An educational trust can claim exemption under section 10(23C) even if it files its ITR 5 instead of ITR 7

Exemption and Deduction Claims of Educational Trust Remanded for Fresh Consideration

Key Issues and Decisions:

I. Exemption under Section 10(23C) and Filing of Incorrect Form:

- Issue: Whether the assessee, an educational trust, can be denied exemption under Section 10(23C) for filing its return in the incorrect form (ITR-5 instead of ITR-7), despite fulfilling all conditions for the exemption.

- Decision: The court held that the assessee’s mistake in filing the wrong form was a bona fide error. The assessee had demonstrated its eligibility for exemption under Section 10(23C) and provided supporting evidence. The matter was remanded to the Assessing Officer (AO) for fresh consideration on merits, taking into account the assessee’s eligibility for the exemption. (Matter remanded)

II. Deduction of Salary Grant under Section 57:

- Issue: Whether the assessee can claim a deduction under Section 57 for the salary grant received from the Government, which was used to pay salaries to teaching and non-teaching staff.

- Decision: The court noted that the assessee had provided documentary evidence to support the claim and establish a nexus between the grant and the salary expenditure. However, the AO did not consider this evidence. The matter was remanded to the AO for fresh consideration, directing them to examine the evidence and determine the allowability of the deduction. (Matter remanded)

Key Takeaways:

- Bona Fide Errors: This case highlights that bona fide errors in tax filings, such as using the incorrect form, should not automatically lead to the denial of legitimate claims. The AO should consider the substance of the claim and the assessee’s eligibility before making a decision.

- Supporting Evidence: The decision emphasizes the importance of providing supporting documentation to substantiate claims for exemptions and deductions. The AO is obligated to consider the evidence presented by the assessee before making a decision.

- Nexus between Income and Expenditure: For claiming deductions under Section 57, a clear nexus between the income and the related expenditure must be established. The AO should examine the evidence to determine if such a nexus exists.

This case provides valuable guidance on the interpretation of Sections 10(23C) and 57 of the Income-tax Act, 1961, emphasizing the need for a fair and reasonable approach by the AO in considering claims for exemptions and deductions, even when there are minor procedural errors or discrepancies in the initial filing.

and Ms. Astha Chandra, Judicial Member

[Assessment Year 2020-21]

1) Though assessee has stated in his letter many times that the Institution is covered u/s 10(23C)(iiiab) of the IT. Act. 1961 However, no documents to substantiate its claim has been provided. No document showing the grant allowed to the Institution by the government has been produced. Except for enclosing the Paysheet prepared by each School of the Trust. In reply to SCN issued on 26/08/2022 assessee submitted copy of grant dating back to the year 1997 and 2000 and that in respect of 6 schools out of 10 schools of the assessee. (Para No. 6. 1 of Assessment Order dt. 21.09.2022)

The institutions, which are covered u/s. 10(23C)(iiiab) are not required to obtain the approval from CCIT / PCIT. Whereas, all other trusts, which are covered u/s. 10(23C)(iv), (v), (vi) and (via) are required to obtain the approval of CCIT / PCIT. The trust is running schools which are mostly granted by Government in the year between 1990-2000.

Certificates from School Education Department, Government of Maharashtra confirming the amount of grants distributed to schools run by trust is enclosed herewith as Annexure “E”.

2) Perusal of the Pay sheets as claimed by the assessee to have been submitted before the pay unit of Education department and verified and sanctioned by the said Govt department, it is seen that Paysheets enclosed by the assessee is a mere Proforma paysheet prepared by the respective schools of the Assessee, signed by the respective School heads. Nowhere it is clear that grant is being received from the government for the school. The paysheet is signed at the end by the Secretary Pay and Employees Provident Fund. It only implies that the same is being submitted to the EFF department for PF purpose. (Pars No. 6.2 Assessment Order dt. 21.12.2022).

In this regard it is submitted that Profarma No. 2 (in marathi प्रपत्र २३ is the form prescribed by School Education Department, Government of Maharashtra for claiming salary grants by Granted Schools. It is not the profarma sheet as understood by the id. AO but the nomenclature of the form is Profarma No. 2 in marathi प्रपत्र – २३.

As stated above the monthly pay sheet in form Profarma No. 2 (in marathi प्रपत्र – २) is being prepared by respective schools and same is submitted to Education officer, Pay and Provident Fund Unit, Zilha Parishad, Latur (and not the Provident Fund Department). After verification of pay sheets submitted by schools the amount of salary grant is credited by Education officer, Pay and Provident Fund Unit, Zilha Parishad, Latur in the bank account of the School maintained with the Latur District Central Co Operative Bank Ltd. with the instruction to make direct payment (by debiting the bank account of school in which salary grant is credited) to the bank account of respective teaching/non teaching staff.

The pay sheet as prepared and signed by respective schools heads are being submitted to Pay and Provident Fund Unit, Zilha Parishad, Latur (not to the EPF Department), After verification of pay sheets submitted by schools the same is signed by Superintendent, Pay and Provident Fund Unit, Zilha Parishad, Latur (and not the Secretary Pay and Employees Provident Fund)).

The name of department looking after the salary grants is “Pay and Provident Fund Unit” and not Provident Fund Department. It seems that the word “Pay” is remained to be observed by learned AO and has concluded that the pay sheets are submitted to EPF Department for Provident Fund purpose.

3) If assessee is claiming exemption u/s 10(23Ciabl, it was required to file return of income in ITR-7. However, the ROI for the relevant assessment year has been filed in ITR-5. When assessee was confronted, he has merely submitted a copy of condonation filed u/s 119(2)(b) before CIT(E), Pune. The outcome of the said application in silent. Further, on verification of E filing portal as on date, it is seen that no return has been filed by the assessee in ITR-7. (Para No. 6.3 of Assessment Order dt. 21.09.2022).

As a procedural matter and with the intention to rectify the genuine mistake, we ourselves have filed delay condonation application with Hon’ble Commissioner of Income Tax (Exemption), Pune.

Technical Mistake in submission of ITR:

Assessee trust is a charitable trust exclusively engaged in imparting of recognized educational courses. Moreover, the institution is substantially financed by the Government, therefore, whole of the income of the trust is exempted u/s. 10(23C) (iiiab) of the Act. Therefore, the assessee trust was required to submit its return in ITR-7. Whereas, by mistake, ITR 5 is submitted.

Your honour, in order to rectify the irregularity, assessee trust has made an application u/s. 119(2)(b) to the Hon. Commissioner of Income Tax, Exemptions, Pune and requested to grant the permission to submit ITR-7. A copy of the letter is enclosed herewith as Annexure “F”.

The assessee trust inadvertently submitted ITR-5 instead of correct ITR-7. It is a procedural technical mistake. It is pertinent to note that, as a result of this mistake neither assessee trust is benefitted nor there was any loss of revenue to the Government. It is purely a technical mistake resulted by the Tax Practitioner. He has confessed his mistake and accordingly submitted an Affidavit. A copy of the letter is enclosed herewith as Annexure “G”.

Your honour, the assessee trust pray that, on account of wrong submission of ITR, return should not be treated as invalid and nonest. A return of income submitted in ITR-7 and enclosed herewith as Annexure “H” may please be admitted and it is to be treated as valid return in the eyes of law.

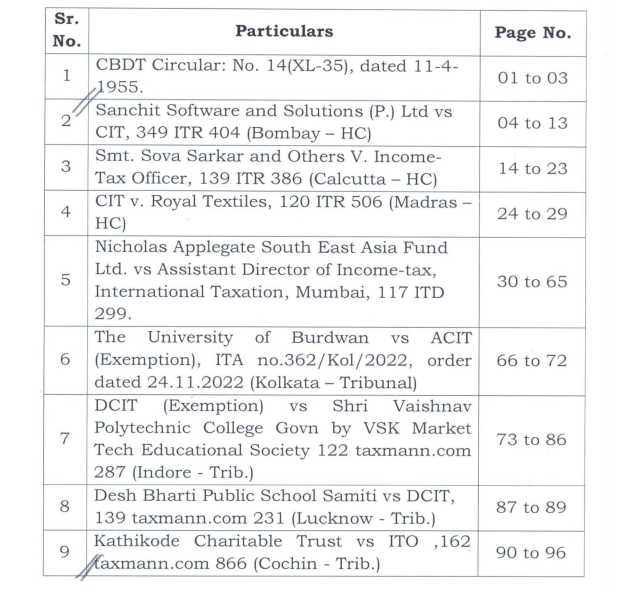

In the above context, assessee trust would like to rely on the following judicial precedents, wherein Hon. High Courts and ITAT Benches, have taken lenient views and considered the mistake of the assessee can be regularized.

| ■ | Mohindra Mohan Sirkar v. ITO [1983] 139 ITR 386 (Calcutta) |

Facts of the case are briefly enumerated here-in-below:

| (a) | In this case, the assessee had filed his returns for three assessment years within time. The assessment proceedings were initiated thereafter on the returns filed, but no assessment was, however, made. Later, the assessee was served with three notices under Section 148 of the Income-tax Act, 1961, calling upon him to file returns for the said assessment years. |

| (b) | Being aggrieved, the assessee initiated proceedings under Article 226 of the Constitution for quashing the said notices. The defense of the Revenue was that the particulars of profits and gains of business had not been submitted with the returns and that, further, one of the returns was not properly verified. Therefore, all the returns were invalid in law. |

| (c) | On the aforesaid facts, it was held by a Division Bench of this court that the returns could not be held to be invalid and non-existent. It was held further that there was a distinction between non-filing of a return and filing of an incorrect and incomplete return. |

| (d) | The Income-tax Act did not provide for rejection of an invalid return but under Section 143, a duty was cast on the Income-tax Officer to assess the total income after notice to the assessee and considering the evidence that might be produced. It was observed that there could be cases where the returns were incomplete to such an extent that they could not be regarded as returns in law, for example, where the return was not signed by the assessee at all or where a blank return was filed. But where returns had been signed and verified by the assessee and the only defect in the returns was that the particulars of the profits and gains of the business had not been stated, the returns could not be treated as invalid and non-existent. |

| (e) | writ was issued commanding the respondents not to love any effect to the impugned notices under Section 148 of the Act. |

| ■ | Nicholas Applegate South East Asia Fund Ltd. v. ADIT (2009) 117 ITD 0299 (Mum) |

“Assessee company having filed four returns in respect of its four units correctly disclosing all relevant information without causing any prejudice to Revenue, such mistake or defect stood removed by operation of s. 292B and consolidated revised return filed by assessee will relate back to the date of filing of original returns entitling assessee to claim carry forward and set off of loss as claimed in original returns and consolidated in revised return.”

In our case, the assessee trust has submitted a return of income in ITR-5, instead of ITR-7, but all the material data in ITR-5 was correct, which converted into ITR-7 subsequently and now ITR-7 is submitted.

Considering the observations of Hon. ITAT, Mumbai in the aforesaid case, your assessee requests that, irregularity may please be considered as rectified.

CIT v. Royal Textiles 120 ITR 0506 (Mad)

Brief facts of the case are as under:

| (a) | In this case, the assessee had filed its return of income in a wrong form. Subsequently, as required by the Income-tax Officer, the assessee filed the return in the correct form. |

| (b) | On the completion of the assessment, the Income-tax Officer charged interest under Section 139(1) up to the date of the filing of the original return. |

| (c) | The Commissioner of Income-tax initiated proceedings under Section 263 of the Income-tax Act, 1961, and directed the Income-tax Officer to levy interest up to the date of the filing of the return in the correct form. |

| (d) | On appeal, the Tribunal set aside the order of the Commissioner. On a reference, it was held by a Division Bench of the Madras High Court that though the assessee had used a wrong form, it did not mean that the return filed in the wrong form was nonest and that the return filed subsequently in the correct form could be treated as the only return filed by the assessee. The mistake of the assessee was innocuous and the return filed could not be treated as a mere scrap of paper resulting in penalty to the assessee. The court noted that the Income-tax Officer had accepted the original return for making a provisional assessment under Section 141 and had levied interest on the basis that the return was actually filed earlier. The court answered the reference in favour of the assessee. |

Sir, considering the aforesaid decision of the Hon. Madras High Court, your assessee trust would like to state that, the correct form of return i.e. ITR-7 may please be accepted. Since the ITR-5 submitted has been processed already u/s 143(1) by the CPC vide intimation, dt.: 29.03.2021 and CPC DIN CPC/2021/A5/159114926.

Your honour, your assessee trust would like to state that;

| (a) | The correct ITR-7 was required to be submitted, but inadvertently ITR-5 was submitted. It is only a technical or procedural mistake. |

| (b) | A return of income submitted under ITR-5 is processed and intimation u/s. 143(1) is issued on 29.03.2021 and DIN is CPC/2021/A5/159114926. |

| (c) | As a result of the said mistake, neither the assessee trust is benefitted nor there was loss of revenue to the Government. |

| (d) | All the particulars in ITR-5 have been filled in ITR-7. No new material or data is furnished in ITR-7. This shows that, there is a technical mistake in submission of ITR-5. |

| (e) | The aforesaid mistake was resulted by the tax consultant an Affidavit enclosed herewith. Sir for the mistake of an Advocate or tax consultant, the assessee trust should not be penalized. |

Considering the case laws referred above, we request before your honour to please accept the ITR-7 filled by us during assessment proceeding.

4) On verification of the E filing Portal it is seen that assessee has filed Form No. 10A on 07/ 01/2020 for A. Y. 2020-21. Filing of Form No. 10A for A.Y. 2020-21 by the assessee is contradictory to the submissions made by the assessee vide his letter dated 18/03/2022 that Since it is covered u/s 10(23)(C) (iliab) and hence It is not required to obtain Certificate of Registration u/s 12A of the Act. (Para No. 6.4 of Assessment Order dt 21.09.2022).

Your honour, we had applied for registration u/s 12AA in Form 10A on 07/01/2020 on E filing Portal but same could not be completed due to pandemic Covid 19, nationwide lock down specifically schools and colleges which remained closed for considerably longer period and other reasons. Hence, the application filed by us got rejected and trust remained to be registered u/s 12AA.

Your honour, with due respect to the authorities, the assessee would like to clarify that, there is no contradictory statement, because the assessee has applied for registration of the trust u/s. 12AA by filing Form No.: 10 is a true fact. But this does not amounts to the contrary act of section 10(23C) (iiiab) of the Act.

Even though the assessee trust has committed the mistake or omission, but the Income Tax Department is not entitled to take the benefit of such mistake. In this context, we draw your kind attention to the CBDT Circular given below:

CBDT Circular No. 14 (XL-35) dated 11/04/1955-Department must not take advantage of ignorance of assessee to collect more tax than what is legitimately due Central Board of Direct Taxes

Miscellaneous-Refund and reliefs due to assessees Departmental attitude towards

The Board have issued instructions from time to time in regard to the attitude which the Officers of the Department should adopt in dealing with assessees in matters affecting their interest and convenience. It appears that these instructions are not being uniformly followed.

| 2. | Complaints are still being received that while 110’s are prompt in making assessments likely to result into demands and in effecting their recovery, they are lethargic and indifferent in granting refunds and giving reliefs due to assessees under the Act. Dilatoriness or indifference in dealing with refund claims (either under s. 48 or due to appellate, revisional, etc., orders) must be completely avoided so that the public may feel that the Government are actually prompt and careful in the matter of collecting taxes and granting refunds and giving reliefs. |

| 3. | Officers of the Department must not take advantage of ignorance of an assessee as to his rights. It is one of their duties to assist a taxpaver in every reasonable way. particularly in the matter of claiming and securing reliefs and in this regard the Officers should take the initiative in guiding a taxpayer where proceedings or other particulars before them indicate that some refund or relief is due to him. This attitude would, in the long run. benefit the Department for it would inspire confidence in him that he may be sure of getting a square deal from the Department. Although, therefore, the responsibility for claiming refunds and reliefs rests with assessees on whom it is imposed by law, officers should- |

| (a) | draw their attention to any refunds or reliefs to which they appear to be clearly entitled but which they have omitted to claun for some reason or other; |

| (b) | freely advise them when approached by them as to their rights and liabilities and as to the procedure to be adopted for claiming refunds and reliefs. |

| 4. | Public Relations Officers have been appointed at important centres, but by the very nature of their duties, their field of activity is bound to be limited. Thus, from the above CBDT Directives, your honour, we request you, any mistake in submission of form or failure to obtain the registration etc., will not change the original constitution and character of the assessee trust. Basically, it is a trust, which has been substantially financed by the Government, therefore, there are no conditions for obtaining registration etc., and submission of Form No.: 10A etc., Therefore, your assessee requests that, the exemption claimed u/s. 10(23C)(iiiab) may please be allowed. |

| 5) | In view of the above facts, the claim of the assessee that Trust is covered u/s 10(23C)(ab) and hence the total income is exempted from tax is not acceptable. It is proved that assessee s case is not covered u/s 10(23C)(iiiab). Assessee has applied for registration u/s 12A by submitting for No.10A (as evident from efiling portal). However, it appears that the same has not been granted to the assessee since no related documents have been putforth by the assessee during the course of assessment proceedings. (Para No. 6.5 of Assessment Order dt. 21.09.2022). |

Your honour, the basic requirement for availing the benefit of exemption u/s. 10(23C)(iiiab) are as under:

It must be a trust.

| ■ | The trust should have carried out, the object of education etc., |

The trust must have received more than 51% of its collection from the Government in the form of grant.

Accordingly, our trust has satisfied all the conditions stated here-in-above. Your honour, the trust has 99.66% of its collection is from the Government Grant, which is obvious from the audited statements of accounts i.e. Income and Expenditure Account. We put before you, grant received by each section of the trust is as under:

| Name of Unit / School | Grant for payment of salary by the Education Department | Grant for payment of arrears of salary by the Education Department | Total Grant received |

| Dnyaneshwar Vidyalaya Kopra | 88,18,568 | 3,49,173 | 91,67,741 |

| Abdul Hamid Urdu Prathmik Ahmedpur | 62,23,614 | 5,36,528 | 67,60,142 |

| Keshavrao Patil Vidyalaya Bothi | 98,22,346 | 1,22,207 | 99,44,553 |

| Mahatma Phule Prathmik Keshavrao Patil Vidyalaya Bothi Andhori | 32,58,697 | 28,325 | 32,87,022 |

| Sant Sadghuru Prathmik Ujana | 29,11,560 | 37,321 | 29,48,881 |

| Sant Sadghuru Vidyalaya Ujana | 1,04,13,812 | 1,55,520 | 1,05,69,332 |

| Rokdoba Vidyalaya Takalgaon | 68,93,372 | 72,581 | 69,65,953 |

| Balkjrushna Vidyalaya Ujalamb Chatrapati Shahu Vidyalaya Nitur | 60,27,896 | 3,91,738 | 64,19,634 |

| Chatrapati Shahu Vidyalaya | 1,01,18,510 | 5,13,767 | 1,06,32,277 |

| TOTAL RS. | 6,44,88,375 | 22,07,160 | 6,66,95,535 |

Thus, during the Fin. Yr.: 2019-20, the total grant received from the Government was Rs. 6,66,95,535. The grant received is already proved by submission of sanction letters and certificates of the Education Department.

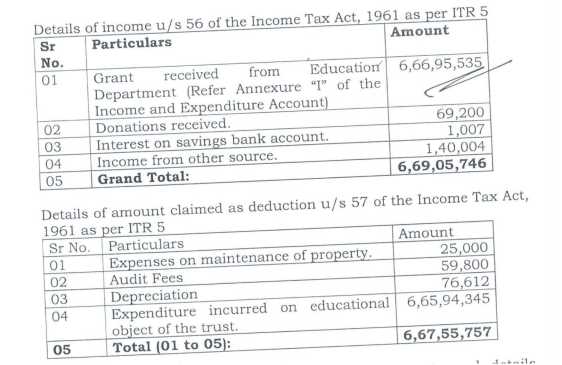

Kindly note that, the credit side of the Income and Expenditure Account for the year ended 31.03.2020 shows credit Rs. 6,69,05,746, which includes grant received from Government Rs. 6,66,95,535, which works out to 99.68% of the total collection. The break up of the same is as under:

| Sr. No. | Particulars of Credit to the Inc. & Exp. Acc. | Amount of Credit |

| 1 | 2 | 3 |

| 01 | State Department of received from Grant Government Education for the purpose of payment of salary to the teaching and non teaching staff | 6,66,95,535 |

| 02 | Donations received | 69,200 |

| 03 | Interest from bank | 1,007 |

| 04 | Sundry Collection | 1,40,004 |

| Total (01 to 04): | 6,69,05,746 |

We have also submitted the Income and Expenditure Account of all the sections, wherein the aforesaid grant is credited and certified by a Chartered Accountant as a Trust Auditor. Therefore, it is beyond doubt that, the institution is clearly covered by the provisions of sec. 10(23C) (iiiab) of the Act.

Considering the facts and circumstances of the case we humbly pray before your honour to please accept our claim of exemption u/s 10(23C)(iiab) and delete the variance/addition of Rs 6,69,44,047/-made by learned AO.

6) Thus in view of the above and on perusal of the details submitted, it can be construed that expenses which are not expended wholly and exclusively for the purpose of making or earning such income which qualifies as income from other sources u/s 56 is liable to be disallowed. Accordingly, the deduction of Rs.6,69,44,047/-claimed u/s 57 of the Act disallowed and added to the total income. Since the assessee has made wrong claim of deduction and thereby underreported his income to that extent, therefore penalty u/s 270A(2) is separately initiated.. (Para No. 6.6 of Assessment Order dt. 21.09.2022)

Sir, on the aforesaid issue, the assessee trust respectfully states as under:

In order to claim the expenditure u/s. 57(iii), assessee must satisfy the following conditions.

| (a) | It should not be a capital expenditure, |

| (b) | Expenditure incurred should be wholly and exclusively for its earnings or making profit, |

| (c) | It should not be a personal expenses of the assessee, |

| (d) | It must be laid out or expended in the relevant previous year and not in any prior or subsequent years. |

On examining the provisions of sec. 57(iii) as enumerated above, the assessee trust has fully complied the conditions prescribed u/s. 57(iii) of the Act.

Your honour, on examining the financial statements and details submitted herewith, it is obvious that, it is not a capital expenditure, because, the Government Grant, which was received specifically for payment of salary has been used for the same purpose. As a result, it is beyond doubt that, payment of salary, which works out to Rs. 6,44,88,372 Le. 96% of the total expenditure. The remaining expenditures, which are incidental to the object. The brief details of the amounts expended during the Fin. Yr.: 2019-2020.

| Sr. No. | Particulars | Amount |

| 1 | 2 | 3 |

| 01 | Payment salaries of the to teaching and non teaching staff of ten institutions. | 6,44,88,372 |

| 02 | Audit Fees | 59,800 |

| 03 | Depreciation on assets | 76,614 |

| 04 | Expenditure other on purposes, but incidental to the main purpose, such as building rent etc., | 23,19,261 |

| 05 | Total (01 to 04): | 6,69,44,047 |

Your honour, from the aforesaid details, it is very clear that, none of the aforesaid expenditure is “capital expenditure”, “personal expenses of the assessee trust”. Moreover, it is beyond doubt that, the entire expenditure is incurred wholly and exclusively for the purpose for which the income or earnings were made. Further, whole of the expenditure is incurred in the Fin. Yr.: 2019-20 relevant to the asst. year: 2020-21. Hence, the assessee trust would like to state that, the said expenditure is neither prior period or after period expenditure. In short, the assessee trust has fully satisfied the conditions lay down u/s. 57(iii) of the Act.

Your honour, for second issue that, there is no nexus between the income and earnings as observed by learned AO in Para No.: 4 and 5 of Assessment Order, the assessee trust would like to state that, the observation made by learned AO is vague without any material basis on the record. Because, the assessee trust would like to state that, during the Fin. Yr.: 2019-20, the assessee trust received grant from the Government, specifically for payment of salary and other recurring expenses amounted to Rs. 6,66,95,535, out of which salaries paid to the teaching and non teaching staff amounted to Rs. 6,44,88,372, which works out to 96% of the total expenditure. The system followed for payment of salary grant and its utilization specifically for payment of teaching and non-teaching staff as per the Education Department of the State Government (i.e. Pay Unit of Education Department)

| (a) | Every month, the school / high school shall prepare the pay sheet of all the teaching and non teaching staff providing details such as name of the staff member, his basic pay, all other allowances and deductions therefrom. |

| (b) | After verification of such pay sheet by pay unit of the Education Department, salary grant will be directly credited to the account of institution by online banking system. |

| (c) | The pay sheet, which is sanctioned by the Education Department, will be submitted to the bank and the bank shall transfer the net amount payable to each teaching and non teaching staff to their savings account on the same day. |

Your honour, it is obvious that, there is a direct nexus of income and expenditure specifically relatable to salary grant and salary expenditure.

In support of this claim, the assessee trust is submitting following documents.

| (a) | A copy of the pay sheet submitted to pay unit of Education Department and verified and sanctioned by the said Government Department. (As a sample for the month of April 2019 is enclosed as Annexure “I”. |

| (b) | A copy of sanction of grant by the pay unit (Refer Annexure “J”. |

| (c) | A copy of the passbook, from which the salary grant received is transferred to the teaching and non teaching staff. (Refer Annexure “K”) |

Your honour, the aforesaid documents proves that, there is a direct nexus of income as well as expenditure, without leaving any scope for doubt.

Sir, in the above context, we draw your kind attention to the following judicial precedents:

| ■ | Eastern Investment Ltd., v. CIT (1951) 20 ITR 0001 (SC) |

Relevant Para No.: 9 and 10 are reproduced below:

. On a full review of the facts it is clear that this transaction was voluntarily entered into in order indirectly to facilitate the carrying on of the business of the company and was made on the ground of commercial expediency. It therefore falls within the purview of s. 12(2) of the IT Act, 1922, before its amendment.

. This being an investment company, if it borrowed money and utilised the same for its investments on which it earned income, the interest paid by it on the loans will clearly be a permissible deduction under s. 12(2) of the IT Act.

. Whether the loan is taken on an overdraft, or is a fixed deposit or on a debenture makes no difference in law. The only argument urged against allowing this deduction to be made is that the person who took the debentures was the party who sold the ordinary shares. It cannot be disputed that if the debentures were held be a third party, the interest payable on the same would be an allowable deduction in calculating the total income of the assessee company. What difference does it make if the holder of the debentures is a shareholder ? There appears to be none in principle in view of the fact that no suggestion of fraud is made in respect of the transaction which is carried out between the company and the administrator and which has been sanctioned by the Court. If the debentures had been paid for in cash by the same party, no objection could have been taken to allowing the interest amount to be deducted. In principle, there appears to us no difference, if instead of paying in cash the payment of the price is in the shape of giving over shares of the company, when the transaction is not challenged on the ground of fraud and is approved by the Court in the reorganisation of the capital of the company. In our opinion, therefore, the ground on which the Tribunal and the High Court disallowed the claim of the assessee is not sound.

10. In our opinion, the High Court has failed to appreciate the true position and the question submitted for its opinion should be answered in the affirmative. The appeal therefore allowed. in The respondent will pay the costs of the appeal in this Court and of the reference in the High Court.

Following the aforesaid principles of Hon. Supreme Court in the case of Eastern Investment Ltd., your assessee would like to state that, the assessee trust has gross receipts (including Government Grant), Rs. 6,69,05,746, only for the purpose of imparting of education and accordingly, the assessee trust has incurred expenditure on imparting of education is Rs. 6,67,55,757 and there was surplus of Rs. 1,49,989. Hence, as per the observations of the Hon. Supreme Court, assessee is entitled to an expenditure u/s. 57(iii) to the extent of Rs. 6,69,44,047. Because there is a direct nexus and expenditure incurred was wholly and exclusively for the purpose of its main moto.

CIT v. Rajendra Prasad Moody 1978) 115 ITR 0519 (SC)

In this case, company had made investment in the shares by raising the funds on which interest was paid. But investment in the shares did not yield in the form of dividend. The question arose is that, as per section 57(iii) of the Act, such expenditure is allowable, even though investment yields NIL income. The principles laid down by the Hon. Supreme Court are as under:

| ❖ | By virtue of the provisions of sec. 57(iii), there must be a purpose for making investment. |

| ❖ | Section 57(iii) does not require this purpose must be fulfilled in order to qualify the expenditure for deduction. |

| ❖ | It does not say that, expenditure shall be deductible only, if any income is made or earned. There is in fact nothing in the language u/s. 57(iii) to suggest that, the purpose for which the expenditure is made should fructify (make fruitful or productive) into any benefit by way of return in the shape of income. |

| ❖ | Based on the aforesaid principles, it was decided by the Hon. Supreme Court that, interest paid on money borrowed for investment in shares is deductible under s. 57 (iii) even though the shares did not yield any dividend. |

Sir, on the basis of the aforesaid principles of Hon. Supreme Court in the case of Rajendra Prasad Moody, the assessee trust would like to state that, it has earned income by way of Government Grant and other source and also incurred the expenditure for the purpose for which income was earned. Therefore, whole of the expenditure incurred is allowable deduction u/s. 57(iii) of the Act.

| “1. | The learned CIT (Appeals), NFAC, Delhi erred in law and on facts in confirming the additions made by the A.O. U/Sec. 143(3) r.w.s. 144B of the Income Tax Act, 1961. |

| 2. | The learned CIT (Appeals), NFAC, Delhi has erred in not appreciating the contention of the Appellant that Appellant is eligible for exemption u/s 10(23C)(iiiab) of the Act and confirming the addition of Rs. 6,69,44,047/- made by the AO by disallowing the deduction claimed u/sec. 57 of the Act by the Appellant, on the ground that Appellant has failed to file the Return of Income in correct form without any valid reason and the gross receipts of the Appellant are exceeding five crores. |

| 3. | The learned CIT (Appeals), NFAC, Delhi has failed to appreciate the submissions made by the Appellant claiming the Appellant Trust is covered u/sec. 10(23C) (iiiab) of Income Tax Act, 1961 disregarding the submissions and evidences furnished by the Appellant. |

| 4. | While confirming the action of the AO, the learned CIT (Appeals), NFAC, Delhi has failed to appreciate that: |

| a. | The Appellant Trust has incorrectly filed the Return of Income in ITR Form No. 5 instead of ITR Form No. 7 due to mistake of the consultant. |

| b. | The Appellant Trust is substantially financed by the Government. |

| 5. | The learned CIT (Appeals), NFAC, Delhi has erred in confirming the action of the AO of not appreciating the contention of the Appellant for allowing the expenditure amounting to Rs.6,69,44,047/- u/sec. 57 of the Act on the ground that Appellant failed to demonstrate its claim with proper supporting evidences disregarding the submissions made by the Appellant Trust. |

| 6. | The appellant craves leave to add, alter, amend or delete any of the above grounds of appeal.” |