ORDER

Rama Kanta Panda, Vice Principal. – The above two appeals filed by the Revenue are directed against the common order dated 29.07.2024 of the learned CIT(A), Pune-12, relating to assessment years 20202021 & 2021-2022 respectively. Since identical grounds have been raised by the Revenue in both these appeals, therefore, these appeals were heard together and are being disposed of by this common order.

ITA.No.1939/PUN./2024 :

2. Facts of the case, in brief, are that the assessee is a company engaged in the business of construction. It filed it’s return of income on 13.02.2021 declaring total income of Rs.23,83,97,010/-. The return was processed u/s.143(1)(a) on 21.06.2021 determining the total income of the assessee at Rs.23,84,93,182/-. Subsequently, the case was selected for complete scrutiny under CASS to examine the following issues:

| (ii) | | Default in TDS & Disallowance for such default |

2.1. Accordingly, the Assessing Officer issued statutory notices u/sec.143(2) and 142(1) of the I.T. Act, 1961, in response to which, the Authorised Representative of the Assessee appeared before the Assessing Officer from time to time and filed the requisite details. The Assessing Officer completed the assessment determining the total income of the assessee at Rs.32,18,44,630/- by estimating the income from contract work at 10% of the turnover as against 7.37% declared by the assessee, which the assessee accepted and paid the due taxes.

2.2. Subsequently, the Assessing Officer initiated penalty proceedings u/sec.270A of the Act. Before the Assessing Officer assessee submitted that penalty u/sec.270A is not levaible as the case of the assessee company is covered by exclusion mentioned in sec.270A(6)(a) of the Act. It was submitted that during the course of assessment proceedings, statement of the Managing Director Shri Mahendra Murlidhar Patil was recorded u/s.131 wherein he has explained that total contract receipts for the impugned assessment year 20202021 is around Rs.317 crores and contract receipts for the year before i.e. assessment year 2019-2020 is around Rs.123 crores. Due to exponential increase of more than 250% in total turnover of the company, the accounts department was overloaded and due to this reason, there can be some unintentional discrepancies in the books of accounts, for which, the Managing Director of the company had offered to estimate the profit @ 9% of the turnover. It was further submitted that the assessee company has accepted the income determined by the Assessing Officer and paid the due taxes. Accordingly, it was requested to drop the penalty proceedings initiated u/sec.270A of the Act.

2.3. However, the Assessing Officer was not satisfied with the arguments advanced by the assessee. He noted that assessee company has inflated the expenses as well as passed false entry in books of account by debiting non-genuine sub-contract expenses to suppress the income. The Assessing Officer referred to the provisions of section 270A(9) of the Act, according to which, a person shall be considered to have misreported his income, if there is suppression of facts as well as false entry in books of account. He further referred to the provisions of section 270A(3)(i)(a), according to which, the amount of under-reported income shall be the difference between the amount of income assessed and the amount of income determined under clause (a) of sub-section (1) of section 143. He accordingly held that assessee has under reported his income in consequence of mis-reporting for the amount of Rs.8,33,51,448/-. The Assessing Officer, therefore, levied penalty of Rs.4,19,55,786/- being 200% of the amount of tax payable on under-reported income in consequence of mis-reporting thereof.

3. Before the Ld. CIT(A) it was argued by the assessee that penalty u/sec.270A is not leviable when the income of the assessee is estimated. It was argued that the Assessing Officer in the instant case has estimated the profit @ 10% of the contract receipts as against 7.37% declared by the assessee. Relying on various decisions, it was submitted that no penalty is leviable when the income is estimated.

3.1. It was further argued by the assessee that the Assessing Officer has levied the penalty without giving details of exact clause of mis-reporting of income under which he wanted to charge the assessee company. Since the Assessing Officer has failed to mention both in the assessment order as well as in the notice issued u/sec.274 r.w.s.270A of the Act as to under which limb/sub-clause of sec.270A(9) of the Act penalty proceedings are initiated, penalty so levied is not in accordance with law. The assessee also relied on various decisions to the proposition that penalty is not leviable in absence of non-communication of the exact limb from clause (a) to (g) of sub-section (2) of section 270A or as to which of the specific clause (a) to (f) of sub-section (9) of section 270A was detriment before imposing the impugned penalty u/sec.270A of the Act in the assessment order or in the notice u/sec.274 r.w.s.270A of the Act.

3.2. Based on the arguments advanced by the assessee, the Ld. CIT(A) cancelled the penalty so levied by observing as under :

“Finding :

5.2. I have considered the submission of the appellant and the facts of the case. From the assessment order, it is seen that the addition is made on account of addition of Net Profit taken 10% of contract receipts of Rs.8,33,51,448/- and penalty proceedings u/s 270A of the Act were initiated for under reporting of income in consequence of misreporting. The appellant has objected that there is not even a whisper both in the assessment order as well as the penalty notice u/s.274 r.w.s. 270A dated 30.09.2022 as to which limb of section 270A of the Act is attracted. Since the Ld. AO had not specified u/s 274 r.w.s. 270A, whether penalty is proposed for any of the conditions mentioned in section 270A(2)(a) to 270A(2)(g) by virtue of which the income of the appellant is held as under- reported and in section 270A(9)(a) to 270A(9)(g) by virtue of which the income of the appellant is held as mis-reported, the penalty levied is obliterated. The appellant has also submitted that the foundation of initiation of notice u/s.274 r.w.s. 270A not being as per the provisions of the Act is invalid, illegal and without the authority of the law and penalty order passed on the basis of such illegal/invalid/ defective notice is bad in law and void ab initio and also deserves to be quashed being violative of fundamental legal proposition. Hence, the penalty order under appeal may be annulled.

5.3. For better understanding the provisions of Section 270A of the Act are reproduced hereunder :

Penalty for under reporting and misreporting of income.

270A. (1) The Assessing Officer or the Commissioner (Appeals) or the Principal Commissioner or Commissioner may, during the course of any proceedings under this Act, direct that any person who has under-reported his income shall be liable to pay a penalty in addition to tax, if any, on the underreported income.

(2) A person shall be considered to have underreported his income, if –

| (a) | | the income assessed is greater than the income determined in the return processed under clause (a) of sub-section (1) of section 143; |

| (b) | | the income assessed is greater than the maximum amount not chargeable to tax, where no return of income has been furnished; |

| (c) | | the income reassessed is greater than the income assessed or reassessed immediately before such reassessment; |

| (d) | | the amount of deemed total income assessed or reassessed as per the provisions of section 115JB or section 115JC, as the case may be, is greater than the deemed total income determined in the return processed under clause (a) of sub-section (1) of section 143; |

| (e) | | the amount of deemed total income assessed as per the provisions of section 115JB or section 115JC is greater than the maximum amount not chargeable to tax, where no return of income has been filed; |

| (f) | | the amount of deemed total income reassessed as per the provisions of section 115JB or section 115JC, as the case may be, is greater than the deemed total Income assessed or reassessed Immediately before such reassessment; |

| (g) | | the Income assessed or reassessed has the effect of reducing the loss or converting such loss into income. |

(3) The amount of under-reported income shall be.-

(i) in a case where income has been assessed for the first time, –

(a) if return has been furnished, the difference between the amount of income assessed and the amount of income determined under clause (a) of sub-section (1) of section 143;

(b) in a case where no return has been furnished,-

(A) the amount of income assessed, in the case of a company, firm or local authority; and

(B) the difference between the amount of income assessed and the maximum amount not chargeable to tax, in a case not covered in item (A);

(ii) in any other case, the difference between the amount of income reassessed or recomputed and the amount of income assessed, reassessed or recomputed in a preceding order:

Provided that where under-reported income arises out of determination of deemed total income in accordance with the provisions of section 115JB or section 115JC, the amount of total under-reported income shall be determined in accordance with the following formula-

(A – B) + (C – D)

where,

A = the total income assessed as per the provisions other than the provisions contained in section 115JB or section 115JC (herein called general provisions);

B = the total income that would have been chargeable had the total income assessed as per the general provisions been reduced by the amount of under-reported Income;

C = the total income assessed as per the provisions contained in section 115JB or section 115JC;

D = the total income that would have been chargeable had the total income assessed as per the provisions contained in section 115JB or section 115JC been reduced by the amount of underreported income:

Provided further that where the amount of under-reported income on any issue is considered both under the provisions contained in section 115JB or section 115JC and under general provisions, such amount shall not be reduced from total income assessed while determining the amount under item D.

Explanation. For the purposes of this section,-

(a) “preceding order” means an order immediately preceding the order during the course of which the penalty under sub-section (1) has been initiated;

(b) in a case where an assessment or reassessment has the effect of reducing the loss declared in the return or converting that loss into income, the amount of under-reported income shall be the difference between the loss claimed and the income or loss, as the case may be assessed or reassessed.

(4) Subject to the provisions of sub-section (6), where the source of any receipt. deposit or investment in any assessment year is claimed to be an amount added to income or deducted while computing loss, as the case may be, in the assessment of such person in any year prior to the assessment year in which such receipt, deposit or investment appears (hereinafter referred to as “preceding year”) and no penalty was levied for such preceding year, then, the under-reported income shall include such amount as is sufficient to cover such receipt, deposit or investment.

(5) The amount referred to in sub-section (4) shall be deemed to be amount of income under-reported for the preceding year in the following order-

(a) the preceding year immediately before the year in which the receipt, deposit or investment appears, being the first preceding year, and

(b) where the amount added or deducted in the first preceding year is not sufficient to cover the receipt, deposit or investment, the year immediately preceding the first preceding year and so on.

(6) The under-reported income, for the purposes of this section, shall not include the following, namely:-

| (a) | | the amount of income in respect of which the assessee offers an explanation and the Assessing Officer or the Commissioner (Appeals) or the Commissioner or the Principal Commissioner, as the case may be, is satisfied that the explanation is bona fide and the assessee has disclosed all the material facts to substantiate the explanation offered; |

| (b) | | the amount of under-reported income determined on the basis of an estimate, if the accounts are correct and complete to the satisfaction of the Assessing Officer or the Commissioner (Appeals) or the Commissioner or the Principal Commissioner, as the case may be, but the method employed is such that the income cannot properly be deduced therefrom: |

| (c) | | the amount of under-reported income determined on the basis of an estimate, if the assessee has, on his own, estimated a lower amount of addition or disallowance on the same issue, has included such amount in the computation of his income and has disclosed all the facts material to the addition or disallowance; |

| (d) | | the amount of under-reported income represented by any addition made in conformity with the arm’s length price determined by the Transfer Pricing Officer, where the assessee had maintained information and documents as prescribed under section 92D, declared the international transaction under Chapter X, and, disclosed all the material facts relating to the transaction; and |

| (e) | | the amount of undisclosed income referred to in section 271AAB. |

(7) The penalty referred to in sub-section (1) shall be a sum equal to fifty per cent of the amount of tax payable on under-reported income.

(8) Notwithstanding anything contained in subsection (6) or sub-section (7), where under-reported income is in consequence of any misreporting thereof by any person, the penalty referred to in sub-section (1) shall be equal to two hundred per cent of the amount of tax payable on under-reported income.

(9) The cases of misreporting of income referred to in sub-section (8) shall be the following, namely:-

| (a) | | misrepresentation or suppression of facts; |

| (b) | | failure to record Investments in the books of account; |

| (c) | | claim of expenditure not substantiated by any evidence; |

| (d) | | recording of any false entry in the books of account; |

| (e) | | failure to record any receipt in books of account having a bearing on total income; and |

| (f) | | failure to report any international transaction or any transaction deemed to be an international transaction or any specified domestic transaction, to which the provisions of Chapter X apply. |

(10) The tax payable in respect of the under-reported income shall be –

| (a) | | where no return of income has been furnished and the income has been assessed for the first time, the amount of tax calculated on the under-reported income as increased by the maximum amount not chargeable to tax as if it were the total income; |

| (b) | | where the total income determined under clause (a) of sub-section (1) of section 143 or assessed, reassessed or recomputed in a preceding order is a loss, the amount of tax calculated on the underreported income as if it were the total income; |

| (c) | | in any other case determined in accordance with the formula- |

(X-Y)

where,

X = the amount of tax calculated on the underreported income as increased by the total income determined under clause (a) of sub-section (1) of section 143 or total income assessed, reassessed or recomputed in a preceding order as if it were the total income; and

Y = the amount of tax calculated on the total income determined under clause (a) of sub-section (1) of section 143 or total income assessed, reassessed or recomputed in a preceding order.

(11) No addition or disallowance of an amount shall form the basis for imposition of penalty, if such addition or disallowance has formed the basis of Imposition of penalty in the case of the person for the same or any other assessment year.

(12) The penalty referred to in sub-section (1) shall be imposed, by an order in writing, by the Assessing Officer, the Commissioner (Appeals), the Commissioner or the Principal Commissioner, as the case may be.”

In this connection, the appellant submitted that the Ld. AO has not specified any limb out of the 7 limbs, that are listed in Section 270A(9) in his notice u/s 274 r.w.s. 270A dated 30.09.2022. Hence, the penalty order is bad in law.

5.4. In this regard, the appellant has relied upon the Hon’ble jurisdictional ITAT, Pune in the case of Kishor Digambar Patil v. ITO vide ITA No. 54 & 55/PUN/2023. In this order, the Hon’ble ITAT has relied upon the following decisions, wherein it is held that “without specifying the limb within which the penalty is imposed is unsustainable”.

| (i) | | Hon’ble Supreme Court in the case of Dilip N Shroff v. JCIT reported |

| (ii) | | Hon’ble Supreme Court in the case of Ashok Pal v. CIT reported in |

| (iii) | | Hon’ble Bombay High Court in the case of CIT v. Samson Pericherry. |

| (iv) | | Hon’ble Bombay High Court in the case of PCIT v. Goa Dorado. |

| (v) | | Hon’ble Bombay High Court in the case of PCIT v. New Era Sova Mine. |

| (vi) | | Prem Brothers Infrastructure LLP V/s. NFAC reported in (2023) 334 CTR (Del) 363, Para No.7. In this case Hon. Delhi High Court held that penalty notice issued u/s.274 r.w.s. 270A does not mention which limb of section 270A of the Act is attracted, hence penalty order is quashed. |

| (vii) | | Alrameez Construction (P) Ltd. Vis. CIT (NFAC), Delhi reported in (2023) 382 (Mumbal Tribunal). In this case Hon. Mumbai ITAT held that if the penalty notice does not mention which limb of section 270A is attracted and how ingredients of section 270A is satisfied, mere reference to the word “under reporting” or “misreporting” in the assessment order or penalty notice for imposing penalty u/s 270A is manifestly arbitrary and deserves to be quashed. |

5.5. Having gone through the relevant material on record and the decisions of above judicial authorities relied upon by the appellant, I am of the view that the above stated judicial precedents regarding the “limb theory” would squarely apply even in case of failure of the Assessing Officer to quote any of the seven sub-limbs as well prescribed in Section 270A(9) (a) to (g) of the Act introduced by the legislature in order “to rationalize and bring objectivity, certainty and clarity in the penalty provisions”. And that his noncompliance to this clinching effect would not only defeat the legislative mandate but also it renders the amending provisions an otiose. I accordingly hold in these peculiar facts and circumstances that the impugned penalty notice issued by the Ld. AO deserves to be quashed as not sustainable in the eye of law. In view of the above, penalty levied u/s 270A of the Act is bad in law. Hence, the AO is directed to delete the impugned penalty. The additional ground raised by the appellant is, therefore, allowed.

5.6. As the ground No.4 of appeal has been allowed, therefore, the grounds no.1 to 3 of the appeal become academic in nature and do not require separate adjudication.”

3.3. Since the Ld. CIT(A) has cancelled the penalty on account of non-specification of limb within which the penalty is imposed as unsustainable, he did not adjudicate the ground challenging the validity of the penalty when such income is estimated.

4. Aggrieved with such order of the Ld. CIT(A), the Revenue is in appeal by raising the following grounds :

| 1. | | “On the facts and in the circumstances of the case and in law the Ld. CIT (A) has erred by deleting penalty levied u/s.270A of the Act of Rs.4,19,55,786/- for mis- reporting income. |

| 2. | | On the facts and in the circumstances of the case and in law, the Ld.CIT(A) has erred by not appreciating the fact that the assessee company has inflated the expenses as well as made false entry in books of account by debiting inflated/non-genuine expenses. |

| 3. | | On the facts and in the circumstances of the case and in law, the Ld.CIT(A) has erred by incorrectly relying on the decisions mentioned in the order of Ld.CIT(A) which did not lay down the ratio that specific limb of section 270A must be mentioned for a valid order u/s 270A. |

| 4. | | On the facts and in the circumstances of the case and in law, the Ld.CIT(A) has erred in holding that the notice u/s.270A r.w.s.274 was invalid as it did not mention the specific clause of Section 270A whereas there is no such requirement mandated by law. |

| 5. | | The appellant craves leave to add, alter, modify, delete and amend any of the grounds, as per the circumstances of the case.” |

5. The Learned DR strongly challenged the order of the Ld. CIT(A) in deleting the penalty. He submitted that when the assessee company has inflated the expenses as well as made false entries in it’s books of account by debiting inflated/non-genuine expenses, the assessee falls under the purview of provisions of sec.270A(3) as well as 270A(9) of the Act. Since there was mis-reporting of income as well as under-reporting of income, the Assessing Officer was fully justified in levying the impugned penalty u/sec.270A of the Act. The Ld. CIT(A) without considering and appreciating the facts properly, has deleted the penalty which is not in accordance with law. He accordingly submitted that the order of the Ld. CIT(A) be reversed and that of the Assessing Officer be restored.

6. Learned Counsel for the Assessee, on the other hand, heavily relied on the order of the Ld. CIT(A). He submitted that the assessee in the instant case has declared a profit rate of 7.37% on the contract receipts. The Assessing Officer rejecting the various explanations given by the assessee, resorted to the provisions of sec.145(3) and estimated the income @ 10%, on which, the assessee paid the taxes. He submitted that neither in the assessment order nor in the notice issued u/sec.274, the Assessing Officer has mentioned the exact limb of sec.270A(9) under which penalty was imposed and, therefore, the penalty proceedings so initiated by the Assessing Officer are not in accordance with law. For the above proposition, the Learned Counsel for the Assessee relied upon the following decisions :

| 1. | | Sagar S. Wedhane v. ITO [ITA No. 191/PUNE/2024] dated 03.07.2024. |

| 2. | | ACIT v. Kedari Redekar Shikshan Sanstha [ITA No. 559/PUNE/2024] dated 05.07.2024. |

| 3. | | Shivaji Sonawane v. ITO [ITA No. 708/PUNE/2023] dated 02.02.2024. |

| 4. | | Annasaheb Gunjal v. ITO [ITA No. 182/PUNE/2024] dated 21.10.2024. |

| 5. | | Kasat Prakash M. HUF v. ITO [ITA No. 1328/PUNE/2023] dated 19.06.2024. |

| 6. | | Ritu Multitrade Services Pvt. Ltd. v. ITO |

| 7. | | Lyka Labs Ltd.v. DCIT [(2024) 38 NYPTTJ 706 (Mum)]. |

| 8. | | Smita Ashok Thakur v. DCIT [ITA No. 4386/Mum/2023] dated 07.10.2024. |

| 9. | | G.R. Infraprojects Ltd. v. ACIT [(2024) 336 CTR 249 (Raj H.C.)]. |

| 10. | | Schneider Electric South East Asia (HQ) PTE Ltd. v. ACIT [(2022) 443 ITR 186 (Del) (HC)]. |

| 11. | | Kishor D. Patil v. ITO [ITA Nos. 54 & 55/PUNE/2023] dated 30.03.2023. |

| 12. | | PCIT v. Jehangir H. C. Jehangir |

| 13. | | Mohd. Farhan A. Shaikh v. DCIT[ |

6.1. He submitted that although the assessee has raised a ground before the Ld. CIT(A) that when profit is estimated, penalty cannot be levied u/sec.270A(9) of the Act, however, the Ld. CIT(A) did not adjudicate the same since he has already deleted the penalty for non-specification of the limb. Referring to the decision of Hon’ble Bombay High Court in the case of

B.R. Bamasi v.

CIT reported in

[1972] 83 ITR 223 (Bombay) (HC), he submitted that the Hon’ble High Court in the said decision has held that assessee is empowered to defend the order of the Ld. CIT(A) by raising an additional legal ground before the Tribunal even when the assessee has not filed cross-objection or cross-appeal against the order of the Ld. CIT(A). He accordingly submitted that the grounds raised by the Revenue be dismissed.

7. We have heard the rival arguments made by both the sides and perused the material available on record. We have also considered the various decisions cited before us by both the sides. We find the Assessing Officer in the instant case completed the assessment u/sec.143(3) determining the total income of the assessee at Rs.32,18,44,630/- as against the returned income of Rs.23,83,97,010/-, wherein he made an addition of Rs.8,33,51,448/- to the income determined u/sec.143(1)(a) by making addition of the difference between the profit estimated @ 10% and the profit declared by the assessee @ 7.37% of the total turnover. Since the Assessing Officer, neither in the assessment order nor in the penalty notice, has specified as to whether penalty is proposed for any of the conditions mentioned in sec.270A(2)(a) to 270A(2)(g) by virtue of which the income of assessee is held as underreported or in sec.270A(9)(a) to sec.270A(9)(f) by virtue of which the assessee has mis-reported it’s income, the Ld. CIT(A) deleted the penalty. The detailed reasoning given by him has already been reproduced in the preceding paragraphs.

7.1. We do not find any infirmity in the order of the Ld. CIT(A) in deleting the penalty so levied by the Assessing Officer. It is an admitted fact that the Assessing Officer in the assessment order has not specified as to under which limb of provisions of sec.270A(2) or 270A(9), the assessee has misreported or under-reported it’s income, we find the Assessing Officer in the body of the assessment order has mentioned as under after making the addition :

“In light of the above, the amount of Rs.8,33,51,480/-is added to the total income of the assessee company for A.Y. 2020-21. Penalty proceedings u/s 270A of the Income Tax Act, 1961 is initiated separately for underreporting in consequence of mis-reporting of income.”

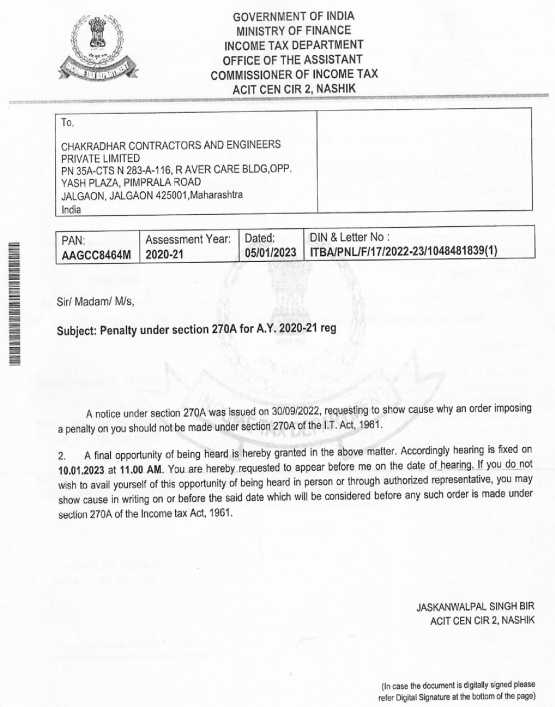

7.1. Similarly, we find the notice issued u/sec.274 r.w.s.270A dated 30.09.20222, copy of which, is placed at page-12 of the paper book, reads as under :

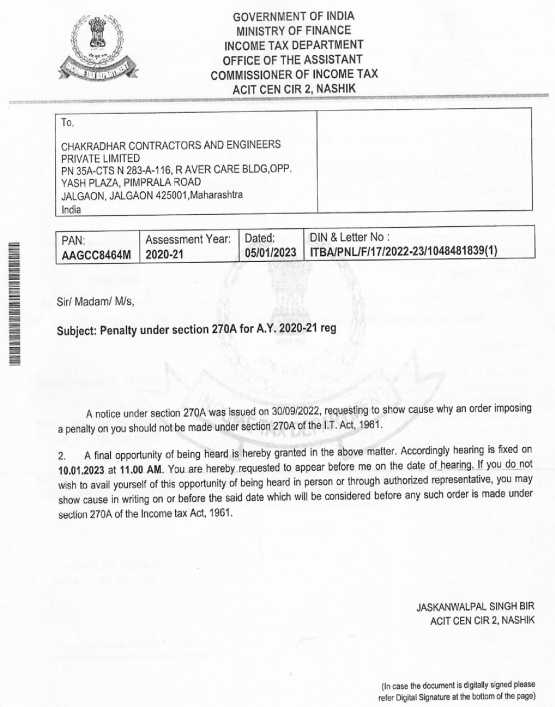

7.2. Similarly, the second notice issued u/sec.270A dated 05.01.2023 reads as under :

7.3. We find the Hon’ble Delhi High Court in the case of Schneider Electric South East Asia (HQ) PTE Ltd. v. ACIT reported in (2022) 443 ITR 186 (Del) has held that when there is not even a whisper as to which limb of sec.270A is attracted and how the ingredient of sub-sec.(9) of sec.270A is satisfied, the action of the Assessing Officer is contrary to the legislative intent. The relevant observations of Hon’ble High Court reads as under :

“6. Having perused the impugned order dt. 9th March, 2022, this Court is of the view that the respondents’ action of denying the benefit of immunity on the ground that the penalty was initiated under s.270A of the Act for misreporting of income is not only erroneous but also arbitrary and bereft of any reason as in the penalty notice the respondents have failed to specify the limb “underreporting” or “misreporting” of income, under which the penalty proceedings had been initiated.

7. This Court also finds that there is not even a whisper as to which limb of s.270A of the Act is attracted and how the ingredient of sub-s.(9) of s.270A is satisfied, In the absence of such particulars, the mere reference to the word “misreporting” by the respondents in the assessment order to deny immunity from imposition of penalty and prosecution makes the impugned order manifestly arbitrary.”

7.4. We find the Coordinate Bench of the Tribunal in the case of ACIT v. Kedari Redekar Shikshan Sanstha in ITA No.559/PUNE/2024] vide order dated 05.07.2024 while deciding an identical issue deleting the penalty levied u/sec.270A has observed as under :

“9. We have carefully considered the rival submissions and perused the records. The assessee is a charitable trust registered u/s 12A of the Act and engaged in educational activities whose income is exempt from tax. It is manifest from para 4 of the assessment order that on perusal of Schedule EC of the ITR, the Ld. AO noticed that the assessee had claimed capital expenditure of Rs.2,40,02,040/-. Vide notice u/s 142(1) of the Act he required the assessee to furnish headwise and naturewise bifurcation of said capital expenditure. It was in reply thereof that the assessee submitted revised computation showing capital expenditure of Rs.97,47,772/- for which explanation was submitted. On consideration of such explanation, the Ld. AO observed in para 4.5 of the assessment order that the assessee has obtained fresh loans of Rs.1,42,54,268/- from bank during AY 2018-19. Accordingly, since the assessee has pleaded that fresh loan has been obtained for capital expenditure on assets which has been claimed as capital expenditure in the ITR and now assessee submits request to reduce its claim of capital expenditure for the assets on which loan has been taken in next years. According to the Ld. AO, the plea of the assessee is found acceptable. Not only this the Ld. AO went on to observe further that in this way, the assessee had saved itself from the double deduction on same capital assets on which loan is availed in coming years whose repayment may have been claimed by the assessee in subsequent AYs. It was in the above backdrop of the factual matrix that the Ld. AO disallowed the excess claim of capital expenditure of Rs.1,42,54,268/-. In our considered view there is no intentional misrepresentation of expenditure as alleged. By no stretch of imagination it can be said to be a case of attempted tax evasion as even after revision of computation, the taxable income remained Nil which is same as returned income of the assessee. In the assessment order there is no whisper that there is under- reporting on total income as a consequence to misreporting as envisaged u/s 270A(8) and (9) of the Act.

10. None-the-less the notice dated 27.12.2019 u/s 274 r.w.s. 270A of the Act states : “it appears to me under-reporting/misreporting of income”. Obviously, the initiation of penalty itself is based on suspicion and surmise. Nowhere it has been pinpointed – either in the penalty notice or in the impugned order of penalty as to under which stipulated specific clauses (a) to (f) to subsection (9) r.w. sub-section (8) of section 270A of the Act, the assessee has committed default attracting “underreporting” as a consequence of “mis-reporting”. In such a scenario the Co-ordinate Bench of the Tribunal in the case of Mahavir Realties (supra) held that not only Hon’ble Bombay High Court’s Full Bench landmark decision in Mohd. Farhan A. Shaikh v. ACIT applies wherein it is held that such a failure on the Assessing Officer’s part indeed vitiates the entire penal proceedings (in old scheme), but also the very principle applies qua this new scheme of section 270A applicable w.e.f. 01.04.2017 for AY 2017-18 onwards as per Schneider Electric South East Asia (HQ) Ltd. v. ACIT (2022) 443 ITR 186 (Delhi).

11. We are inclined to agree with the submissions of the Ld. AR that a revision in computation of income was made with a view to correct bonafide mistake which did not have any tax implication so as to cause misrepresentation resulting in misreporting. Misrepresentation is often willful or intentional done with the intention of gaining wrongfully. Nothing of the sort has been done by the assessee. It only corrected an inadvertent mistake.

12. For the reason set out above, we endorse the finding of Ld. CIT(A) that on the facts and in the circumstances of the case of the assessee, the impugned penalty is not exigible. Consequently, we reject the appeal of the Revenue being devoid of any merit and substance.

13. In the result, the appeal of the Revenue is dismissed.

7.5. We find the Pune Bench of the Tribunal in the case of Kasat Prakash M. HUF v. ITO in ITA No.1328/PUNE/2023 vide order dated 19.06.2024 while deciding an identical issue deleting penalty levied u/sec.270A has observed as under :

“4. We have given our thoughtful consideration to the assessee’s forgoing legal issue raised in the instant appeal that the impugned penalty proceedings stand vitiated on account of the Assessing Officer’s failure to pinpoint the relevant clauses (a) to (f) to sub-section (9); while initiating the proceedings herein u/s.270A(8) of the Act, thereby alleging under reporting of income as a sequence of misreporting. Faced with this situation, we find no merit in Revenue’s arguments placing reliance on M/s. Veena Estate Pvt. Ltd. (supra) once the issue before their lordships was that of the concerned appellant seeking to frame an additional substantial question of law in section 260A proceedings whereas the law regarding the tribunal’s jurisdiction to entertain such a pure question of law, not requiring any further detailed investigation on facts, is already settled in NTPC Ltd. v. CIT That being the case, we are of the considered view that going by the foregoing judicial precedent, this tribunal is very much entitled to entertain and decide such a pure legal plea for the first time in section 254(1) proceedings. We accordingly reject the

Revenue’s instant technical arguments to conclude in light of section 270A (8) & (9) r.w. clauses (a to (f) that the learned Assessing Officer’s failure to pinpoint the corresponding default of assessee’s part indeed vitiates the entire proceedings as per (2022) 443 ITR 186 (Del) Schneider Electric South Asia Ltd. v. ACIT (in the new scheme) and Md. Farhan S.A. v. ACIT(c) old penal provision. We order accordingly. The impugned penalty of Rs. 15,54,736/-stands deleted in very terms.

5. This assessee’s appeal is allowed.”

7.6. The various other decisions relied on by the Learned Counsel for the Assessee also supports his case to the proposition that where neither in the assessment order nor in the notice issued u/sec.274 r.w.s.270A the Assessing Officer has specified as to under which limb of provisions of sec.270A(2) or 270A(9) the case of the assessee falls, then in that case, no penalty u/sec.270A is leviable. We, therefore, uphold the order of the Ld. CIT(A) and the grounds raised by the Revenue are dismissed.

7.7. Even otherwise also, it is an admitted fact that profit of the assessee has been estimated by resorting to the provisions of sec.145(3). It has been held in various decisions that penalty u/sec.271(1)(c) of the Act is not leviable when the profit is estimated. The same corollary in our opinion is also applicable to the provisions of sec.270A of the Act. We, therefore, do not find any infirmity in the order of the Ld. CIT(A) cancelling the penalty levied by the Assessing Officer u/sec.270A(9) of the Act. The grounds raised by the Revenue are accordingly dismissed.

8. In the result, appeal of the Revenue is dismissed.

ITA.No.1940/PUN./2024 :

9. The Revenue raised the following grounds in the instant appeal :

| 1. | | “On the facts and in the circumstances of the case and in law the Ld. CIT (A) has erred by deleting penalty levied u/s.270A of the Act of Rs.2,22,45,572/- for mis- reporting income. |

| 2. | | On the facts and in the circumstances of the case and in law, the Ld.CIT(A) has erred by not appreciating the fact that the assessee company has inflated the expenses as well as made false entry in books of account by debiting inflated/non-genuine expenses. |

| 3. | | On the facts and in the circumstances of the case and in law, the Ld.CIT(A) has erred by incorrectly relying on the decisions mentioned in the order of Ld.CIT(A) which did not lay down the ratio that specific limb of section 270A must be mentioned for a valid order u/s 270A. |

| 4. | | On the facts and in the circumstances of the case and in law, the Ld.CIT(A) has erred in holding that the notice u/s.270A r.w.s. 274 was invalid as it did not mention the specific clause of Section 270A whereas there is no such requirement mandated by law. |

| 5. | | The appellant craves leave to add, alter, modify, delete and amend any of the grounds, as per the circumstances of the case.” |

10. After hearing both the sides, we find that grounds raised in the instant appeal are identical to grounds raised in ITA.No.1939/PUN./2024. We have already decided the issue and the grounds raised by the Revenue have been dismissed. Following similar reasoning, the grounds raised by the Revenue in the instant appeal are dismissed.

11. In the result, both the appeals of the Revenue are dismissed. A copy of this common order be placed in the respective case files.