ORDER

Ravish Sood, Judicial Member. – The present appeal filed by the revenue is directed against the order passed by the Commissioner of Income-Tax (Appeals)-II, Raipur, dated 07.09.2020, which in turn arises from the order passed by the A.O under Sec.143(3) of the Income-tax Act, 1961 (in short ‘the Act’) dated 31.03.2015 for the assessment year 2012-13. The revenue has assailed the impugned order on the following grounds of appeal before us:

” 1. “Whether on points of law and on facts & circumstances of the case, the Ld. CIT(A) was justified in deleting the addition of Rs. 2,25,00,000/- made by the AO u/s 68 of the Act?”

2. Whether on points of law and on facts & circumstances of the case, the Ld. CIT(A) was justified in deleting the addition of Rs. 2,25,00,000/- by ignoring the facts as brought on record by the AO that the assessee company failed to prove the identity, genuineness and creditworthiness of the investor company as per the parameters of the legal provisions u/s 68 of the Act?”

3. “Whether on points of law and on facts & circumstances of the case, the Ld. CIT(A) was justified in deleting the addition, thereby not considering and not distinguishing the findings of the AO which is well supported by the ratio of the judgment of Hon’ble Gujurat High Court in the case of Pavan kumar M Sanghvi v. ITO [2018] 90 ITR 601 (Gujarat), wherein it is mentioned that it is also settled legal position that the onus of the assessee, of explaining nature and source of credit, does not get discharged merely by filing confirmatory letters, or demonstrating that the transactions are done through the banking channels or even by filing the income tax assessment particulars’?”

4. “Whether on points of law and on facts & circumstances of the case, the Ld. CIT(A) was justified in deleting the addition which is contrary to the ratio of the decisions in CIT v. Precision Finance Pvt Ltd 1994 2008 ITR 465, wherein it was held that it is for the assessee to prove the identity of the creditors, the creditworthiness and genuineness of the transaction and mere furnishing of particulars is not enough?

5. “Whether on points of law and on facts & circumstances of the case, the Ld. CITIA) was justified in deleting the addition which is contrary to the ratio of the decisions of Hon’ble Supreme Court in the case of A. Govindarajulu Mudaliar Va CIT [1958] 34 ITR 807 (SC)(SC), CIT v. M.Ganapathi Mudaliar [1964] 53 ITR 623 (SC), which clearly states that where the assessee failed to prove satisfactorily the source and nature of a credit entry in his books, and it is held that the relevant amount is the income of the assessee, it is not necessary for the Department to locate its exact source?”

6. Whether on points of law and on facts & circumstances of the case, the Ld. CIT(A) was justified in deleting the addition, thereby without considering and distinguishing the ratio of the judgment of the cases such as Rameshwar Prasad Bagla [1968] 68 ITR 653 (Allahabad)(Allahabad) & Homi v. CIT [1961] 41 ITR 135 (SC), 142 by (Supreme Court) wherein it is stated that the totality of circumstances must be considered in a case of circumstantial evidence & the totality of the circumstances has to be taken into consideration and the combined effect of all those circumstances is determinative of the question as to whether or not a particular act is proved?”

7. “Whether on points of law and on facts & circumstances of the case, the Ld. CIT(A) was justified in deleting the addition made by the AO and giving a decision in favour of the assessee and against the revenue, thereby giving a finding against the ratio of the settled law of the Hon’ble Bombay High Court in the case of Sanjay Bimalchand Jain, Nagpur (I.T.A. No. 18/2017 dated 10.04.2017, Bombay High Court, Nagpur Bench) wherein it is stated that since there is no economic or financial justification for the investment in the shares, the transaction has all the ingredients of attracting the rigors of Section 68 of the IT Act?”

8. Whether on points of law and on points of facts & circumstances of the case, the Ld.CIT(A) having concurrent powers of the AO u/s 250(4) of the Act, was justified in deleting the addition of Rs. 2,25,00,000/- made by the AO in the absence of satisfaction of parameters prescribed u/s 68 of the Act?”

9. “Whether on points of law and on facts & circumstances of the case, the Ld. CIT (A) was justified by giving a finding which is contrary to the evidence on record, as the Ld. CIT(A) has accepted the identity, creditworthiness of the entities investing in the share capital and share premiums of the assessee company as genuine, a finding which is factually incorrect, thereby rendering the decision, which is perverse?”

10 “Whether on points of law and on facts & circumstances of the case, the Id. CIT(A) was justified in ignoring the ratio of Hon’ble Delhi High Court in the case of CIT-II v. Jansampark Advertising & Marketing (P.) Ltd. reported in [2015] 5 ITR 373 (Delhi)held that “though it is obligation of assessing officer to conduct proper scrutiny of material, in even of assessing officer failing to discharge his functions properly, obligation to conduct proper inquiry shifts to commissioner (Appeals) and they cannot simply delete addition made by assessing officer on ground of lack of inquiry.”

11 “Whether on points of law and facts & circumstances of the case, the Ld. CIT(A) was justified in giving a decision in favour of the assessee and against the revenue though there is no nexus between the conclusion of fact and primary fact upon which without conclusion is based?”

12. “The order of the Id. CIT(A) is erroneous both in law and on facts”.

13. “Any other ground that may be adduced at the time of hearing”

2. Also, the assessee company has filed an application under Rule 27 of the Income Tax Appellate Tribunal, Rules, 1963 raising the following preliminary objection:

“Ground No.1 “On the facts and circumstances of the case and in law, assessment made u/s 143(3) dt. 31-3-15 by ITO-4(1), Raipur is invalid in absence of order u/s 127 by the competent authority (i.e., CIT, Kolkata); when notice u/s 143(2) issued on 12-8-13 from ITO-4(1), Kolkata; assessment made u/s 143(3) dt. 31-3-15 would be invalid, bad in law and is liable to be quashed”

Ground No.2 “On the facts and circumstances of the case and in law, when ‘case’ of the assessee has been transferred from one AO in West Bengal to another AO in Chhattisgarh and the 2 AOs are not subordinate to same Chief CIT; in absence of an agreement between the Chief CITs u/s 127(2)(a) in respect of such transfer of jurisdiction; assessment made u/s 143(3) dt. 31-3-15 by ITO-4(1), Raipur would be without jurisdiction and is liable to be quashed.”

As the assessee company based on its aforesaid application has assailed the validity of the jurisdiction that was assumed by the A.O, i.e. ITO-4(1), Raipur for framing the assessment u/s.143(3) of the Act, dated 31.03.2015 in absence of any order of transfer u/s.127 of the Act, the adjudication of which would not require looking any further beyond the facts available on record, therefore, we have no hesitation in admitting the same. Our aforesaid view is fortified by the judgments of the Hon’ble High Court of Bombay in the case of Peter Vaz v. CIT, Central Circle, Bangalore [2021] ITR 616 (Bombay)and that of the Hon’ble High Court of Delhi in the case of Sanjay Sawhney v. Pr. CIT (2020) 316 CTR 392 (Del). Also involving identical facts, the ITAT, Raipur in the case of ITO-2, Raigarh v. Shri Bishambhar Dayal Agrawal ITA No. 223/RPR/2016, 27.10.2023 had admitted the preliminary objection raised by the assessee under Rule 27 of the Income Tax Appellate Tribunal Rules, 1963.

3. Succinctly stated, the assessee company, viz. Bhagyaarna Gems & Jewellery Pvt. Ltd. (earlier known as M/s. Top Flow Property Pvt. Ltd.) had filed its return of income for A.Y.2012-13 on 25.09.2012, declaring an income of Rs.660/-. Subsequently, the case of the assessee company was selected for scrutiny assessment u/s. 143(2) of the Act.

4. The A.O during the course of the assessment proceedings observed that the assessee company had received share application money of Rs.2.25 crore from five share applicants, as under:

| S. No. | Name | Address | Amount |

| 1. | Jatadhari Marketing Pvt. Ltd. | 3rd Floor, 55, Ezra Street, Kolkata (WB)-700 001 | 5000000 |

| 2. | Needful Vioncom Pvt. Ltd. | 3, Marshi Devendra | 5000000 |

| 3. | Overflow Merchandise Pvt. Ltd. | 5th Floor, 52, Weston Street, Kolkata (WB)-700 012 | 5000000 |

| 4. | Shivratri Tradelink Pvt. Ltd. | 4th Floor, 74, Burtolla Street, Burra Bazar, Kolkata9WB)-700 007 | 5000000 |

| 5. | Trump Traders Pvt. Ltd. | 5th Floor, 83/85, Netaji Subhash Road, Dalhousie, Kolkata (WB)-700 001 | 5000000 |

On being queried, the assessee company in its attempt to substantiate its claim of having received genuine share application money from the aforesaid parties filed before the A.O the copies of share application forms, copies of return of income, balance sheets, profit & loss account and bank statements of the share applicant companies. The A.O in order to verify the veracity of the aforesaid transactions of receipt of share application money issued through post notice(s) u/s.133(6) of the Act to all the aforesaid share applicant companies. However, all the notices/letters were received back by the A.O with an endorsement of “not-known” by the postal authority. The A.O brought the aforesaid facts to the notice of the assessee company and directed it to substantiate the identity, creditworthiness of the investor companies a/w. genuineness of the respective transactions of receipt of share application money from them. Also, the A.O directed the assessee company to produce directors of the share applicant companies so that the authenticity of its claim of having received genuine share application money from them could be verified. However, the assessee company submitted that notice(s) issued u/s. 133(6) of the Act could not be served upon the share applicant companies for the reason that they had shifted to a new address. However, the A.O was not inspired by the aforesaid claim of the assessee because correspondence with the share applicant companies was carried out by him at the addresses that were provided by the assessee company.

5. As the assessee company had failed to substantiate the identity, creditworthiness of the share applicant companies and also the genuineness of its claim of having received share application money from them, therefore, the A.O held the entire amount of Rs.2.25 crore as unexplained cash credit u/s. 68 of the Act. Accordingly, the A.O vide his order passed u/s. 143(3) of the Act, dated 31.03.2015 determined the income of the assessee company at Rs.2,25,00,660/-.

6. Aggrieved the assessee carried the matter in appeal before the CIT(Appeals). The assessee company submitted before the CIT(Appeals) that though it had provided to the A.O the new correspondence addresses of all the share applicant companies but he had without carrying out any verification summarily held the entire amount of share application money as unexplained cash credit u/s. 68 of the Act. It was further submitted by the assessee company that as it had filed before the A.O the complete details of the share applicant companies a/w. their complete addresses, certificates of incorporation, copies of their returns of income, computation of income, annual returns and, thus, discharged the primary onus that was cast upon it as regards proving its claim of having received genuine share application money from the said investor companies, therefore, the A.O without dislodging the same by placing on record any material proving to the contrary was not justified in treating the entire amount of share application money as unexplained cash credit u/s. 68 of the Act. As the assessee by pressing into service the financial statements of the share applicants/investor companies, had claimed before the CIT(Appeals) that the said respective investor companies/share applicant companies had substantial creditworthiness to make respective investments towards share application money, therefore, the CIT(Appeals) called for a “remand report” from the A.O. In compliance, the A.O filed his “remand report” and a copy of the same was made available to the assessee to file its rejoinder.

7. The CIT(Appeals) after deliberating at length on the facts of the case in the backdrop of a host of judicial pronouncements, concluded that the onus that was cast upon the assessee company to prove the identity, creditworthiness and genuineness of the transactions of receipt of share application money from the five share applicant companies was duly discharged. Accordingly, the CIT(Appeals) based on his observations vacated the addition of Rs.2.25 crore (supra) that was made by the A.O u/s.68 of the Act. For the sake of clarity, the observations of the CIT(Appeals) are culled out as under:

“2.3 I have gone through the submission of the assessee and perused the assessment order. Facts are that during the assessment proceedings, the assessee was required to furnish the details of share application money received at Rs. 2.25 crores and to explain the genuineness of the transactions, identity and creditworthiness of the share applicants. In response to the query, the assessee-Co submitted the details of share applicants along with their complete address, certificate of incorporation, copy of ITR, computation of income & annual return of all the share applicants. The AO issued notice u/s133(6) to the respective share applicants, to call information but, some notices were not served and were returned back with remark “Not Known”, the reason for the same was change in name & address of the share applicants as the notices were issued to their old name at their old addresses, as under. AO confronted this fact to the appellant and the assessee- Co provided new name of the shareholders with their complete addresses alongwith copy of bank statements, ROC papers for change in name & address to the Id AO for verifying the real facts. But, without considering the reply of the assessee-Co, the Id AO made addition of Rs.2.25 crores stating that the assessee- Co has failed to prove the identity & creditworthiness of the share applicants and genuineness of the transaction by relying on Oasis Hospitalities P Ltd [2011] ITR 119 (Delhi). As per the AO the reply of the assessee regarding change of name and address is not acceptable. करदाता के सी० ए० के द्वारा प्रस्तुत जवाब विश्वास के योग्य नहीं है। क्योकि निर्धारण कार्यवाही के दौरान करदाता से ही शेयर होल्डरों का पता पूछा गया था परन्तु उनके द्वारा जो पता दिया गया उसी पते पर पत्राचार किया गया। He relied on the decision in the case of Oasis Hospitalities Pvt. In the present case the appellant has provided complete details of all the share applicants in form of complete name, complete address, copy of ITR, copy of balance sheet, copy of bank statements, ROC papers & annual returns. copy of the entire documentary evidences. Where as the decision of Oasis Hospitalities P Ltd the addition on account of share application money u/s 68 was sustained as in that case in one year (2007) the assessee had not furnished any proof of the identity, genuineness of the transaction. It may be noted that in other 2 years (i.e., 2008 & 2010) were in favor of the assessee- Oasis Hospitalities P Ltd as the primary onus laid upon was duly discharged by the assessee-Oasis Hospitalities P Ltd. In the instant case, the assessee-Co has provided full detail of all the shareholders and also all the documentary evidences regarding share application money received by the assessee-Co and also the new name & new complete address of the shareholders which were changed during the year. Hence, the assessee-Co has discharged the onus laid down by the revenue. The Id AO has not considered the reply made by the assessee-Co regarding the new address & new name of some of the shareholders but, he simply not accepted the contention of the assessee and made addition of share capital of Rs.2.25 crores. There are umpteen number of cases on the issue. In the case of Vodafone India Services (P) Ltd (2014) (Bom HC), it has been held that the ‘share premium’ being on the ‘capital amount’ cannot be subjected to tax as income.

Comments of the AO were called for who submitted her report vide letter dated 3.6.2019. The AO has defended the addition on the ground that

– All the investor companies are based in Kolkata

– The ROI of companies shows negligible income

– In these companies the AO’s have added their share capital u/s 68.

– Companies have changed their names and address.

– The companies are providing accommodation entries.

Sec 68 is invoked when the assessee is unable to explain the credits appearing in its books of accounts. In the present case, the assessee-Co has duly explained the said credit entries in the form of various documentary evidence filed. The said documentary evidence contained details, which set out not only the identity of the share applicants but also gave information, with respect to their address as well as PAN numbers and bank details. Hence, the addition made u/s68 in form of share application money may kindly be deleted.

Just because a company is located in Kolkata and it has changed its name and address cannot be ground for treating its capital as bogus. Regarding the other points raised, the issues are discussed as under. In short there is no evidence that the companies are providing accommodation entries. It has been held in various decisions that small ness of income is not a criteria to treat an investor not-creditworthiness. His state of affairs has to be seen from funds available as per the balance sheet.

Ld AO has simply brushed aside the reply of the assessee informing about the changed address and name of shareholders. He did not examine the documents submitted to establish the genuineness of share capital. On perusal of the documents submitted the audited balance sheet of M/s. Jatadhari Marketing Pvt Ltd (newly known as M/s. Wondrous Marketing Pvt Ltd) as on 31-3-12 the balance of shareholders fund is Rs.7.21 crores, long term borrowing is Rs.5.10 crores and noncurrent liabilities is Rs.2.83 crorers. The company has non-current investment of Rs.12.03 crores which was the investment made companies including the assessee company. An amount of Rs.50 lakhs has been invested in the assessee-Co and from this, it is very clear that the alleged share applicant had sufficient creditworthyness to invest the alleged money of Rs.50 lakhs in the assessee-Co. In the case of this investor, scrutiny assessment u/s143(3) for the AY12-13 had been completed vide assessment order dated 26-3-15 by the ITO, ward-2(4), Kolkata, in which addition of Rs.6.97 crores on account of share application money had been made by the revenue and substantial demand of Rs.3.17 crores had already been raised in the case of alleged share applicant.

From perusal of the balance sheet of M/s. Needful Vincom Pvt Ltd (newly known as M/s. Wondrous Vincom Pvt Ltd) as on 31-3-12 it is seen that out of the total investment of Rs.6.76 crores Rs.50 lakhs (ie., 8.86% of the total investment of the shareholder) is invested in the assessee-Co and from this, it is evident that the alleged share applicant i.e., M/s. Needful Vincom P Ltd had sufficient creditworthiness to invest the alleged money of Rs.50 lakhs in the assessee-Co. Further, in the case of M/s. Needful Vincom Pvt Ltd, scrutiny assessment u/s143(3) for the AY12-13 had been completed on 29-3-15 by the ITO, ward-6(4), Kolkata, in which a huge addition of Rs.8.99 crores on account of share application money had been made by the revenue and substantial demand of Rs.4.08 crores had been raised in the case of alleged share applicant.

From perusal of the balance sheet of M/s.Shivratri Tradelink Pvt Ltd (newly known as M/s.Casuarina Tradelink Pvt Ltd) as on 31-3-12 it is seen that out of the total investment of Rs.7.95 crores Rs.50 lakhs (i.c., 6.28% of the total investment of the shareholder) is invested in the assessee-Co. In the case of this company scrutiny assessment u/s143(3) for the AY12-13 had been completed vide assessment order dated 13-3-15 by the ITO, ward-6(1), Kolkata, in which addition of Rs.3.66 crores on account of share application money had been made by the revenue and substantial demand of Rs.1.66 crores had been raised in the case of alleged share applicant.

From perusal of the balance sheet of M/s.Trump Traders Pvt Ltd (newly known as M/s.Ecstatic Traders Pvt Ltd) as on 31-3-12 it is seen that out of the total investment of Rs.10.70 crores Rs.50 lakhs (i.e., 4.67% of the total investment of the shareholder) is invested in the assessee-Co. Thus it is evident that the alleged share applicant had sufficient creditworthiness to invest the alleged money of Rs.25 lakhs in the assessee-Co. In the case of M/s Ecstatic Traders Pvt Lid scrutiny assessment u/s143(3) for the AY12-13 had been completed on 14-3- 15 by the ITO, ward-5(3), Kolkata and addition of Rs.5.36 crores had been made by the AO on account of share application money and substantial demand of Rs.2.43 crores has also been raised in the case of alleged share applicant.

In case of M/s.Overflow Merchandise Pvt Ltd (newly known as M/s Ecstatic Merchandise Pvt Ltd) as on 31-3-12 the share applicant had sufficient creditworthiness to invest the alleged money of Rs.50 lakhs in the assessee-Co. In the case of this company scrutiny assessment u/s143(3) for the AY12-13 had been completed vide assessment order dated 4-3-15 in which addition of Rs.7.16 crores had been made by the AO.

In the case of Kansal Fincap Ltd [2014] (Delhi)) it has been held that if the any amount has been assessed in the hands of shareholders and he has investment money in the assessee company out of this fund, then the addition cannot be made in the hands of assessee company. In that case the AO held that the assessee was unable to discharge the onus, and prove genuineness of the receipt of Rs.63 lakhs as ‘SAM’. Bank accounts statement of the said 11 companies/share applicants disclosed that they were providing accommodation entries to the beneficiaries. Accordingly, addition of Rs.63 lakhs was made. Another addition of Rs.31,500 was made as commission paid by the assessee to the aforesaid companies to procure the entries. The assessee, succeeded in the first appeal on merits. The

FAA observed that the assessee had placed on record share application forms, data from the Registrar of Companies, board resolution of the aforesaid 11 companies, affidavit, PANs and ack form of the returns. He referred to the Lovely Exports (P) Ltd (2008) (SC) and other cases. He observed that the AO had not made out a case for taxing the ‘SAM’ received through banking channels.

Aggrieved, Revenue preferred an appeal before the Tribunal. Tribunal referred to the factual matrix and several decisions including the Nova Promoters & Finlease (P) Ltd [2012] 1ITR 169 (Delhi)in which the Lovely Export (P) Lid (2008) (SC) and Orissa Corpn (P) Ltd (1986) (SC) have been considered. Thereafter, the following directions have been issued by the Tribunal:

“18.1 In the light of view taken in the aforesaid decisions, we are of the opinion that the ratio laid down by Lovely Exports (P) Ltd (2008) (SC) and other decisions relied upon by y the Id CIT(A), without analyzing the facts and circumstances or material/ documents forwarded to the AO by the DIT(Inv), is not applicable in the present case.

18.2 Moreover, all the aforesaid 9 companies are stated to be assessed to tax in some year or other. What is the position of assessments of these companies for the relevant AY is not evident from the impugned order not has been brought to our notice by the la DR of the id AR. If the impugned amounts were assessed in the hands of the share applicants, the same could not be assessed in the hands of the assessee and vice versa.

18.3 In view of the foregoing, we consider it fair and appropriate to set aside the order of the Id CIT(A) and restore the matter to the file of the AO for deciding the issues raised in the grinos.2 and 2.1 in the appeal, afresh in accordance with law in the light of our aforesaid observations and various judicial pronouncement, including those referred to above and of course, after allowing sufficient opportunity to the assessee. With these observations gr.nos.2 and 2.1 in the appeal of the Revenue are disposed of. Consequently, gr.no.3 in the CO becomes infructuous.”

The HC remanded the matter to the AO to objectively examine the whole issue in the light of para 18.2 of the tribunal’s order as above.

All the shareholder companies are assessed to IT as per the assessment orders mentioned above. Also the acknowledgments of filing of their IT returns by those companies were submitted before the Id AO. As per the ITR, computation of income for the AY12-13 of all the share applicants, audited financial statements for the AY12-13 of all the share applicants, copy of bank statements of the assessee-co, which shows the receipt of share application money and ledger accounts of share capital from the books of the assessee-co the other two ingredients of share capital i.e identity and genuineness of share capital is established.

U/s 68, the ld AO has jurisdiction to undertake enquiries with regard to the amount credited in the books of the accounts of an Assessee. This could be any sum whether in the form of sale proceeds or receipt of share capital money. First, the AO is to enquire whether the alleged shareholders in fact exist or not. The truthfulness of the assertion by the Assessee regarding the nature and the source of the credit in its books of accounts can be examined by the AO. Where the identity the shareholders stands established and it is shown that they had in fact invested money in the purchase of the Assessee’s shares, and then the amount received would be regarded as capital. Where the Assessee offers no explanation at all or the explanation offered is unsatisfactory, the sec 68 may be invoked. If the assessee has discharged it onus by furnishing all the documents then as per decision in the case of Vodafone India Services (P) Ltd [2014] 50ITR 1 (Bombay), the ‘share premium’ being on the ‘capital amount’ cannot be subjected to tax as income.

On identical facts the decision of ITAT in the case of Goodview Trading (P) Ltd (2016) 47 ITR(T) 555 (Del-Trib) dt.15-1-16 had been affirmed by the Hon’ble Delhi HC in Goodview Trading (P) Ltd (2017) (Del HC), Facts in the case were that the CIT(A) noticed that the details of the share applicants such as their IT returns as well as the ‘net worth’ were available on the file of the assessment record. Based upon analysis and the submissions, the CIT(A) concluded that the share applicants had sufficient net worth and finances to invest in the assessee’s offerings with the premium of Rs.23 crores. The CIT(A) recorded inter alia as follows:

“I have considered the assessment order and submissions of the appellant. It is settled law that the onus of proving a claim is initially on the assessee but this is a shifting burden and once an assessee discharge its primary onus, the burden shifts on the revenue. In the present case the appellant had duly discharged its onus by submitting necessary evidence available to establish the bona fide of the transactions. Thereafter, the onus shifted on the revenue to prove that the claim of the appellant was factually incorrect. Simply by pointing out that the claim of the appellant was factually incorrect. Simply by pointing out that the applicant companies did not have sufficient income or that the bank accounts indicated credits and debits in rapid succession leaving little balance does not discharge the burden cast upon the revenue to take an adverse view in the matter. Further, if there was statement of a person or any other material indicating tax evasion by the appellant, or persons in control of its management, the material relied upon should have been made available to the appellant in its entirety. From the records, it appears that this was not done. It has been held by the Hon’ble Apex Court that taxing authorities exercise quasi-judicial powers and in doing so they must act in a fair and not a partisan manner. Although it is part of their duty to ensure that no tax which is legitimately due from the assessee should remain unrecovered, they must also at the same time not act in a manner as might indicate that scales are weighted against the assessee. It is impossible to subscribe to the view that unless those authorities exercise the power in a manner most beneficial to the revenue and consequently most adverse to the assessee, they should be deemed to have exercised it in a proper and judicious manner- Simon Carves Ltd (1976) (SC). In my considered opinion, this is not the case where addition should have been made u/s153C, but u/s147/143(3) after A.Y 12-13, Appeal No100/15-16 making proper enquires. In the present facts of the case, the addition is not legally sustainable and is deleted. Appellant gets relief of Rs 25,00,96,500.”

The ITAT concurred with this view- The revenue urges that the CIT(A) and the ITAT both grievously erred in cancelling the additions made. It is submitted that the genuineness of the transactions and the credit worthiness is suspect in the circumstances of the case. Ld counsel relied upon a tabular chart prepared by the AO to submit that most of the share applicants had paid little or no IT and that analysis of the bank statements furnished by such investors revealed that the amounts were deposited in cash and also routed through different entities. It was submitted that whereas the identity of the investors was no doubt established, neither the genuineness nor credit worthiness could be said to have been satisfied to pass the test of bona fide transactions. It is submitted that in these circumstances, the CIT(A)’s decision- as endorsed by the ITAT- is required to be set aside in this appeal.

This Court has considered the materials on record. As against the AO’s tabular appreciation of the facts, the CIT(A) also framed another chart which interestingly reveals the ‘net worth of the companies that had invested in the course of the share offerings, of the applicant.

It is quite evident from the CIT(A)’s reasoning in para-1.3, that the materials clearly pointed to the share applicants’ possessing substantial means to invest in the assessee’s company. The AO seized certain material to say that minimal or insubstantial amounts, was paid as tax by such share applicants and did not carry out a deeper analysis of rather chose to ignore it. In these circumstances, the inferences drawn by the CIT(A) are not only factual but facially accurate. Having regard to these circumstances, the Court discerns no que of law, least a substantial que, having regard to the fact that the judgment in Lovely Exports (SC) was cited and applied. For these reasons, there is no merit in the appeal; the same is accordingly dismissed.

On identical facts in the case of Bahubali Dyes Ltd (2015) (Del-Trib), held as under:

18. From the above, it is evident that the share capital including reserves and surplus of all the 6 companies who applied in the shares of the assessee-Co is several times more than the investment made by them in the shares of the assessee-Co. The assessee has also furnished the copy of the assessment order passed u/s143(3) in the case of 4 companies, viz., Beetal Plantation P Ltd, Integrator Consultants P Ltd, Pragati Foods P Ltd and Unit Commercial P Ltd. The assessee has produced certificate of inCorpn issued by the ROC in the case of all companies. Copy of bank account of all the companies is produced which shows the amount debited for acquiring the shares in the assessee-Co. On the basis of the above evidence, we have no hesitation to hold that the identity of all the 6 shareholder companies is duly established, all the companies are registered with the ROC, they are assessed to IT and they have also responded in response to the summons issued by the AO. Therefore, identity of these companies cannot be disputed. So far as creditworthiness is concerned, we find that the share capital as well as share premium/reserve of all the companies is several times more than the amount invested by them in the share capital of the assessee-Co. All the companies are assessed to IT, therefore, in cur our opinion, the creditworthiness far as genuineness of these companies cannot be disputed. So of the transaction is concerned, we find that the amount has come by cheque, the assessee has furnished the copy of the bank account of the company from where the cheque was issued, been disclosed in the schedules amount invested in the shares of investment attached with the of the assessee-Co has b-sheet of each company. Each company is assessed to IT and the shares were allotted to each company on the basis of the share application form. Therefore, in our opinion, the genuineness of the transaction is also duly established. The AO doubted the creditworthiness or the genuineness of the transaction on the basis of mere presumption and suspicion without properly appreciating the evidences on record. In view of the above, we entirely agree with the above finding of the Id CIT(A).”

The AO has to establish that there was re-routing of funds of the assessee in the form of share capital. If this fact is not established, no addition can been made. In SVP Builders (1) Ltd (Del HC), [2016] 67 t23(Delhi)] the honourable HC referred their decision in the case of M/s Five Vison Promoters Pvt Ltd:

In sum, it was explained by this Court in Five Vision Promoters (P) Ltd [2016] ITR 289 (Delhi)that:

“u/s 68, the AO has jurisdiction to undertake enquiries with regard to the amount credited in the books of the accounts of an Assessee. This could be any sum whether in the form of sale proceeds or receipt of share capital money. First, the AO is to enquire whether the alleged shareholders in fact exist or not. The truthfulness of the assertion by the Assessee regarding the nature and the source of the credit in its books of accounts can be examined by the AO. Where the identity of the shareholders stands established and it is shown that they had in fact invested money in the purchase of the Assessee’s shares, then the amount received would be regarded as capital. Where the Assessee offers no explanation at all or the explanation offered is unsatisfactory, the sec 68 may be invoked.”

When the impugned order of the ITAT T is examined in the light of the law governing sec 68, the Court finds that the ITAT was fully justified in coming to the conclusion that there exists no evidence to establish that there was any re-routing of the money collected by the RespondentCompanies. None of the shareholders denied having contributed to their share capital. The Revenue has not been able to show why the decision of Lovely Exports (P) Ltd (2009) (SC) does not apply to the facts and circumstances of the case.”

Further there has to be material on record to support that the ‘on-money’ collected in cash was routed back into the SVP Group companies in the form of share application and later reinvested in purchase of further lands for new projects. Also there was no material to conclude that some of the investors were ‘paper’ companies. They had been regularly assessed to tax and had produced their books during made the investment In Five Vision Promoters (P) Ltd (2016) (Del HC), held as under:

The Revenue had been unable to deny the factual position that only 11 of the 20 companies in Table I had actually been searched. The material on record showed that directors of 18 companies of the 20 companies were examined by the AO in the course of the remand proceedings and found from the books of accounts that the share capital stands duly recorded in their books of accounts. Thus, there was no justification for drawing an adverse inference particularly since no contrary material was placed on record by the revenue.

The decision of this Court in Nova Promoters & Finlease (P) Ltd [2012] 18342 ITR 169 (Delhi)was distinguishable on facts since in that case, 2 directors of the shareholder companies admitted to maintaining benami accounts and providing accommodation entries, whereas in the present cases there were no such statements. Also, here the AO did not take any steps to rebut the confirmation and evidence tendered by the shareholders.

The common address of shareholders was not a valid basis to disregard the claim of the Assessee in view of the decision of this Court in Winstral-Petrochemicals (P) Ltd [2011] 10135/330 ITR 603 (Delhi).

The subsequent sale of the shares subscribed was not germane to the que of the genuineness of the share capital amount received by the Assessees. Once the capital raised stood explained, the issue of disinvestment by the shareholder subsequently was a non-issue. The addition if at all was to be examined in the hands of the person purchasing the shares.

There was no material to support the Revenue’s case that the ‘on-money’ collected in cash was routed back into the SVP Group companies in the form of share application and later reinvested in purchase of further lands for new projects.

There was no material to conclude that some of the investors were ‘paper’ companies. They had been regularly assessed to tax and had produced their books of account during their respective assessment proceedings to show that they had made the investment in que. This had been accepted by the CIT(A) in their assessments by deleting the additions made of the said sums to their income by the AO concerned by holding that the additions if at all should be made in the hands of the beneficiaries. In the appeals filed in those cases, the Revenue had contended that the additions ought to have been sustained. Thus, the stand of the Revenue was contradictory and untenable.

The Assessee had discharged primary onus of proving the identity, genuineness and creditworthiness of the said shareholders.

28. Before proceeding to discuss the above submissions, a brief recapitulation of the legal position as regards sec 68 is necessary. U/s 68, the AO has jurisdiction to undertake enquiries with regard to the amount credited in the books of the accounts of an Assessee. This could be any sum whether in the form of sale proceeds or receipt of share capital money. First, the AO is to enquire whether the alleged shareholders in fact exist or not. The truthfulness of the assertion by the Assessee regarding the nature and the source of the credit in its books of accounts can be examined by the AO. Where the identity of the shareholders stands established and it is shown that they had in fact invested money in the purchase of the Assessee’s shares, then the amount received would be regarded as capital. Where the Assessee offers no explanation at all or the explanation offered is unsatisfactory, the sec. 68 may be invoked.

29. A Full Bench of this Court in Sophia Finance Ltd held in the context of sec 68 that:

| (i) | | The Assessee has to prima facie prove “(1) the identity of the creditor/ subscriber, (2) the genuineness of the transaction, namely, whether it has been transmitted through banking or other indisputable channels; (3) the creditworthiness or financial strength of the creditor/ subscriber”. |

| (ii) | | If the relevant details of the address of PAN identity of the creditor/ subscriber are furnished to the Deptt along with copies of the Shareholders Register, Share Application Forms, Share Transfer Register etc., it would constitute acceptable proof or acceptable explanation by the Assessee. |

| (iii) | | The Deptt would not be justified in drawing an adverse inference only because the creditor/ subscriber fails or neglects to respond to its notices. |

| (iv) | | The onus would not stand discharged if the creditor/subscriber denies of repudiates the transaction set up by the Assessee nor should the AO take such repudiation at face value and construe it, without more, against the Assessee. |

| (v) | | The AO is duty-bound to investigate the creditworthiness of the creditor/ subscriber, the genuineness of the transaction and veracity of the repudiation. |

Considering the above submission and case decisions relied on, the assessee- Co has duly proved the identity of the share applicants through the copy of ITRs, assessment orders u/s 143(3); has proved creditworthiness of the share applicants through the audited balance sheet wherein it is clear that these share applicants had sufficient net worth to invest the alleged money in the assessee-co and has also proved the genuineness of the transaction as the investment were made through banking channels and duly recorded in the books of account of the alleged share applicants, thus, the impugned additions. In fine, the assessee has discharged its onus by furnishing details and documents establishing the three limbs of genuineness of share capital. Ld AO has without finding any fault in the documents furnished by the appellant, made adverse finding. Where the assessee has furnished details of creditors and their confirmation and the AO did not make any inquiry and no effort was made to pursue so called creditors, the addition made by the AO is not sustainable [CIT v. Orissa Corporation Pvt Ltd 213/264 ITR 254 (Gauhati)held that where the assessee has furnished confirmation and other records of creditors and established identity, genuineness and creditworthiness, he has discharged his burden and no addition can be made. In the present case the Ld AO made inquiry at incorrect address. Thus The Hon’ble Apex Court in the case of CIT v. Lovely Exports (P) Ltd, reported in [2008] 216 CTR 195 (SC)and the jurisdictional High Court viz. Chhattisgarh High Court in the case of ACIT v. Venkateshwar Ispat (P) Ltd reported in [2009] 319 ITR 393 (Chhattisgarh)have dealt similar instances. As per the decision in M/s Lovely Exports (supra) if the share application money is received by the assessee company from alleged bogus shareholders, whose names are given to the AO, then the Department is free to proceed to reopen their individual assessments in accordance with law, but it cannot be regarded as undisclosed income of assessee company.

The honourable jurisdictional High Court Chhattisgarh has in the case of ACIT v. Venkateshwar Ispat Pvt Ltd [2009] 319 ITR 393 (Chhattisgarh)Chhattisgarh 2010, 41 DTR 350 justified the deletion of addition by ITAT. Briefly stated, the facts of the case are that the assessee-company filed its return for the assessment year 1989-90.h The Assessing Officer during assessment proceedings, not satisfied with the explanation of the assessee, added Rs.13,36,000 towards holdings of the shareholders, whose confirmation could not be adduced. Before the Commissioner of Income-tax (Appeals), the assessee sought permission for adducing additional evidence under rule 46A of the Income-tax Rules, 1962, which was accepted and appeal of the assessee was allowed on the basis of additional evidence adduced by the assessee as also keeping in view of the fact that for subsequent assessment year, the share holders investment was confirmed during the assessment proceedings.. The appeal preferred by the Revenue was dismissed by the ITAT. Before the honourable HC, it was submitted on behalf of the department that apart from the reasons assigned by the respondent, the Tribunal, wherein it has been held that the investment has been verified on the basis of the additional evidence adduced by the assessee, in view of the latest judgment of the hon’ble Supreme Court in the matter of CIT v. Lovely Exports P. Ltd. [2009] 319 ITR (St.) 5; [2008] 216 ITR (St.) 195, investment by the alleged bogus shareholders in a company cannot be regarded as the undisclosed income of the assessee-company, though individual investors can be proceeded against by the Department. The Court has deliberated that in the matter of Lovely Exports P. Ltd. [2009] 319 ITR (St.) 5, the question before the hon’ble Supreme Court was-whether the amount of share money can be regarded as undisclosed income under section 68 of the Act Answering the above question, the hon’ble Supreme Court has held that if the share application money is received by the assessee-company from alleged bogus shareholders, whose names are given to the Assessing Officer, then the Department is free to proceed to reopen their individual assessments in accordance with law, but it cannot be regarded as undisclosed income of the assessee-company. It was held that in view of the binding judgment of the hon’ble Supreme Court as also the findings recorded by the Commissioner of Income-tax (Appeals), which have been subsequently confirmed in appeal by the Appellate Tribunal, there is no question of law, much less a substantial question of law, arising for adjudication of this appeal. The appeal was, accordingly, dismissed.

In the present case I find that the investments made by the share applicant is duly reflected in the audited financial statement of the investor. It is a settled principle of law that reason for suspicion, however grave it may be, cannot be a basis for holding adversity against appellant. In my considered opinion, the ratio of the foresaid judgments are binding in nature on all the revenue authorities and courts etc. and further, the judgment of the jurisdictional High Court has been rendered on identical facts. Hence, it is impermissible to deviate from the ratio laid down therein and against the law of judicial precedents.

Recently vide order dated 18.1.2018 the jurisdiction ITAT Raipur has on the basis of similar facts in the case of ITA Nos. 225 to 231/RPR/2014 DCIT, Central Circle Raipur v. R.R.Energy Ltd has ruled in assessee’s favour. Following all these decisions, in view of the above facts, the addition of share capital is hereby deleted.

Therefore the addition of share capital as assessee’s income is hereby deleted and grounds of the assessee are allowed.

3.0 Appeal is allowed.”

8. The revenue being aggrieved with the order of the CIT(Appeals) has carried the matter in appeal before us.

9. We have heard the Ld. Authorized Representatives of both the parties, perused the orders of the lower authorities and the material available on record, as well as considered the judicial pronouncements that have been pressed into service by them to drive home their respective contentions.

10. As the assessee company has assailed the validity of the jurisdiction that was assumed by the A.O for framing the assessment vide his order passed u/s. 143(3) of the Act, dated 31.03.2015, for the reason that the impugned assessment was framed without any order of transfer u/s. 127 of the Act, based on which, it’s case was transferred from ITO-4(1), Kolkata to ITO-1(1), Raipur, therefore, we shall first deal with the same.

11. Shri Sunil Kumar Agrawal, Ld. Authorized Representative (for short ‘AR’) for the assessee company, at the threshold of hearing of the appeal, submitted that as the case of the present assessee was transferred from ITO-4(1), Kolkata to ITO-1(1), Raipur de-hors any order of transfer passed u/s.127 of the Act by the CIT, Kolkata, therefore, the A.O had wrongly assumed jurisdiction and framed the assessment vide his order passed u/s.143(3) of the Act, dated 31.03.2015. Elaborating on his contention, the Ld. AR submitted that as the case of the present assessee was transferred from ITO-4(1), Kolkata to ITO-1(1), Raipur i.e. from one A.O to another A.O who were not sub-ordinate to the same Pr. CIT, therefore, an order of transfer was mandatorily required to be passed under sub-section (2) of Section 127 of the Act. The Ld. AR in support of his aforesaid contention had taken us through Section 127(2) of the Act. The Ld. AR to buttress his claim that passing of an order u/s. 127 was an indispensable precondition for valid assumption of jurisdiction by the A.O to frame the assessment had relied on the judgment of the Hon’ble High Court of Delhi in the case of Raj Sheela Growth Fund (P) Ltd. v. ITO [2024] ITR 26 (Delhi)and that of the Hon’ble High Court of Orissa in the case of Vedanta Resources Ltd. v. ACIT [2023] . Also, the Ld. AR had relied on the order of the ITAT, Raipur in the case of Jindal Power Limited v. Jt. CIT, ITA Nos. 201 & 202/RPR/2017 dated 25.06.2024.

12. Per contra, the Ld. Senior Departmental Representative (for short ‘DR’) relied on the assessment order. The Ld. DR submitted that as the assessee company as per the mandate of Section 124(3) of the Act had in the course of the assessment proceedings not assailed the validity of the jurisdiction that was assumed by the ITO-4(1), Raipur (who had issued notice u/s. 143(2) of the Act, dated 20.02.2015), therefore, it could not be permitted to raise the said objection for the first time in the course of the present proceedings. The Ld. DR had relied on the judgment of the Hon’ble High Court of Punjab & Haryana in the case of Amarjit Singh Tut v. Union of India, [2010] ITR 585 (Punjab & Haryana).

13. As the assessee company had challenged the validity of the assessment framed by the A.O u/s. 143(3) of the Act, dated 31.03.2015 for the reason that no order of transfer u/s. 127 of the Act was passed by the Pr. CIT, Kolkata at the stage of transferring the case of the assessee to the A.O at Raipur, therefore, to verify the factual position the Ld. Sr. DR was directed to obtain a report from the A.O.

14. Before proceeding any further, we may herein observe that the appeal of the revenue was taken up for hearing way back as on 25.11.2022, which, thereafter, was adjourned for one or the other reason on 25 occasions. On a careful perusal of the file, we find that the Ld. DR on the majority of the dates had requested for some time so that the order of transfer u/s.127 of the Act could be obtained. However, we find that despite the fact that sufficient opportunities running over more than a year had been allowed to the department, but nothing has been placed on record which would prove that any order of transfer u/s.127 of the Act was passed by the Pr. CIT, Kolkata. For the sake of clarity, we deem it fit to cull out in a chronological manner the reports/correspondence that have been placed on record by the Ld. DR on the various dates of hearing of the appeal, as under:

I. Letter dated 22.08.2023 (sent though email) by the ITO-4(1) Raipur to ITO-4(1), Kolkata

| ■ | | On a perusal of the aforesaid correspondence forwarded through email, it transpires that the ITO-4(1), Raipur had made a reference of. viz. (i) the order sheet entry dated 22.08.2014, wherein it was mentioned that a letter was sent through email from CIT-II, Kolkata for transferring PAN of the assessee to ITO-4(1), Raipur; and (ii) the order sheet entry dated 14.10.2014, wherein it was stated that the PAN of the assessee had been migrated to ITO-1(1), Raipur as was requested by the ITO-4(1), Kolkata. Also, it is found mentioned in the aforesaid letter dated 22.08.2023 that no migration order or order u/s. 127 of the Act is found in the assessment folder of the assessee for A.Y.2012-13. The ITO-4(1), Raipur in the backdrop of the aforesaid facts, had requested the ITO-4(1), Kolkata to provide a copy of the order u/s. 127 of the Act and migration order pursuant to transfer of PAN of the assessee to ITO-1(1), Raipur as hearing of the matter was going on before the Tribunal. |

II. Letter dated 09.01.2023 (received through email).

| ■ | | The ITO-4(1), Kolkata had informed the ITO-4(1), Raipur that the order u/s. 127 of the Act that was requested by the latter being an old record was not readily available. At the same time, it was assured that as and when the same would be traced it would be made available. Apart from that, the ITO-4(1), Kolkata had suggested the ITO-4(1), Raipur to contact the Pr. CIT-II, Kolkata for obtaining a copy of order of transfer u/s. 127 of the Act. |

III. Letter dated 18.09.2023 (forwarded through email) of ITO-4(1), Raipur addressed to ITO-4(1), Kolkata

| ■ | | The ITO-4(1), Raipur had vide his aforesaid letter referring to the earlier correspondence once again requested the ITO-4(1), Kolkata to trace the copy of order of transfer u/s. 127 of the Act at the earliest and send a copy of the same as it was to be filed before the Tribunal on or before 25.09.2023. |

IV. Letter dated 18.09.2023 (through email) of ITO-4(1), Kolkata

| ■ | | the ITO-4(1), Kolkata vide his aforesaid email correspondence dated 18.09.2023, had stated that as was earlier informed the order u/s. 127 of the Act was not traceable as it was related to a very old case. Also, the ITO-4(1), Kolkata had once again suggested the A.O to obtain a copy of the order from the CIT. |

V. Letter dated 25.08.2014 of the ITO-4(1), Kolkata addressed to CIT-II, Kolkata

| ■ | | The ITO-4(1), Kolkata referring to certain facts had requested the CIT-II, Kolkata that the PAN of the assessee, viz. Bhagyaarna Gems & Jewellery Pvt. Ltd. (earlier known as M/s. Top Flow Property Pvt. Ltd.) may be migrated to the ITO-1(1), Raipur. |

VI. Letter dated 09.11.2023 of the Addl. CIT (ITAT), Raipur to Pr. CIT-II, Kolkata

| ■ | | The aforesaid letter (through email acknowledgement) revealed that the Addl. CIT (ITAT) Raipur had requested the Pr. CIT-II, Kolkata for providing a copy of the order passed in the case of the assessee u/s.127 of the Act. |

VII. Letter dated 17.10.2023 of ITO-4(1), Raipur addressed to Jt. CIT, ITAT, Raipur

| ■ | | The ITO-4(1), Raipur in his aforesaid letter had stated that he had requested the ITO-4(1), Kolkata to provide a copy of the order u/s.127 of the Act. It was stated by him that the ITO-4(1), Kolkata vide his email reply, dated 01.09.2023 had informed that as the record was very old and not readily available, therefore, the order u/s. 127 of the Act could not be traced. Also, it was suggested by him that the Pr. CIT-II, Kolkata may be contacted for providing a copy of the order. The ITO-4(1), Raipur had further stated that he had though once again through email dated 18.09.2023 requested for a copy of the order u/s. 127 of the Act, but he was again informed that the same was not traceable a/w. a suggestion that the CIT, Kolkata may be contacted for the same. |

| ■ | | ITO-4(1), Raipur in his letter had further stated that though he had tried his best to get a copy of the order u/s.127 of the Act from the O/o. Pr. CIT-1, Raipur, but it could not be traced out. It is also stated by him that he had once again requested the ITO-4(1), Kolkata vide his email dated 17.10.2023 to contact the office of the Pr. CIT-II, Kolkata to obtain the copy of order u/s. 127 of the Act. |

| ■ | | The ITO-4(1), Raipur vide his aforesaid letter dated 17.10.2023 had informed the Jt. CIT, ITAT, Raipur that as the order u/s. 127 of the Act was not presently available, therefore, the Tribunal may be requested to allow some further time. |

| ■ | | The ITO-4(1), Raipur had further informed that as per the office note sheet dated 28.08.2014 & 14.10.2014 and the letter dated 25.08.2014 of the ITO-4(1), Kolkata available in the assessment folder, the PAN of the assessee was transferred from Kolkata to Raipur in pursuance of the order of the then CIT-II, Kolkata but the same was not available in the said folder. At the same time, it was stated by him that as the case of the assessee was under scrutiny for the year under consideration and the migration of the PAN from Kolkata to Raipur could not have been done without the order u/s. 127 of the Act of the CIT/Pr. CIT. |

| ■ | | The ITO-4(1), Raipur had, inter alia, further stated that as the assessee had not objected as regards the order u/s. 127 of the Act as per the mandate of Section 124(3)(a) of the Act, therefore, he could not now be permitted to call in question the jurisdiction of the A.O in the course of the present proceedings before the Tribunal. |

VIII. Letter dated 17.10.2023 of the Jt. CIT, Range-1, Raipur

| ■ | | Jt. CIT, Range-1, Raipur vide his letter dated 17.10.2023 addressed to the Jt. CIT (ITAT) Raipur, had, inter alia, stated that though ITO-4(1), Raipur had made all efforts to obtain a copy of order u/s.127 of the Act but the same could not be found till date. The Jt. CIT, Range-1, Raipur had requested that some further time may be sought from the Tribunal. |

IX. Letter dated 18.10.2023 of the Jt. CIT, ITAT, Raipur

| ■ | | The Jt. CIT, ITAT, Raipur vide his letter dated 18.10.2023 addressed to the Jt. CIT, Range-1, Raipur had requested him to submit his report a/w. copy of order u/s. 127 of the Act on or before 03.11.2023. |

X. Letter of the Jt. CIT, Range-1, Raipur, dated 17.10.2023

| ■ | | The Jt. CIT, Range-1, Raipur vide his aforesaid letter dated 17.10.2023 addressed to the Jt. CIT, ITAT, Raipur, had once again stated that the copy of order of transfer u/s. 127 of the Act could not be traced and requested that some further time may be sought from the Tribunal. |

XI. Letter dated 06.11.2023 of the Jt. CIT, ITAT, Raipur.

| ■ | | The Jt. CIT, ITAT, Raipur vide his letter dated 06.11.2023 had requested the Pr. CIT-2, Kolkata that the order u/s. 127 of the Act passed by the then CIT/Pr.CIT may be provided on or before 28.11.2023. The Jt. CIT, ITAT, Raipur had further informed the Pr. CIT-2, Kolkata that the PAN jurisdiction over the case of the assessee was migrated from ITO-4(1), Kolkata to ITO-1(1), Raipur vide reference No.104002826131, dated 05.09.2014. |

XII. PAN migration sheet filed before us by the ITO-4(1), Raipur reveals as under:

XIII. Reminder letter dated 09.11.2023 of the Addl. CIT, ITAT, Raipur

| ■ | | The Addl. CIT, ITAT, Raipur vide his reminder letter dated 09.11.2023 had requested the Pr. CIT-II, Kolkata for providing a copy of the order u/s. 127 of the Act passed in the case of the assessee company. |

XIV. Letter dated 28.11.2023 of the St. DR, ITAT, Raipur

| ■ | | The Ld. Sr. DR vide her letter dated 28.11.2023 had requested for a copy of the order passed u/s. 127 of the Act. |

XV. Letter dated 14.12.2023 of the Jt. CIT, ITAT, Raipur

| ■ | | The Jt. CIT, ITAT, Raipur vide his letter dated 14.12.2023 had requested the Pr. CIT-II, Kolkata for providing a copy of the order of transfer u/s. 127 of the Act in the case of the assessee company. |

XVI. Letter dated 15.02.2024 of the ITO-4(1), Raipur.

| ■ | | The ITO-4(1), Raipur vide his letter dated 15.02.2024 addressed to the ITAT, Raipur had referred to his earlier request letters which were issued by his office to the ITO-4(1), Kolkata as well as the Pr. CIT-II, Kolkata for providing a copy of order u/s. 127 of the Act but the same had not been made available till date. For the sake of clarity, the details of the earlier correspondence referred by the ITO-4(1), Raipur vide his letter dated 15.02.2024 is culled out as under: |

| SI. No. | Letter No. /Mail | Date | Letter/Mail addressed to |

| (i) | F. No. ITO-4(1)/RPR/ITAT-Bhagyaarna/2023-24 | 22.08.2023 | ITO-4(1), Kolkata |

| (ii) | Mail | 22.08.2023 | ITO-4(1), Kolkata |

| (iii) | Mail | 04.09.2023 | ITO-4(1), Kolkata |

| (iv) | Mail | 18.09.2023 | ITO-4(1), Kolkata |

| (v) | Mail | 17.10.2023 | ITO-4(1), Kolkata |

| (vi) | F. No. ITO-4(l)/RPR/127/2023-24 | 19.10.2023 | Pr.CIT, Kolkata-2 |

| (vii) | F. No. ITO-4(l)/RPR/l27/2023-24 | 19.10.2023 | Pr. CIT-1, Raipur |

| (viii) | Mail | 13.01.2024 | ITO-4(1), Kolkata |

XVII. Letter dated 12.04.2024 of the Jt.CIT, ITAT, Raipur

| ■ | | The Jt. CIT, ITAT, Raipur vide his letter dated 12.04.2024 had placed on record of the Tribunal, a copy of the report of the ITO-4(1), Raipur, dated 10.04.2024. The ITO-4(1), Raipur in his report dated 10.04.2024 had, inter alia, stated that the order u/s 127 of the Act was not available with the department. At the same time, it was stated by him that as the assessee had not objected to the validity of the jurisdiction of the AO as required per the mandate of section 124(3)(a) of the Act, therefore, he was precluded from raising the same in the course of the present appellate proceedings. |

XVIII Letter dated 04.04.2024 of the ITO-4(1), Raipur addressed to the DCIT, ITO-4(1), Raipur.

| ■ | | The ITO-4(1), Raipur vide his letter dated 04.04.2024 had, inter alia, informed the Jt. CIT, ITAT, Raipur that as per the jurisdiction details the PAN of assessee was transferred from Kolkata to Raipur in pursuance of the order of the then CIT-II, Kolkata but the same was not available in the assessment folder. It is also stated that as the case of the assessee for the subject year i.e. 2012-13 was selected for scrutiny, therefore, the migration of the PAN from Kolkata to Raipur could not have been carried out in absence of an order of transfer u/s 127 of the Act of the CIT/Pr. CIT as there was involvement of RSA token of the CIT/Pr. CIT for transferring the PAN from one Pr. CIT to another Pr. CIT. |

15. As the department despite having been allowed substantial time period had failed to place on record a copy of the order of transfer passed by the CIT-2, Kolkata u/s.127 of the Act, therefore, considering the fact that in case any such order would have been passed by the CIT-2, Kolkata transferring the case of the assessee company from ITO-4(1), Kolkata to ITO-1(1), Raipur, then as per the mandate of sub-section (1) r.w. subsection (3) of Section 127 of the Act, an opportunity of being heard would have been afforded to the assessee company, the Ld. AR was queried about the same. In reply, as the Ld. AR had stated that the assessee company was unaware about any such order of transfer much the less any opportunity of being heard having been afforded to it, therefore, he was directed to place on record an “affidavit” of the director of the assessee company. On the next date of hearing, i.e. on 25.06.2024, the Ld. AR had placed on record an “affidavit” dated 24.06.2024 of Shri Haresh Advani, director of the assessee company, wherein it is, inter alia, stated by him that the assessee company was not informed about the transfer of its case from Kolkata to Raipur.

16. Ostensibly, a perusal of the aforesaid correspondence, inter se, the departmental officers as had been placed on our record read a/w. the affidavit” dated 24.06.2024 filed by the assessee company, reveals that no order u/s. 127 of the Act transferring the case of the assesse company from ITO-4(1), Kolkata who had initiated the assessment proceedings vide his notice u/s.143(2) of the Act, dated 12.08.2013, Page 1 of APB to the ITO-1(1), Raipur (succeeded by ITO-4(1), Raipur) i.e. the A.O who had framed the assessment u/s.143(3) of the Act, dated 31.03.2015 is found available on record.

17. We, thus, based on the aforesaid facts shall proceed with and adjudicate the solitary issue for which our indulgence has been sought i.e. as to whether or not the assessment order passed by the ITO-4(1), Raipur u/s. 143(3) of the Act, dated 31.03.2015 can be sustained in absence of any order of transfer u/s. 127 of the Act passed by the Pr. CIT, Kolkata?

18. Before proceeding any further for adjudicating the aforesaid issue, i.e. sustainability of the order passed by the ITO-4(1), Raipur u/s.143(3) of the Act, dated 31.03.2015 in absence of any order of transfer u/s.127 of the Act of the Pr. CIT, Kolkata, we deem it fit to briefly cull out the facts involved in the present case.

19. On a perusal of the record, it transpires that the assesse company viz. M/s. Top Flow Property Pvt. Ltd. (present name i.e. M/s. Bhagyaarna Gems & Jewellery Pvt. Ltd.) was incorporated vide certificate of incorporation dated 10.01.2012 issued by the Registrar of Companies, West Bengal, Page 103 of APB. The assesse company had filed its return of income for the subject year i.e. A.Y.2012-13 (1st year) with the ITO-4(1), Kolkata on 25.09.2012 declaring an income of Rs.660/-, Page 85 of APB. Thereafter, the case of the assessee company was selected for scrutiny assessment and notice u/s. 143(2) of the Act, dated 12.08.2013 was issued by the ITO-4(1), Kolkata, Page 1 of APB. Also, the ITO-4(1), Kolkata, had, thereafter issued notice u/s. 142(1) of the Act, dated 25.06.2014, wherein the assesse company was called upon to place on record certain information/documents, Page 2 of APB.

20. Information was shared by the DDIT (Inv.)-III, Raipur with the ITO-4(1), Kolkata that M/s.Bhagyaarna Gems & Jewellery Pvt. Ltd. (previously known as M/s.Top Flow Property Ltd.) had inaugurated its franchisee showroom at Sadar Bazar, Raipur on 07.10.2013. It was further informed that survey operation u/s. 133A of the Act was carried out at the business premises of M/s. Bhagyaaarna Gems & Jewellery Pvt. Ltd., Sadar Bazar, Raipur on 11.10.2013.

21. As is discernible from the “order sheet” noting, the case of the assesse company pursuant to an order u/s. 120 of the Act, dated 08.08.2014 of the CIT-2, Kolkata was transferred from ITO-4(1), Kolkata to ITO-1(1), Raipur. Also, as per the “order sheet” entry dated 14.10.2014 the PAN of the assessee company at the request of ITO-4(1), Kolkata vide his letter dated 25.08.2014 addressed to the CIT, Kolkata-2, Kolkata was transferred to ITO-1(1), Raipur.

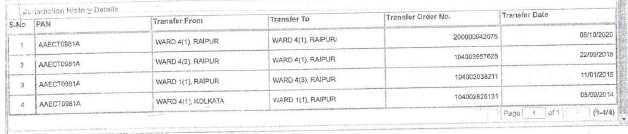

22. At this stage, we may herein observe that the case of the assessee company was initially transferred from ITO-4(1), Kolkata to ITO-1(1), Raipur and, thereafter, it was transferred to ITO-4(3), Raipur and finally to ITO-4(1), Raipur who had framed the assessment vide his order passed u/s. 143(3) of the Act, dated 31.03.2015. For the sake of clarity, the sequential transfer of the case as can be gathered from the letter of the ITO-4(1), Raipur, dated 15.04.2014 is culled out as under:

| Transfer from | Transfer To | Transfer Order No. | Transfer Date |

| Ward-4(1), Kolkata | Ward-l(l), Raipur | 104002826131 | 05/09/2014 |

| Ward-l(l), Raipur | Ward-4(3), Raipur | 104003038211 | 11/01/2015 |

| Ward-4(3), Raipur | Ward-4(1), Raipur | 104003957628 | 22/09/2015 |

| Ward-4(1), Raipur | Ward-4(1), Raipur | 200000942075 | 06/10/2020 |

23. At this stage, we may herein observe that the controversy involved in the present appeal hinges around two issues, viz. (i) whether or not the CIT, Kolkata-2, Kolkata had validly transferred the case of the assesse company from ITO-4(1), Kolkata to ITO-1(1), Raipur?; and (ii) whether the transfer of the case of the assessee company to an A.O not sub-ordinate to the same CIT who originally exercised jurisdiction over it could have been carried out without passing an order after giving the assessee company a reasonable opportunity of being heard in the matter and recording his reasons for doing so as required per the mandate of Section 127 of the Act?

24. Apropos the first issue, we are of a firm conviction that in terms of Section 120 of the Act, pursuant to a CBDT direction, it though might have been possible for the CIT, Kolkata-2, Kolkata to have authorized vesting the exercise of powers and performance of functions of one Incometax authority subordinate to him to another Income-tax authority subordinate to him, but are afraid that there was no power vested with him u/s. 120 of the Act to have transferred the jurisdiction to an A.O who was not sub-ordinate to him. We, say so, based on the clearly worded subsection (2) of Section 120 of the Act, which reads as under:

“120(2) The directions of the Board under sub-section (1) may authorise any other income-tax authority to issue orders in writing for the exercise of the powers and performance of the functions by all or any of the other income-tax authorities who are subordinate to it.”

(emphasis supplied by us)

Our aforesaid conviction is fortified by the judgment of the Hon’ble High Court of Orissa in the case of Vedanta Resources Ltd. v. Assistant Commissioner of Income Tax, International Taxation, Bhubaneshwar, [2023] (Orissa), dated 09.02.2023, wherein it was, inter alia, held as under:

“16. While in terms of Section 120 of the Act, it might be possible for the CIT (IT), New Delhi to transfer jurisdiction from one Assessing Officer to another within his jurisdiction, there is no power under Section 120 of the IT Act to transfer jurisdiction to an AO who is not subordinate to the CIT (IT), Delhi. For that purpose, it is only Section 127(2)(a) of the IT Act that could apply. In similar circumstances, the Delhi High Court in an order dated 13th May 2022 in W.P.(C) No.9713/2019 (Louis Dreyfus Company Asia Pte. Ltd. v. Commissioner of Income Tax (International Taxation- 2) quashed the notices issued to the Petitioner by the DCIT in Mumbai when in fact that case was subject to the jurisdiction of the DCIT (IT) in New Delhi.”

Accordingly, we are of the view that the claim of the Ld. Departmental Representative (for short ‘DR’), which in turn, is based on the “order sheet” noting dated 08.09.2014 (supra) that the case of the assesse company had been transferred to ITO-1(1), Raipur from ITO-4(1), Kolkata pursuant to the order passed u/s.120 of the Act, dated 08.08.2014 of the CIT, Kolkata- 2, Kolkata cannot be accepted and thus, fails.

25. We shall now deal with the second aspect, for which, our indulgence has been sought in the present appeal, i.e. whether transfer of the case of the assessee company from ITO-4(1), Kolkata to ITO-1(1), Raipur i.e. inter se the A.O’s who were not sub-ordinate to the same CIT could have been carried out without passing an order as required under sub-section (2) of Section 127 of the Act.

26. Before proceeding any further, we deem it fit to cull out the provisions of Section 127 of the Act, which reads as under:

“127. (1) The Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner may, after giving the assessee a reasonable opportunity of being heard in the matter, wherever it is possible to do so, and after recording his reasons for doing so, transfer any case from one or more Assessing Officers subordinate to him (whether with or without concurrent jurisdiction) to any other Assessing Officer or Assessing Officers (whether with or without concurrent jurisdiction) also subordinate to him.

(2) Where the Assessing Officer or Assessing Officers from whom the case is to be transferred and the Assessing Officer or Assessing Officers to whom the case is to be transferred are not subordinate to the same Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner,—

(a) where the Principal Directors General or Directors General or Principal Chief Commissioners or Chief Commissioners or Principal Commissioners or Commissioners to whom such Assessing Officers are subordinate are in agreement, then the Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner from whose jurisdiction the case is to be transferred may, after giving the assessee a reasonable opportunity of being heard in the matter, wherever it is possible to do so, and after recording his reasons for doing so, pass the order;

(b) where the Principal Directors General or Directors General or Principal Chief Commissioners or Chief Commissioners or Principal Commissioners or Commissioners aforesaid are not in agreement, the order transferring the case may, similarly, be passed by the Board or any such Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner as the Board may, by notification in the Official Gazette, authorise in this behalf.

(3) Nothing in sub-section (1) or sub-section (2) shall be deemed to require any such opportunity to be given where the transfer is from any Assessing Officer or Assessing Officers (whether with or without concurrent jurisdiction) to any other Assessing Officer or Assessing Officers (whether with or without concurrent jurisdiction) and the offices of all such officers are situated in the same city, locality or place.

(4) The transfer of a case under sub-section (1) or sub-section (2) may be made at any stage of the proceedings, and shall not render necessary the re-issue of any notice already issued by the Assessing Officer or Assessing Officers from whom the case is transferred.”

(emphasis supplied by us)

On a perusal of sub-section (2) of Section 127 of the Act, it transpires that the same therein contemplates that where the A.O or A.Os from whom the case is to be transferred and the A.O or A.Os to whom the case is to be transferred are not subordinate to the same Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner, then, the same postulates two situations, viz. (i) where the Directors General or Chief Commissioners or Commissioners to whom such Assessing Officers are subordinate are in agreement, then the Director General or Chief Commissioner or Commissioner from whose jurisdiction the case is to be transferred may, after giving the assessee a reasonable opportunity of being heard in the matter, wherever it is possible to do so, and after recording his reasons for doing so, pass the order; and (ii) where the Directors General or Chief Commissioners or Commissioners are not in agreement, the order transferring the case may, similarly, be passed by the Board or any Director General or Chief Commissioner or Commissioner as the Board may, by notification in the Official Gazette, authorise in this behalf.

27. Accordingly, as in the case of the present assessee company before us, the case was to be transferred from ITO-4(1), Kolkata to ITO-1(1), Raipur, i.e. the officers were not sub-ordinate to the same CIT, therefore, as per the clearly worded sub-section (2) of Section 127 of the Act, the CIT, Kolkata-2, Kolkata i.e. from whose jurisdiction the case was to be transferred, after giving the assessee company a reasonable opportunity of being heard in the matter and after recording his reasons for doing so was obligated to pass an order. We, thus, in terms of our aforesaid observations are of a firm conviction that the obligation of passing an order of transfer as per sub-section (2) of Section 127 of the Act was required to be statutorily complied with and could not have been dispensed with for valid assumption of jurisdiction by the ITO-1(1), Raipur to whom the case was transferred.

28. Our aforesaid view that as per the mandate of law a transfer order is statutorily required to be passed by the prescribed authority u/s.127 of the Act, and an A.O cannot on his own transfer an income tax file to another officer in the absence of the aforesaid order is squarely covered by the judgment of the Hon’ble High Court of Calcutta in the case of Kusum Goyal v. ITO and Ors2010] 329 ITR 283 (Calcutta). For the sake of clarity, the observations of the Hon’ble High Court are culled out as under:

“The question which falls for consideration is whether under section 127 of the Act an Assessing Officer on his own can transfer an income tax file to another officer and whether an order is required to be passed. In order to appreciate the issue it is necessary to refer to the relevant provisions in section 127 of the Act which is as under :

“127.(1) The Director General or Chief Commissioner or Commissioner may, after giving the assessee a reasonable opportunity of being heard in the matter, wherever it is possible to do so, and after recording his reasons for doing so, transfer any case from one or more Assessing Officers subordinate to him (whether with or without concurrent jurisdiction) to any other Assessing Officer or Assessing Officers (whether with or without concurrent jurisdiction) also subordinate to him.

(2) Where the Assessing Officer or Assessing Officers from whom the case is to be transferred and the Assessing Officer or Assessing Officers to whom the case is to be transferred are not subordinate to the same Director General or Chief Commissioner or Commissioner –

(a) where the Directors General or Chief Commissioners or Commissioners to whom such Assessing Officers are subordinate are in agreement, then the Director General or Chief Commissioner or Commissioner from whose jurisdiction the case is to be transferred may, after giving the assessee a reasonable opportunity of being heard in the matter, wherever it is possible to do so, and after recording his reasons for doing so, pass the order;

(b) Where the Directors General or Chief Commissioners or Commissioners aforesaid are not in agreement, the order transferring the case may, similarly, be passed by the Board or any such Director General or Chief Commissioner or Commissioner as the Board may, by notification in the Official Gazette, authorise in this behalf.

(3) Nothing in sub-section (1) or sub-section (2) shall be deemed to require any such opportunity to be given where the transfer is from any Assessing Officer or Assessing Officers (whether with or without concurrent jurisdiction) to any other Assessing Officer or Assessing Officers (whether with or without concurrent jurisdiction) and the offices of all such officers are situated in the same city, locality or place.” (Emphasis supplied)

From a reading of the language of section 127(3) it is evident that when a file is transferred from one assessing officer to another whose offices are located in the same city, locality or place, though other statutory formalities are required to be complied with, the opportunity of hearing as postulated in section 127 (1) and (2) in case of inter city transfer, is not required.

Now keeping the position of law in mind let the letter/notice dated 21st October, 2009 issued by the respondent no.2 be examined. In order to appreciate the issue it is necessary to refer to the relevant portion of the impugned intimation issued by the respondent no.2 which is as under:

“Since your income has exceeded minimum threshold limit of Rs.10 lac for the assessment year 2007-2008, the jurisdiction to/of your case automatically gets vested with the Jurisdictional DCIT-Circle-54, Kolkata as per above Directives.

You are kindly informed hereby that no order u/s 127 of the Income Tax Act 1961 by the Ld. Commissioner of Income Tax -XIX, WB is required to be passed for getting the assessment records transferred from ITO Ward-54(2), Kolkata to DCIT Circle-54, Kolkata by virtue of the provisions of sub-section 3 of section 127 of the Income Tax Act, 1961. For your ready reference the provisions of the said section is appended below.

Section 127 sub-section (3) of the Income Tax Act, 1961 states/reads as:……