ORDER

Rathod Kamlesh Jayantbhai, Accountant Member.- By way of this appeal the assessee – appellant challenges the order of the learned Commissioner of Income Tax Addl./JCIT(A)-1, Pune[for short CIT(A)]dated 03-03-2024 which relates to the assessment year 2013-14 raising therein following grounds of appeal.

”1. On the facts and circumstances of the case, the order passed by the learned AO (CPC) is bad, both in the eye of law and on the facts.

2. On the facts and circumstances of the case, the learned AO (CPC) has erred, both onfacts and in law, in disallowance of Rs. 43,272/- under section 11(1)(a) of the Act on account of amount accumulated or set apart for charitable or religious purpose. That the said disallowance has been made despite the same has been accumulated in the manner as provided in section 11(5) of the Act read with Rule 17 of the Income Tax Rules.

3. Charging of tax @30% instead of applicable tax u/s 2 of Finance Act, 2013 @10% is bad in law and facts.

4. On the facts and circumstances of the case, the learned AO (CPC) has erred, both on facts and in law, charging of tax @30% instead of 10% merely on account of error in punching of certain information in the Form ITR-7.

5. On the facts and circumstances of the case, the learned AO (CPC) has erred, both onfacts and in law, computing the income the under normal provisions of the Act.

6. On the facts and circumstances of the case, the learned AO (CPC) has erred, both on facts and in law, in charging tax at the maximum marginal rate which also being contrary to the provisions of law hence being without jurisdiction and contrary to the facts, such taxation be quashed.

7. That the said disallowed has been made despite the amount has been shown in the Form ITR-7. That the said amount has been disallowed despite the same has been claimed by complying with all the statutory conditions specified there in and ignoring the Statutory Auditor’s Reports and other evidences filed by the assessee to justify its claim despite the fact that no such disallowances have been made in the preceding assessment years and the assessee is consistently claiming the above deduction in all the years.”

2. The brief facts related to the dispute are that in the case of the assessee appellant the AOCPC while processing the ITR of the assessee, has not allowed 15 % of the receipt for an amount of Rs. 43,272/- [page 2 of the impugned intimation in question]. The CPC also while taxing the income charged the tax at Maximum Marginal Rate [MMR] and has not considered that the assessee is a trust registered u/s. 12A [page 83 registration certificate] merely because the assessee while filling the ITR against the information whether the trust is registered as u/s. 12A/12AA stated “NO” [page 88 of the paper book] and therefore, the income was charged at MMR.

3. Aggrieved from that order of the ld. AO CPC the assessee has preferred the appeal before the ld. CIT(A) which delayed by 1672 days. The ld. CIT(A) has not deemed it fit that the delay was on account of the reasonable cause not therefore, the appeal was considered as non-maintainable being out of time and thus the appeal was dismissed.

4. Aggrieved with that order of the order of the ld. CIT(A) the assessee is in appeal before this tribunal challenging the order of the ld. CIT(A). The bench noted that the appeal which was filed by the assessee before the ld. CIT(A) was delayed by 1672 and the same was explained that the assessee was not informed about the disallowance of claim of 15 % income and thereby charging the trust at MMR. Even the assessee on the advise received deposited the impugned demand on the every same advice. Thus, when it came to the knowledge of the assessee the same was challenged being the sufficient reason as thatlis between the parties has to be decided on merits so that nobody’s rights could be scuttled down without providing opportunity of being heard to the assessee on merits when the assessee expressed that the delay was attributable to the counsel’s wrong advice. We get strength for condoning the delay from the decision of the Hon’ble Supreme Court in Pathapati Subba Reddy v. Special Deputy Collector (LA) [2024 SCC OnLine SC 513 : 2024 KHC OnLine 6197] laid down the following eight principles;

“(i) Law of limitation is based upon public policy that there should be an end to litigation by forfeiting the right to remedy rather than the right itself;

(ii) A right or the remedy that has not been exercised or availed of for a long time must come to an end or cease to exist after a fixed period of time;

(iii) The provisions of the Limitation Act have to be construed differently, such as Section 3 has to be construed in a strict sense whereas Section 5 has to be construed liberally;

(iv) In order to advance substantial justice, though liberal approach, justice- oriented approach or cause of substantial justice may be kept in mind but the same cannot be used to defeat the substantial law of limitation contained in Section 3 of the Limitation Act;

(v) Courts are empowered to exercise discretion to condone the delay if sufficient cause had been explained, but that exercise of power is discretionary in nature and may not be exercised even if sufficient cause is established for various factors such as, where there is inordinate delay, negligence and want of due diligence;

(vi) Merely some persons obtained relief in similar matter, it does not mean that others are also entitled to the same benefit if the court is not satisfied with the cause shown for the delay in filing the appeal;

(vii) Merits of the case are not required to be considered in condoning the delay; and

(viii) Delay condonation application has to be decided on the parameters laid down for condoning the delay and condoning the delay for the reason thatthe conditions have been imposed, tantamounts to disregarding the statutory provision.”

Here the bench noted that the merits of the case is required to be determined as the assessee was not advised properly and therefore, we condone the delay in filling the appeal before the ld. CIT(A) in the interest of equity and justice.

5. Having condoned the delay in filling an appeal before the ld. CIT(A) the issue is required to be decided on its merits before us the ld. DR stated that same be remitted to ld. AO or that of the CIT(A). On the other hand ld. AR of the assessee submitted that the issue is covered by the decision of the Rajasthan High Court so far as the deduction of 15 % and that of the 12A registration not mentioned in the ITR being the unintentional and even the Id. AO CPC has not considered the audit report which say that the assessee is trust in the light of those facts already on record the appeal be decided based on that merits. In support of the contention on merits the ld. AR of the assessee has filed the following written submission:

You honour, the Facts of the case, in brief, are as under:-

1. The return of income was processed under section 143(1)(a) of the Act on 15.11.2014 by the CPC Bangalore:

1.1. Disallowing the amount Rs. 43,272/- which was claimed under section 11 (1)(a) (11)(b) as accumulated or set apart for application to charitable purposes to the extent it does not exceed 15 per cent of the income (page no. 2 point no. 9 of the Intimation u/s 143(1)).

1.2. The Ld. AO (CPC) Charged tax @30% instead of applicable tax u/s 2 of Finance Act, 2013 @10%

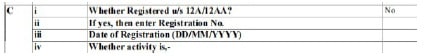

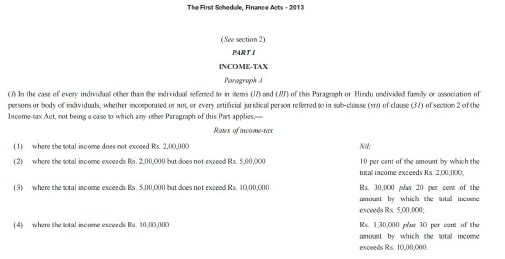

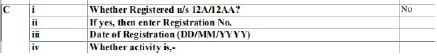

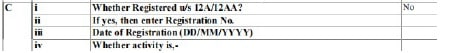

2. The reason of aforesaid disallowance is that the assessee’s professional while filing the ITR failed to punch the details correctly and made errors in punching of certain information in the Form ITR-7. Kindly see ITR page no. 1 (at paper book page no. 88 “other details” point no. C). The relevant scanned portion of the ITR is as under:-

3. Your honour the undisputed facts are as under:-

3.1. The assessee is Registered u/s 12A/12AA since 1995 the copy of the certificate (at page no. 83-86.)

3.2. Kindly see ITR page no. 1 (at page no. 88), the details is given that the return was filed u/s 12.

3.3. The FORM NO. 10B was also filed along with the ITR: Audit report under section 12A(b) of the Income-tax Act, 1961, in the case of charitable or religious trusts or institutions (at page no. 81-82.) duly reflecting and claimed as such. All the details pertaining to the said claim of Rs. 43,272/- u/s 11(1)(a) were duly apparent.

3.4. Kindly see ITR page no. 2 (at page no. 89) wherein point no. 6(iv) is appearing wherein the assessee claimed Rs. 43,272/- as “Amount accumulated or set apart / finally set apart for application to charitable or religious purposes to the extent it does not exceed 15 per cent. of income derived from property held in trust wholly or in part only for such purposes under section 11(1) (a)”

3.5. The assessee has e-filed the return of income (enclosed at page no. 87-100) on 06.9.2014 claiming exemption under section 11 of the Act.

Hence, it is requested that the assessee should not be deprived from the legitimate claim merely due to wrong punching of information bonafidely.

The grounds of appeal filed are as under:-

1. On the facts and circumstances of the case, the order passed by the learned AO (CPC) is bad, both in the eye of law and on the facts.

2. On the facts and circumstances of the case, the learned AO (CPC) has erred, both on facts and in law, in disallowance of Rs. 43,272/- under section 11(1)(a) of the Act on account of amount accumulated or set apart for charitable or religious purpose. That the said disallowance has been made despite the same has been accumulated in the manner as provided in section 11(5) of the Act read with Rule 17 of the Income Tax Rules.

3. Charging of tax @30% instead of applicable tax u/s 2 of Finance Act, 2013 @10% is bad in law and facts.

4. On the facts and circumstances of the case, the learned AO (CPC) has erred, both on facts and in law, charging of tax @30% instead of 10% merely on account of error in punching of certain information in the Form ITR-7.

5. On the facts and circumstances of the case, the learned AO (CPC) has erred, both on facts and in law, computing the income the under normal provisions of the Act.

6. On the facts and circumstances of the case, the learned AO (CPC) has erred, both on facts and in law, in charging tax at the maximum marginal rate which also being contrary to the provisions of law hence being without jurisdiction and contrary to the facts, such taxation be quashed.

7. That the said disallowed has been made despite the amount has been shown in the Form ITR-7. That the said amount has been disallowed despite the same has been claimed by complying with all the statutory conditions specified there in and ignoring the Statutory Auditor’s Reports and other evidences filed by the assessee to justify its claim despite the fact that no such disallowances have been made in the preceding assessment years and the assessee is consistently claiming the above deduction in all the years.

The submission is as under :-

1. GOA 1

ON THE FACTS AND CIRCUMSTANCES OF THE CASE, THE ORDER PASSED BY THE LEARNED AO (CPC) IS BAD, BOTH IN THE EYE OF LAW AND ON THE FACTS.

1.1. Facts of the case, in brief, are that the assessee is a trust. The assessee has efiled the return of income (Kindly find enclosed herewith From page no. 87-100) on 06.9.2014 declaring Rs. 2,45,210 income after claiming exemption under section 11 of the Act. The assessee is registered under Section 12A of the Act. (Copy of the Certificate u/s 12A of the Act is enclosed at page no. 83-86. The assessee claimed Rs. 43,272/- Amount accumulated or set apart / finally set apart for application to charitable or religious purposes to the extent it does not exceed 15 per cent. of income derived from property held in trust wholly or in part only for such purposes under section 11(1) (a). (Kindly see paper book page no. 89 point no. 6 (iv)).

1.2. The return of income was processed under section 143(1)(a) of the Act on 15.11.2014 by the CPC Bangalore, however, the amount accumulated or set apart for application to charitable purposes to the extent it does not exceed 15 per cent of the income, claimed at Rs. 43,272/- under section 11 (1)(a) (11)(b) of the Act were not allowed. Accordingly, the income was computed at Rs. 2,88,480/-.

1.3. Further, your honour, income tax Charging of tax @30% instead of applicable tax u/s 2 of Finance Act, 2013 @10% is bad in law and facts.

1.4. On the facts and circumstances of the case, the learned CIT (Appeals) NFAC has erred, both on facts and in law in confirming the order passed by the Ld. AO (CPC), charging of tax @30% instead of 10% merely on account of error in punching of certain information in the Form ITR-7.

1.5. On the facts and circumstances of the case, the learned CIT (Appeals) NFAC has erred, both on facts and in law in confirming the order passed by the Ld. AO (CPC), computing the income the under normal provisions of the Act.

1.6. On the facts and circumstances of the case, the learned CIT (Appeals) NFAC has erred, both on facts and in law in confirming the order passed by the Ld. AO (CPC), in charging tax at the maximum marginal rate which also being contrary to the provisions of law hence being without jurisdiction and contrary to the facts, such taxation be quashed.

1.7. That the said disallowed has been made despite the amount has been shown in the Form ITR-7. That the said amount has been disallowed despite the same has been claimed by complying with all the statutory conditions specified there in and ignoring the Statutory Auditor’s Reports and other evidences filed by the assessee to justify its claim despite the fact that no such disallowances have been made in the preceding assessment years and the assessee is consistently claiming the above deduction in all the years.

1.8. Your honour, disallowance has been made by the CPC and confirmed by the learned CIT (Appeals) NFAC in an intimation issued u/s. 143(1) dated 09/07/2018 denying the exemption claimed u/s. 11.

1.9. No disallowance could be made u/s. 11 by the CPC in an intimation issued u/s. 143(1) of the Act.

1.10. Section 143(1) as it was applicable for the relevant period reads as under:

143. (1) Where a return has been made under section 139, or in response to a notice under sub-section (1) of section 142, such return shall be processed in the following manner, namely:-

| (a) | | the total income or loss shall be computed after making the following adjustments, namely:- |

| (i) | | any arithmetical error in the return;[or] |

| (ii) | | an incorrect claim, if such incorrect claim is apparent from any information in the return. |

| (b) | | the tax and interest, if any, shall be computed on the basis of the total income computed under clause (a); |

| (c) | | the sum payable by, or the amount of refund due to, the assessee shall be determined after adjustment of the tax and interest, if any, computed under clause (b) by any tax deducted at source, any tax collected at source, any advance tax paid, any relief allowable under an agreement under section 90 or section 90A, or any relief allowable under section 91, any rebate allowable under Part A of Chapter VIII, any tax paid on selfassessment and any amount paid otherwise by way of tax or interest; |

| (d) | | an intimation shall be prepared or generated and sent to the assessee specifying the sum determined to be payable by, or the amount of refund due to, the assessee under clause (c); and |

| (e) | | the amount of refund due to the assessee in pursuance of the determination under clause (c) shall be granted to the assessee: |

Provided that an intimation shall also be sent to the assessee in a case where the loss declared in the return by the assessee is adjusted but no tax or interest is payable by, or no refund is due to, him: Provided further that no intimation under this sub-section shall be sent after the expiry of one year from the end of the financial year in which the return is made.

Explanation.:-For the purposes of this sub-section,-

| (a) | | “an incorrect claim apparent from any information in the return” shall mean a claim, on the basis of an entry, in the return,- |

| (i) | | of an item, which is inconsistent with another entry of the same or some other item in such return; |

| (ii) | | in respect of which the information required to be furnished under this Act to substantiate such entry has not been so furnished; or |

| (iii) | | in respect of a deduction, where such deduction exceeds specified statutory limit which may have been expressed as monetary amount or percentage or ratio or fraction; |

| (b) | | the acknowledgement of the return shall be deemed to be the intimation in a case where no sum is payable by, or refundable to, the assessee under clause (c), and where no adjustment has been made under clause (a). |

1.11. In the mechanism of application of Section 143(1) for the relevant assessment year, we find that, the first proviso to Section 143 (1) mandates that “no adjustments” except for arithmetical mistakes and/or an incorrect claim that is apparent from any information in the return. The scope of permissible adjustments under section 143(1)(a) for the relevant year is much narrower.

1.12. Hon’ble Bombay High Court in case of KhatauJunkar Ltd. v. K.S. Pathania reported in (1992) 196 ITR 157, has observed that, where a claim has been made which requires further inquiry, it cannot be disallowed without hearing the parties and/or giving the party an opportunity to submit proof in support of its claim. In the absence of section 143(1)(a) being read in the above manner i.e. debatable issues cannot be adjusted by way of intimation under section 143(1)(a), would lead to arbitrary and unreasonable intimations being issued, leading to chaos.

1.13. A Similar view has been taken by Hon’ble Bombay High Court in case of Bajaj Auto Finance Ltd.Vs. CIT reported

Hence, your honour, on the facts and circumstances of the case, the intimation passed by the learned ao (cpc) is bad, both in the eye of law and on the facts.

2. GOA 2

ON THE FACTS AND CIRCUMSTANCES OF THE CASE, THE LEARNED AO (CPC) HAS ERRED, BOTH ON FACTS AND IN LAW, IN DISALLOWANCE OF RS. 43,272/- UNDER SECTION 11(1)(A) OF THE ACT ON ACCOUNT OF AMOUNT ACCUMULATED OR SET APART FOR CHARITABLE OR RELIGIOUS PURPOSE. THAT THE SAID DISALLOWANCE HAS BEEN MADE DESPITE THE SAME HAS BEEN ACCUMULATED IN THE MANNER AS PROVIDED IN SECTION 11(5) OF THE ACT READ WITH RULE 17 OF THE INCOME TAX RULES.

2.1. Facts of the case, in brief, are that the assessee is a trust. The assessee has efiled the return of income (Kindly find enclosed herewith From page no. 87-100) on 06.9.2014 declaring Rs. 2,45,210 income after claiming exemption under section 11 of the Act. The assessee is registered under Section 12A of the Act. (Copy of the Certificate u/s 12A of the Act is enclosed at page no. 83-86. The assessee claimed Rs. 43,272/- Amount accumulated or set apart / finally set apart for application to charitable or religious purposes to the extent it does not exceed 15 per cent. of income derived from property held in trust wholly or in part only for such purposes under section 11(1) (a). (Kindly see paper book page no. 89 point no. 6 (iv)).

2.2. The return of income was processed under section 143(1)(a) of the Act on 15.11.2014 by the CPC Bangalore, however, the amount accumulated or set apart for application to charitable purposes to the extent it does not exceed 15 per cent of the income, claimed at Rs. 43,272/- under section 11 (1)(a) (11)(b) of the Act were not allowed. Accordingly, the income was computed at Rs. 2,88,480/-.

2.3. Your honour, the assessee’s professional while filing the ITR failed to punch the details correctly and made errors in punching of certain information in the Form ITR-7. Kindly see ITR page no. 1 (in the paper book page no. 88 “other details” point no. C). The relevant scanned portion of the ITR is as under:-

2.4. In this regard the AR on behalf of the assessee submits as under:-

2.4.1. Whereas the fact is that the assessee is Registered u/s 12A/12AA since 1995 the copy of the certificate is enclosed in paper book at page no. 83-86.

2.4.2. Further, while filing the above ITR in filing status, Kindly see ITR page no. 1 (in the paper book page no. 88), the details is given that the return was filed u/s 12.

2.4.3. The assessee also filed FORM NO. 10B along with the ITR:Audit report under section 12A(b) of the Income-tax Act, 1961, in the case of charitable or religious trusts or institutions as appearing on paper book page no. 80-82.

2.4.4. Kindly see ITR page no. 2 (paper book page no. 89) wherein point no. 6(iv) is appearing wherein the assessee claimed Rs. 43,272/- as “Amount accumulated or set apart / finally set apart for application to charitable or religious purposes to the extent it does not exceed 15 per cent. of income derived from property held in trust wholly or in part only for such purposes under section 11(1) (a)”

2.5. Hence, the relevant forms, reports and such being Form No. 10B was already furnished electronically, duly reflecting and claimed as such. All the details pertaining to the said claim of Rs. 43,272/- u/s 11(1)(a) were duly apparent. Hence, the assessee should not be deprived from the legitimate claim merely due to wrong punching of information bonafidely.

2.6. Your honour kind attention is invited to section 12 which reads as under:-

“Income of trusts or institutions from contributions 2. Any voluntary contributions received by a trust created wholly for charitable or religious purposes or by an institution established wholly for such purposes (not being contributions made with a specific direction that they shall form part of the corpus of the trust or institution) shall for the purposes of section 11 be deemed to be income derived from property held under trust wholly for charitable or religious purposes and the provisions of that section and section 13 shall apply accordingly.”

2.7. Your honour, the accumulation upto 15% of the income under sec 11(1) is permissible, i.e 15% can be retained by a charitable organisation without applying it for charitable purposes in the year in which the income was accrued. Your honour kindly see intimation page no. 2 point no. 9(iv) wherein it is clearly stated that Rs. 43,272/- was accumulated and the same is upto 15%.

Hence, your honour, On the facts and circumstances of the case, the Ld. AO (CPC) has erred, both on facts and in law, in disallowance of Rs. 43,272/- under section 11(1)(a) of the Act on account of amount accumulated or set apart for charitable or religious purpose. That the said disallowance has been made despite the same has been accumulated in the manner as provided in section 11(5) of the Act read with Rule 17 of the Income Tax Rules.

Your honour is requested to kindly allow the relief and delete the entire addition.

3. Your honour, kindly allow me to submit a defence of Ground no. 3, 4, 5, 6 and 7 together. These Grounds are as under:-

GOA 3

CHARGING OF TAX @30% INSTEAD OF APPLICABLE TAX U/S 2 OF FINANCE ACT, 2013 @10% IS BAD IN LAW AND FACTS.

GOA 4

ON THE FACTS AND CIRCUMSTANCES OF THE CASE, THE LEARNED AO (CPC) HAS ERRED, BOTH ON FACTS AND IN LAW, CHARGING OF TAX @30% INSTEAD OF 10% MERELY ON ACCOUNT OF ERROR IN PUNCHING OF CERTAIN INFORMATION IN THE FORM ITR-7.

GOA 5

ON THE FACTS AND CIRCUMSTANCES OF THE CASE, THE LEARNED AO (CPC) HAS ERRED, BOTH ON FACTS AND IN LAW, COMPUTING THE INCOME THE UNDER NORMAL PROVISIONS OF THE ACT.

GOA 6

ON THE FACTS AND CIRCUMSTANCES OF THE CASE, THE LEARNED AO (CPC) HAS ERRED, BOTH ON FACTS AND IN LAW, IN CHARGING TAX AT THE MAXIMUM MARGINAL RATE WHICH ALSO BEING CONTRARY TO THE PROVISIONS OF LAW HENCE BEING WITHOUT JURISDICTION AND CONTRARY TO THE FACTS, SUCH TAXATION BE QUASHED.

GOA 7

THAT THE SAID DISALLOWED HAS BEEN MADE DESPITE THE AMOUNT HAS BEEN SHOWN IN THE FORM ITR-7. THAT THE SAID AMOUNT HAS BEEN DISALLOWED DESPITE THE SAME HAS BEEN CLAIMED BY COMPLYING WITH ALL THE STATUTORY CONDITIONS SPECIFIED THERE IN AND IGNORING THE STATUTORY AUDITOR’S REPORTS AND OTHER EVIDENCES FILED BY THE ASSESSEE TO JUSTIFY ITS CLAIM DESPITE THE FACT THAT NO SUCH DISALLOWANCES HAVE BEEN MADE IN THE PRECEDING ASSESSMENT YEARS AND THE ASSESSEE IS CONSISTENTLY CLAIMING THE ABOVE DEDUCTION IN ALL THE YEARS.

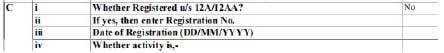

3.1. Facts of the case, in brief, are that the assessee is a trust. The assessee has efiled the return of income (Kindly find enclosed herewith From page no. 87-100) on 06.9.2014 declaring Rs. 2,45,210 income after claiming exemption under section 11 of the Act. The assessee is registered under Section 12A of the Act. (Copy of the Certificate u/s 12A of the Act is enclosed at page no. 83-86. The assessee computed tax as under:-

| SNO | Particular | Income | Rate | Tax |

| 1 | First 2,00,000 | 2,00,000 | Nil | Nil |

| 2 | Balance 45,210 | 45,210 | 10% | 4521 |

3.2. The above calculation was made being eligible u/s 2 of the Finance Act, 2013. (kindly see paper book page no. 101) the scanned relevant portion is as under:-

3.3. The return of income was processed under section 143(1)(a) of the Act on 15.11.2014 by the CPC Bangalore, however, CPC charged the tax @30% on entire income of Rs. 2,45,210 instead of applicable tax as above u/s 2 of Finance Act, 2013.

3.4. Your honour, the assessee’s professional while filing the ITR failed to punch the details correctly and made errors in punching of certain information in the Form ITR-7. Kindly see ITR page no. 1 (in the paper book page no. 88 “other details”

point no. C). The relevant scanned portion of the ITR is as under:-

3.5. In this regard the AR on behalf of the assessee submits as under:-

3.5.1. Whereas the fact is that the assessee is Registered u/s 12A/12AA since 1995 the copy of the certificate is enclosed in paper book at page no. 83-86.

3.5.2. Further, while filing the above ITR in filing status, Kindly see ITR page no. 1 (in the paper book page no.88), the details is given that the return was filed u/s 12.

3.5.3. The assessee also filed FORM NO. 10B along with the ITR:Audit report under section 12A(b) of the Income-tax Act, 1961, in the case of charitable or religious trusts or institutions as appearing on paper book page no. 80-82.

3.5.4. Kindly see ITR page no. 2 (paper book page no. 89) wherein point no. 6(iv) is appearing wherein the assessee claimed Rs. 43,272/- as “Amount accumulated or set apart / finally set apart for application to charitable or religious purposes to the extent it does not exceed 15 per cent. of income derived from property held in trust wholly or in part only for such purposes under section 11(1) (a)”

3.5.5. Kindly see ITR page no. 3 (paper book page no. 90) wherein point no. 2(2a) is appearing wherein the assessee computed tax at the normal rate @10%.

3.6. Hence, the relevant forms, reports and such being Form No. 10B was already furnished electronically, duly reflecting and claimed as such. All the details pertaining to the said claim were duly apparent. Hence, the assessee should not be deprived from the legitimate claim merely due to wrong punching of information bonafidely. Kindly see the Intimation page no. 3 point no. 28 wherein “TAX ON NORMAL RATE (20-21-22)” appears. The Ld. AO though filled this row by charging tax but charged @ 30% instead of 10%. The Ld. AO had not given any reason for charging @ 30% instead of 10%.

Hence, your honour, charging tax @30% on entire income of Rs. 2,45,210 instead of applicable tax u/s 2 of the finance act, 2013 @ nil upto Rs. 2 Lacs and @10% on balance Rs. 45,210 is bad in law and facts.

Your honour is requested to kindly allow the relief and order for charging of applicable tax as per u/s 2 of the finance act, 2013 which is @ nil upto Rs. 2 Lacs and @10% on balance Rs. 45,210.

4. The AR relied on the decisions held as under:-

| SNO | PARTICULARS | PNO |

| 1 | ChandraprabhuSwetamberJainvs ACIT, Palghar Circle, on 12 August, 2016 Income Tax Appellate Tribunal – Mumbai | 23 32 |

| 2 | Rajasthan Cricket Association v. Add. Cit, Jaipur on 23 March, 2017 IN THE ITAT,JAIPUR ITA No. 388/JP/2012 & 944/JP/2013 AY: 2008-09& 2009-10. | 33 72 |

| 3 | The ICAIVs ACIT (ITAT Delhi)Appeal Number : I.T.A. No. 2156/Del/2018Date of Order : 13/04/2018Related Assessment Year : 2014-15Courts : All ITAT (6060) ITAT Delhi (1372) | 73 79 |

So your honour is requested kindly to allow the appeal

PRAYER:-

| 1. | | Your honor is requested kindly to delete the disallowance of Rs. 43,272/- under section 11(1)(a) of the Act. |

| 2. | | Your honor is requested kindly to order for Charging of tax as applicable u/s 2 of Finance Act, 2013 @ nil upto Rs. 2 Lacs and @10% on balance Rs. 45,210. |

6. On the other hand, the ld. DR supported the order of the lower authorities and submitted that assessee has not mentioned about the registration details in the ITR and therefore, treatment given in the order of the CPC is correct.

7. We have heard the rival contentions and perused material available on record. The bench noted that in this case the benefit u/s. 11(1)(a) claimed by the assessee was not considered as the assessee while filling the ITR did not mention 12A details reads as under :

Whereas the assessee has filed the audit report which suggest that the assessee is trust. Even the assessee in the past and subsequent year allowed the benefit of section 12A even the trust still enjoy that benefit. Merely an error in the ITR which was Bonafide the deduction which are otherwise allowable cannot be denied. Since the issue is related to the provision of section 11(1)a) of the Act it would be appropriate to reads the said provision:

Income from property held for charitable or religious purposes.

11. (1) Subject to the provisions of sections 60 to 63, the following income shall not be included in the total income of the previous year of the person in receipt of the income—

| (a) | | income derived from property held under trust wholly for charitable or religious purposes, to the extent to which such income is applied to such purposes in India; and, where any such income is accumulated or set apart for application to such purposes in India, to the extent to which the income so accumulated or set apart is not in excess of fifteen per cent of the income from such property; |

That provision, being very clear as vanilla the claim of the assessee is very much within the law. Not only that the issue which the revenue raised has already been settled by our Hon’ble Rajasthan High Court in the case of C IT, Bikaner v. Krishi Upaj Mandi Samiti, Raisinghnagar(Rajasthan) wherein the High Court held that;

Where assessee, a charitable trust, incurred expenditure in excess of income in previous year relevant to assessment year for charitable purposes, out of accumulated charity fund, it could not be denied benefit of exemption under section 11(1)(a) in respect of income of previous year relevant to assessment year, which had been admittedly applied for charitable purposes

Respectfully following the binding precedent and the provision of the law we consider the claim of the assessee for Rs. 43,272 as claimed in the ITR is allowable. Since we have considered that the assessee trust is registered u/s. 12A of the Act necessary benefit of charging the income be given to the assessee and accordingly ld. AO is directed to give the effect as directed in this order.

8. In the result the appeal of the assessee is allowed.