THE GAZETTE OF INDIA : EXTRAORDINARY [PART III—SEC. 4]

INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA

NOTIFICATION

Hyderabad, the 13th July, 2016

F. No IRDAI/RI/18/130/2016.—In exercise of the powers conferred by Sub-section (2) of the Section 101A of the Insurance Act 1938, the Authority, after consultation with the Advisory Committee constituted under section 101B of the Insurance Act 1938 and with the previous approval of the Central Government, hereby makes the following notification namely:-

The percentage cessions of the sum insured on each General Insurance Policy to be reinsured with the Indian Reinsurer shall be 5% in respect of insurance attaching during the year 1st April, 2016 to 31st March 2017 (except for government sponsored health insurance schemes, wherein it would be made ‘NIL’)

Section 101A (4) provides that a notification under sub-section (2) of Section 101A of the Insurance Act, 1938 may also specify the terms and conditions in respect of any business of re-insurance required to be transacted under this section and such terms and conditions shall be binding on Indian re-insurers and other insurers.

In pursuance of the power conferred by Section 101A of the Insurance Act, 1938 the Authority with the approval of the Central Government, hereby specifies the percentage and terms and conditions for the reinsurance cessions to the “Indian Reinsurer” in compliance with section 101A of the Act.

Profit Commission

1. Sliding scale of Profit commission based on the total obligatory portfolio of the company

2. Profit commission is payable if Loss Ratio is less than or equal to 78%

3. Surplus to be calculated after factoring

• Incurred loss % (to be worked at the end of 3 Financial years)

• Management Expenses at 2%

• Profit at 5%

• Commission at 15%

• Loss Ratio at 78% to 50%

4. No profit commission is payable if the loss ratio exceeds 78%.

5. Surplus to be shared between the direct insurer and GIC on 50%: 50% basis.

6. Profit commission shall not exceed 14%

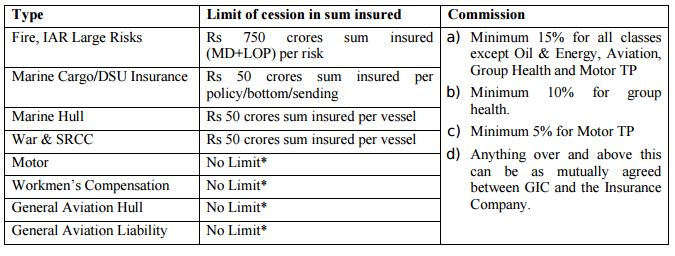

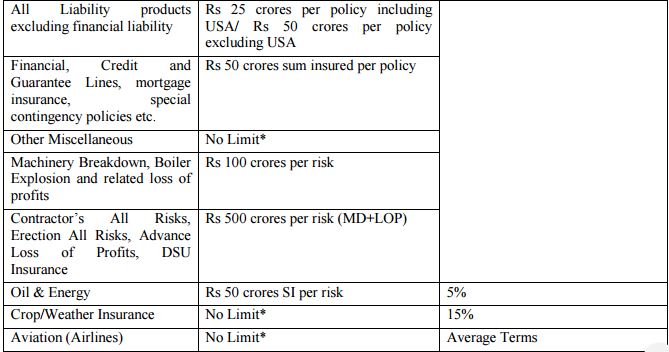

* Note: in respect of cessions with “No Limit” marked by an asterisk above, the “Indian Reinsurer” may require the ceding insurer to give immediate notice with underwriting information of any cession to it exceeding an amount per risk specified by it. Cessions in excess of such limits will be binding subject to the notice and information been given.

T. S. VIJAYAN, Chairman

[ADVT.-III /4/Exty/173(161)]