Income Tax Stay application cannot be rejected simply because assessee not covered by Instruction No. 1914 : High Court

HIGH COURT OF MADRAS

Hemant Shantill Jain

v.

Assistant Commissioner of Income-tax

M. SUNDAR, J.

W.P. NO. 34301 OF 2022

W.M.P. NO. 33760 OF 2022

W.M.P. NO. 33760 OF 2022

DECEMBER 22, 2022

Ms. Vandana Vyas and Ms. A. Niveditha for the Petitioner. A.P. Srinivas, Sr. Standing Counsel (Income-tax) and Ms. S. Premalatha, Jr. Standing Counsel (Income-tax) for the Respondent.

ORDER

1. This order will now dispose of the captioned writ petition and captioned ‘Writ Miscellaneous Petition'[‘WMP’ for the sake of brevity].

2. Ms.Vandana Vyas, learned counsel on record for writ petitioner is before this Court. Learned counsel submitted that there was a search operation qua the writ petitioner under section 132 of the ‘Income Tax Act, 1961’ (‘IT Act’ for the sake of brevity); that on the basis of seized material, a notice under section 153C of IT Act was issued; that this was followed by a notice dated 14-12-2021 under section 143(2) and a notice dated 20-1-2022 under section 142(1); that all this culminated in an order dated 28-3-2022 made by the first respondent inter alia under section 143(3) read with section 153 of IT Act [hereinafter ‘said order of Assessing Officer’ for the sake of convenience and clarity]; that vide the said order of Assessing Officer, the Assessing Officer had come to the conclusion that there is unaccounted capital drawings and unexplained interest credit both under section 56 of IT Act; that pursuant to such assessment a demand of Rs. 73,23,592/- was raised; that the said order of Assessing Officer was carried in appeal by the writ petitioner by way of an appeal dated 26-4-2022 to the second respondent; that it is to be noted that the second respondent is the Appellate Authority; that this Court is informed that the appeal is under section 246A of IT Act; that pending appeal, writ petitioner moved the first respondent (Assessing Officer) under section 220(6) of IT Act with an interim prayer; that the first respondent in and by a terse ‘order dated 12-12-2022 bearing reference ITBA/COM/F/17/2022-23/1047943054(1)’ [hereinafter ‘impugned order’ for the sake of convenience and clarity] negatived the interim prayer; that captioned writ petition has been filed assailing the impugned order.

3. Considering the narrow compass on which the captioned main writ petition turns, this Court deemed it appropriate to take up the captioned main writ petition with the consent of counsel for writ petitioner and Mr.A.P.Srinivas, learned Senior Standing Counsel (Income Tax) along with Ms.S.Premalatha, learned Junior Standing Counsel (Income Tax) who accepted notice for both the respondents.

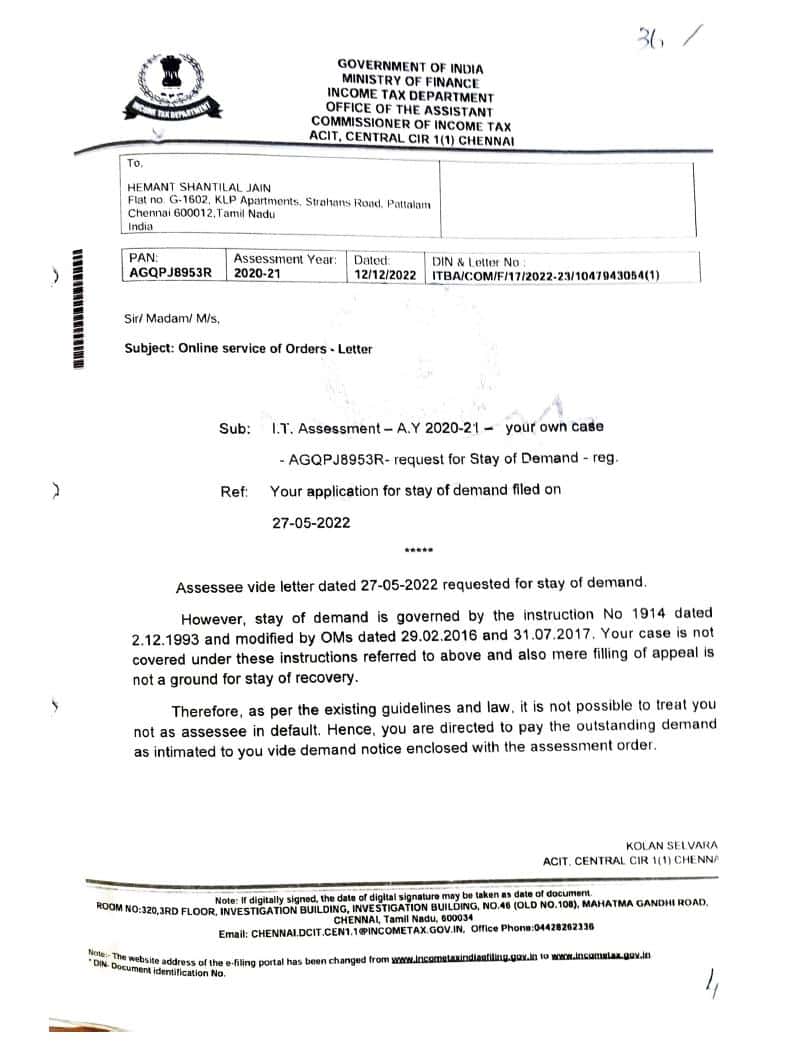

4. As already alluded to supra, the impugned order of the first respondent is terse and a scanned reproduction of the same is as follows:

5. The impugned order has been made on one basis and that lone basis is that the writ petitioner’s case is not covered under ‘Instruction No. 1914 dated 2-12-1993 as modified by two Office Memoranda dated 29-2-2016 and 31-7-2017’ [hereinafter collectively ‘said instruction’ for the sake of convenience and clarity]. There is no disputation or disagreement as between the petitioner’s counsel and the learned Revenue counsel that this is incorrect. This is evident and obvious from the first and second sentences in the first paragraph of impugned order. The first sentence says that stay of demand is governed by said instruction and second sentence says that writ petitioner is not covered by said instruction.

6. As there is no disputation or disagreement that the writ petitioner’s case i.e., writ petitioner’s plea that interim order is covered by said instruction read with Section 220(6) of IT Act and as the only ground on which the prayer has been negatived is that the writ petitioner is not covered by said instruction, this Court deems it appropriate to interfere qua the impugned order.

7. In the light of the narrative thus far, the following order is passed:

| (a) | the impugned order i.e., order dated 12-12-2022 bearing reference ITBA/COM/F/17/2022-23/1047943054(1) made by the first respondent is set aside. The impugned order is set aside on the sole ground that it has proceeded on the lone erroneous basis that said instruction (Instruction No. 1914 dated 2-12-1993 as modified by two office memoranda dated 29-2-2016 and 31-7-2017) does not apply to the writ petitioner; | |

| (b) | The petition of the writ petitioner seeking interim order is remitted back to the first respondent for consideration on its own merits and in accordance with law inter alia by applying said instruction; | |

| (c) | The above exercise shall be completed by the first respondent as expeditiously as his business would permit and in any event, within three weeks from today i.e., on or before 12-1-2023; | |

| (d) | Though obvious it is made clear that the writ petitioner’s petition styled ‘petition to keep the demand of tax in abeyance’ before the first respondent now gets revived and the same will stand over for consideration by the first respondent as per the aforementioned directive within aforementioned time line. | |

| (e) | Though obvious, it is made clear that this Court has not expressed any view or opinion on the merits of the matter and the facts have been captured for limited purpose of appreciating this order. |

Captioned writ petition disposed of with the aforementioned directives. Consequently, captioned WMP is disposed of as closed.

There shall be no order as to costs.