Section 56(2)(x) is not applicable to investments made before its insertion.

Unexplained Investment Addition Deleted, and Section 56(2)(x) Deemed Inapplicable

Key Issues and Decisions:

I. Unexplained Investment in a Flat:

- Issue: Whether an addition made under Section 69 for an unexplained investment in a flat is justified when the investment was made in an earlier year and was duly reflected in the assessee’s balance sheet.

- Decision: The court held that the addition was not justified. The investment in the flat was not unexplained, as it was made in a previous year and was properly recorded in the assessee’s financial records. Additionally, the payments for the flat were made through banking channels, further supporting the legitimacy of the transaction. (In favor of assessee)

II. Applicability of Section 56(2)(x) for Property Purchase:

- Issue: Whether Section 56(2)(x), which deals with the taxation of certain receipts, is applicable to a property purchased by the assessee before the provision was introduced by the Finance Act, 2017.

- Decision: The court held that Section 56(2)(x) was not applicable in this case. The property was purchased prior to the insertion of clause (x) in Section 56(2), and therefore, the provision could not be applied retrospectively. The addition made under Section 56(2)(x) was deleted. (In favor of assessee)

Key Takeaways:

- Unexplained Investments: This ruling clarifies that an investment cannot be treated as unexplained if it is properly documented and reflected in the assessee’s financial records.

- Retrospective Application: The decision confirms that Section 56(2)(x) cannot be applied retrospectively to transactions that occurred before its introduction.

This case provides valuable guidance on the interpretation of Sections 69A and 56(2)(x) of the Income-tax Act, 1961, emphasizing the importance of considering the timing of transactions and the availability of supporting documentation before making additions for unexplained investments or applying specific tax provisions.

and PRADIP KUMAR CHOUBEY, Judicial Member

[Assessment Year 2020-21]

(2) In particular, and without prejudice to the generality of the provisions of subsection (1), the following incomes, shall be chargeable to income-tax under the head “Income from other sources”, namely :—

****

(x) where any person receives, in any previous year, from any person or persons on or after the 1st day of April, 2017,—

(a) ***

(b) any immovable property,—

(A) without consideration, the stamp duty value of which exceeds fifty thousand rupees, the stamp duty value of such property;

(B) for a consideration, the stamp duty value of such property as exceeds such consideration, if the amount of such excess is more than the higher of the following amounts, namely:—

(i) the amount of fifty thousand rupees; and

(ii) the amount equal to ten per cent of the consideration:

Provided that where the date of agreement fixing the amount of consideration for the transfer of immovable property and the date of registration are not the same, the stamp duty value on the date of agreement may be taken for the purposes of this sub-clause:

Provided further that the provisions of the first proviso shall apply only in a case where the amount of consideration referred to therein, or a part thereof, has been paid by way of an account payee cheque or an account payee bank draft or by use of electronic clearing system through a bank account or through such other electronic mode as may be prescribed28, on or before the date of agreement for transfer of such immovable property:

Provided also that where the stamp duty value of immovable property is disputed by the assessee on grounds mentioned in sub-section (2) of section 50C, the Assessing Officer may refer the valuation of such property to a Valuation Officer, and the provisions of section 50C and sub-section (15) of section 155 shall, as far as may be, apply in relation to the stamp duty value of such property for the purpose of this sub-clause as they apply for valuation of capital asset under those sections:

[Provided also that in case of property being referred to in the second proviso to sub-section (1) of section 43CA, the provisions of sub-item (ii) of item (B) shall have effect as if for the words “ten per cent”, the words “twenty per cent” had been substituted;]

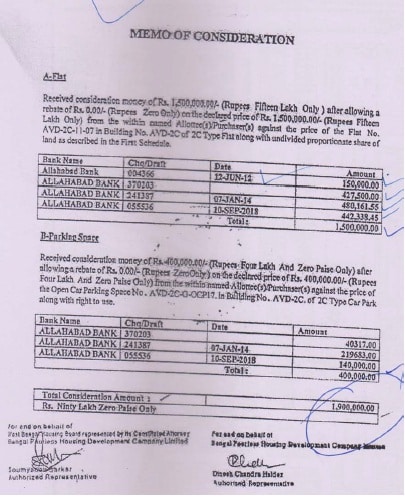

6. We heard the parties and perused the record. We notice that the AO has considered the stamp duty value as on the date of registration of the agreement to sell for the purpose of determining the applicability of sec.56(2)(x) of the Act. However, the facts that the assessee had been allotted both the properties by way of allotment letters and further, the assessee has also paid instalments as per that letter are not disputed. Hence, the question that arises is whether the allotment letter can be considered as “agreement to sale” within the meaning of the provisos to sec. 56(2)(x) of the Act, which states that the stamp duty valuation as on the sale of sale agreement should be taken into consideration for the purpose of sec.56(2)(x), provided that amount of consideration or part thereof had been paid as per the mod prescribed on or before the date of agreement for transfer of such immovable property.

7. Before us, the Ld A.R placed reliance on the decision rendered by the coordinate bench in the case of Mr. Sajjanraj Mehta v. ITO (ITA No.56/Mum/2021 dated 05-09-2022), wherein it was held that the date of allotment letter can be taken as date of agreement of sale for the purposes of sec.56(2)(x) of the Act. On the contrary, the Ld D.R placed his reliance on the decision rendered by another co-ordinate bench, which was relied upon by AO & CIT(A), viz., SujauddianKasimsab (supra).

8. With regard to the decision rendered in the case of SujauddianKasimsab (supra), the Ld A.R submitted that the said decision has been rendered on the basis of facts prevailing in that case. The assessee, in the above said case, had paid Rs.3.00 lakhs before the date of agreement, but the same was described as “earnest money deposit” in the Agreement, meaning thereby, the assessee did not fulfill the condition prescribed in sec.56(2)(x) of the Act. The Ld A.R furthersubmitted that the Tribunal did not consider the effect of second proviso to sec.56(2)(x) of the Act in the above said case. We agree with the submissions of Ld A.R with regard to the distinguishing features pointed out in the decision rendered by the co-ordinate bench in the case of SujauddianKasimsab (supra). Hence, we are of the view that the above said decision could not lend support to the case of the revenue.

9. On the contrary, we are of the view that the decision rendered by another coordinate bench in the case of MrSajjanraj Mehta (supra) is applicable to the facts of the present case. The decision rendered in the case of MrSajjanraj Mehta by the co-ordinate bench is extracted below, for the sake of convenience:-

“10. We have gone through the order of the A.O, Ld. CIT(A) and various submissions of assessee dated 06-10-2021. Vide pg no-23 to 27 of paperbook we have observed the payment made by the assessee to the developer on 17-102011 amounting to Rs 14 lacs vide cheque no 906740, Bank of Maharashtra to enter into an agreement cum acknowledgement of payment made and other terms and conditions about the property. This agreement between assessee and developer clearly confirms the amount of consideration along with other terms and conditions relating to levy of stamp duty, service tax and other charges to be paid by the assessee.

11. The finding of the A.O vide pg no-4, para-2.6 wherein he observed that assessee has deposited Rs 14 lacs with the developer to year mark the said premises for Rs 70 lacs. Even if for the time being it is assumed that this agreement is merely a letter of intent, still amount mentioned in this so called letter of intent can’t be changed by either of the party.At the max the parties involved may opt for exit from the transaction but amount of consideration can’t be changed. This transaction of the assessee has to be analysed in commercial parlance, without finalisation of consideration nobody will deposit 20% of the final consideration. The vitality of the agreement further found force from the behaviour of the assessee as confirmed by the A.O also that assessee paid further Rs 34.5 lacs till financial year 2012-13. Assessee also paid Rs 1,00,285/- as VAT, Rs 1,35,187/- as service tax, Rs 5,02,000/- as stamp duty and Rs 30,000/- as registration charges.

12. The chronology of the events confirms that the finding of the A.O treating the agreement of the assessee as letter of intent is not correct. In this matter treating the said agreement as letter of intent shows an over thinking and hyper technical interpretation at the end of the A.O.assessee’s case clearly falls in the proviso to Section 56(2)(vii)(b). For sake of clarity we are reproducing herein below the relevant portion of proviso

“Provided that where the date of the agreement fixing the amount of consideration for the transfer of immovable property and the date of registration are not the same, the stamp duty value on the date of the agreement may be taken for the purposes of this sub-clause:

Provided further that the said proviso shall apply only in a case where the amount of consideration referred to therein, or a part thereof, has been paid by any mode other than cash on or before the date of the agreement for the transfer of such immovable property”.

13. We further relied on following judicial pronouncement of coordinated benches of ITAT, Hon’ble High Court and Apex Court as under:

(a) “Siraj Ahmed Jamalbhai Bora v. ITO Ward- 1(3)(1)ITA No. 1886/M/ 2019 dtd. 28/10/2020, (Mum.) (Trib.):

Date of registration irrelevant for Sec 56(2)(vii)(b) as substantial obligation discharged on date of agreement.

(b) Radha Kishan Kungwani v. ITO Ward – 1(2) ITA No. 1106/JP/2018 dtd. 19/08/2020, ] Where assessee entered into agreement for purchase of flat and had made certain payment at time of booking of flat, stamp duty valuation or fair market value of immovable property was to be considered as on date of payment made by assessee towards booking of flat

(c) Sanjay Dattatraya Dapodikar v/s ITO Ward – 6(2), Pune ITA No. 1747/PN/2018 dtd. 30/04/2019(Pune) (Trib)

Where date of agreement for fixing amount of consideration for purchase of a plot of land and date of registration of sale deed were different but assessee, prior to date of agreement, had paid a part of consideration by cheque, provisos to section 56(2)(vii)(b) being fulfilled, stamp value as on date of agreement should be applied for purpose of said section

(d) Ashutosh Jhavs. ITO Ward-2(5), Ranchi ITA No. 188/Ranchi/2019 dtd. 30/04/2021,

Where assessee purchased a property and made part payment of sale consideration by cheque on very next day of execution of purchase agreement and registry was done after a year, since such part payment made by cheque on very next day of execution of agreement was towards fulfilment of terms of purchase contract itself and there was no mala fide or false claim on part of assessee, no addition could be made on account of difference between amount of sale consideration for property shown in purchase agreement and stamp duty value of said property on date of registry by invoking section 56(2)(vii)(b)

(e) Dy. CIT-5(3)(1) v. Deepak Shashi Bhusan Roy ITA No. 3204 & 3316/M/2016 dtd. 30/07/2018(Mum.) (Trib.) In order to determine taxability of capital gain arising from sale of property, it is date of allotment of property which is relevant for purpose of computing holding period and not date of registration of conveyance deed

(f) Mohd. Ilyas Ansari v. ITO- 23(2)(3),Mumbai [ITA No. 6174/M/2017dtd. 06/11/2020, Where Assessing Officer mechanically applied provisions of section 56(2) to difference between stamp duty value and actual sale consideration paid by assessee and made additions, without making any efforts to find out actual cost of property, additions made by Assessing Officer were to be set aside.”

14. Similar property in the case of assessee’s wife with similar transactions has been accepted by the same A.O without any addition for the same A.Y. Here we would like to rely on the decision of Hon’ble Gauhati HC.

“Gulabrai Hanumanbox. v. Commissioner of Wealth-tax

Two different Assessees having similar/identical facts w.r.t valuation of property cannot be assessed with different rates for the same property. Thereby, the order passed by the Assessing officer for cosharer of property is arbitrary and unjustified in law”

15. Keeping in view the facts of the case, chronology of events and respectfully following the pronouncements of the co-ordinated benches of ITAT, we delete the addition made by A.O and confirms that assessee is entitled to the benefits of proviso to Section 56(2)(vii)(b).”

10. Accordingly, following the above said decision, we hold that the respective allotment letters issued to the assessee should be considered as “Agreement to sellfor the purposes of sec.56(2)(x) of the Act. Since the assessee has paid the parts of consideration as per the terms and conditions of allotment through banking channels prior to the execution of Sale agreement, we are of the view that the provisos to sec.56(2)(x) shall apply to the facts of the present case. Accordingly, the stamp duty valuation as on the date of respective Allotment letters should be considered for the purposes of sec.56(2)(x) of the Act. Hence the AO was not justified in considering the stamp duty valuation as on the date of execution of agreement to sell.

11. On a perusal of record, we notice that the details of stamp duty value as on the date of respective allotment letters was not brought on record. Since we have held that the stamp duty valuation as on the date of respective allotment letters should be considered for the purpose of sec.56(2)(x) of the Act, it is imperative on the part of the assessee to show that the actual consideration was equal or less than the stamp duty valuation as on the date of issue of respective allotment letters. Accordingly, we are restoring this issue to the file of AO for the limited purpose of comparing the actual sale consideration with the stamp duty valuation as on the date of respective allotment letters. In the limited set aside, the AO shall take appropriate decision in accordance with law after affording adequate opportunity of being heard.