HELD

The investment in mutual funds was temporarily placed by the appellant company in order to ensure liquidity and availability of money as and when required and accordingly inextricably linked with the setting up of the power plant

Interest Received from Income tax department on TDS Refund has been earned from the funds borrowed for the purpose of acquisition of land and other project related activities and thus the same has been rightly adjusted from the interest cost incurred on such borrowed funds

IN THE INCOME TAX APPELLATE TRIBUNAL,

AMRITSAR BENCH;

M/s. Talwandi Sabo Power Ltd. vs. Income Tax Officer

AMRITSAR (SMC)

BEFORE SH. A.D. JAIN, JUDICIAL MEMBER

ITA No.635(Asr)/2014

Assessment year:2010-11

Appellant by:Sh. Ajay Vohra, Sr. Adv. Respondent by:Sh.Tarsem Lal, DR Date of hearing: 06/10/2015 Date of pronouncement: 01/01/2016

ORDER

This is the assessee’s appeal for the assessment year 2010-11, against the order dated 02.07.2014 passed by the ld. CIT(A), Bathinda, contending that the ld. CIT(A) has erred in not considering the details and bifurcation of Rs.9,40,082/-, observing that these details were not furnished before the AO and hence, liable for rejection under Rule 46A(1) of the Income Tax Rules, 1962 and thereby bringing to tax the amount of Rs.9,40,000/- as interest from deposits.

2. The facts are that the assessee filed e-return declaring income of Rs.2,58,580/- under the head of income from other sources. A revised ereturn was filed, wherein, the assessee declared nil income. The AO assessed the income of the assessee at Rs.9,40,000/- under the head of income from other sources. The AO observed that the assessee company was setting up a thermal power plant at Mansa. The assessee company is a wholly owned subsidiary of M/s. Sterline Energy Ltd, Tamil Nadu, as 100% of the equity shares of the company are held by M/s. Sterline Energy Ltd. Since the assessee company was setting up a power project, no commercial activities had been started. The AO found that the assessee had surplus funds which were not required immediately for setting up the power project. These funds were invested in short-term deposit, as well as in mutual funds. In the original return, the assessee declared interest income under the head of income from other sources, whereas in the revised return, the assessee did not offer any interest income. The AO found the facts of the assessee’s case to be in parimateria with those of “Tuticorin Alkali Chemicals & Fertilizers Ltd. vs. CIT”, 227 ITR 172 (SC). The AO, therefore, asked the assessee to show cause as to why the interest reflected by the assessee as deposits be not added back to the income of the assessee company under the head of income from other sources. It was stated by the AO that as in the assessee’s case, in “Tuticorin Alkali Chemicals & Fertilizers Ltd. vs. CIT” (supra) also, part of interest bearing funds borrowed for setting up of the thermal power project, which funds were not immediately required by Tuticorin Alkali Chemicals & Fertilizers Ltd., for the said setting up of the thermal power project and which funds were surplus funds, were invested in short-term deposits and the Hon’ble Supreme Court, after giving detailed reasons, held that the interest received/dividend on the said deposits would be chargeable under the head “Income from other sources”. The AO further stated that the interest paid on borrowed funds was not adjustable against the interest received and the same was required to be capitalized in view of the decision of the Hon’ble Supreme Court in the case of “Chellapalli Sugar Ltd. vs CIT”, 98 ITR 167(SC).

3. The assessee responded by stating that during the year, the assessee company had not commenced its business of generation of power and the entire net expenses debited to the profit and loss account had been subsequently transferred to capital work in progress; that the income of the year did not include any income from funds invested in short term deposits; that the investments were made out of the funds immediately not required, but raised to meet the contractual requirements of the project, in mutual funds, on which, dividend had been received by the company, in accordance with the principle of capitalizing expenditure/income during the construction of the project; that the said income had been capitalized during the year; and that the matter regarding not treating such income under the head of income from other sources stood considered in numerous judgments. These judgments were enumerated by the assessee. It was further contended that “Tuticorin Alkali Chemicals & Fertilizers Ltd. vs. CIT” (supra), was also distinguished in “Indian Oil Panipat Power Consortium Ltd. vs. ITO”, 315 ITR 255 (Del.). It was contended that besides, dividend received from mutual funds is exempt u/s 10(35) of the Act, as per which, income received in respect of the units of the mutual funds does not form a part of the total income; and that dividend distribution tax has already been paid on the same; and that the assessee had capitalized the net amount of expenditure/income, since the same was inextricably linked with the setting up of the plant and would go to reduce the capital cost of the plant and would not be assessable as income from other sources.

4. The AO, however, rejected the assessee’s contention and assessed the assessee’s income of Rs.9,40,000/- under the head ‘Income from other sources’, by following “Tuticorin Alkali Chemicals & Fertilizers Ltd. vs. CIT” (supra).

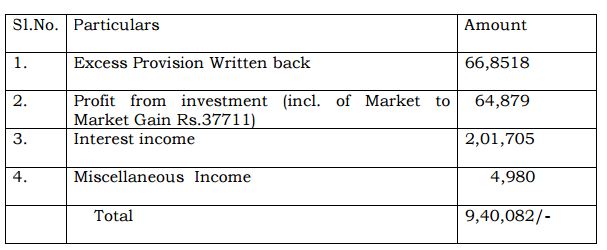

5. Before the ld. CIT(A), the assessee gave a bifurcation of the amount of Rs.9,40,000/- [as per the ld. CIT(A), taken at Rs.9,40,003/- by the AO and at Rs.9,40,082/- by the assessee]. This bifurcation is as follows:

6. The ld. CIT(A), however, in para 1.5 of the impugned order, observed that this bifurcation was not furnished by the assessee before the AO during the assessment proceedings and it had been admitted by the assessee in its reply filed before the AO, that the investment had been made out of the funds immediately not required to meet the contractual requirement of the business. The ld. CIT(A) observed that no corroborative evidence had been filed in the appellate proceedings to justify the bifurcation of Rs.9,40,003; and that the same also did not arise from the grounds of appeal on account of lack of evidence. It was observed that Rule 46A(1) of the I.T. Rules prohibits the ld. CIT(A) from admitting any additional evidence without any application stating why the assessee could not produce the same before the AO in the assessment proceedings. It was, therefore, that the ld. CIT(A) rejected the contention of the assessee and the entire amount of Rs.9,40,000/- was treated as interest from deposits, as held by the AO.

7. The ld. CIT(A) further observed that on merit also, the case of the assessee is covered by the order dated 31.12.2013 of the Amritsar Bench of the Tribunal in the case of “HPCL Mittal Energy Limited Vill Phoolokhari, Talwandi Sabo”, in ITA Nos.445 & 446(Asr)/2013, wherein it has been held that such interest is not a capital receipt and is income of revenue nature.

8. Aggrieved, the assessee is in appeal.

9. On behalf of the assessee, it has been contended as follows:

The ld. CIT(A) has erred in not considering the details/bifurcation of Rs.9,40,000/- . These details/bifurcation were available in the assessee’s books of account, lucidly depicted in the balance sheet. This bifurcation is self-explanatory for ascertaining the nature of entries and not being in the nature of any additional evidence. The ld. CIT(A) failed to appreciate that in the assessment proceedings, the AO had merely disputed the taxability of interest received/receivable on short-term deposits with the bank. As such, the assessee had no occasion to deal with the entries. The ld. CIT(A) has, thereby erred in not considering such bifurcation erroneously observing the case of the assessee to be hit by Rule 46A(1) of the I.T. Rules. While doing so, the ld. CIT(A) failed to appreciate the power available to him under Rule 46A(1) of the I.T. Rules as well as u/s(s) 250(4) and 250(5) of the Act. It has been contended that without prejudice, the taxation of the amount of Rs.9,40,000/- under the head “Income from other sources” instead of abating the work in progress account, is arbitrary and unjust and at any rate, very excessive. It is also completely against the rule of consistency vis-a-vis the method of accountancy earlier accepted.

10. The ld. counsel for the assessee has further contended that the ld. CIT(A) has erred in observing that bifurcation of the amount of Rs.9,40,003/- was not furnished by the assessee before the AO during the assessment proceedings, and that no corroborative evidence had been furnished in the appellate proceedings to justify such bifurcation and therefore, the same could not be admitted as additional evidence. It has been contended that the bifurcation is self explanatory and it does not comprise any additional evidence. Attention in this regard has been drawn to the table at page-11 of the impugned order, which is the bifurcation itself and reads as follows:

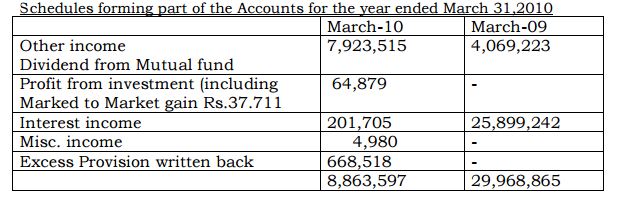

11. It has been contended that this very bifurcation was available with the AO during the assessment proceedings, filed by the assessee as part of the audited financial statements of the assessee for the previous year ending 31.03.2010 relevant to the assessment year under consideration and by schedules forming part of the accounts for the year ended 31.03.2010. For this attention has been drawn to page 12 of the APB.

12. The ld. counsel for the assessee has further argued that the ld. CIT(A) has erred in observing that the case of the assessee is covered by the decision of the jurisdictional Bench of the Tribunal in the case of “HPCL Mittal Energy Limited vs. ACIT”, ITA Nos. 445 & 446(Asr)/2013. As per the ld. CIT(A), according to the said Tribunal order, interest, like the one involved herein, is not a capital receipt and is income of revenue nature.

13. The ld. counsel for the assessee, referring to copy of the said order of the Tribunal, which is contained at APB 51 to 89, has taken me through paras 8 to 18 of the said Tribunal order (APB 68-86). It has been contended that in that case, interest was earned on short-term deposits made by the assessee with the bank and the HPCL. The ld. counsel for the assessee has stressed that in the present case no interest has been earned. It has been argued that therefore, HPCL Mittal Energy Ltd. (supra), is not at all applicable to the facts of the present case. Further, I have also been taken through the assessee’s written submissions filed before the ld. CIT(A) alongwith bifurcation of the amount in question. A copy of the said written submissions has been placed at APB110-123. At APB 119 to 126, in the said written submissions, the break up of the amount of Rs.9,40,003/- has been dealt with in detail, showing that no interest has been earned. It was contended that “Tuticorin Alkali Chemicals & Fertilizers Ltd.” (supra) and “HPCL Mittal Energy Limited” (supra), are not at all applicable to the present case.

14. Strong reliance has been placed by the ld. counsel for the assessee on “CIT vs. Bokaro Steel Ltd.”, 102 Taxman 94 (SC) [CLPB 1-6 ], “CIT vs. Karnal Co-operative Sugar Mills Ltd.”, 243 ITR 2 (SC) [CLPB -7], “CIT vs. Karnataka Power Corporation”, 247 ITR 268 (SC) [CLPB-8-9], “Bongaigaon Refinery and Petrochemicals Ltd. vs. CIT”, 251 ITR 329 (SC) [CLPB10-11], Indian Oil Panipat Power Consortium Ltd. vs. ITO”, 315 ITR 255 (Del) [CLPB 12-15] and “NTPC Sail Power Company Pvt. Ltd. vs. CIT”, order dated 17.07.2012, of the Hon’ble Delhi High Court in ITA No.1238/2011 [CLPB 16-27).

15. In “Bokaro Steel Ltd.” (supra), the assessee was in process of constructing and erecting its plant and had not started any business during relevant assessment years. It received certain amounts through (i) rent charged by the assessee from its contractors for housing workers and staff employed by the cont5ractor for the construction work of the assessee (ii) hire charges for plant and machinery given to the contractors for use in the construction work of the assessee and (iii) interest from advances made to contractors for the purpose of facilitating work of construction. These receipts had been adjusted against the charges payable to the contractors and, thus, they had gone to reduce the cost of construction. The Hon’ble Supreme Court held that all these three receipts, being intrinsically connected with construction of assessee’s plant would be capital receipt and not the assessee’s income from any independent source. There was another receipt, i.e., royalty for excavation and use of stones lying on assessee’s land for construction work. It was held that this receipt being royalty received for stone excavated from the assessee’s land would go to reduce cost of plant and could not be taxed as income.

16. In “Karnal Co-operative Sugar Mills Ltd.” (supra), the assessee had deposited money to open a letter of credit for the purchase of the machinery required for setting up its plant in terms of the assessee’s agreement with the supplier. Some interest had been earned on the money so deposited. The Hon’ble Supreme Court held that it was not a case where any surplus share capital money which was lying idle, had been deposited in the bank for the purpose of earning interest. The deposit of money was held to be directly linked with the purchase of plant and machinery and it was held that any income earned on such deposits was incidental to the acquisition of the assets for setting up of the plant and machinery. The interest was held to be capital receipt, which will go to reduce the cost of asset.

17. In “Karnataka Power Corporation” (supra), the Hon’ble Supreme Court confirmed the order of the Tribunal upholding the ld. CIT(A)’s action in deleting the addition being interest receipts and hire charges from contractors by holding that the same were in the nature of capital receipts which would go to reduce capital cost.

18. In “Bongaigaon Refinery And Petrochemicals Ltd.” (supra), the Hon’ble Gauhati High Court, held that the income from house property, guest house, hire charges for equipment and recoveries from contractors for supply of water and electricity supply received during the period of formation of assessee-company’s main business of oil refinery and petrochemicals which was being set up were taxable as “Income from other sources”. Reversing the decision of the High Court, the Hon’ble Supreme Court held that these items of receipts were not taxable income, but were to be adjusted against the project cost for the business of oil refinery and petrochemicals. Bokaro Steel (supra), was applied. Karnal Co-operative Sugar Mils Ltd (supra), Karnataka Power Corporation (supra) and Tuticorin Alkali Chemicals & Fertilizers Ltd. (supra) were referred to.

19. In “Indian Oil Panipat Power Consortium Ltd. vs. ITO” (supra), the assessee-company was incorporated in pursuance of a joint venture entered into between Indian Oil Corporation and Marubeni Corporation of Japan to set up a power project. To effectuate the purpose for which joint venture was conceived, share capital was contributed by the two Corporations comprising it. This included Rs.20 crores by way of additional share capital. The assessee temporarily placed money received as share capital in a fixed deposit temporarily awaiting acquisition of land which had run into legal entanglements on account of title. The AO treated the interest received thereon as “Income from other sources”. The ld. CIT(A) accepted the assessee’s stand that the interest was in the nature of capital receipt, liable to be set off against pre-operative expenses. The Hon’ble Delhi High Court held that the funds in the form of share capital were infused for the purpose of acquiring land and the development of infrastructure; that therefore, the interest earned on funds primarily brought for infusion in the business, could not be classified as income from other source; and that since the income was earned in a period prior to commencement of business it was in the nature of a capital receipt and was required to be set off against preoperative expenses. ‘Bokaro Steel Ltd.” was referred to. “Tuticorin Alkali Chemicals & Fertilizers Ltd.” was distinguished. While doing so, it was observed that the test which permeates through the “Tuticorin Alkali Chemicals (supra), is that if the funds have been borrowed for setting up of a plant and if the funds are surplus and then, by virtue of that circumstance, they are invested in fixed deposits, the income earned in the form of interest will be taxable under the head “Income from other sources”; that on the other hand, ratio in “Bokaro Steel Ltd.” (supra) is that if income is earned, whether by way of interst or in any other manner on funds which are otherwise inextricably linked to the setting up of the plant, such income is required to be capitalized to be set off against pre-operative expenses. It was observed that the test in “whether activity taken up for setting up of the business and the funds which are garnered are inextricably connected to the setting up of the plant; once it is held that the asessee’s income is connected with business, it cannot be held that income derived by parking the funds temporarily will result in the character of the funds being changed; that where the funds are infused in the business for specific purpose, the interest earned thereon cannot be classified as “Income from other sources”, as income received cannot be discussed as income from other sources only if it does not fall under any other head of income; that since the income earned in a period prior to commencement of business is in the nature of capital receipt required to be set off against pre-operative expenses; that whereas in “Tuticorin Alkali Chemicals” (supra), since the funds available were surplus funds, the Hon’ble Supreme Court held the interest earned thereon liable to be treated as “Income from other sources”. In “Bokaro Steel Limited” (supra), the interest was found to be inextricably linked to the setting up of the plant, leaving to be held to be a capital receipt permitted to be set off against pre-operative expenses.

20. In “NTPC Sail Power Company Pvt. Ltd.” (supra), the Hon’ble Delhi High Court considered the “Tuticorin Alkali Chemicals” (supra), “Bokaro Steel Ltd.” (supra), “Indian Oil Panipat Power Consortium Ltd.” (supra), “Karnataka Power Corporation” (supra) and “Bongaiogaon Refinery & Petrochemicals Ltd.” (supra). It was observed that in all these case, the interest was received by the assessee on borrowed funds invested, which funds could not be immediately put to use for the purpose for which they were taken and it was held both, by the Hon’ble Delhi High Court and the Hon’ble Supreme Court that if the receipt was inextricably linked to setting up of the project, it will be capital receipt not liable to tax but would ultimately be used to reduce the cost of the project. This very reasoning was applied to the case of “NTPC Sail Power Company Pvt. Ltd.” (supra) . where the assessee was in the process of its expansion of business by setting up new units at Bhilai for generation of power, additional capital was raised for financing the expansion plans and interest was earned on temporary deposits made from surplus funds and on the deposits made with banks by way of margin or giving advances, etc., for the purpose of expansion, the interest earned on the surplus funds by way of margin or giving advances for the purpose of expansion having been adjusted to the incidental expenses during construction, the AO having treated this interest as income from other sources, the ld. CIT(A) having accepted the assessee’s appeal and the Tribunal having reversed the ld. CIT(A)’s order on appeal by the department.

21. The Ld. DR, on the other hand, has sought to place strong reliance on the observations of the ld. CIT(A), made in para 1.5 and 1.6 of the impugned order, as above. He has contended that the assessee has not been able to dislodge the categorical finding recorded by the ld. CIT(A) that the bifurcation of the amount of Rs. 9,40,03/- had never been furnished by the assessee before the AO in the assessment proceedings, that even in the appellate proceedings before the ld. CIT(A), the assessee had not filed any corroborative evidence to justify the said bifurcation and that the said bifurcation was not admissible by way of additional evidence, for these reasons. It has been contended that the assessee has also not been able to come out of its admission in the reply filed before the AO as correctly taken note by the ld. CIT(A) that the investment was made out of funds immediately not required. It has further been submitted that alternatively the matter be remitted to the filed of the ld. CIT(A), in case the bifurcation filed by the assessee is found to be justified and admissible in evidence.

22. I have considered the matter in the light of the rival contentions and the material placed on record. First of all, it would be appropriate to juxtapose the assessee’s Schedule forming part of the accounts for the year ended 31.03.2010. The bifurcation sought to be produced by the assessee before the ld. CIT(A), which the ld. CIT(A) refused to take into consideration. Against which bifurcation is given by way of chart/table at page 11 of the impugned order as follows:

23. A copy thereof has been filed at APB-12 as follows:

24. The comparative examination of these documents shows that the bifurcation presented by the assessee before the ld. CIT(A) is nothing new, which could be termed as additional evidence not produced by the assessee before the AO for any good reason and, therefore, not admissible under Rule 46A of the I.T. Rules, 1962. In fact, as correctly pointed out on behalf of the assessee, each of the items of the said bifurcation are comprised in the Schedule forming part of the assessee’s accounts for the year ended 31.03.2010. The excess provision written back of Rs.6,68,518/-, which is item no.1 in the bifurcation, is the last item in the Schedule. The profit from investment amounting to Rs.64,879/- at item no.2 of the bifurcation, is item no.2 of the Schedule. Interest income of Rs.2,01,705/-, item no.3 in the bifurcation, is the third item in the Schedule. Lastly, misc. income, item no.4 in the bifurcation, i.e., misc. income of Rs.4,980/-, is the fourth item in the Schedule.

It cannot be disputed, as has also not been done by the Authorities below, that the aforesaid Schedule forming part of the accounts of the assessee for the year ended 31.03.2010 was filed by the assessee alongwith the return of income before the AO. This is the primary requirement for the assessment to be made. In the index of the paper book filed before this Bench also, this Schedule has been certified to have been drawn from the records of the lower authorities, which fact also remains undisputed. Therefore, it cannot, in any manner whatsoever, be said that the bifurcation filed by the assessee was nothing new filed for the first time before the ld. CIT(A). The ld. CIT(A) has obviously erred in observing that this bifurcation was not furnished by the assessee before the AO in the assessment proceedings; that there was no corroborative evidence to justify such bifurcation; that the same also did not arise from the Grounds of appeal before the ld. CIT(A) on account of lack of evidence; that it was prohibited from being admitted as additional evidence under Rule 46A of the Income Tax Rules, 1962. The fact remains, as discussed, that the Schedule forming part of the assessee’s accounts for the year ended 31.03.2010 contains all the items of this bifurcation. Further, even in the assessee’s written submissions filed before the ld. CIT(A), this break up has been explained in detail, as follows:

“Keeping into consideration the above principles, each item which included in the amount of Rs.9,40,003/- is discussed as under:

(i) Rs.6,68,518/-: Excess provisions written back It comprises of the following

(a) Provisions for legal expenses Rs.5,00,227/-

(b) Provision for office expenses Rs.1,68,290/-

The above provisions were actually made in Financial Year 2008-09, i.e. preceding year and were accounted in preoperative expenses shown in the balance sheet under the head “capital work in progress”, meaning thereby that in preceding year on account of such provision the capital work on progress as shown in the balance sheet was increased. However, during the year under consideration, it was no longer required and accordingly the appellant-company excluded the same out of the capital work in progress account, thereby crediting the work in progress account by same. The amount of Rs.6,68,518/- being the provision returned back amounts to reversal of entries made in preceding year. It is not an income earned by the appellant made on account of investment of any funds. It is only an adjustment entry nullifying , the entry made earlier in the work in progress account and hence by no stretch of imagination it can be considered as income because its nature will remain the same, i.e. capital. In earlier year, the provision so made was not claimed as revenue expenses and accordingly, its writeback cannot be treated as income in the year under consideration.

“ (ii) Rs.64879/-: Profit from investment (inclusive of mark to market (MTM) gain of Rs.37,711/-. The above comprises of mark to market gain of Rs.37,711/- and profit from investment in mutual fund on switching from growth scheme to growth plus liquid scheme of Rs.27,168/-. The investment in mutual funds was temporarily placed by the appellant company in order to ensure liquidity and availability of money as and when required and accordingly inextricably linked with the setting up of the power plant as held by the Hon’ble Supreme Court and Hon’ble Delhi High Court in the cases explained above.

Without prejudice to the above submission, so far as mark to market gain of Rs.37,711/- is concerned, it may be noted that the same has arisen due to valuation of mutual fund at its market value on the closing day of the financial year and the same thus is an unrealized gain. The appellant company would like to place reliance on Instruction No.03/2010 dated 23.03.2010 wherein the following treatment has been specified for the unrealized MTM losses:

“In cases where no sale or settlement has actually taken place and the loss on Marked to Market basis has resulted in reduction of book profits, such a notional loss would be contingent in nature and cannot be allowed to be set off against the taxable income. The same should therefore be added back for the purpose of computing the taxable income of an assessee”

Applying the above principle to the facts of the present case, it would be abundantly clear that the action of the ld. AO of demanding income tax on the amount of unrealized MTM gain is totally arbitrary and hence, not sustainable in as much as the said income is notional in nature.

It is not out of place to mention here that under the Income tax Act, the entries do not generate any income: Under the Act, the income chargeable to tax is the income that is received or is deemed to be received in India in the previous year relevant to the year for which assessment is made or the income that accrues or arises or is deemed to be received or arise in India during such year. ……… ……… ……

(iii) Rs.2,01,705/-/- interest

The above comprises of

(a) Rs.8,000/- on FDs made with the bank for furnishing bank guarantee to VAT Department. During the course of construction and erection of plant and machinery, the appellant company required various statutory items etc. from the VAT Department. For this purpose, the appellant had to obtain registration under the VAT/CST law and as per the statutory requirements the appellant company was required to furnish the bank guarantee to VAT Department. The amount of Rs.8,000/- was earned by the appellant as interest on such FDs made with the bank for furnishing bank guarantee to the VAT Department and because the furnishing of bank guarantee is inextricably linked with the setting up of the power plant, hence the interest thereon is liable to be adjusted against the expenses incurred by the appellant which has been capitalized in view of the above judicial pronouncements.

(b) Rs.1,93,705/- being the interest received from Income tax Department on account of TDS refund. In the Financial Year 2007-08, funds were borrowed for the acquisition of land for the project site and other project related activities. The same were temporarily invested in fixed deposits which yielded some interest income. However, in line with the judicial pronouncements, the borrowing cost was capitalized after netting off the interest income and accordingly, in TDS deducted on interest income was claimed as returned in the Income Tax Return of the Financial Year 2007-08. The said TDS was refunded by the Income Tax Department in the Financial year 2009-10 alongwith applicable interest. From the above, it would be clear that the interest on TDS has been earned from the funds borrowed for the purpose of acquisition of land and other project related activities and thus the same has been rightly adjusted from the interest cost incurred on such borrowed funds. Accordingly, the action of the ld. AO of disallowing the said adjustment is incorrect in view of the judicial pronouncements as explained above. It may particularly be noted that the appellant company was having state capital of Rs.5 lakhs only at the relevant time which had already been utilized in earlier years prior to the commencement of construction activities.

The interest of Rs.1,93,705/- as received on account of excess deduction of TDS made during the course of construction activities is inextricably linked with the setting up of the power plant and is liable to be adjusted against the expenditure capitalized in work in progress as explained in above cases.

Rs.4,980/-: Miscellaneous Income

It represents the consideration of data cards transferred to Bharat Aluminium Co. Ltd. The data cards as and when purchased in earlier years were capitalized in the books under the head “Work in progress” and accordingly the consideration received on account of such data cards is also a capital receipt liable to be adjusted against the expenses incurred in work in progress as explained above. Therefore, in view of the above facts, circumstances and the judicial principle pronounced by the Hon’ble Supreme Court and the High Courts from time to time none of the items comprised in the figure of Rs.9,40,003/- deserves to be assessed under the head “Income from other sources” and accordingly deserves to be excluded out of the income assessed.”

25. The ld. CIT(A) is also found to be incorrect in holding the assessee’s case to be covered by “HPCL Mittal Energy Limited” (supra). As available from para-8 (APB 68 to 76), in that case, interest was earned by HPCL Mittal Energy Limited to the tune of Rs.26,81,85,996/- on short-term deposits with the bank and HPCL.

26. Per-contra, in the present case, no interest has been earned. Rather, dividend had been received by the company on investments made out of funds immediately not required to meet the contractual requirement of the project, in mutual funds, which income was capitalized during the year in accordance with the principle of capitalized expenditure/income during the construction of the project. Remarkably, there is no controversion by the Taxing Authorities to the assessee’s assertion that the dividend from mutual funds is exempt u/s 10(35) of the Act, as per which, income received in respect of units of mutual funds does not form part of the total income. Anyway, at the outset, on facts, ‘HPCL’ (supra) is not applicable and the ld. CIT(A) wrongly held it to cover the assessee’s case.

27. There is, accordingly, no merit in the department’s contention that the matter be remitted to the file of the ld. CIT(A) for decision afresh. The assessee’s contention that this is a legal issue, qua which, all relevant material is available before me and nothing further needs to be gone into, notwithstanding, even otherwise, as seen hereinabove, since the bifurcation was all along available with the AO by way of the Schedule to the assessee’s accounts for the year ended 31.03.2010, the ld. CIT(A) fell in error in not taking the same into consideration, as has been held in the preceding paragraphs. Since there was no interest income to the assessee from the funds invested in short-term deposits, the assessee is held to be justified in not offering any interest income for taxation in the revised return filed.

28. In view of the above discussion, the grievance of the assessee is found to be correct. The same is hereby accepted. The order of the ld. CIT(A) is cancelled. The addition of Rs.9,40,003/- is deleted.

29. In the result, the appeal is allowed.

Order pronounced in the open court on 01/01/2016.

Sd/- (A.D. JAIN)

JUDICIAL MEMBER