ORDER

T.R. Senthil Kumar, Judicial Member.- This appeal is filed by the Revenue as against the appellate order dated 06.04.2021 passed by the Commissioner of Income Tax (Appeals)-12, Ahmedabad arising out of the assessment order passed under section 143(3) of the Income Tax Act, 1961 (hereinafter referred to as ‘the Act’) relating to the Assessment Year 2012-13.

2. Brief facts of the case is that the assessee is Private Limited Company has no business activity during the financial year and filed its Return of Income for the Asst. Year 2012-13 on 27-09-2012 claiming a loss of Rs.16,301/-. The return was processed u/s. 143(1) of the Act and then after taken for scrutiny assessment. The Assessing Officer found that the assessee company has received share application money with premium from three parties of Rs.10.5 crores and has given loans and advances of Rs.10.46 crores. The Assessing Officer issued notices to provide the share applicant’s/subscribers details, proof of identity, credit worthiness, bank transaction and copy of the Returns filed by the above applicants. The assessee failed to comply with the notices and when A.O. issued notices u/s. 133(6) to the share applicants, the same were also not replied by them. Thereby the Assessing Officer treated the share application money of Rs.10.5 crores as unexplained income of the assessee and also treated the commission expenses calculated at 2.5% on the above amount of Rs.26,25,000/- as unexplained expenditure u/s. 69C of the Act and demanded tax thereon as follows:

| Sr. No. | Name of the applicant | Number of shares | Amount of share capital | Amount of share premium | Total share capital |

| 1. | Iscon Aviation Pvt. Lid | 2000000 | 2,00,00,000 | 0 | 2,00,00,000 |

| 2. | M/s. Adamina Traders Pvt. Ltd. | 130000 | 6,50,000 | 6,43,50,000 | 6,50,00,000 |

| 3. | M/s.Acacio Tradelink Pvt. Ltd. | 40000 | 2,00,000 | 1,98,00,000 | 2,00,00,000 |

| Total | 2170000 | 20850000 | 8,41,50,000 | 10,50,00,000 |

3. Aggrieved against the assessment order, assessee filed an appeal before Ld. CIT(A) who deleted the above additions by passing a detailed order after calling for Remand Report from the Assessing Officer and Rejoinder from the assessee by observing as follows:

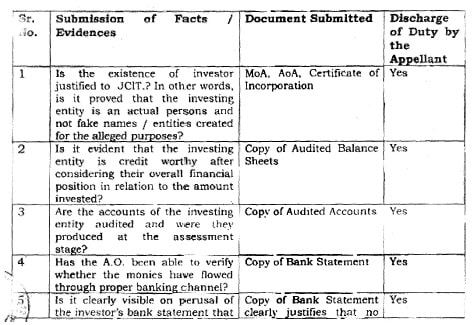

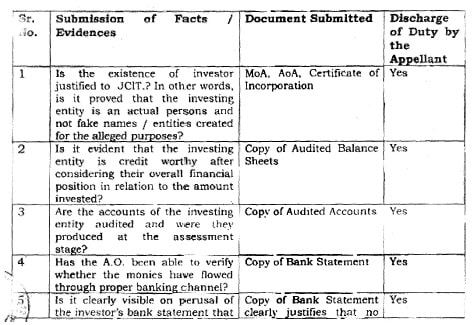

“… 9.5. Against the reasons given for making the additions, the appellant company filed detailed submissions, rebuttal to the remand report of the AO as well as justification admission of additional evidence under for Rule 46-A of the 1.T Rules, 1961. With regard to the Identity of the share applicant companies / proving of subscribers in respect of amount Share capital of Rs.2,00,00,000/- and amount of share of from Iscon Aviation Pvt. Ltd premium of Rs.6,43,50,000/-M/s. Adamina Traders Pvt. Ltd and Rs.1,98,00,000/- M/s. Acacio from Tradelink Pvt.Ltd, the appellant company submitted the following documents:

| (i) | | Confirmation of the party |

| (ii) | | Copy of Bank Statements |

| (iii) | | Acknowledgement copy of ITR along with copy of Annual Report. |

| (v) | | Application Form, Form No. 2 |

| (vi) | | Master Data with Directors Details from the website of ROC |

| (vii) | | Memorandum and Articles of Association. |

| (viii) | | Copy of Board Resolution |

The copy of summary chart of all the documents submitted along with relevant page number of Paper Book is attached herewith.

3.1. Ld CIT[A] further held that the share application money received from the above companies cannot be treated as unexplained as the amount has been received through cheques and reflected in the audited accounts of the company. There is no factual evidence to prove that the transactions were not genuine or there were some cash transactions to prove that the share application money was not genuine and relied upon Supreme Court judgement in the case of Lovely Exports as follows:

“…… 9.22. After considering the finding given by the AO, the detailed submissions given by the appellant and facts of the case, I am of the considered opinion that appellant company has duly discharge its onus of explaining the share application money received by the appellant company. In the present case, the AO has not been able to dispute the evidence furnished by the appellant company in support of share application money. Similar view has been taken in the case of Lovely Exports (P) Ltd (cited supra). In view of the aforesaid facts and settled legal position the issue in the present case of the appellant is duly covered by the decisions of the Hon’ble Bombay High Court in the case of Orchid Industries Pvt.Ltd wherein, the Hon’ble High Court has considered the decision of the division Bench of Bombay High Court in the case of CIT v. Gagandeep Infrastructure Pvt. Ltd 12017)and the Hon’ble Supreme Court in the case of CIT v. Lovely Exports (P) Ltd

“… 5. The Assessing Officer added Rs.95 lakhs as income under section 68 of the Income tax Act only on the ground that the parties to whom the share certificates were issued and who had paid the share money had to appeared before the Assessing Officer and the summons could be served on the address given as they were not traced and in respect of some of the parties who had appeared, it was observed that just before issuance of cheques the amount was deposited in their account.

6. The Tribunal has considered that the Assessee has produced on record the documents to establish the genuineness of the party such as PAN of all the creditors along with the confirmation, their bank statements showing payment of share application money. It was also observed by the Tribunal that the Assessee has also produced the entire record regarding issuance of shares ie. allotment of shares to these parties, their share application forms, allotment letters and share certificates, so also that books of account. The balance sheet and profit and loss account of these persons discloses that these persons had sufficient funds in their accounts for investing in the shares of the assessee. In view of these voluminous documentary evidence, only because those persons had not appeared before the Assessing Officer would not negate the case of the Assessee. The judgment in the case of Gagandeep Infrastructure (P) Ltd (supra) would be applicable in the facts and circumstances of the present case”

9.23. The appellant company has received share application money from various entities only by account payee cheques through regular banking channels and the appellant company after observing the formalities laid down under the Companies Act as regards to the issue of share capital and allotment of shares and for which necessary forms required to be filed with the Registrar of Companies have also been filed by the appellant company and that the respective parties who have made subscription in the share capital of the appellant company is being duly reflected as the investment in the share capital of the appellant company in their balance sheet and in their books of accounts.

3.2. Ld CIT[A] further held that the No opportunity of Cross examination of Shirish Chandrakant Shah and others whose statements have been relied upon by the AO, but the copy of which has not been provided to the assessee company nor provided during the Remand report proceedings so the additions are liable to be rejected by observing as follows:

“… 9.18. Further, the appellant company was not confronted with the material collected by the ITO, Ward 4(1)(1), Ahmedabad by the A.O and no opportunity of examination of such documents and cross examination of the persons, whose statements have been recorded and relied upon by the AO has been provided to the appellant company. The principles of natural justice demand that the appellant company should be given an opportunity to verify and examine all such adverse and incriminating materials, which the AO has utilized against it. This is a clear mandate which emerges from the various judicial pronouncements. These facts have not been established by the A.O so far and therefore, the AO has not been able to establish the allegation that the appellant company has failed to offer any satisfactory explanation of credits in the name of share application money received from the three companies as mentioned in the table herein above,

9.60. The A.O for the first time in his show cause notice dated 16th March 2015 used the statement of Shri Shirish C Shah & others as well as two directors of two Private Limited Companies namely: 1. Adamina Traders PVI Ltd, 2. Acacio Tradelink Pvt. Ltd as departmental witnesses statements recorded behind the back of the appellant company and also used computer excel sheets and computer data extracts and extracts of affidavits and declarations filed by the directors was for the first time; given only in the remand report made by the AO.

9.61. The appellant company as well as Mr. Jayesh Kotak (Director of JP Iscon Group) came to know from the remand report, where the AO for the first time made a reference of the statement of Shri Shirish C. Shah and seven other directors in the remand report as a departmental witness’s statement recorded behind the back of the appellant company as departmental witness cannot be used against appellant company without granting an opportunity of crossexamination in view of the judicial pronouncements of Hon’ble Supreme Court in the case of Andaman Timber Industries v. Commissioner of Central Excise, cited supra.

9.62, The A.O in the aforementioned paragraph has relied upon the statement of Shri Shirish C. Shah recorded on 11/03/2016 u/s. 131 of the 1.T Act before DCIT Central Circle 1(a) Ahmedabad, the copy of which has not been provided to the appellant company nor is it attached to this remand report so it is required and liable to be rejected/ignored altogether on facts as well as in law. This is because the statement is not confronted to the appellant company at any stage even till today.”

3.3. Ld CIT[A] held that the AO has alleged the transaction to be that of an accommodation entry without bringing on record independent or cogent material evidence suggesting that genuine transaction so carried out by the assessee company following due provisions u/s. 68 of the Act as well as due process of law as laid down under the Companies Act, 1956 by observing as follows: “… 9.46. No incriminating material such as alleged cash payment by the appellant company has been found during the search proceedings of “J. P. Iscon Group. It is vital to note here that the search in the case of J P Iscon Group was carried out on 25-02-2016 which is much later vis-a-vis the search carried out in the case of Shri Shirish C Shah on 09-04-2013 and the subsequent returning of funds as per the condition laid down by Shri Shirish C Shah in December, 2013, and thus the veracity of the alleged documents or incriminating evidence found on the aforementioned search date at the premises of Shri Shirish C Shah at Mumbai is highly debatable and unlikely, as no evidence corresponding to the aforementioned cash payments as alleged by the AO have been placed on record for either cross verification or cross- examination by the appellant company.

9.47. The aforesaid facts establish that the share capital along with premium issued by J.A. Infracon Pvt. Ltd. to the respective companies were genuine share capital funds received by J.A. Infracon Pvt. Ltd, and J.P. Iscon Group are not the ultimate beneficiaries of the said funds except the said funds were available with J.P. Iscon Group only for a temporary period as Unsecured Loan Inter Corporate Deposits in J.P. Iscon Group and as soon as J.P. Fincorp Services Pvt. Ltd decided not to come up with public issue, the said funds received by way of share capital including premium were returned back to the company J.A. Infracon Pvt. Ltd and Satya Retail Pvt. Ltd and the management and control of the said companies were handed over to the directors nominated by the management of the companies who have invested in the share capital including premium in the company JA Infracon Pvt.Ltd and Satya Retail Pvt. Ltd.”

3.4. Ld CIT[A] held that the documents seized from Third Party premises cannot be used against the assessee and without supporting evidences having been brought on record by observing as follows:

“… 9.14 It has been noticed that the AO has issued the notice u/s. 133(6) of the I.T. Act, 196L to the aforesaid investor companies and in response to the same, the party namely M/s. Acacio Tradelink Pvt. Ltd and M/s. Adamina Traders Pvt. Ltd confirmed the transactions with the appellant company with necessary documents and evidences. These confirmations have not been properly controverted by the AO by way of bringing anything adverse on record. Further, in spite of availability of all the documents on record, nothing has been brought on record to doubt the transaction with the share applicant companies who have made the share application in the appellant company. The A.O instead of considering the cogent material evidences placed on record by the appellant company chose to rely upon the oral statements of the directors of the two investor companies, despite in the statements given by the directors of the two investor companies nowhere the name of the appellant company is appearing nor admitted of giving any share capital with premium issued to the two investor companies and Iscon Aviation Pvt. Ltd(without premium) being referred in those statements. The A.O, being a quasi judicial authority should have made an enquiry from the directors of the companies as well as from Shri Shirish C. Shah and others on whose statements, chooses to rely upon. It may also be noted that addition has been made on the basis of documents received during search conducted at the third-party premises i.e. Shri Shirish C Shah without any independent enquiry having been made nor supporting evidences having been brought on record which could reasonably hint at any cash payment. It is also noted that no agreement, payment vouchers or any reasonably incriminating evidence had been recovered from the premises of J.P Iscon Group during the course of search proceedings that could justify the allegation of cash payment and in support of this the reliance is placed on decision of Hon’ble Supreme Court rendered in the case of C.B.I. v. V.C. SHUKLA &Ors., Criminal Appeal Nos. 247 of 1998 – 256 of 1998 and in the case of Common Cause (A Registered Society and Others v. Union of India and Ors.

9.15 That it can be accepted that the presumption u/s. 132(4A) r.w.s.292C is applicable to the third party in whose case seized material has been recovered and not in case of the Appellant. The AO has not brought on record any cogent material and independent clinching evidences to establish on record that the Investor companies were shell I paper companies controlled by Shri Shirish C. Shah. The complete addresses, PAN Nos, details of payments and confirmation from the sellers as well as the purchasers were available on record with the AO which prima facie proved the genuineness of the transactions of the shares. Thus in absence of adverse observations about the authenticity of these supporting documents, the payments having been routed through account payee cheques and no cash having been taken by the appellant from the purchasers or taking back to the sellers, over and above the consideration has been proved.”

3.5. Ld CIT[A] further held that the statements and affidavits of Directors that have been relied upon by the Ld. AO have not been Directors in the company at the time when the transactions have been carried out.

“… 9.75 In the remand report the AO has mentioned about the affidavits of some of the directors of the investee companies. However, on going through the details as available on the MCA website as provided by the appellant it is noticed that either those persons were not directors in the year under consideration in the investee companies or remained director for a part of the period under consideration. Details of the same are as under:

| Name of company | Director | Period of directorship |

| Acacio Tradelink Pvt Ltd, | Baban Gyanisingh | 16.06,2012 to 01-05.2013 |

| Acaeio Tradelink Pvt Ltd, | Anand Krishna Yadav | [01.04.2011 to 01.10.2014 |

| Acacio Tradelink Pvt Ltd, | Jasmin Kumar Lodaya | 10.10.2009 to 07.07.2010 |

| Acacio Tradelink Pvt Ltd. | Ajay Mahendra Shah | 10.07.2013 to 21.01.2016 |

| Acacio Tradelink Pvt. Ltd. | Sharmila Bipin Jain | 18.05.2010 to 16.06.2012 |

| Adamina Trades Pvt. Ltd. | Prasant Sanjay Indalkar | 12.10.2012 to 05.03.2014 |

| Adamina Trades Pvt. Ltd. | Kalpesh Vinodrai Mehta | 01.12.2009 to 13.10.2011 |

9.76. So when a person was not director or director for few months during the year under consideration then the specific knowledge about the investment in share capital in the appellant company could not be expected from him. Even in their affidavits no one has admitted that the investee company has provided the accommodation entries in the form of share capital to the appellant company. So their affidavits does not have any evidentiary value against the appellant company more so when their affidavits have not been provided to the appellant company for rebuttal in the assessment proceedings or they were not presented for cross examination in the assessment proceedings.

9.77. In the remand report the AO has mentioned that in the statement recorded of Shri Shirish C. Shah on 11.02.2016 u/s 131 he has mentioned that he has provided the accommodation entry pertains to Jayesh Kotak of JP Iscon Group. In this regard, neither the full statement of Shri Shirish C. Shah was provided to the appellant company before taking cognizance of the same against the appellant company nor in the statements it has been asked from Shri Shirish C. Shah that how and in what manner the accommodation entry has taken place. In other words, how the share capital investment in the appellant company has been exchanged with receipt of the cash by Shri Shirish C. Shah and in which bank account such cash was deposited and thereafter that deposit was channelised with different bank accounts till the final bank account from where the cheque of the share capital was given to the appellant company. So there was no details of the route through such accommodation entry travelled as the same was very important to judge the valacity of the statement of Shri Shrishi C. Shah. Mere self serving statement Shri Shirish C. Shah without any corroborative evidence does not have any relevance. Further it has been noticed in the remand report as noted by the AO that in answer to Q.No.7 Shri Shirish C. Shah has answered that the accommodation entry pertains to Shri Jayesh Kotak of JP Iscon Group. From the above answer of Shri Shirish C. Shah it is apparent that the accommodation entry may be pertaining to Shri Jayesh Kotak who was not the director in the appellant company and hence on the basis of that how the adverse inference can be drawn against the appellant company. Thus the statement of Shri Shirish C. Shah recorded by the AO referred above cannot be legally and adversely viewed in the case of appellant company.”

3.6. Ld CIT[A] further considered the remand report from the AO and observed the end beneficiary of funds are as follows:

” 9.66. When Shri Jasmeen Kumar Lodaya came on board, he being the tenant for the premises and the said address also being the registered address on the website of the ROC i.e. Al4/2, Swastik Societ5r, Stadium Circle, Off C.G Road, Navrangpura, Ahmedabad-380009, gave the user rights to J. A Infracon Pvt Ltd for using only a portion of the said premises as the registered address of the appellant company by entering into an Agreement for Business Utility dated 5th August, 2013 which is available as an attachment to Form No-18 filed with the ROC. The primary fact that a legally registered and backed NOC was issued in favour of the appellant company for use of the aforementioned portion of the premises puts to rest any legal claims of any third party as regards the possession of the said property especially in view of the statement under oath of Shri Kamleshkumar Naranbhai Patel, an employee of Dalal & Associates not being factually backed by any legal documents or acceptable evidence.

9.67. The statement on oath of Shri Kamleshkumar Naranbhai Patel, an employee of Dalal & Associates used by the AO as reliable incriminating evidence against the appellant company could not have been factually correct with regards to the alleged unhindered occupation of the premises since 2005 by Dalal & Associates as has been taken on record by the AO behind the back of the appellant company without granting the opportunity of cross examination of Shri Kamleshkumar Naranbhai Patel being departmental witness; in view of the Agreement of Business Utility entered and submitted with the ROC. Hence, the statement used by the AO against the appellant company stands disproved and inadmissible on grounds of both factual incorrectness and on grounds of no independent and clinching evidences having been placed on record to support the aforementioned Statement which is erroneous both in fact and in law.

9.68. It is pertinent to note that the funds that were received in March 2012 and the first cheque funds being received on 7th March, 2012 in the bank account of J.A. Infracon Pvt Ltd. maintained with Citi Bank, Ahmedabad Branch and the same funds were advanced to J.P. Fincorp Services Pvt. Ltd as unsecured Loan Inter corporate deposit so that as and when J.P. Fincorp Services Pvt. Ltd comes into public issue, against the said unsecured loan inter corporate deposit, the funds given by the appellant company can be converted into equity shares and J.P. Fincorp Services Pvt. Ltd would make the allotment of shares to J.A. Infracon Pvt. Ltd. & Satya Retail Pvt Ltd in consultation with the management of the companies that invested in the share capital issued at premium in JA Infracon Pvt Ltd and Satya Retail Pvt. Ltd.

9.69. Hence, as per the modalities decided, J.P. Pincorp Services Pvt.Ltd returned the funds taken as Unsecured Loan/Inter Corporate Deposit from J.A. Infracon Pvt. Ltd in the month of December, 2013 and the funds received by J.P. Fincorp Services Pvt.Ltd in its bank account with Allahabad Bank, Sardar Patel Nagar Branch, Ahmedabad bearing account Number- 50069254068& Citi Bank, Ahmedabad bearing account number 00 14723668 was transferred to the bank account of the company M/s. J.A. Infracon Pvt.Ltd. opened with Axis Bank Ltd, Vejalpur Branch, Ahmedabad bearing the account Number-913020042815667and operated by the Directors nominated by the Investor Companies who have invested in the share capital with premium in the appellant Company, having their directors as the anthorized signatories so as to conclude that the end beneficiary of the funds was the appellant company J.A. Infracon Pvt.Ltd, controlled and managed by the newly formed Board of directors appointed by Shri Shirish C Shah from where the actual transaction had started.

9.70. In support of the aforesaid contention, the appellant has placed on record the bank statement of J.A. Infracon Pvt. Ltd maintained with Citi Bank, Ahmedabad starting from the date of receipt of share application money in the company duly reflecting the funds received as share capital in J.A. Infracon Pvt.Ltd, thereafter transferred as Unsecured Loan/Inter Corporate Deposit in the bank account of J.P. Fincorp Services Pvt.Ltd maintained with Allahabad Bank, Ahmedabad& Citi Bank, Ahmedabad and subsequently, return of the funds by J.P. Fincorp Services Pvt.Ltd to the bank account of J.A. Infracon Pvt.Ltd maintained with Axis Bank, Ahmedabad opened, operated and maintained by the directors appointed by the management of companies who subscribed in the share capital with premium of the appellant. company and further, the said funds have been transferred through RTGS to various companies managed and controlled by Shri Shirish C Shah, so as to say the entire funds were enjoyed by none other than Shri Shirish C Shah in his controlled and managed companies,

9.71. The aforesaid facts establish that the share capital along with premium issued by J.A. Infracon Pvt.Ltd. to the respective companies were genuine share capital funds received by J.A. Infracon Pvt.Ltd, and J.P. Iscon Group are not the ultimate beneficiaries of the said funds except the said funds were available with J.P. Iscon Group only for a temporary period as Unsecured Loanfinter Corporate Deposits in J.P. Fincorp Services Pvt. Ltd. and as soon as J.P. Fincorp Services Pvt. Ltd decided not to come up with public issue, the said funds received by way of share capital including premium were returned back to the company J.A. Infracon Pvt.Ltd and Satya Retail Pvt. Ltd and the management and control of the said companies were handed over to the directors nominated by the management of the companies who have invested in the share capital including premium in the company JA. Infracon Pvt. Ltd and Satya Retail Pvt. Ltd. way back as on 29th December 2012. Furthermore, what needs to be noted is that according to the condition laid down by Shri Shirish C Shah, if JP Iscon Group would not have returned the funds in the event of non fulfillment of the public issue clause, then JP Fincorp Services Pvt Ltd. would’ve had to wind up as a consequence, so the ultimate beneficiary of the said funds which are the subject matter of the addition are enjoyed by none other than Shri Shirish C Shah.

9.72. The said funds so raised through share capital including premium were received in the bank accounts maintained with Axis Bank, Ahmedabad opened and operated by the new management and thereafter the same funds have been under the use and control of the newly formed management and they were the ultimate beneficiaries of the said funds having their directors as a signatory in the bank. So as to briefly summarise that the funds went back in the hands of the same entities ie. J. A Infracon Pvt Ltd controlled and managed by the directors nominated by the companies investing in the share capital as suggested by Shri Shirish C Shah, as alleged by the Ld A.O in his remand report.

9.73. So, the allegations made by the by AO in the remand report that the funds received by way of share capital along with premium in J.A. Infracon Pvt.Ltd the ultimate beneficiaries of which were J.P. Iscon Group is factually incorrect in light of the factual averments made by the appellant company as aforementioned and the A.O if at all wants to make any addition then it could be made in the hands of the companies Acacio Tradelink Pvt Ltd and Adamina Traders Pvt Ltd whose source remains unexplained as JA Infracon Pvt Ltd has already provided prima facie evidences passing the litmus test of section 68 of the Income Tax Act, 1961.”

3.7. Thus after the above detailed discussion Ld CIT[A] deleted the addition made by the Ld AO and consequently deleted the commission expenses calculated at 2.5% on the above amount of Rs.26,25,000/- as unexplained expenditure u/s. 69C of the Act and allowed the assessee appeal.

4. Aggrieved against the appellate order, the Revenue is in appeal before us raising the following Grounds of Appeal:

1. On the facts and in the circumstances of the case and in law, the Ld. CIT(A) has erred in deleting the addition of Rs. 10,50,00,000/- made by the Assessing Officer u/s 68 of the Act on account of unexplained cash credit.

2. On the facts and in the circumstances of the case and in law, the Ld. CIT(A) has erred in deleting the addition of Rs.26,25,000/- made by the Assessing Officer u/s.69C of the Act on account of unexplained expenditure.

3. On the facts and in the circumstances of the case and in law, the Ld. CIT(A) ought to have upheld the order of the A.O.

4. It is, therefore, prayed that the order of the Ld. CIT(A) be set aside and that of the A.O. be restored to the above extent.

5. In support of the above Grounds of Appeal, Ld CIT DR Sri A.P. Singh heavily relied on the assessment order passed by the Ld AO and requested to uphold the additions.

6. Per contra Ld Counsel Ms. Nupur Shah appearing for the assessee strongly relied upon the Appellate order, supporting Paper Books filed by the assessee and requested to uphold the appellate order passed by the Ld CIT[A] and thus the Revenue appeal is liable to be dismissed.

7. We have given our thoughtful consideration and perused the materials available on record including the Paper Books filed by the assessee. The assessee company has received share application money with premium from three parties of Rs.10.5 crores but partially complied with the notices issued by Ld A.O. and the share applicants also filed to reply to the notices u/s.133(6) of the Act. However during the appellate proceedings the assessee invoked Rule 46A of the 1.T Rules, with regard to the identity of the share applicants/subscribers in respect of amount share capital of Rs. 2 crores from M/s.Iscon Aviation Pvt. Ltd and amount of share premium of Rs.6,43,50,000/- and Rs.1,98,00,000/- from M/s. Adamina Traders Pvt. Ltd and M/s.Acacio Tradelink Pvt. Ltd respectively. The assessee company further submitted [i) Confirmations from the Subscribers; (ii) Copy of Bank Statements; (iii) Acknowledgement copy of ITR alongwith copy of Annual Reports; (iv) Bank Statements; (v) Share Application in Form No. 2; (vi) Master Data with Directors-details available from the website of ROC; (vii) Memorandum and Articles of Association; (viii) Copy of Board Resolutions; (ix) Details of Net worth Share Applicants.

8. Further Ld CIT[A] called for a Remand Report from the Ld AO issued notice u/s. 133(6) of the Act to the aforesaid investor companies and in response to the same, the party namely M/s. Acacio Tradelink Pvt. Ltd and M/s. Adamina Traders Pvt. Ltd confirmed the transactions with the assessee company with necessary documents and evidences. These confirmations have not been properly controverted by the AO by way of bringing anything adverse on record. Further, in spite of availability of all the documents on record, nothing has been brought on record by the Ld AO to doubt the transaction with the share applicant companies who have made the share application in the assessee company. The A.O instead of considering the cogent material evidences placed on record by the assessee company chose to rely upon the oral statements of the directors of the two investor companies. Even in the statements given by the directors of the two investor companies nowhere the name of the assessee company is appearing nor admitted of giving any share capital with premium issued to the two investor companies and M/s. Iscon Aviation Pvt. Ltd (without share premium) being referred in those statements. In the above circumstances the Ld AO, being a quasi-judicial authority should have made an enquiry from the directors of the companies as well as from Shirish C. Shah and others on whose statements relied upon by him. It is further noticed that the addition made on the basis of documents received during search conducted at the third-party premises Shirish C Shah without any independent enquiry having been made by the Ld AO nor supporting evidences having been brought on record are not sustainable in law.

9. Thus the A.O has made the aforesaid allegation merely on presumption without bringing on record any independent and cogent material evidences to substantiate that the funds in the guise of share capital have been received in the company by paying cash to Shirish Chandrakant Shah. Further it is noticed that there was no incriminating material or seized material found from the premises of JP Iscon Group when the search was carried out on 25.02.2016. Further the A.O has also not identified any statement of directors or employees of JP Iscon Group recorded during the course of search proceedings of having admitted such allegation of payment of cash in lieu of share capital to entry provider Shirish Chandrakant Shah. It has placed reliance on such affidavits/declarations but none of these statements/affidavit/ declarations are placed on record proving that those companies have received cash from JP Iscon Group in lieu of share capital received in the assessee company. Thus the LdAO has also not placed on record any bank statement of the aforesaid companies who have invested in the share capital of the assessee company, identifying any cash being deposited in those companies bank accounts.

10. In the remand report the Ld AO has mentioned about the affidavits of some of the directors of the investee companies. However, Ld CIT[A] on verification of the MCA website as provided by the assessee company, held that neither those persons were not directors in the year under consideration nor thereafter. So when a person was not director or director for few months during the year under consideration then the specific knowledge about the investment in share capital in the assessee company could not be expected from him. So their affidavits does not have any evidentiary value against the assessee company more so when their affidavits have not been provided to the assessee company for rebuttal during the assessment proceedings. Similarly they were not presented for cross examination by the assessee in the assessment proceedings.

11. Thus, in our considered view the Ld AO has made the additions based on surmises and conjectures without making proper verification of facts with relevant materials and evidences, whereas the Ld CIT[A] made full verification of facts, material evidences and called for a remand report from the AO and deleted the additions. Further Revenue could not dispute the above findings with relevant materials or evidences. Detailed legal analysis of Ld CIT[A] order is already extracted in paragraphs 3 to 3.7 of this order, therefore the same does not require any interferences. Thus the Grounds of Appeal raised by the Revenue are devoid of merits and liable to be dismissed.

12. In the result, the appeal filed by the Revenue is hereby dismissed.