Exemption under section 54B can be claimed if the land was used for agricultural purposes in the preceding two years.

Limited Scrutiny Assessment and Capital Gains Exemption on Agricultural Land

Key Issues and Decisions:

I. Limited Scrutiny Assessment and Section 56(2)(vii)(b) Addition:

- Issue: Whether the Assessing Officer (AO) can make an addition under Section 56(2)(vii)(b) for the difference between the purchase consideration and the fair market value of a property during a limited scrutiny assessment when this issue was not part of the original scope of scrutiny.

- Decision: The court held that the AO could not make such an addition during a limited scrutiny assessment. As per CBDT Circular No. 20/2015, the AO must convert the limited scrutiny into a complete scrutiny before venturing into issues outside the original scope. The addition made under Section 56(2)(vii)(b) was quashed due to the lack of jurisdiction. (In favor of the assessee)

II. Exemption under Section 54B for Capital Gains from Agricultural Land:

- Issue: Whether the assessee can claim exemption under Section 54B for capital gains from the sale of agricultural land when the AO denied the exemption due to lack of evidence of agricultural use.

- Decision: The court held that the assessee was eligible for the exemption. The sale deeds (Form P-II/Khasra) clearly showed that agricultural activities were being carried out on the land in the two years preceding the sale, fulfilling the condition for exemption under Section 54B. The AO was directed to allow the exemption, subject to verification of other conditions. (In favor of the assessee)

Key Takeaways:

- Limited Scrutiny: This ruling clarifies the limitations of a limited scrutiny assessment and emphasizes the need for conversion to a complete scrutiny if the AO wants to examine issues outside the original scope.

- Section 54B Exemption: The decision confirms that evidence of agricultural use, as mentioned in the sale deeds, can be sufficient to fulfill the condition for exemption under Section 54B.

This case provides valuable guidance on the conduct of limited scrutiny assessments and the requirements for claiming exemption under Section 54B, ensuring that taxpayers are not unfairly denied benefits and that assessments are conducted within the scope of the law.

IN THE ITAT RAIPUR BENCH

Rahul Bajpai

v.

Deputy Commissioner of Income-tax

Ravish Sood, Judicial Member

and ARUN KHODPIA, Accountant Member

and ARUN KHODPIA, Accountant Member

IT Appeal No.345 (RPR) of 2023

[Assessment Year 2015-16]

[Assessment Year 2015-16]

JANUARY 29, 2025

R.B Doshi, CA for the Appellant. S.L. Anuragi, CIT-DR for the Respondent.

ORDER

Ravish Sood, Judicial Member.- The present appeal filed by the assessee is directed against the order passed by the Commissioner of Income-Tax (Appeals), National Faceless Appeal Center (NFAC), Delhi, dated 28.09.2023, which in turn arises from the order passed by the A.O under Sec.143(3) of the Incometax Act, 1961 (in short ‘the Act’) dated 15.12.2017 for the assessment year 2015-16. The assessee has assailed the impugned order on the following grounds of appeal before us:

“1. That the order u/s.250 as passed by the Ld.CIT (Appeals) is bad in law as well as on facts.

2. On the facts and circumstances of the case the Ld. CIT (Appeal) has grossly erred in not considering the appellants submission before him as such the order is against the principle of natural justice, bad in law and deserves to be cancelled.

3. On the facts and circumstances of the case, the ld. CIT (Appeal) erred in not allowing the legitimate deduction u/s.54B on sale of agricultural land. The Ld. AO treated the sale of land as non-agricultural. Ignoring the facts that land is cultivated one subject to land revenue and agricultural income shown by the appellant in the ITR was accepted by the A.O.

4. On the facts and circumstances of the case the ld. CIT (Appeal) erred in confirming the disallowance of claim of Rs.3,90,94,919/-on account of deduction claimed u/s.54B of the Income Tax Act 1961.

5. On the facts and circumstances of the case the Ld. CIT (Appeal) erred in confirming the addition of Rs.50,65,900/- on account of difference between stamp value and purchase value ignoring the fact that the land was not purchased during the relevant assessment year but in A.Y.2012-13, hence the addition during the year deserves to be deleted.

6. That the appellant craves leave to add to and/or amend, alter, rescind the grounds taken here in above, before or the time of hearing of this appeal.”

2. Also, the assessee has raised an additional ground of appeal which reads as under:

“Ld. CIT(A) erred in confirming the addition of Rs.50,65,900/-made by the A.O invoking Sec.56(2)(vii)(b) without appreciating the fact that the issue relating to addition is not covered by scope of “limited scrutiny”.

As the assessee based on the additional ground of appeal has assailed the validity of the jurisdiction that was assumed by the A.O for framing the impugned assessment, the adjudication of which would not require looking any further beyond the facts available on record, therefore, we have no hesitation in admitting the same. Our aforesaid view that where an assessee, had raised, though for the first time, an additional ground of appeal before the Tribunal which involves purely a question of law and requires no further verification of facts, then, the same merits admission finds support from the judgment of the Hon’ble Supreme Court in the case of National Thermal Power Company Ltd. Ltd. v. CIT

3. Succinctly stated, the assessee had e-filed his return of income for A.Y.2015-16 on 31.03.2016, declaring an income of Rs.65,80,280/-.

Subsequently, the case of the assessee was selected for “limited scrutiny” u/s.143(2) of the Act.

4. During the course of the assessment proceedings, the A.O observed that the assessee had purchased certain land for a consideration of Rs. 5 lacs, whereas, the Fair Market Value (FMV) of the same was Rs.55,65,900/-. The A.O called upon the assessee to put forth an explanation as to why the difference in the aforesaid value i.e. Rs.50,65,900/-[Rs.55,65,900/- (-) Rs.5,00,000/-] may not be added to his income u/s.56(2)(vii)(b) of the Act. As the reply filed by the assessee did not find favour with the A.O, therefore, he made an addition of Rs.50,65,900/-u/s.56(2)(vii)(b) of the Act.

5. Further, the A.O observed that the assessee in his return of income for the subject year had claimed deduction u/s.54D(sic) of the Act aggregating to Rs.3,90,94,919/- i.e. [Rs.97,09,279/- (+) Rs.1,01,40,469/-(+) Rs.1,92,45,171/-] against the Long Term Capital Gain (LTCG) on sale of immovable properties. The A.O observed that the assessee had during the subject year sold three properties, as under:

| S. No. | Transaction Amount | Transaction Amt. As per A/c. | Transaction dated in Books of A/c. | Name of purchaser party |

| 1. | 11857000/- | 10840100/- | 21/07/2014 | Balaji Builders |

| 2. | 23064000/- | 23064000/- | 02/09/2014 | Zodiac Dealers Pvt. Ltd. |

| 3. | 21372000/- | 21372000/- | 02/09/2014 | Zodiac Dealers Pvt. Ltd. |

The assessee clarified that the claim for deduction was raised u/s. 54B (wrongly mentioned u/s.54D of the Act in the return of income).

6. Apropos the claim for deduction of Rs.3,90,94,919/- (supra) u/s. 54B of the Act, the A.O taking cognizance of the fact that no proof was provided by the assessee as regards the agricultural activities that were claimed to have been carried out on the subject land which was a precondition for claiming the aforesaid deduction, thus, called upon him to explain that as to why the same be not declined.

7. As is discernible from the assessment order, the A.O was of the view that the “kisan kitab” produced by the assessee did not substantiate his claim that agricultural activities were carried out on the subject lands that were transferred by him during the year under consideration. It was further observed by the A.O that the assessee had neither disclosed any agriculture income in his return of income nor had filed any proof or evidence supporting his claim that agricultural activities were carried on the aforesaid lands. Accordingly, the A.O based on his aforesaid deliberations declined the assessee’s claim for deduction u/s. 54B of the Act of Rs.3,90,94,919/-.

8. Thus, the A.O after making the aforesaid additions/disallowances, viz. (i) addition u/s.56(2)(vii)(b) of the Act : Rs.50,65,900/-; and (ii) declining the assessee’s claim for deduction u/s.54B of the Act : Rs.3,90,94,919/-, vide his order passed u/s.143(3) of the Act, dated 15.12.2017 determined his income at Rs.5,07,41,099/-.

9. Aggrieved the assessee carried the matter in appeal before the CIT(Appeals), wherein he had assailed the aforesaid additions /disallowances made by the A.O but without any success. For the sake of clarity, the observations of the CIT(Appeals) are culled out as under:

“5. Observations, Findings and Decisions:

5.1 I have examined the fact of the case, the order of the assessing officer (hereinafter the AO) under section 143(3) of the income tax Act,1961 (hereinafter Act) and appellant’s submissions. Although the appellant has taken 7 grounds listed above in this order to challenge the AO’s order, the effective grounds are two.

5.2 The appellant has contested the addition of Rs.50,65,900/-which represents the difference between stamp duty value and deed value shown in deed of conveyance(purchase price) of the land in question. In the assessment proceedings, the AO observed that appellant bought land from Shri Somesh Sukla and the return of income of the appellant showed purchase cost of Rs.5,00,000/-, but stamp duty value of the land determined by the stamp duty authority was Rs.50,65,900/-. When asked to explain why the difference between the stamp duty value and the purchase cost of the land disclosed by the appellant in his return of income should not be added, he stated that the land was bought for Rs.5,00,000/- and the same should considered as the value of land. The AO did not agree with the arguments of the appellant, so they were rejected. As a result, he added Rs.50,60,990/-, which was the difference between the stamp duty value determined by the stamp duty authority and purchase cost of the land disclosed in return of income by the appellant under section 56(2)(vii)(b) of the Act.

5.3 The appellant’s arguments on this issue revolve around two points listed below.

| (a) | The AO, while making addition of Rs.50,60,900/- under section 56(2)(vii)(b) of the Act, considered the purchase of the land in question in the financial year 2014-15, even though it was purchased in the financial year 2011-12. |

| (b) | . The land in question was stock in trade of business and was recorded on the balance sheet. |

5.4 The appellant contends that the land it question was acquired in the financial year 2011-12 because deed of conveyance was executed and presented for registration, payment was made to the seller, and possession of the land was taken in the financial year 2011-12. The appellant has admitted that deed presented for registration of the land was released in the financial year 2014-15 after payment of addition stamp duty. It has been argued by the appellant that proviso 2 of section 56(2)(vii)(b) is applicable to his case, so the AO’s addition of Rs.50,65,900/-was not justified.

5.5 The record shows the issue regarding purchase of the land in the financial year 2011-12 was not brought to the notice of the AO during the assessment proceedings. The claim of the appellant that the land in question was bought in the financial year 201112 has not be validated by supporting documentary evidence, such as a copy of agreement for purchase, proof of taking possession of the land and evidence of payment made to the seller by cheque. Onus lies on the appellant to prove that the land in question was purchased in the financial year 2011-12 by producing evidence. As stated earlier, the claim of the appellant is not backed by the evidence, so it cannot be given any consideration. In this context, it is important to mention that the section 56(2)(vii)(b) is applicable to any property and does not restrict it to a specific type of property. The section also encompasses agricultural land. Thus, appellant’s claim is rejected.

5.6 It has been observed once aging that appellant’s claim that subject land was stock in trade in his business and the same was recorded on the balance sheet was not raised before the AO. However, while assessing the case of the appellant for the A.Y. 2014-15, the Ld. AO extensively discussed in the reassessment order u/s 147 for the said assessment year the issue and made a categorical finding that no opening and closing stock was disclosed in the return of income filled by the appellant for the assessment 2012-13 to 2017-18. It was also found by the AO that in the said proceedings that appellant was not engaged in real estate business for those assessment years. The above finding of the AO was confirmed in the 1st appeal for the assessment year 2014-15. The view that the land was not stock-in-trade of business is supported by the fact that the appellant himself treated land as capital asset and gain arising out of sale of land was disclosed as capital gain in his return of income for the assessment year in appeal and for the assessment 2014-15 respectively. Mere presumption by the appellant that land in question was held as stock-in-trade is not sufficient and he needs to prove it by producing evidence which the appellant failed. Thus, the appellant’s assertion that the land in question was stock-in-trade is merely an afterthought.

5.7 Based on the discussion above, I am inclined to agree with the AO’s view that provisions section 56(2)(vii)(b) are applicable to the present case. As a result, the appellant’s arguments in this regard are rejected. Therefore, considering the discussion made above the addition of Rs.50,65,900/- is upheld. The grounds of appeal on said issue are, thus, dismissed.

5.8 The last issue to discuss is whether the appellant is entitled to a deduction under section 54B of the Act. The AO noted that the appellant did not carry out any agricultural activities as no income was reported in the returns of income filed by the appellant. The AO further observed that submission of (Kisan ‘Kitab’ was not sufficient to prove that agricultural activities were conducted on the land in question by the appellant. Consequently, he rejected the appellant’s claim for a deduction of capital gain of Rs.3,90,94,919/- arising out sale agricultural land under section 54B of the Act because the appellant failed to prove the land in question was used for agricultural purpose preceding two years immediately before transfer.

5.9 Both the AO and the appellant reproduced the Section 54B of the Act, which requires following two conditions to be met in order to claim deduction under that Section.

| (a) | The land should have been used for two years immediately before transfer. |

| (b) | The land purchased for claim deduction should be utilized for agricultural purpose as well. |

5.10 As noted by the Hon’ble Tribunal, Pune, in ITA no.704/PUN/2022, the Hon’ble Supreme Court in the case of Commissioner Customs (Prentive), Mumbai v. Dilip Kumar (69GST239) held that exemption provisions shall be interpreted strictly. It was held by the Tribunal in the said ITA that section 54B allows deduction to the assessee which is a kind of exemption, therefore such provision is be interpreted strictly.

5.11 It is the appellant’s responsibility to prove that the conditions set forth in Section 54B of the Act have been met. In order to claim deduction under section 54B of the Act, the appellant must demonstrate that the land was used for agricultural purposes. The appellant has not substantiated the claim of use of land in question for agricultural purpose by filing clinching evidence. The mere filing of ‘Kisan Kitab’ does not necessarily indicate that the land was used for agricultural purpose. The decisions relied upon by the appellant are not to the fact of the present case.

5.12 Considering the discussion above, and the appellant’s failure to establish that the land was used for agricultural purpose, I do not find any defects in the order of the AO. As a result, the AO’s disallowance of deduction claimed under section 54B of the Act of Rs.3,90,94,919/- is confirmed. The grounds of appeal on said issue e, thus, dismissed.

6. In the final result, the appeal filed by the appellant is treated as dismissed.”

10. The assessee being aggrieved with the order of the CIT(Appeals) has carried the matter in appeal before us.

11. We have heard the Ld. Authorized Representatives of both the parties, perused the orders of the lower authorities and the material available on record, as well as considered the judicial pronouncements that have been pressed into service by the Ld. AR to drive home his contentions.

12. Shri R.B Doshi, Ld. Authorized Representative (for short ‘AR’) for the assessee, at the threshold of hearing, submitted that the A.O had grossly erred in law and facts of the case in wrongly assuming jurisdiction and making an addition of Rs.50,65,900/- u/s. 56(2)(vii)(b) of the Act. Elaborating on his contention, the Ld. AR submitted that as the case of the assessee was selected for “limited scrutiny” u/s. 143(2) of the Act for examination of specific issues, viz. (i) sale of property mismatch; (ii) mismatch in income/Capital Gain on sale of land or building; (iii) deduction claimed under the head Capital Gains; and (iv) tax credit mismatch, therefore, the A.O had traversed beyond the scope of his jurisdiction and made an addition of Rs.50,65,900/- u/s.56(2)(vii)(b) of the Act i.e. an issue which had never formed a basis for selection of the assessee’s case for “limited scrutiny”. The Ld. AR to buttress his claim that in case of “limited scrutiny”, the A.O was divested of his jurisdiction for making an addition which never formed the basis for selection of the case for such scrutiny assessment had relied on the CBDT Instruction No.20/2015, dated 29.11.2015, Page No.117 & 118 of APB and Instruction No.5/2016, dated 14.07.2016, Page 119 to 120 of APB. The Ld. AR had taken us through the aforesaid CBDT Instructions Nos.20/2015 (supra) and Instruction No.5/2016 (supra), which fortified his contention that in cases under “limited scrutiny”, the scrutiny assessment proceedings would initially be confirmed only to issues under “limited scrutiny” and questionnaire, enquiry, investigation etc. would be restricted to such issues. Carrying his contention further, the Ld. AR submitted that as per CBDT Instruction No.5/2016 (supra) it is only where it comes to the notice of the A.O that there is potential escapement of income exceeding Rs.5 lacs (for non-metro cases) requiring substantial verification on any other issue(s), then he may with an approval of the Pr. CIT/CIT concerns take up the case for “complete scrutiny”. The Ld. AR submitted that as the case of the present assessee that was selected for “limited scrutiny” was at no stage converted into “complete scrutiny”, therefore, the addition of Rs.50,65,900/- made by the A.O u/s. 56(2)(vii)(b) of the Act i.e. an issue which had never formed a basis for selection of his case for “limited scrutiny” cannot be sustained and was liable to be struck down for want of valid assumption of jurisdiction. The Ld. AR in support of his aforesaid contention had relied on the order of the ITAT, Raipur in the case of Shrivastava Associates v. ITO, ITA No. 283/RPR/2023, dated 05.12.2023.

13. On merits, the Ld. AR submitted that the A.O had substituted the actual purchase consideration of the subject property of Rs.5,00,000/- by its FMV of Rs.55,65,900/- without making any reference to the valuation officer as was required per the mandate of the provisions of Section 56(2)(vii) of the Act. Elaborating further on his contention, the Ld. AR submitted that as the subject land was a disputed one and under the unauthorized possession of third parties, therefore, the same was purchased by the assessee for a consideration of Rs.5,00,000/- as against its FMV of Rs.55,65,900/-. The Ld. AR submitted that the A.O while substituting the actual purchase consideration by the FMV/stamp duty value ought to have referred the matter to the Valuation Cell and could not have summarily made an addition in the hands of the assessee by triggering the provisions of Section 56(2)(vii)(b) of the Act. The Ld. AR in support of his aforesaid contention relied on the judgment of the Hon’ble High Court of Calcutta in the case of Sunil Kumar Agrawal v. Commissioner of Income Tax 372 ITR 83 (Calcutta). The Ld. AR submitted that the Hon’ble High Court in the aforesaid case, had held that the valuation by the departmental valuation officer as contemplated u/s. 50C of the Act is required to avoid miscarriage of justice. The Ld. AR submitted that it was further observed that even in a case where no such prayer was made by the advocate representing the assessee, who may not have been properly instructed in law, the A.O, while discharging the quasijudicial function remained under a bounden duty to act fairly and to give a fair treatment by giving the assessee an option to follow the course provided by law. The Ld. AR submitted that as the “proviso” to Section 56(2)(vii) of the Act was pari-materia to sub-section (2) of Section 50C of the Act, therefore, the A.O as per the ratio of the judgment of the Hon’ble High Court of Calcutta in the case of Sunil Kumar Agrawal v. Commissioner of Income Tax (supra) in the present case was obligated to have made a reference to the Valuation Cell instead of summarily triggering the provisions of Section 56(2)(vii)(b) of the Act which, thus, had resulted to a substantial addition in the hands of the assessee.

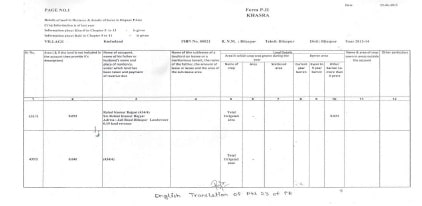

14. Apropos the observation of the A.O that as the assessee had failed to place on record supporting documentary evidence which would substantiate that the lands sold by him during the year under consideration were either being used by him or his parents for agricultural purpose in the two years immediately preceding the date on which the same were transferred i.e. a pre-condition for claiming deduction u/s. 54B of the Act, therefore, his claim for deduction of Rs.3,90,94,919/- was liable to be disallowed, the Ld. AR rebutted the same. The Ld. AR submitted that a perusal of the registered sale deeds pertaining to the aforementioned lands sold by the assessee in itself revealed that the assessee was carrying out agricultural activities on the same in the two years immediately preceding the date on which the same were transferred. The Ld. AR to buttress his aforesaid claim had taken us through the copies of the registered sale deeds, Page No. 9 to 81 of APB. Also, the Ld. AR had specifically drawn our attention to “Form-P-II/Khasra” of the subject lands which formed a part of the registered sale deeds, Page No(s).1 & 23 of APB, Page No(s).26, 40-41 of APB AND Page No(s).58 & 68 of APB. Apart from that, the Ld. AR had drawn our attention to the translated copies of “Form-II/Khasra” (supra) (copies separately placed on record). Elaborating further on his contention, the Ld. AR submitted that a perusal of the “Form-P-II/Khasra” revealed that respective agricultural lands in the two years immediately preceding the date on which the same were transferred were being used by the assessee for agricultural purposes. The Ld. AR had taken us through the aforesaid “Form-II/Khasra” which revealed that either of the aforesaid lands during the preceding two years i.e. F.Y.2012-13 and 2013-14 were used for growing paddy or were in the nature of irrigated area. The Ld. AR submitted that as the “Form-P-II/Khasra” forming part of the registered sale deeds in itself revealed beyond doubt that the agricultural lands were being used by the assessee for carrying out agricultural operations, therefore, it was incorrect on the part of the A.O to have drawn adverse inferences by stating that the assessee had failed to place on record any documentary evidence substantiating his claim that agricultural activities in the two years immediately preceding the date on which the same were transferred were being carried out on the same as was required per the mandate of Section 54B of the Act.

15. Per contra, Shri S.L Anuragi, Ld. Departmental Representative (for short ‘CIT-DR”) relied on the orders of the lower authorities.

16. Controversy involved in the present appeal hinges around three issues, viz. (i) that as to whether or not, the A.O was right in law and fats of the case in assuming jurisdiction for making an addition u/s.56(2)(vii)(b) of the Act of Rs.50,65,900/- i.e. an issue which did not form a basis for selection of the assessee’s case for “limited scrutiny”? (ii) that as to whether or not, the A.O without making any reference to the valuation cell rightly triggered the provisions of Section 56(2)(vii) r.w.s. 50C(2) of the Act and substituted the FMV of the lands purchased by the assessee as against the actual purchase consideration? AND, (iii) that as to whether or not the A.O is right in law and facts of the case in concluding that the assessee had failed to substantiate his entitlement for claiming deduction u/s. 54B of the Act?

17. Ostensibly, it is a matter of fact discernible on a perusal of the notice issued by the A.O u/s. 143(2) of the Act, dated 19.09.2016, Page No. 116 of APB that the case of the assessee was selected for “limited scrutiny” for examination of the following issues:

| (i) | sale of property mismatch; |

| (ii) | mismatch in income/Capital Gain on sale of land or building; |

| (iii) | deduction claimed under the head Capital Gains; and |

| (iv) | tax credit mismatch. |

Admittedly, the examination of the difference/variance in the purchase consideration of the property i.e. land situated at Mouja : Khapargaunge, Bilaspur (admeasuring 206.143 Aq. Mtrs.) that was purchased by the assessee for a consideration of Rs.5 lacs as against the FMV/stamp duty value of Rs.55,65,900/- in the backdrop of Section 56(2)(vii)(b) of the Act was not an issue for which the case of the assessee was selected for “limited scrutiny” u/s.143(2) of the Act.

18. Apropos, the addition of Rs.50,65,900/- made by the A.O u/s. 56(2)(vii)(b) of the Act with respect to difference in the Fair Market Value (FMV) i.e. stamp duty/segment rate of the aforementioned property viz. land situated at Mouja : Khapargaunge, Bilaspur (admeasuring 206.143 Sq. mtrs.) as against the actual purchase consideration paid by the assessee vide registered deed, dated 29.04.2014, we find substance in the Ld. AR’s claim that the A.O had traversed beyond the scope of his jurisdiction and made the said addition. As the case of the assessee was selected for limited scrutiny, therefore, the A.O. could not have ventured into an issue that did not form the basis for taking up the case for such scrutiny assessment. We are of the view that the A.O without getting the said limited scrutiny converted into complete scrutiny as per the CBDT Circular No.20/2015 dated 29.12.2015, had traversed beyond his jurisdiction and made the impugned addition of Rs.50,65,900/- (supra). Our aforesaid view is fortified by the order of the ITAT, Raipur, in the case of Aryadeep Complex (P) Ltd. v. Pr. CIT, (2022) 219 TTJ 735 (Raipur), wherein the Tribunal, based on its exhaustive deliberations and after considering the CBDT Instruction No.20 of 2015 dated 29.12.2015 and drawing support from the order of the ITAT, Mumbai in the case of Su-Raj Diamond Dealers (P) Ltd. v. Pr. CIT (2020) 203 TTJ (Mumbai) 137, had observed, that since the assessee’s case was selected for “limited scrutiny” under CASS with respect to certain specific issues, therefore, the jurisdiction of the A.O in the absence of getting the said case converted into complete scrutiny as per the CBDT Instruction No.20 of 2015 dated 29.12.2015, was confined only to the specific reason/issue based on which the case of the assessee was picked up for such scrutiny. Accordingly, on the basis of our aforesaid observations, we are of the considered view that the addition of Rs.50,65,900/- (supra) made by the A.O u/s.56(2)(vii)(b) is liable to be quashed for want of valid assumption of jurisdiction by the A.O while framing the “limited scrutiny” assessment vide his order u/s.143(3) of the Act, dated 15.12.2017. Thus, the addition of Rs.50,65,900/- made by the A.O. is vacated for want of valid assumption of jurisdiction.

19. As we have vacated the addition of Rs.50,65,900/- made by the A.O u/s.56(2)(vii)(b) of the Act for want of valid assumption of jurisdiction on the part of the A.O, therefore, we refrain from adverting to and dealing with the other contentions raised by the Ld. AR, based on which, he has assailed before us the validity of the impugned addition, which, thus, is left open. Thus, the additional ground of appeal a/w. Ground of appeal No.5 raised by the assessee is allowed in terms of our aforesaid observations.

20. Apropos the declining of the assessee’s claim for deduction u/s.54B of the Act by the A.O, for the reason that he had failed to place on record documentary evidence which would substantiate that the subject lands sold by him during the year under consideration were in the two years immediately preceding the date on which the same were transferred, being used by the assessee or his parents for agricultural purposes, we are unable to fully concur with the view taken by him. We, say so, for the reason that on a bare perusal of the “Form P-II/Khasra” (forming part of the respective sale deeds of the subject properties), Page No.9 to 81 of APB, it can safely be gathered that agricultural operations were being carried out by the assessee on some of the subject lands in the two years immediately preceding the date on which the same were transferred.

21. Before proceeding any further, we may herein observe that the assessee had during the year under consideration sold three lands vide registered sale deeds, viz. (i) registered sale deed, dated 21.07.2014, Page 9 to 23 of APB; (ii) registered sale deed, dated 02.09.2014, Page 24 to 55 of APB; (iii) registered sale deed, dated 02.09.2014, Page 56-81 of APB. We shall now deal with the respective sale deeds of the subject property, as under:

A. Land admeasuring 0.23 acres/0.093 hectares (Khasra No.434/4 & 435/2) situated at Village : Kududund, Dist : Bilaspur-sold vide registered sale deed, dated 21.07.2014:

22. (i) On a perusal of the record, it transpires that the aforementioned land admeasuring 0.093 hectare was sold by the assessee vide a registered sale deed, dated 21.07.2014, Page 9 to 23 of APB. On a perusal of the “Form P-II/Khasra” of the aforementioned land, Page 23 of APB (translated copy separately placed on record), it transpires that the said land was in the nature of irrigated area. Rather, the land admeasuring 0.053 hectare (out of 0.093 hectares) is classified as barren land for more than five years. For the sake of clarity, the “Form P-II/Khasra” of the aforementioned land (forming part of the registered sale deed) i.e. the translated copy separately placed on record is culled out as under:-

(ii) As there is nothing discernible from the record which would reveal that the aforesaid land was being used by the assessee for agricultural operations in the two years immediately preceding the date on which the same was transferred i.e. on 21.07.2014, therefore, we are unable to concur with the Ld. AR’s claim that the aforesaid land transferred by him was an agricultural land which satisfied the pre-condition for claiming deduction u/s.54B of the Act

B. Land admeasuring 1.922 hectare, Khasra No.22/1. 22/4 and 28/2, situated at Mouja : Parsoda, Tehsil: Bilaspur:

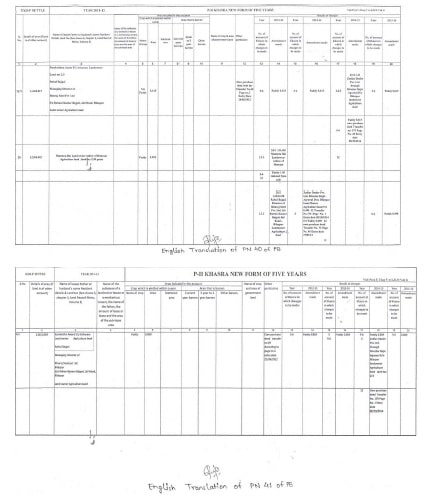

23. (i) On a perusal of the record, it transpires that the assessee had sold the subject property vide a registered sale deed, dated 02.09.2014, Page 24 to 55 of APB. On a perusal of the “Form-P-II/Khasra” of the aforementioned agricultural land, Page No.40-41 of APB (translated copy separately placed on record), we find that the same reads as under:

As per the aforesaid “Form P-II/Khasra”, the aforesaid bifurcated details of usage of the aforesaid 1.922 hectares of land for agricultural operations by the assessee are culled out as under:

| Land (area) | Khasra No. | Remarks |

| 0.615 hectare | 22/4 | (i) agricultural land admeasuring 0.615 hectares owned by Shri Ramkrishna Anant, F/o. Asharam was transferred to the assessee, viz. Shri Rahul Bajpai in F.Y.2012-13 (entry date 24.06.2012) (ii) agricultural land admeasuring 0.615 hectares was being used by the assessee during F.Y.2012-13 and F.Y.2013-14 for growing paddy crop. |

| 0.498 hectares | 28/2 | (i) out of the agricultural land admeasuring 0.902 hectares that was earlier owned by Smt. Mantara Bai wd/o. Late Shri Henram, land admeasuring 0.498 hectares was transferred to the assessee, viz. Shri Rahul Bajpai in F.Y.2012-13 (entry date 17.07.2012) (ii) 0.498 hectares of agricultural land was transferred by the assessee, viz. Shri Rahul Bajpai to M/s. Zodiac Dealer Pvt. Ltd. during F.Y.2013-14 (entry date 08.10.2014) (iii) there is nothing available on record from where it can be gathered that 0.498 hectares of agricultural land was being used by the assessee for agricultural operations in the two years immediately preceding the date on which the same was transferred i.e. 02.09.2014. |

| 0.809 hectare | 22/1 | (i) agricultural land admeasuring 0.809 hectares owned by Shri Ramkrishan Anant, S/o. Asharam was transferred to the assessee, viz. Shri Rahul Bajpai (entry date 22.06.2012) (ii) agricultural land admeasuring 0.809 hectares was being used by the assessee during F.Y.2012-13 and F.Y.2013-14 for growing paddy crop. |

| Total area | 1.922 hectares |

Accordingly, based on the aforesaid facts gathered from the “Form P-II/Khasra” of the aforesaid land (forming part of the registered sale deed) that was sold by the assessee vide a registered sale deed, dated 02.09.2014, out of 1.922 hectares the assessee had been carrying agricultural operations i.e. growing paddy crop on 1.424 hectares [0.615 hectares (-) 0.809 hectares] in the two years immediately preceding the date on which the aforesaid land was transferred i.e. on 02.09.2014.

C. Land admeasuring 1.781 hectare, Khasra No.17/2 situated at Mouja : Parsoda, Tehsil : Bilaspur-sold vide registered sale deed dated 02.09.2014:

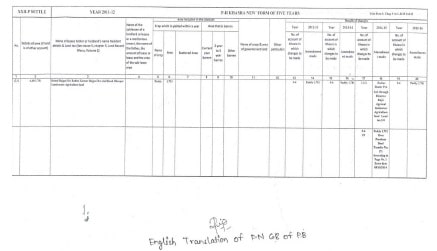

24. On a perusal of the record, it transpires that the assessee had sold the subject agricultural land admeasuring 1.781 hectares i.e. Khasra No.17/2 vide a registered sale deed, dated 02.09.2014, Page No. 58-59 of APB (translated copy separately placed on record), which reads as under:

As per the aforesaid facts gathered from the “Form P-II/Khasra” the details of the usage of the aforesaid land admeasuring 1.781 hectares of agricultural land for agricultural operations by the assessee is culled out as under:

| Land (area) | Khasra No. | Remarks | |

| 1.781 hectare | 17/2 | Agricultural land was being used by the assessee during F.Y.2012-13 and F.Y.2013-14 | |

| Total area | 1.781 hectare | ||

Accordingly, based on the aforesaid facts gathered from the “Form P-II/Khasra” of the aforesaid land (forming part of the registered sale deed) that was sold by the assessee vide a registered sale deed, dated 02.09.2014, the assessee had been carrying agricultural operations on agricultural land admeasuring 1.781 hectares i.e. growing paddy crop in the two years immediately preceding the date on which the aforesaid land was transferred i.e. on 02.09.2014.

25. We, thus, in terms of our aforesaid observations, find that the agricultural lands sold by the assessee during the year under consideration, viz. (i) agricultural land admeasuring 1.424 hectares (out of 1.922 hectares) sold by the assessee vide registered sale deed dated 02.09.2014 i.e. (out of Khasra No.22/1, 22/4 and 28/2) situated at Mauja: Parsoda, Tehsil: Bilaspur; and (ii) agricultural land admeasuring 1.781 hectares (bearing Khasra No.17/1) situated at Mauja : Parsoda, Tehsil: Bilaspur sold by the assessee vide registered sale deed dated 02.09.2014, were in the two years immediately preceding the date on which they were transferred i.e. on 02.09.2014, being used by the assessee for agricultural operations i.e. growing paddy crop. Accordingly, we herein conclude that the aforesaid pre-condition contemplated u/s.54B(1) of the Act i.e. usage of the agricultural lands in the two years immediately preceding the date on which they were transferred is duly satisfied by the assessee in so far the aforesaid agricultural lands admeasuring 1.424 hectares (supra) and 1.781 hectares (supra) are concerned.

26. We, thus, in terms of our aforesaid deliberations modify the order of the CIT(Appeals), and conclude that the pre-condition as regards usage of the lands sold by the assessee for agricultural purposes in the two years immediately preceding the date on which they were transferred is found to have been satisfied in so far the aforesaid lands are concerned, viz. (i) agricultural land admeasuring 1.424 hectares (out of 1.922 hectares) (supra); and (ii) agricultural land admeasuring 1.781 hectares (supra). Accordingly, the A.O is directed to allow the assessee’s claim for deduction u/s. 54B of the Act in so far the same pertains to the aforesaid lands sold by him during the subject year are concerned subject to verification of satisfaction of the other conditions contemplated in the said statutory provision. Thus, the Grounds of appeal No.3 & 4 raised by the assessee are partly allowed in terms of our aforesaid observations.

27. Grounds of appeal Nos. 1, 2 and 6 being general in nature are dismissed as not pressed.

28. In the result, appeal of the assessee is partly allowed in terms of our aforesaid observations.