you have expenses that aren’t reflected in your bank withdrawals, such as receiving gifts from relatives or using credit cards extensively.

To investigate further, they’ve issued this notice under Section 142(1) to gather more details about your family’s income and expenses. They want to understand how you’re managing your household expenses with a seemingly low withdrawal.

What does section 142(1) of Income Tax Act says

Section 142(1) of the Income Tax Act, 1961 empowers the Assessing Officer (AO) to make inquiries before completing an assessment. It essentially allows the tax department to gather information and verify details provided in your income tax return.

Here’s what Section 142(1) allows the AO to do:

- Demand for Return: If you haven’t filed your return, the AO can issue a notice demanding you to file it within a specified time.

- Call for Information/Documents: The AO can ask you to provide any accounts, documents, or information related to your income and expenses.This could include bank statements, invoices, receipts, or any other relevant financial records.

- Require Attendance: The AO can require you to attend their office in person to provide explanations or clarifications regarding your return.

In your case, the notice is issued under Section 142(1) because the tax department requires further information about your household expenses. They’re essentially exercising their power to call for information and documents to verify the accuracy of your declared income and expenses.

It’s important to comply with the notice and provide the requested information within the given timeframe. Failure to do so can lead to penalties and further scrutiny from the tax department.

What if the Taxpayer could not Explain the Personal Expenses

If the taxpayer cannot explain the expenses to the satisfaction of the Assessing Officer (AO), it could lead to several consequences:

Best Judgment Assessment: The AO may make an assessment based on their “best judgment” using the available information. This could result in an estimated income and tax liability higher than what you originally declared.

Higher Tax Liability: If the AO determines that your expenses are higher than what you reported, they may assume a higher household withdrawal. This would increase your taxable income and, consequently, your tax liability.

Penalties: Failure to provide satisfactory explanations or documentation could attract penalties under the Income Tax Act. For instance, Section 271(1)(b) can impose a penalty of ₹10,000 for non-compliance with a notice under Section 142(1).

Further Scrutiny: The AO may decide to conduct a more detailed scrutiny of your income and expenses, potentially including a review of your bank accounts and other financial records.

Prosecution: In extreme cases of non-compliance or if the AO suspects tax evasion, prosecution under Section 276D of the Income Tax Act could be initiated. This may result in imprisonment of up to a year and/or a fine.

It’s crucial to cooperate with the AO and provide all necessary information and documentation to support your claims. If you’re unable to explain certain expenses, it’s advisable to seek professional help from a tax advisor or chartered accountant to guide you through the process and ensure compliance with the law.

Income Tax on Unexplained Expenses

Section 115BBE of the Income Tax Act, 1961 deals with the taxation of income from certain unexplained sources. It’s a special provision that levies tax at a flat rate on income that cannot be satisfactorily explained by the taxpayer.

Here’s a breakdown of Section 115BBE:

Applicability:

This section applies to income of any nature that is:

- Unexplained: The taxpayer fails to offer a satisfactory explanation for the source of this income.

- Falls under specific categories: These categories include:

- Money, bullion, jewellery, or other valuable articles found in the possession of the taxpayer and not explained.

- Investments not fully disclosed in the books of account.

- Expenses not recorded in the books of account but found to be incurred by the taxpayer.

- Any other income where the Assessing Officer is not satisfied with the explanation given by the taxpayer.

Tax Rate:

Income falling under Section 115BBE is taxed at a flat rate of 60%. This is higher than the regular tax rates for individuals and is meant to discourage taxpayers from concealing income or providing inadequate explanations.

Additional Provisions:

- Surcharge: A surcharge of 25% on the income tax is applicable if the total income exceeds ₹1 crore.

- Cess: Health and Education Cess of 4% is levied on the income tax and surcharge.

- Penalty: A penalty under Section 271AAC may also be levied for unexplained income or expneses

Relevance to Taxpayer Notice:

While taxpayer notice under Section 142(1) primarily focuses on verifying household expenses, Section 115BBE could become relevant if taxpayer fail to provide a satisfactory explanation for the source of funds used for those expenses. If the Assessing Officer believes that taxpayer have unexplained income that has been used to fund your lifestyle, they might consider applying the provisions of Section 115BBE.

| Unexplained Transaction | ||

| Section 115BBE | ||

| Reflected in Books | Not Reflected in Books | |

| Tax Rate (A) | 60% | 60% |

| Add Surcharge (B) | 25% of Tax | 25% of Tax |

| C=(A+B) | 75% | 75% |

| Add Education cess (D) | 4% of C | 4% of C |

| Effective Rate E = C+D | 78% | 78% |

| Add Penalty u/s 271AAC F=A*10% | 10% of tax | |

| Effective Rate G= E+F | 84% | |

Example of Tax Calculations if Expenses say of Rs 200000 are unexplained

| Cash Expenses- unexplained | 200000 |

| Tax Rate @ 60% (A) | 120000 |

| Add Surcharge @ 25% (B) | 30000 |

| C=(A+B) | 150000 |

| Add Education cess 4% (D) | 6000 |

| Effective Rate E = C+D | 156000 |

| Add Penalty u/s 271AAC F=A*10% | 12000 |

| Effective Rate G= E+F | 168000 |

Key Takeaway:

It’s crucial to maintain accurate records of your income and expenses and be prepared to provide explanations and supporting documentation if requested by the tax department. Transparency and proper documentation can help you avoid falling under the ambit of Section 115BBE and facing higher tax liabilities.

How to respond to the Income Tax notice:

- Gather all necessary information and documents: Compile all relevant details and supporting evidence to back up your claims.

- Provide a clear and concise explanation: If your expenses are genuinely low, explain the reasons behind it, such as support from family, non-cash transactions, or a frugal lifestyle.

- Seek professional help if needed: If you are unsure about any aspect of the notice or need assistance with preparing your response, consult a tax advisor or chartered accountant.

- Respond within the stipulated time: Adhere to the deadline mentioned in the notice to avoid penalties or further complications

Draft Reply of Income tax Notice for Personal Expenses

[Your Name]

[Your Address]

[Your PAN]

[Date]

To,

The Assessing Officer

Income Tax Department

[Address of the Income Tax Office]

Subject: Response to Notice under Section 142(1) of the Income Tax Act, 1961

Dear Sir/Madam,

This is in response to the notice received under Section 142(1) of the Income Tax Act, 1961, dated [Date of Notice], seeking information regarding my household expenses.

I hereby provide the following details:

1. Family Details:

| Member Name | Relationship | PAN | Annual Income |

| [Your Name] | Self | [Your PAN] | [Your Annual Income] |

| [Spouse Name] | Spouse | [Spouse PAN] | [Spouse Annual Income] |

| [Child Name] | Child | [Child PAN] | [Child Annual Income] |

| … | … | … | … |

2. Monthly Ration Expenses:

Please find attached a detailed statement with breakup quantity and rate for monthly ration expenses, including:

- Wheat flour

- Rice

- Spices

- Oil

- Gas

- Electricity

3. Other Household Expenses:

Please find attached a detailed statement with breakup for other household expenses, including:

- Clothing

- Shoes

- Polishes

- Hair Cuts

- Cosmetics

- Perfumes

- Social Events

- Student Fees

- Books

- Rent

- Car Running Expenses

- Car Insurance

- Health Insurance

- Building Expenses

- Building Insurance

- Life Insurance

- Gifts to Relatives and Others

- Restaurant Expenses

- Get-Together Expenses

- Social Events Expenses

Supporting Documents:

I have enclosed the following supporting documents:

- Bank Statements

- Credit Card Statements

- Invoices/Receipts for major expenses

- [Any other relevant documents]

Explanation for Low Household Withdrawal:

[Provide a clear and concise explanation for the seemingly low household withdrawal. This could include factors like:]

- Support from family members

- Non-cash transactions

- Utilization of savings

- Minimalistic lifestyle

- [Any other relevant factors]

I trust that the provided information and documents will be sufficient to address your concerns. I am available for any further clarification or assistance you may require.

Thank you for your time and consideration.

Sincerely,

[Your Signature]

[Your Name]

Important Notes:

- This is a sample reply and needs to be customized based on your specific situation and the details requested in your notice.

- Ensure that all information is accurate and supported by relevant documents.

- If you are unsure about any aspect of the reply, it’s highly recommended to seek professional guidance from a tax advisor or chartered accountant.

- Respond to the notice within the stipulated time frame to avoid any penalties or further complications.

Reply Income Tax Notice witnin Time

- Income tax notices for personal expenses are issued to verify the accuracy of declared household expenditure.

- Taxpayers need to provide detailed information and supporting documents to substantiate their claims.

- Responding promptly and accurately can help avoid penalties and maintain a clean tax record.

- Seeking professional help can be beneficial in navigating the complexities of tax notices

Challange to Income Tax Notice

You can also Challange the validity of Income Tax Notice.

While the notice itself appears to be a standard format used by the Income Tax Department, there might be certain weaknesses or grounds on which its validity could be challenged, depending on the specific circumstances of your case. Here are some potential areas to explore:

1. Vague and Overbroad Requests:

- The notice demands details of “similar day-to-day expenses,” which is quite vague and could be interpreted broadly. You could argue that this is overly burdensome and requires you to disclose an unreasonable amount of personal information.

- It also asks for details of “social events expenses” twice, indicating a lack of clarity and precision in the notice.

2. Lack of Specifics:

- The notice doesn’t specify the period for which the expenses need to be furnished. It could be argued that this ambiguity makes it difficult to comply with the notice.

- It doesn’t mention the legal basis for demanding such detailed personal information, particularly regarding family members who may not be directly assessed.

3. Potential for Fishing Expedition:

- The notice could be seen as a “fishing expedition” to gather information without any specific suspicion of wrongdoing. This could be challenged on the grounds of privacy and proportionality.

4. Basis for Suspicion:

- The notice mentions that your household withdrawal is “very low,” but it doesn’t provide any specific data or criteria to support this claim. You could request the department to provide the basis for their suspicion and the methodology used to determine the expected level of household withdrawal.

5. Threat of Arbitrary Assessment:

- The notice warns that non-submission of details will entitle the office to consider a household withdrawal of ₹10,00,000. This could be challenged as an arbitrary and unreasonable assumption, especially if you can provide evidence to support your actual expenses.

What to do to Challenge the Notice:

If you believe the notice is invalid or unreasonable, you can consider the following options:

- Filing a written response: Address the specific concerns and request clarification on vague or overbroad requests.

- Seeking legal advice: Consult with a tax lawyer to explore the legal grounds for challenging the notice and the best course of action.

- Approaching higher authorities: If your concerns are not addressed by the Assessing Officer, you can escalate the matter to higher authorities within the Income Tax Department.

It’s important to remember that challenging a notice should be done with proper legal guidance and based on the specific facts and circumstances of your case.

Key Learning for taxpayers:

Understanding these notices and responding appropriately can benefit taxpayers in several ways:

- Avoid penalties and legal issues: Timely and accurate response can help avoid penalties and potential legal consequences for non-compliance.Maintain a clean tax record: Addressing the tax department’s concerns ensures a clean tax record and avoids unnecessary scrutiny in the future.

- Promote transparency and trust: Providing complete and truthful information fosters transparency and builds trust with the tax authorities.

Refer Income Tax India website Click Here