ORDER

Prashant Maharishi, Vice President.- M/s Adarsh Developers (assessee) and The Deputy Commissioner of Income tax CIT, CC 1(2), Bangalore [The ld. AO] has preferred cross appeal against the appellate order passed by the Commissioner of Income Tax (Appeals)-15, Bangalore [ld. CIT(A)] dated 30.3.2024 for AY 2020-21 wherein the appeal filed by the Assessee against the assessment order passed by the ld AO was partly allowed. Both the parties are aggrieved and are in appeal before us.

2. At the time of hearing, the ld. AR submits that in appeal of the assessee in ITA No.1082/Bang/2024 dispute has been settled under Vivad Se Vishwas Scheme, 2024 (VSVS) and Form 4 has also been issued on 25.1.2025 and therefore the appeal does not survive.

3. On examination of the above Form, it is correct that the dispute in appeal filed by the assessee has been settled and therefore ITA No.1082/Bang/2024 is dismissed as withdrawn.

4. Now only appeal in ITA No.1160/Bang/2024 filed by the ld. AO survives, wherein the appeal filed by the assessee against the assessment order passed by the AO u/s. 143(3) of the Act dated 20.9.2022 was partly allowed.

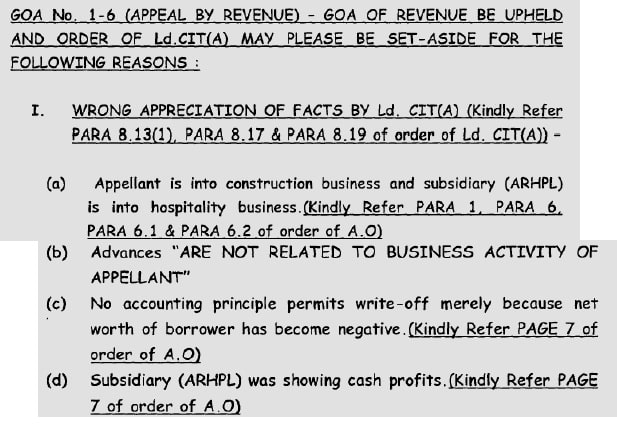

5. The grievance of the ld. AO is as per the following grounds of appeal:-

“1. Based on the facts and circumstances of the case, the learned CIT(A) was not correct in deleting the addition made by the AO

2. The CIT (A) erred in deleting the addition made on account of write off of Sundry Advances given to M/s Adarsh Reality and Hotels P Ltd (ARHPL) without appreciating the fact that the advances had not become bad as the advances was being regularly repaid by ARHPL and the outstanding was reducing year on year.

3. The CIT(A) erred in deleting the addition made on account of write off of Sundry Advances U/s 37 when the advances made related to capital advances given on account of transfer of land and licences to ARHPL by the assessee.

4. The CIT(A) erred in deleting the addition made on account of write off of sundry advances U/s 37 just on the ground that the advances were written off in the books of account which applicable only to trade receivables written off under section 36

5. The CIT(A) erred in deleting the addition made on account of write off of sundry advances on the ground that the amount written off is offered to tax by M/s ARHPL, when the same could/ not be offered to tax as per provisions of section 28 by M/s ARHPL

6. The brief facts of the case show that assessee is a partnership firm, engaged in the business of construction, filed its return of income on 15.2.2021 declaring total income of NIL. This return was processed u/s. 143(1) at Rs.11,54,94,482. Subsequently return was picked up for scrutiny for 6 reasons and notice u/s. 143(2) was issued on 29.6.2021. The assessment proceedings were concluded by passing the assessment order u/s. 143(3) of the Act on 20.9.2022 wherein the total income of the assessee was assessed at Rs. 489,90,33,206. Many additions/ disallowances were made by the ld. AO, however only dispute before us is concerning allowability of deduction on account of the write off of advances of Rs. 468,80,84,462. There were certain other additions/disallowances made to the total income of assessee, but same were not challenged by either party before us, therefore those matters are concluded.

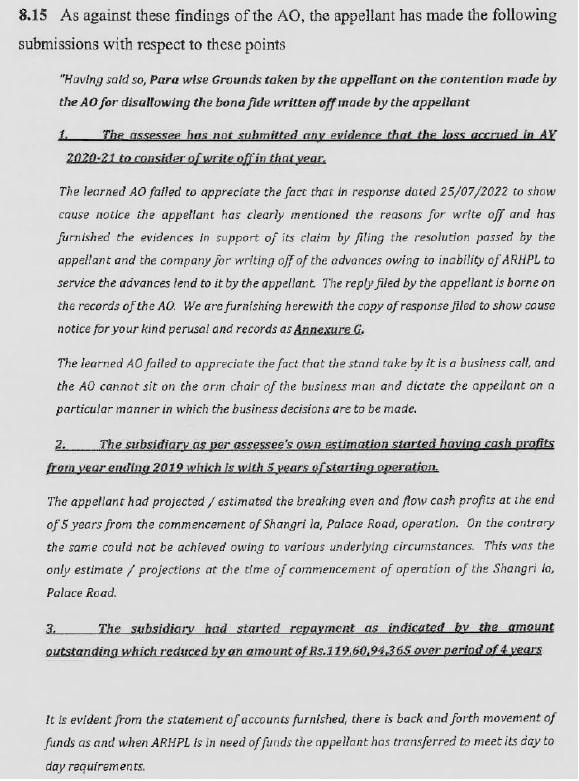

7. Therefore, the facts relating to addition/disallowance of Rs. 468,80,84,462 is culled out from the assessment order. The facts show that as per Profit & Loss account the assessee has claimed the above amount as sundry advances written off being amount given to one associate concern namely Adarsh Realty & Hotels P. Ltd. (ARHPL). The ld. AO issued a show cause notice to the assessee stating that the above sum is proposed to be disallowed as it does not satisfy condition u/s. 36 (2) and not allowable u/s. 37 also, that the above loss is incurred during the year to the assessee. The AO noted that write off amount is in respect of investment made by the assessee in another company which is subsidiary [(sic) associate concern/ Special Purpose vehicle] of the assessee and same are written off. The AO further verified the ledger account of Adarsh Realty & Hotels P. Ltd. (ARHPL) and found that the amount outstanding as on 31.3.2020 is less than the amount outstanding as on 31.3.2019 and further the amount outstanding as on 31.3.2021 is also lower than the amount outstanding as on 31.3.2020. Therefore, according to the AO, there is no basis for write off as part of the advances is duly recovered during the current year and next financial years. The AO further noted that the assessee has further advanced the amounts to the company even after write off of advances during the year clearly indicating that assessee expects the that company to do well and repay the amount.

8. The assessee answered the query stating that the above advances are given to ARHPL for expansion of the business of the assessee and same were written off and claimed as deduction u/s. 37 as that company could not do the business profitably. It was stated that the subsidiary was funded with share capital of Rs.15 crores and loan of Rs.746 crores to set up for creating infrastructure in hotels and tied up with reputed brand of hotels to enhance the business. Being a new entity and on account of intense competition the business could not run successfully and subsidiary could not even break even resulting into continuous losses eroding its net worth which became negative on 31.3.2019. There were huge commitments to the financial institutions of Rs. 385 crores as on 31.3.2020, whereas net worth of the subsidiary company was negative of Rs. 375 crores. Therefore, the assessee has written off the loans & advances to the tune of Rs.465 crores as not recoverable as the advances given by the assessee is wholly and exclusively incidental to the business of the assessee. The assessee further submitted that when the loan itself is justified on the grounds of commercial expediency, even write off of such loan is incidental to the business. The assessee further relied upon several judicial precedents.

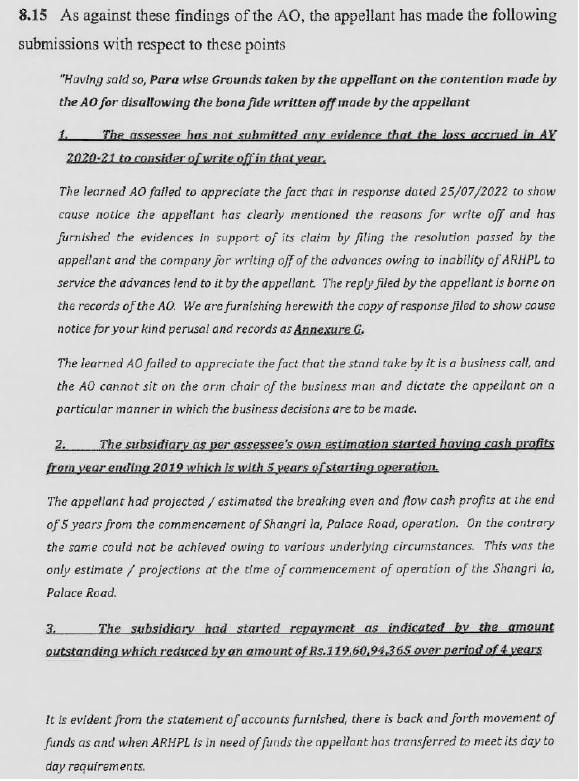

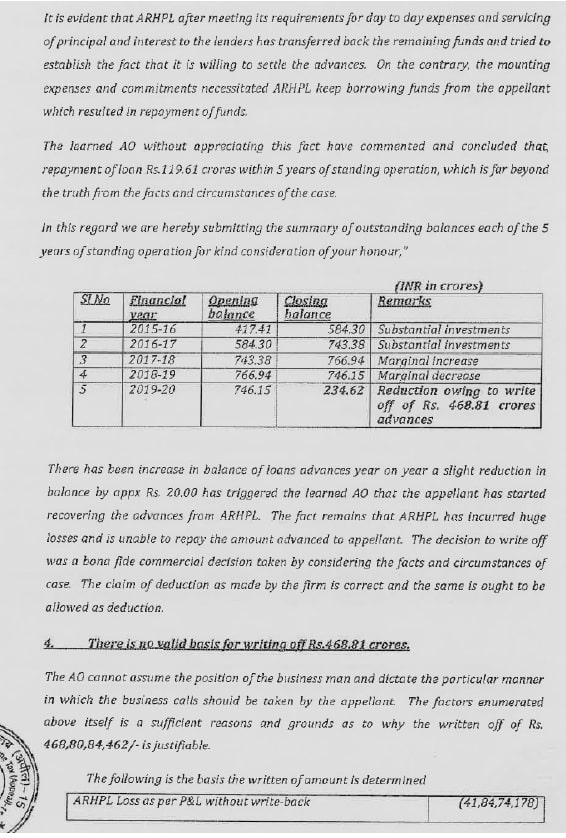

9. The ld. AO rejected the contention of the assessee stating that the amount written off was investment in shares. Further some of the judicial precedents where it a is allowed as bad debts, in those cases assessee offered interest on loan given as income, hence the bad debt was allowed u/s. 36 and therefore such judicial precedents are not applicable to the facts of the case. The AO further held that to improve the net worth of the subsidiary, the assessee could have converted the loan given to equity to improve the net worth of the subsidiary company. The ld. AO further noted that the loan could be said to be not recoverable only when the lender is not in a position to recover the amount. But in this case, the write off is not correct because the amount of advance is actually reduced from year to year. On page 11 of the assessment order, the ld. AO tabulated the amount outstanding for each of the year to show that the amount is reducing every year. The AO was of the view that the write off of the loan in the current year and bad debt has also not accrued during the year.

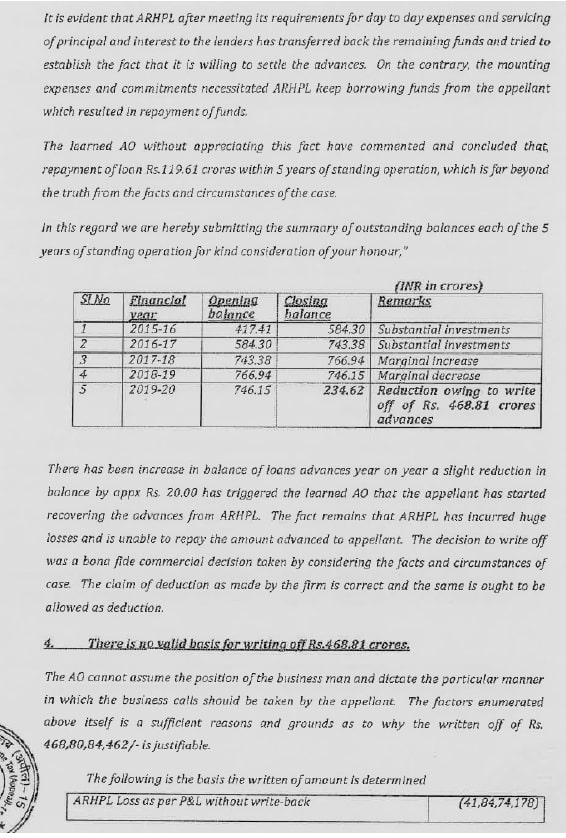

10. The ld. AO further noted a point that during this AY, the assessee has earned profit on sale of land which would be chargeable to tax and would result into payment of taxes and therefore the entire transaction of write off was a colourable device to avoid the payment of tax. The ld. AO relied upon the decision of coordinate Bench in the case of VST Industries v. ACIT in ITA No.691/Hyd/2005 wherein the coordinate Bench relied upon the decision of Supreme Court and held that advances given to subsidiary cannot be allowed u/s. 36 or 37 of the Act. The ld. AO further rejected the contention of the assessee that part write off is possible. Thus, the ld. AO did not allow the above claim of Rs. 468,80,84,462 for the following 5 reasons: –

| i. | | The assessee has not submitted any evidence that the loans accrued in AY 2020-21 to consider write off in that year. |

| ii. | | The subsidiary started having cash profit from the year ending 2019 which is within 5 years of starting of operation. |

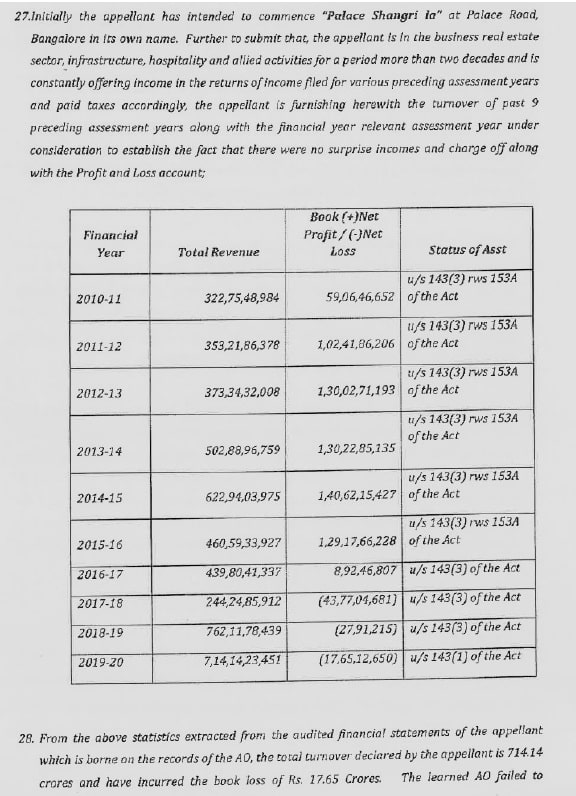

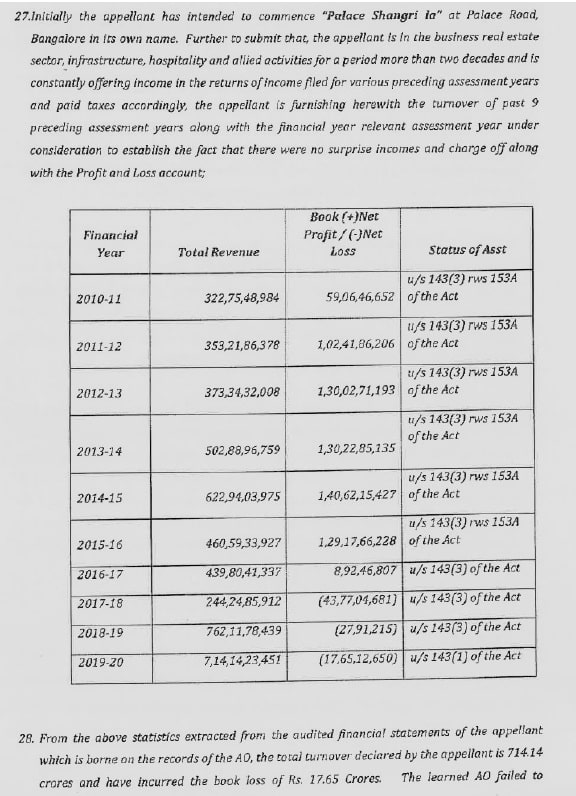

| iii. | | The subsidiary has started repayment which reduces the outstanding liability by Rs. 119.61 crores over a period of 4 years. |

| iv. | | There is no valid basis for writing of Rs.468.81crores. |

| v. | | The only reason for write off in FY 2019-20 is to avoid payment of tax as the assessee has received certain unexpected receipts in FY 2019-20. |

11. The assessee aggrieved with the same challenged this issue before the ld. CIT(Appeals) which has been dealt in as per ground no.6 in para no.8 of the appellate order. The ld. CIT(A) allowed the claim of the assessee as under:-

12. The ld. AO aggrieved with the above order is in appeal before us. Ground No.1 is general in nature. As per ground no.2, the AO contends that the advance given to the subsidiary having not become bad as subsidiary was mainly repaying and the outstanding was reducing year on year. As per ground 3, the allowance u/s. 37 is challenged while stating that these are capital advances and therefore given on account of transfer of land and licences to subsidiary by the assessee. Ground 4 challenges the allowance u/s 37 for the reason that advances were written off in the books of account, such condition applies only to section 36. Ground 5 challenges that merely because subsidiary has offered the amount as income, that amount written off and claimed by the assessee, could not be a ground to allow the claim in the hands of assessee.

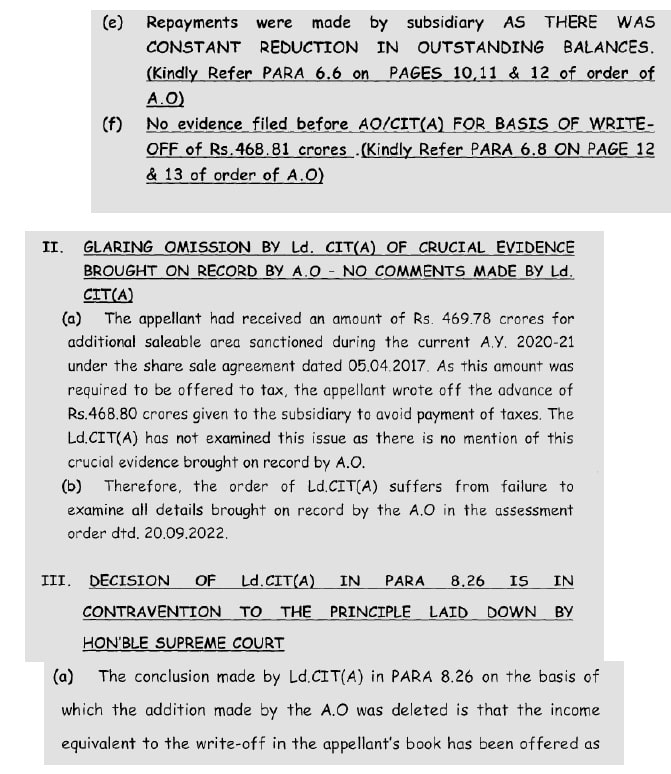

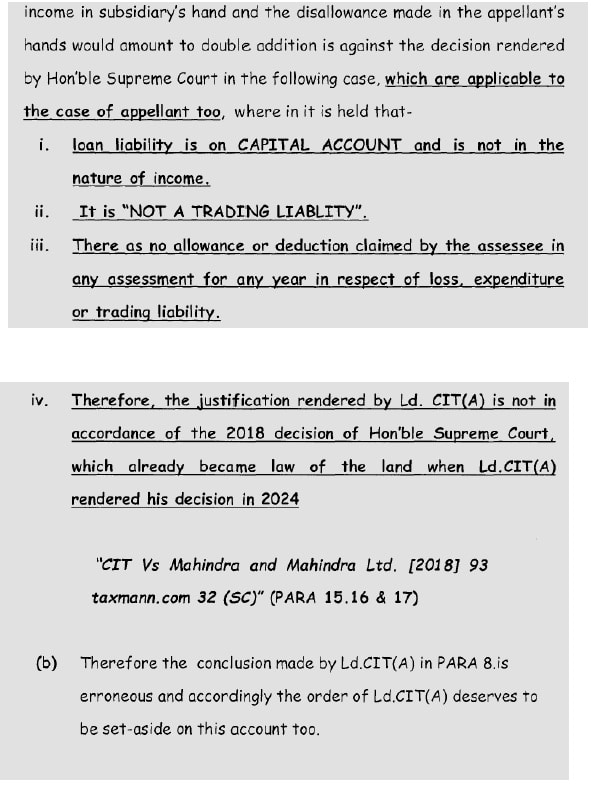

13. The ld. CIT(DR) vehemently supported the order of the ld. AO and submitted a brief synopsis dated 04.12.2024 as under:-

14. In her written submissions, the ld. CIT(DR) relied upon the decision of Hon’ble Supreme Court, specifically on para 15 to 17 of the decision in the case of CIT v. Mahindra & Mahindra Ltd. Mainly the contention is that there is a difference between trading liability and other liabilities and same corollary to be drawn for loan given on a capital account and on a trading account. Thus, the claim of the ld. CIT(DR) is that the ld. CIT(A) deleted the disallowance by wrong appreciation of facts and glaring omission of the ld. CIT(A) in ignoring the crucial evidence brought on record by the ld. AO for the reason that assessee was to pay tax on income and therefore to reduce that particular income, this amount is written off and shown as allowable claim so as to reduce payment of taxes. Therefore she supported the order of the ld. AO and submitted that the disallowance deleted by the ld. CIT(Appeals) is incorrect.

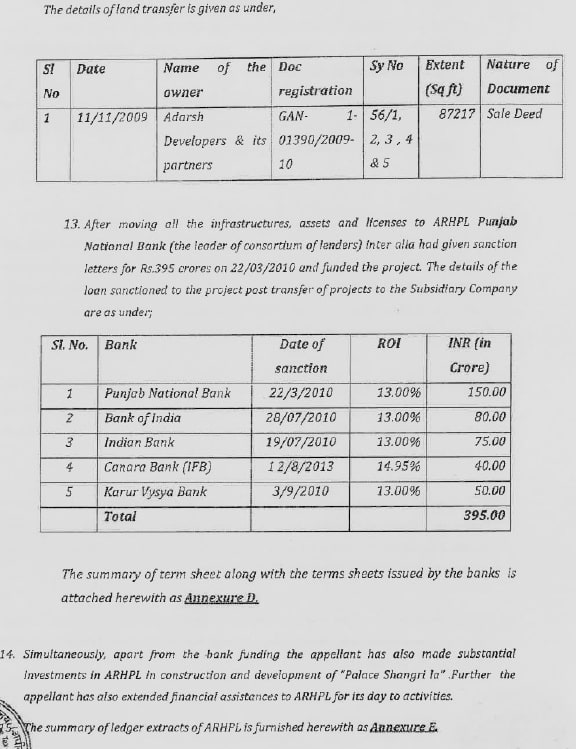

15. The ld. AR assailing the order of the ld. AO and supporting the appellate order of the ld. CIT(A) filed a paperbook containing 753 pages along with written synopsis and event chart. The ld. AR also referred to several judicial precedents in caselaw paperbook compilation of 574 pages. First referring to list of dates & events chart, the ld. AR submitted that on 1.4.1989 the assessee firm was converted from proprietary concern to partnership form. On 26.8.1996 assessee acquired various land parcels to construct an infrastructure hotel project. Subsequently various approvals were also obtained by the assessee for setting up the hotel. It also entered into agreements with another company for management and setting of hotel project. On 11.11.2009, assessee transferred hospitality business to AHPRL. In 2010 Consortium of Banks lent Rs.395 crores to AHPRL. The assessee also contributed Rs.150 crores towards share capital and also advances given to that company of Rs.468.80 crores. The partners of the assessee firm written off the above amount on 16.3.2020 by passing the resolution and therefore on the above events, the amount was written off by the assessee. The ld. AR referred to the written submissions containing 66 pages to support his contention.

16. The ld. AR firstly submitted that ground nos. 3 & 5 should not be admitted for the reason that by raising these grounds, the appellant is trying to improve the case of the ld. AO which is not permitted. He submitted that grounds 3 & 5 are referring to capital advance and allowing the claim of assessee for the reason that amount is offered by the subsidiary as income in its hands. It was the claim of the ld. AR that the AO disallowed the claim u/s. 37 for the reasons mentioned in page 13 of the assessment order and those reasons are not discussed at all which are raised in ground nos. 3 & 5. He submits that there is an attempt by the AO to improve upon the case of the AO. He referred to the decision of M/s. Balaji Trust in ITA No.5139/Mum/2017 dated 25.11.2021 to support his case. Thus he submits that grounds of appeal nos. 3 & 5 should be dismissed as not maintainable.

17. With respect to other grounds, he submits that the claim of assessee is allowable u/s. 37(1). He submits that the business of the assessee is conducted by a subsidiary company by advancing funds to that company. It represents extension of assessee’s business and therefore business of the assessee and business of the subsidiary has a close nexus and proximity. He further submits that business of the assessee and subsidiary had the commercial sense of continuous cash flow, appreciation in asset value and diversification of business. He submits that despite having several advantages it resulted into continuous losses resulting in erosion of net wealth of the subsidiary company. The assessee continued to lend the fund to the subsidiary and also stood as guarantor for the bank funds and loans to the subsidiary. He referred to the annual accounts of the subsidiary to show that as on 1.4.2019 the negative net worth of subsidiary company was Rs.375.67 crores and therefore a sum of Rs.468.80 crores being portion of the existing advances was written off, thus has made the negative net worth of the subsidiary into a positive net worth of Rs.52.91 crores. Had this not been done, the subsidiary could be taken to liquidation by the lender, also would have resulted in to the invocation of the guarantee of the assessee. He submitted that assessee has established the write off of the advances given to the subsidiary was in the normal course of business, out of commercial expediency and was incurred wholly and exclusively for the purpose of the business and therefore the claim of the assessee is allowable u/s. 37(1) of the Act.

18. He also submitted that the allegation of the AO that write off of the advances to subsidiary was made with an intention to avoid payment of taxes by the assessee on account of gain is unfounded. He tabulated the total Profit & Loss account for the last 10 years and submitted that there is no unexpected income or charge earned by the assessee. He submitted that income derived from transaction of share purchase agreement dated 5.4.2017 was already offered by the assessee as income in FY 2018-19 and 2019-20 and therefore did not have any impact in AY 2020-21 at all.

19. He further submitted that if the above business of hospitality was carried out by the assessee in its own name and not through the wholly owned Special Purpose Vehicle of the subsidiary company, such loss would have been recorded in the books of assessee and could be allowable for set off against other income. Therefore write off of the advances is a revenue neutral transaction which the ld. AO failed to appreciate.

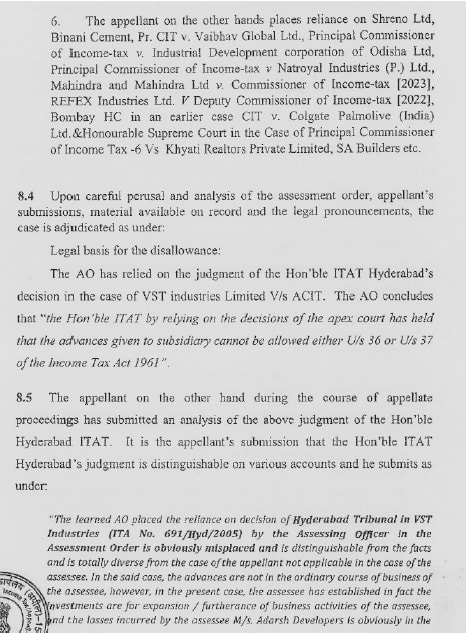

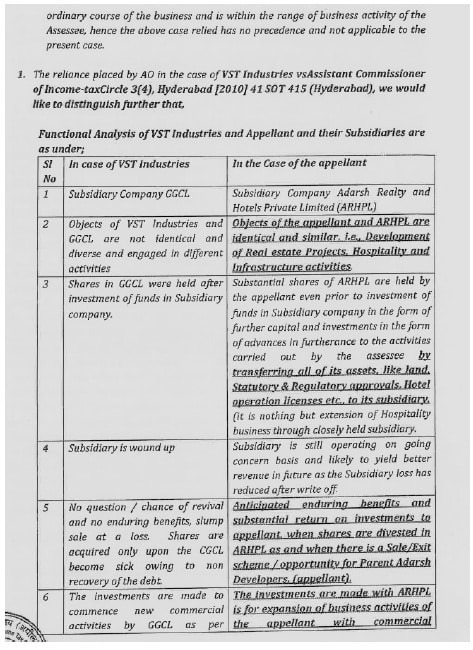

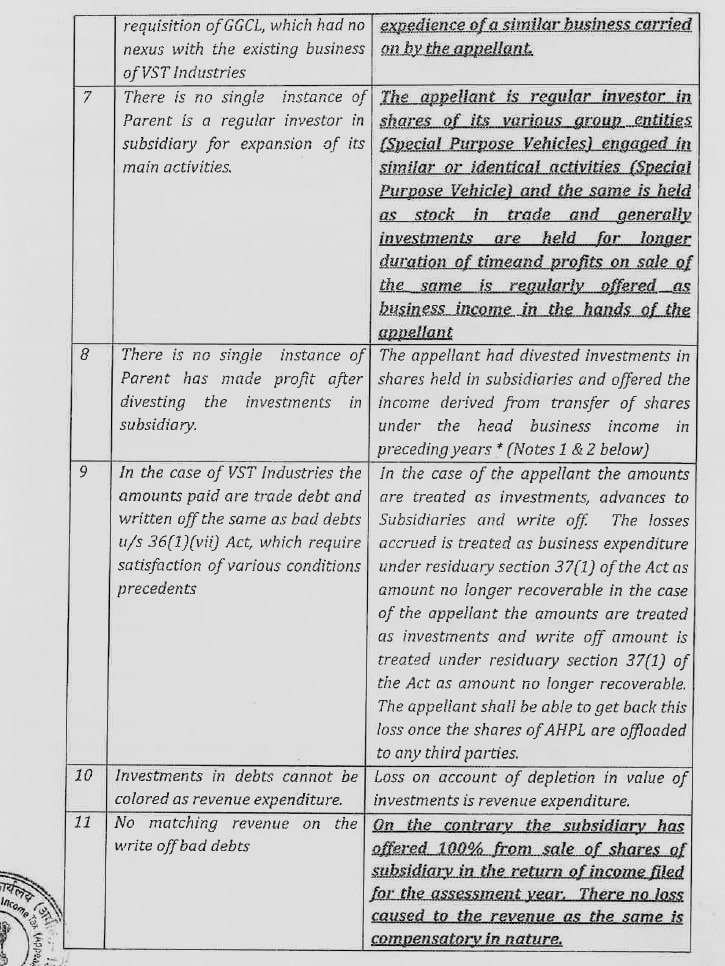

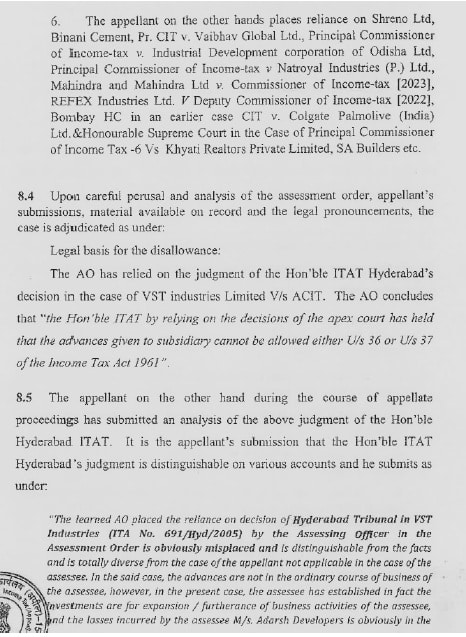

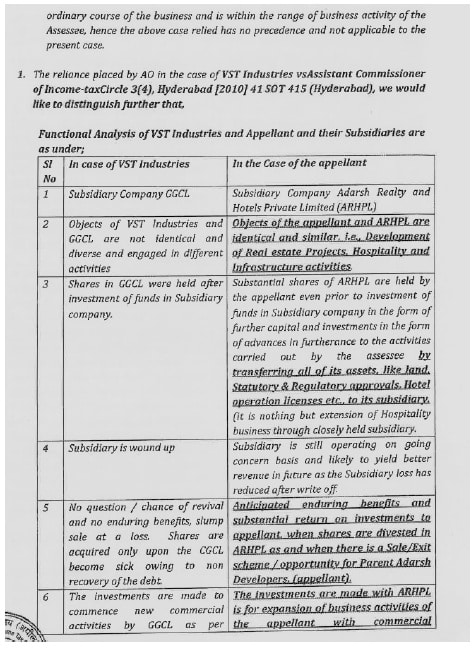

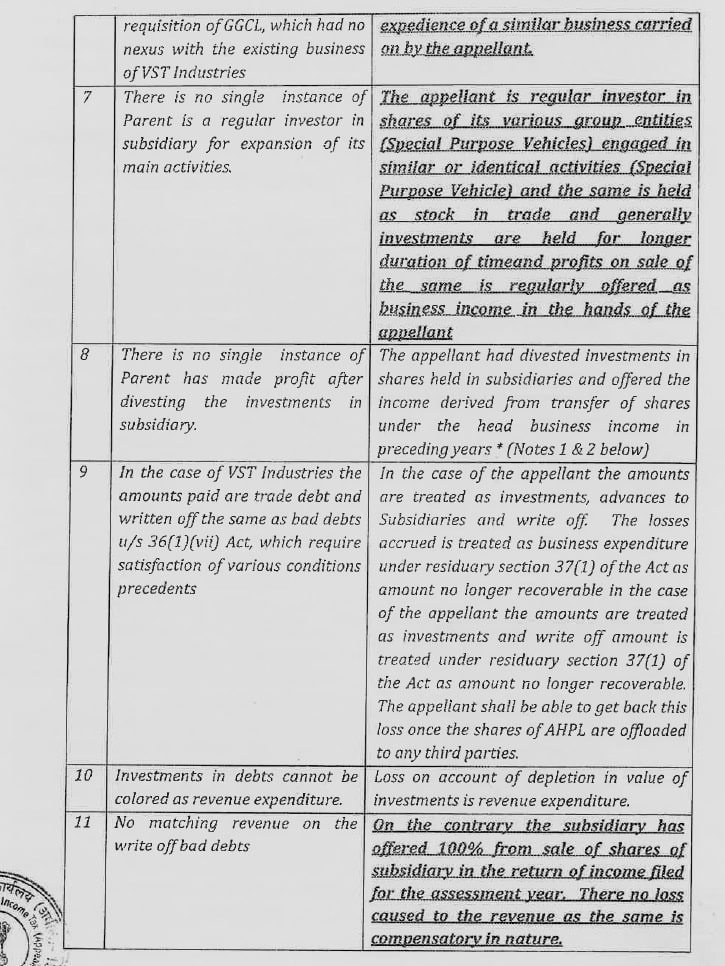

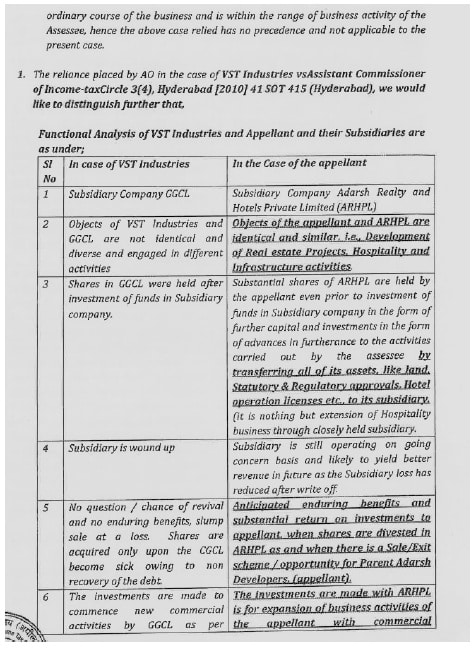

20. He submitted that the decision relied upon by the ld. AO in the case of Hyderabad Bench of the Tribunal is on different facts and he tabulated 10 reasons to submit that the decision in that case was on different facts and therefore does not apply.

21. The ld. AR specifically referred to the decision of the Hon’ble Rajasthan High Court in the case of Vaibhav Global Ltd.,wherein on identical facts and circumstances, deduction was allowed. He further submitted that the revenue’s SLP against that decision has been dismissed by the Hon’ble Supreme Court. He further referred to the decision of Binani Cements Ltd. of Hon’ble Calcutta High Court reported in [2016] 380 ITR 116 (Calcutta) and Industrial Development Corporation of Orissa Ltd.He further relied on several other judicial precedents.

22. In the end, he submitted that the issue is also covered by the decision of Hon’ble Karnataka High Court in the case of Ace Designers Ltd.(Karnataka) wherein relying upon the decision of Hon’ble Bombay High Court in the case of Colgate Palmolive Ltd write off of the investments in subsidiary was allowed as business losses.

23. Accordingly he submitted that there is no infirmity in the order of the ld. CIT(Appeals) in allowing the claim of assessee u/s. 37(1) of the Act. Thus he submitted that appeal of the revenue deserves to be dismissed on this ground.

24. The ld. CIT DR in rejoinder reiterated and relied upon her written submission and reasons given by the ld. AO in assessment order.

25. We have carefully considered the rival contentions and perused the orders of the lower authorities with respect to claim of allowability of amount written off by assessee in part with respect to advances given to Adarsh Realty and Hospitality private Limited of Rs 468 Crores.

26. Briefly stated the facts of the case shows that assessee is a partnership, carrying on the business of property development, builders, contractors and subcontractors for construction, designing and in the commission thereof, business of property development members contractors for construction designing investment in special purpose vehicle private limited companies etc. Assessee is into the business of property development creating infrastructure, and furtherance of business to create hotels, restaurants; technology parks, commercial office places, residential infrastructure and other property development. The assessee has invested in special purpose vehicle for extension of its business to carry out the creation of infrastructure facilities and creating branded hotels, restaurants, commercial properties etc. Assessee is stated to have invested into such special purpose vehicles based on the commercial expediency to further business objectives related to the business operations of the firm. The firm also over and above investing in equity capital of the special purpose vehicles, extended loans and advances to support the business of SPvs.

27. Assessee has one such special purpose vehicle namely Adarsh reality and Hospitalities Limited with a share capital of ? 15 crores and a loan of ? 746.15 crores. This company has created infrastructure hotels and tied up with the brand of hotels to enhance its business. As on 31st of March 2020, the assessee holds 99.826 percentage in the equity share capital of Adarsh reality and hotels private limited represented by it managing partner. This company was in fact established on 26th day of August 1996.

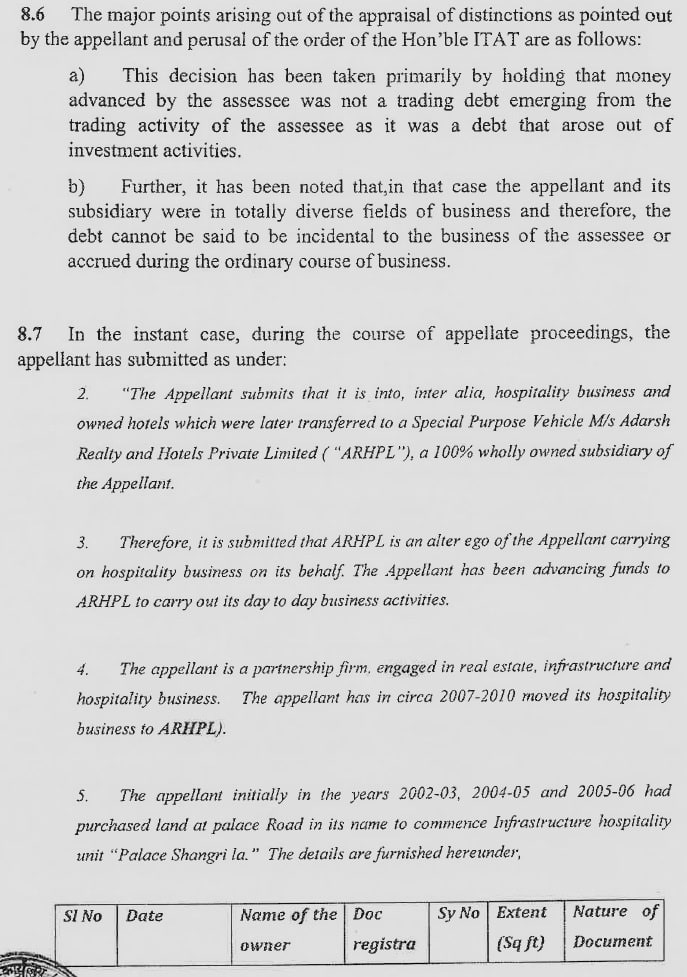

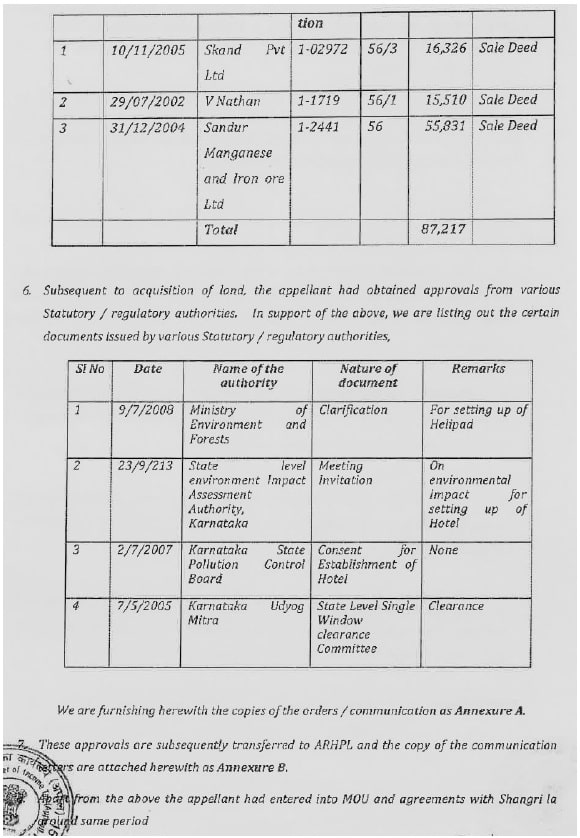

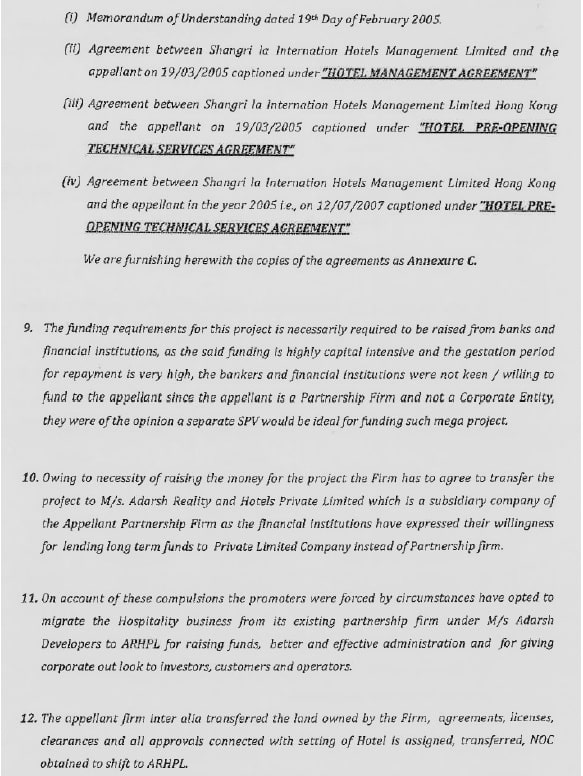

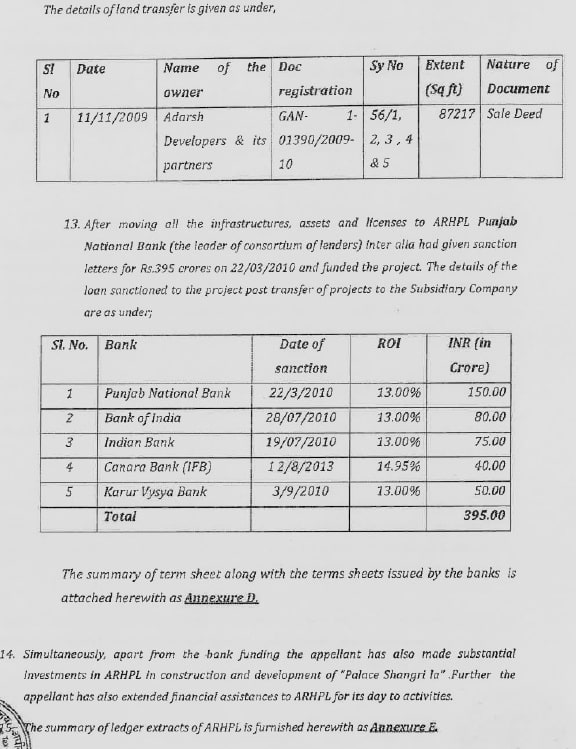

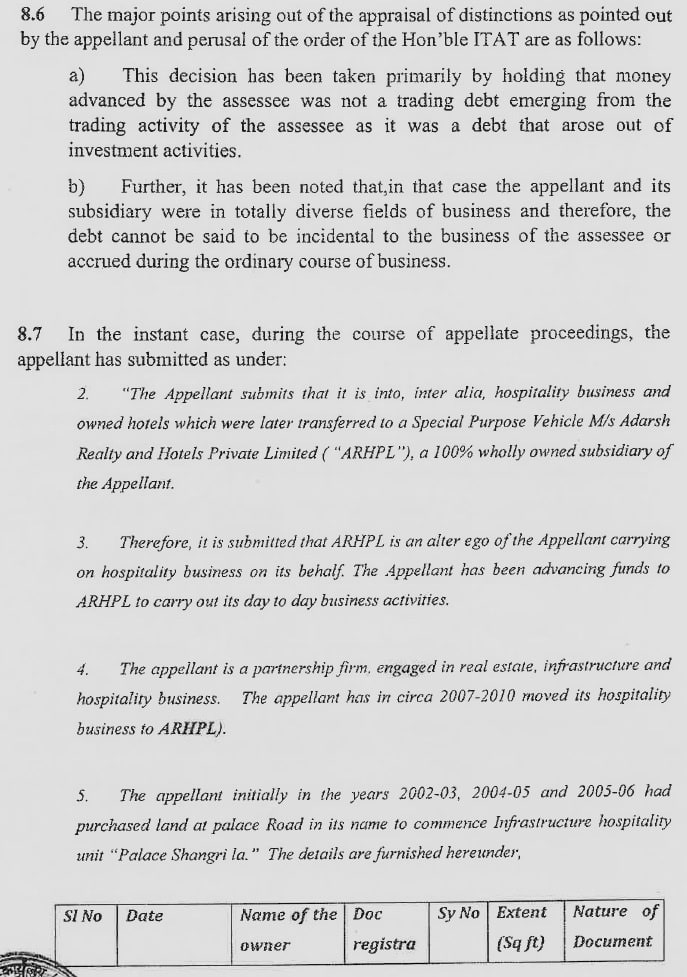

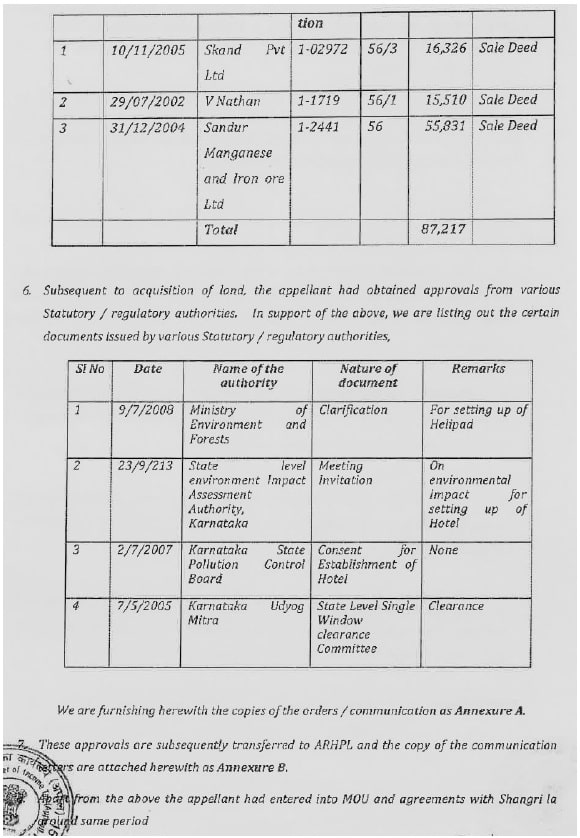

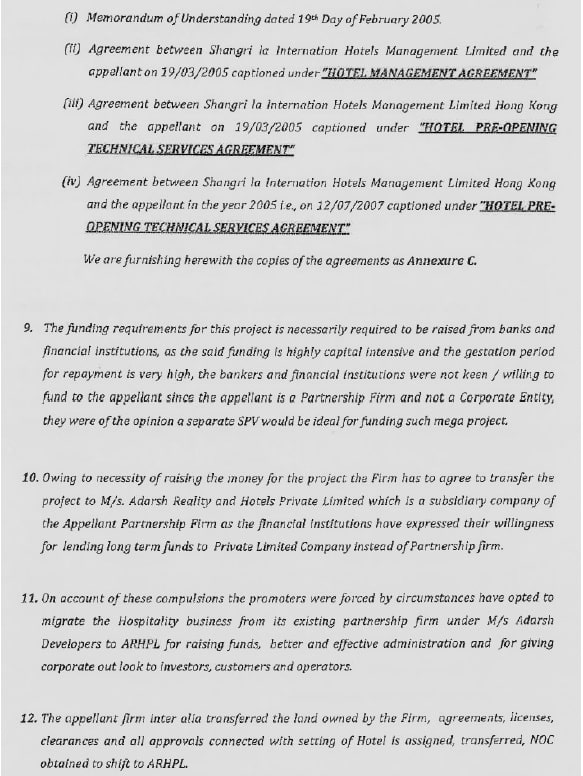

28. Further the assessee during financial year 2002 – 03 to 2005 – 06 to construct and infrastructure project for Hotel acquired various land parcels. Subsequently, the assessee also obtained various approvals from the competent authorities for setting up of a five-star category hotel. For this, assessee entered into a memorandum of understanding and agreement with a Hong Kong-based company to set up and manage the Hotel project in 2005. Somewhere in 2009 the assessee transferred the hospitality business to the Adarsh reality and hotels private limited along with land and all such licenses and approval. Consortium bank funding of app. Rs 395 crores were also obtained. In addition to external funding, the assessee also advanced substantial amounts in the form of loans and advances from time to time.

29. As the hotel projects could not breakeven, up to financial year 2019 -20 it incurred consistent losses. As on 31st of March 2019 the cumulative loss resulted in the negative net worth of the company of ? 375 crores eroding the capital base of that company. Thus, in view of the negative net worth of Rs 375 crores and further financial loan of the banks to the tune of ? 385 crores resulted in default for payment of instalments of bank loan.

30. As even the bank loans could not be repaid in time, in view of sluggish business, the assessee has written off the loans and advances to the tune of ? 460.80 crores given to that company as not recoverable business advance. This was claimed by the assessee as an expenditure/ loss eligible for the deduction. This is to the extent of 60% of such advances and investment in that company.

31. Meanwhile as the borrower company has a running account with the assessee, it paid cost recharge expenses and certain expenses to the assessee, which are part of income of the assessee in respective financial years. Assessee also paid directly to the vendors and service providers of hotels, and same was recovered by assessee from borrower way of debit note which was credited in the running account of the debtor and credited as the income of the assessee company. Therefore, the assessee did receive certain sums from the borrower company which were offered as income of the assessee. This fact has not been disputed by the revenue.

32. During assessment proceedings, the assessee submitted the various details and asked the learned assessing officer to grant it as a deduction under section 37 (1) of the act or as bad debt. The learned AO disallowed the claim of the assessee as business loss holding that (i) whether the loss has been incurred during the year or not is not shown, (ii) borrower has started having cash profit, (iii) borrower has started even repayment over a period of 4 years, (iv) there is no valid basis for such write off. Thus, the claim of the assessee was denied.

33. The learned assessing officer further held that because of some income arising from the assessee during the year which would have entailed payment of taxes, the assessee has written off this amount to avoid such payment of taxes.

34. Aggrieved with the above order the assessee preferred an appeal before the learned CIT – A allowed the claim of the assessee.

35. The learned departmental representative categorically challenges the appellate order stating that the learned CIT – A has recorded incorrect facts that assessee is in construction business and hospitality business therefore the advances are related to the business activity of the assessee. According to the revenue the advances given by the assessee company are not related to or have any nexus with the business activity of the assessee and therefore such advances written off could not be considered eligible for deduction. However, we find that the Adarsh reality and hotels private limited was incorporated as 100% owned private limited company of the assessee on 26/8/ 1996. Prior to that in 2002 – 2004 and 2005 the assessee has acquired various land parcels to construct infrastructure hotel. The assessee also obtained various approvals from the competent authorities for setting up the new infrastructure hotel. A memorandum of understanding was also entered into by the assessee for setting up and management of the hotel. Subsequently on 11/11/2009, the assessee transferred the hospitality business to that company along with land and all licenses and approval. This clearly shows that the assessee was having the hospitality business which was subsequently transferred to the borrower company. Further advances given by the assessee to that company along with the share capital and clearly related to the business activity of the assessee. Therefore, there is no infirmity in the order of the learned and CIT – A holding that advances given by the assessee to the above company has nexus with the business of the assessee.

36. The second objection of the revenue was that though the net worth of the borrower has become negative but that does not permit allowance of write-off of such advances. It is true that merely because the borrower has negative net worth, if the advances are written off, those should not be allowed to the assessee as deduction. Similarly, when the borrower starts showing cash profits it is not always true that the allowances for losses or bad debt are not allowable to the assessee. Subsequent repayment of the party cannot also be a deciding factor for claim of losses or bad debts. If the assessee does not have any chance of recovery of the loans or advances given by the assessee company to the borrower, the assessee is entitled to write off such advances and claim either as bad debts or as a business loss provided it satisfies the condition laid down in the Income tax Act.

37. Further the learned assessing officer was of the view that assessee has received an amount of ? 469.78 crores as additional income during the assessment year 2020 – 21 and therefore as this amount is chargeable to tax, assessee was required to pay income tax, to avoid payment of such income tax, assessee has written of the above amount of loans and advances to the subsidiary company and claimed it as an allowable loss or expenditure. In response to this the assessee has clearly stated that that receipt from the sale of shares is not in the nature of any unexpected win as for earlier years also the assessee has received ? 320 crores, and these advances could have been written off in that year also. It was also stated that the income is arising to the assessee in view of share purchase agreement dated 5/4/2017. Income arising from the above share purchase agreement was partly offered to taxation in assessment year 2019 – 20 and party was to be offered in this assessment year. Therefore, it is not correct that the write-off of the losses on claim of the assessee is to avoid payment of taxes.

38. We further note that the learned and CIT DR has stated that that such loan liability is on capital account and not a trading liability. To Support this contention, the learned CIT DR relied upon the decision of the honourable Supreme court in case of Mahindra and Mahindra Limited ITR 1 (SC) citing paragraph number 15 – 17 of that decision. We have carefully considered and found that the above decision was squarely on the issue of taxability of income on account of waiver of loan and is in an altogether different context and does not deal with issue of allowance of business losses or bad debt. Further the fact shows that income arising on sale of shares of SPVS, is always offered by the assessee as business income and not capital gains. Therefore this argument of the ld. DR does not hold any water.

39. No further infirmities could be pointed out by the ld. CIT DR in the appellate order passed by the ld. CIT (A) in her written submission.

40. Now further examining the order of the ld. CIT (A), we find that while allowing the claim of the assessee, he has held that the loss arising to the assessee on account of write-off of the above advances is emanating from the business of the assessee for the reason that the assessee has transferred hotel business after purchasing the land and licenses/ approvals, entering into management agreement with an Hong Kong-based company, incorporated a subsidiary, introducing capital contribution and loan in that SPV. Therefore, the loans and advances and investment of the assessee is for the purposes of the business of the assessee.

41. With respect to whether loss incurred by the assessee is incurred by the assessee during the assessment year, the learned CIT – A in paragraph number 8.23 has categorically recorded the fact about slowdown in the tourism industry due to pandemic globally, reaching the conclusion by the assessee on 16 March 2020 that the amount of advances given to the company should be written off by a resolution of the partners passed during this year. Therefore the incident of incurring of the loss resulting into write-off happened during this assessment year.

42. Honourable Karnataka High Court had an occasion to consider identical issue in case of case of Ace Designers Ltd v. Additional Commissioner Of Income Tax (Karnataka) (Karnataka) where a company engaged in the business of manufacturing and export of computerised numerically controlled machine claimed write-off of the investment in subsidiary company was allowed following decision of honourable Bombay High Court in case of Colgate-Palmolive India Ltd holding that where the assessee makes an investment in its hundred percent subsidiary for business purposes, loss on sale of investment has to be treated as business loss of the assessee. The facts of the present case are also pari materia same as assessee has by writing of the investment in subsidiary has claimed such write off as business loss.

43. Further in case of the decision of the honourable Rajasthan High Court in case of Principal Commissioner Of Income Tax versus Vaibhav Global Limited(Rajasthan) ] [Rajasthan] where the issue arose that when the loss arises on account of permanent diminution in value of the investment made in subsidiary company in order to expand business being driven by the business expediency is allowable as a revenue expenditure under section 37 (1) of the act or not. The honourable High Court held it to be allowable under section 37 (1) of the act as a business loss. In the present case also the writing of the amount given by the assessee to the subsidiary company written off in books of accounts of the assessee company would also be entitled on the same corollary as allowable deduction under section 37 (1) of the Act.

44. Even the alternative claim allowable as bad debts, Honourable Supreme Court in case of Khyati Realtors private limited in civil appeal 672 of 2020 paragraph number 22 has categorically held that even if the claim for deduction under section 36 is not allowable, the alternative claim under section 37 can also be entertained. Thus, the claim of the assessee either as bad debt or as a business loss can be allowed.

45. Further the claim of the assessee can also be allowed as a deduction as bad debt because of the reason that assessee has offered part of the amount as income which is demonstrated by submitting the Ledger account of the borrower company at page number 400 – 409 of the paper book part of the submission before the assessing officer dated 20 July 2022. Therefore, the claim of the assessee can also fall as eligible for deduction under the provisions of section 36 (1) (vii) of the act as ‘part of that debt’ that has already been offered by the assessee as income from subsidiary. This satisfies the provisions of subsection (2) of that section.

46. Honourable Bombay High Court in case of CIT V Pudumjee Pulp & Paper Mills Ltd. 2015 (Bombay) has held that:-

“12. So far as first part of Section 36(2)(i) of the Act is concerned, i.e. (a) above, we find that the Respondent-Assessee had during the earlier Assessment Years offered to tax an amount of Rs. 42.65 lakh received as interest on the deposit made with M/s. GSB Capital Market Ltd. The Appellant (sic.) had since Assessment Year 1998-99 claimed an amount of Rs. 49.82 lakhs as doubtful debts from M/s. GSB Capital Market Ltd. This consisted of the aggregate of principal and interest payable by M/s. GSB Capital Market Ltd. It was in the subject Assessment Year that a settlement was arrived at between the parties and the Respondent-Assessee received Rs.15 lakhs from M/s. GSB Capital Market Ltd. and the balance amount of Rs. 34.82 lakhs being non-recoverable was being claimed as bad debts by writing off the same in its books of account. It would thus be noticed the amount of Rs. 34.82 lakhs which constitutes partly the principal amount of the inter-corporate deposits and partly the interest which is unpaid on the principal debt. The Assessing Officer’s contention that amount of Rs. 34.82 lakhs was not offered to tax earlier and, therefore, deduction under Section 36(2)(i) of the Act is not available, is no longer re-integra. This very issue came up for consideration before this Court in Shreyas S. Morakhia (supra) wherein the assessee was a stock broker and engaged in the business of sale and purchase of shares. The brokerage payable by the client was offered for tax. Subsequently, it was found that the principal amount which was to be received from its clients would not be received. The assessee sought to claim as bad debts not only the brokerage amounts not received but the aggregate of principal and brokerage amounts not received in respect of the shares transacted. This Court held that the debt comprises not only the brokerage which was offered to tax but also principal value of shares which was not received. Therefore, even if a part of debt is offered to tax, Section 36(2)(i) of the Act, stands satisfied. The test under the first part of Section 36(2)(i) of the Act is that where the debt or a part thereof has been taken into account for computing the profits for earlier Assessment Year, it would satisfy a claim to deduction under Section 36(1)(vii) read with Section 36(2)(i) of the Act. In fact, the Revenue also does not dispute the above provisions as no submission in that regard were made during the course of hearing before us.”

47. Thus, the claim of the assessee to write off the amount advances of Rs 468 Crores to the subsidiary company is allowable under section 37 (1) of the act as well as under section 36 (1) (vii) of the Act.

48. Though ld. AR has relied up on the several judicial precedents, which we have considered while deciding the issue but same are not separately dealt with each of them as only the principle governing the allowability of claim of the loss is required to be decided, which was well enshrined in the decision of the honorable jurisdictional high court, which we have followed.

49. We have also noted the objection of the assessee with respect to the admissibility of ground number 3 and 5 of the revenue stating that those are not the issues on which the learned this allows the claim of the assessee and therefore the revenue is now raising a new ground and thus improving the case of the assessing officer. However, as we have already decided the issue on the merits of the case allowing in favour of the assessee, the objection of the assessee becomes merely academic.

50. Thus we do not find any infirmity in the order of the learned CIT – A allowing the appeal of the assessee by deleting the disallowance made by the learned assessing officer being amount written off by the assessee of advances given to its subsidiary company of Rs 468,80,84,462/- as business loss incurred by the assessee during the year, which is not a capital loss and also is a loss arising out of the business of the assessee.

51. In the result appeal of the learned assessing officer is dismissed on its merit and appeal of the assessee is also dismissed as withdrawn.