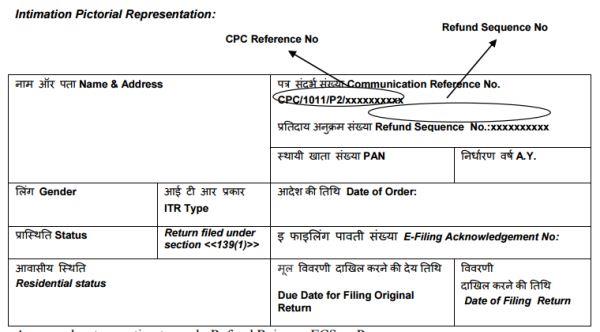

Income Tax refund Sequence No

Income Tax refund Sequence No is written on the intimation sent u/s 143(1) by income Tax department on your registered email ID with incometaxindiaefiling portal.

How to Request for the Intimation Order u/s 143(1)

After the Income Tax Return is processed by CPC, taxpayer receives an Intimation at their registered email ID. If the taxpayers request to resend the Intimation, perform the following steps.

| Step 1 | Logon to ‘e-Filing’ Portal www.incometaxindiaefiling.gov.in | ||||||

| Step 2 | Go to the ‘My Account’ menu located at upper-left side of the page ⇒ Click ‘Service Request’ ⇒ Select the ‘Request Type’ as ‘New Request’ and Select the ‘Request Category’ as ‘Intimation u/s 143(1)154/16(1)/35’ ⇒ Click ‘Submit’ | ||||||

| Step 3 | Enter the following details:

| ||||||

| Step 4 | Click ‘Submit’ | ||||||

| Step 5 | To View the status of submitted form,

|

How to check Income Tax Refund Status Online?

Through NSDL site

Easiest and quickest way to check you income tax refund status online is via NSDL site. You just need to enter Permanent Account Number (PAN) and select the Assessment Year for which you are looking for refund. You can check refund status for past 10 years.

As you would hit the submit button, refund status would be displayed on your screen Click here to check

Though this is the quickest way to check refund status but anyone can view the refund status of another person with having PAN number

Through Income-Tax e-filing Portal

Another way to check your refund/demand status is through incometaxefiling.gov.in. You have to login with your login credentials and select MY ACCOUNT : view efiling return form : Income tax return

Than you click on Acknowledgment number of respective Assessment year to check whether ITR has been processed and Income Tax refund has been released.

Check income tax refund status

Offline

Phone Call

Tax Department has also started a toll free helpline number particularly for income tax refund status related queries. The number is 1800-425-2229.

SBI is the refund banker of tax department and in case you are not able to enquire about refund online than you can at SBI’s toll free number, 1-800-4259760, to check for the refund status.

If you are not able to get through the above toll free numbers, the last resort of help would be contacting Aaykar Sampark Kendra at 0124-2438000.

How to request for Reissue of Refund?

There can be instances such as Incorrect Bank Account details, Incorrect Address, IFSC Code and so on, and then taxpayer may have to request the ITD to re-issue a refund cheque.

Refunds are issued through two modes:

- By crediting the refund amount in Assesse Bank account if the taxpayer has correctly mentioned the Bank account details in ITR.

- By sending the Income Tax Refund cheque if taxpayer failed to submit correct Bank Account details in ITR.

Perform the following steps to raise Refund Re-issue Request:

| Step 1 | Logon to ‘e-Filing’ Portal www.incometaxindiaefiling.gov.in |

| Step 2 | Go to the ‘My Account’ menu located at upper-left side of the page ⇒ Click ‘Service Request’ ⇒ Select the ‘Request Type’ as ‘New Request’ and Select the ‘Request Category’ as ‘Refund Reissue’ |

| Step 3 | Click ‘Submit’ hyperlink located under Response column ⇒ After clicking submit, fill the additional details such as Bank Account number, Account Type, IFSC Code and so on ⇒ Click ‘Submit’ Note: For successful submission of Refund Reissue request, user must have registered DSC or EVC. |

| Note: | If the Refund Failure is due to Validation (PFMS), How to Get the Refund from CPC?

|

To View the status of submitted Refund Re-issue,

| Step 1 | Logon to ‘e-Filing’ Portal www.incometaxindiaefiling.gov.in |

| Step 2 | Go to the ‘My Account’ menu located at upper-left side of the page ⇒ Click ‘Service Request’ ⇒ Select the ‘Request Type’ as ‘View Request’ and Select the ‘Request Category’ as ‘Refund Reissue’ |

| Step 3 | Click ‘Submit’ |

Related post

How to Claim Income Tax Refund & Interest on Refund ? (FA 2019)

Automatic Credit of Income Tax Refund Into Bank A/c linked with PAN from 01.03.2019

Check Income Tax Refund Status Online (India)

How to Request for Refund Re-issue on IncomeTaxIndiaEfiling

How to Claim Refund of Excess Income Tax Paid by the Taxpayer [ FA 2018]

Income Tax Refund in non-CASS case to be issued without adjustment of Demand

New Provision of Interest on Income tax Refund as per Finance Bill 2016

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal