I. Capital Gain on Sale of Rights Entitlement Exempt Under India-Ireland DTAA Article 13(6), Not Taxable as Share Sale

Issue:

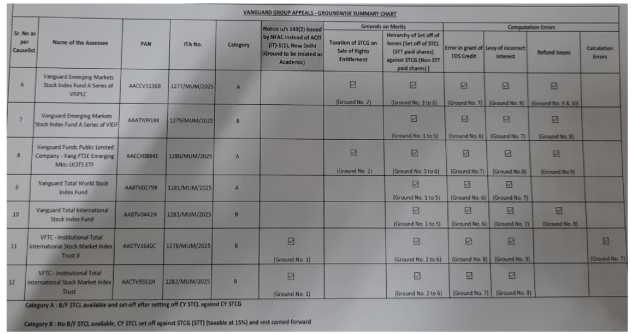

Whether Short Term Capital Gains (STCG) earned by an Irish company from the sale of rights entitlement of shares of an Indian company should be taxed as “sale of shares” under Article 13(5) of the India-Ireland Double Taxation Avoidance Agreement (DTAA), or if it is exempt under Article 13(6) of the same DTAA, which deals with capital gains not covered by other clauses.

Facts:

For the assessment year 2022-23, the assessee, a company incorporated in Ireland, earned Short Term Capital Gains (STCG) from the sale of rights entitlement of shares of an Indian company. The assessee claimed this STCG as exempt under Article 13(6) of the India-Ireland DTAA. The Assessing Officer (AO), however, held that STCG on the sale of rights entitlement was to be taxed as “sale of shares” under Article 13(5) of the India-Ireland DTAA, making an addition towards STCG as taxable in India.

Decision:

Yes, the court held that rights entitlement is distinct from shares. Therefore, gain on the transfer of rights entitlement would fall within the purview of Article 13(6) and not under Article 13(5) of the India-Ireland DTAA. Consequently, the Assessing Officer was not correct in denying the exemption under Article 13(6) of the India-Ireland DTAA to the assessee, and thus, the addition made in this regard was to be deleted.

Key Takeaways:

- Distinction Between Shares and Rights Entitlement: The core of the decision lies in recognizing that “rights entitlement” (the right to subscribe to shares) is a distinct financial instrument or right from the “shares” themselves.

- DTAA Interpretation: Tax treaties (DTAAs) are interpreted based on their specific wording.

- Article 13(5) (India-Ireland DTAA): Typically deals with gains from the alienation of shares, granting taxing rights to the source country (India) if the shares derive more than 50% of their value directly or indirectly from immovable property situated in that country. If not, the gains are taxable only in the country of residence.

- Article 13(6) (India-Ireland DTAA): This is a residual clause that states “Gains from the alienation of any property other than that referred to in paragraphs 1, 2, 3, 4 and 5 shall be taxable only in the Contracting State of which the alienator is a resident.”1

- Taxability in Residence Country: Since rights entitlement is not explicitly covered by the earlier specific clauses of Article 13 (including 13(5) for shares), it falls into the residual Article 13(6), meaning the gains are taxable only in the country of residence of the alienator (Ireland, in this case), and not in India.

- Favor of Assessee: The decision is in favor of the assessee, confirming the exemption of STCG from the sale of rights entitlement in India.

II. Set-off of STCL from STT-Paid Shares Against STCG from Non-STT Paid Shares Permissible

Issue:

Whether an assessee is permitted to set off Short Term Capital Loss (STCL) arising from the sale of STT-paid shares against Short Term Capital Gain (STCG) arising from the sale of non-STT paid shares, particularly when the Assessing Officer argues that Section 70 allows set-off only if income and losses are arrived at under similar computation.

Facts:

For the assessment year 2022-23, the assessee, a company incorporated in Ireland, incurred Short Term Capital Loss (STCL) from the sale of STT (Securities Transaction Tax) paid shares. It also had Short Term Capital Gain (STCG) arising from the sale of non-STT paid shares. The assessee sought to set off the STCL from STT-paid shares against the STCG from non-STT paid shares. The Assessing Officer (AO) rejected this set-off, arguing that as per Section 70 of the Income-tax Act, 1961 (which deals with set-off of loss from one source against income from another source under the same head of income), only those incomes and losses arrived at under “similar computation” should be allowed to be set off.

Decision:

Yes, the court held that there is no prohibition under the Act with regard to the hierarchy of set-off of STCL arising out of STT-paid shares against STCG arising out of non-STT paid shares. In the absence of any prohibition or any specific chronology for set-off prescribed under the Act, the assessee was entitled to choose the chronology of set-off that was most beneficial to the assessee. Therefore, the Assessing Officer was not correct in denying the benefit of set-off of STCG arising out of non-STT paid shares against STCL of STT-paid shares.

Key Takeaways:

- Section 70 (Set-off of Losses under Same Head): Section 70 permits set-off of loss from one source against income from another source falling under the same head of income. Here, both STCL and STCG fall under the head “Capital Gains.”

- No Prohibition for Set-off (STT vs. Non-STT): The crucial point is that the Income-tax Act does not explicitly prohibit the set-off of STCL from STT-paid shares against STCG from non-STT paid shares. The fact that one type of share is subject to STT and the other is not pertains to their taxation treatment (e.g., Section 111A for STT-paid STCG), but it doesn’t create a barrier to set-off within the same head of capital gains.

- Assessee’s Right to Beneficial Set-off: In the absence of a specific statutory hierarchy or prohibition, an assessee is generally entitled to arrange the set-off of losses in a manner most beneficial to them.

- Section 111A (STT-Paid STCG): Section 111A provides for a concessional tax rate (15%) on STCG from the sale of equity shares/units of equity-oriented funds where STT is paid. While this section dictates the rate of tax, it does not alter the fundamental nature of the income as “Short Term Capital Gain” for set-off purposes under Section 70.

- Favor of Assessee: This decision is beneficial to the assessee, allowing them to optimize their tax liability by setting off losses against the STCG that might otherwise be taxed at a higher rate (if it were non-STT paid income).

and Ms. Padmavathy S., Accountant Member

[Assessment year 2022-23]

| Particulars | Amount (INR) |

| Short term capital gain on transaction subject to STT (15%) | 13,14,57,337 |

| Short term capital gain on transaction not subject to STT(30%) | 27,833 |

| Less: Short term capital loss on transaction subject to STT (15%) | (3,69,58,992) |

| Net Short-term Capital gain | 9,45,26,178 |

| Less: Brought forward short term capital loss | (9,45,26,178) |

| Total Short term capital gains chargeable to tax | 0 |

| Short term capital loss carried forward | (33,50,27,576) |

“5. The learned ACIT erred in treating the short-term capital gains on sale of rights entitlement of INR 65,328,217, as falling within the purview of Article 13(5) of the Double Taxation Avoidance Agreement (DTAA) between India and Ireland (Treaty) and thereby chargeable to tax in India under the provisions of the Act, instead of the same being exempt under Article 13(6) of the Treaty, by virtue of being taxable only in Ireland.”

| • | Rights entitlement are a discount on equity shares; |

| • | Shares represent ownership in the company whilst right entitlements are the rights given to existing shareholders to buy new shares in a right issue. By exercising their right entitlements, shareholders can subscribe to the new shares and increase their ownership in the company. |

| • | Right entitlement are like bonus for existing shareholders; |

| • | The assessee has the option to buy the equity shares at a^ discounted price or sell the rights entitlement: |

| • | Rights entitlement by virtue of it being able to be used to ‘purchase shares at a discount, is a part equity share. Further, rights entitlement can only be used to buy the company’s shares at a discounted price and hence, source and application are for shares only. |

| • | Merely because the holder of rights entitlement is not entitled to receive dividend does not have any bearing on its nature being that of a share since the dividend entitlement is available only when shares are fully subscribed. Shares and rights entitlements are exactly similar assets and the rights embedded therein may be slightly different. |

| • | Shares as per Article 13(5) can be given a broad interpretation to include similar or comparable interest in light of Article 13(4) as amended by the MLI since rights entitlement are linked to shares in origin and also in final conversion upon exercise of subscription. |

| • | Shareholder’s eligibility to apply for the rights issue are closer to ‘shares’ under a broad interpretation of Article 13(5) than other property as per Article 13(6) – Shares have broader connotation and meaning than ‘equity’ and stand for tradable securities related to the underlying company: |

| • | Differentiation between separate International Securities Identification Number (ISIN’) assigned to rights entitlement is necessary because their base price is significantly different from the current market price of the equity shares. |

| 5. | We have heard both the parties at length and also perused the relevant finding given in the impugned order. The moot question before us is, whether capital gain earned from sale of rights entitlement” can be claimed as exempt under Article 13(6) of India-Ireland DTAA which provides that gains from transfer / alienation of any property other than those mentioned in Articles 13(1) to 13(5) shall be taxable only in Ireland. For the sake of ready reference, the relevant Article 13 of IndiaIreland DTAA prior to modification by the MLI which deals with the capital gains reads as under:- |

| 1. | Gains derived by a resident of a Contracting State from the alienation of immovable property referred to in Article 6 and situated in the offer Contracting State may also be taxed in that other State |

| 2. | Gains from the alienation of movable property forming part of the business property of a permanent establishment which an enterprise of a Contracting State has in the other Contracting State or of movable property pertaining to a fixed base available to a resident of a Contracting State in the other Contracting State for the purpose of performing independent personal services, including such gains from the alienation of such permanent establishment (alone or with the whole enterprise) or of such fired base, may also be taxed in that other State. |

| 3. | Gains derived by an enterprise of a Contracting State from the alienation of ships or aircraft operated in international traffic or movable property pertaining to the operation of such ships or aircraft shall be taxable only in that State |

| 4 | Gains from the alienation of shares of the capital stock of a company the property of which consists directly or indirectly principally of immovable property situated in a Contracting State may be taxed in that State |

| 5. | Gains from the alienation of shares other than those mentioned in paragraph 4 in a company which is a resident of a Contracting State may be taxed in that Contracting State. |

| 6. | Gains from the alienation of any property other than that referred to in paragraphs 1, 2, 3, 4 and 5 shall be taxable only in the Contracting State of which the alienator is a resident.” |

“62. Further issue of share capital (1) Where at any time, a company having a share capital proposes to increase its subscribed capital by the issue of further shares such shares shall be offered 1. (a) to persons who, at the date of the offer, are holders of equity shares of the company in proportion. as nearly as circumstances admit, to the paid-up share capital on those shares by sending a letter of offer subject to the following conditions, namely (1) the offer shall be made by notice specifying the number of shares offered and limiting a time not being less than fifteen days 1 for such lesser number of days as may be prescribed) and not exceeding thirty days from the date of the offer within which the offer if not accepted shall be deemed to have been declined, (ii) unless the articles of the company otherwise provide, the offer aforesaid shall be deemed to include a right exercisable by the person concerned to renounce the shares offered to him or any of them in favours of any other person, and the notice referred to in clause (1) shall contain a statement of this right; (ii) after the expiry of the time specified in the notice aforesaid or on receipt of earlier intimation from the person to whom such notice is given that he declines to accept the shares offered, the Board of Directors may dispose of them in such manner which is not disadvantageous to the shareholders and the company.”

1.3.2. REs shall be credited to the demat account of eligible shareholders in dermaterialized form.

1.3.3. in REs process, the REs with a separate ISIN shall be credited to the demat account of the shareholders before the date of opening of the issue, against the shares held by them as on the record date.”

“The right to subscribe to additional offer of shares/debentures on right basis on the strength of existing shareholding in the company comes into existence when the company decides to come out with the rights offer. Prior to that, such right, though embedded in the original shareholding, yet remains inchoate. The same crystallizes only when the rights offer is announced by the company. The said right to subscribe to additional shares/debentures is a distinct, independent and separate right, capable of being transferred independently of the existing shareholding, on the strength of which such rights are offered.”

| • | Section 2(42A) of the Act reckons holding period in respect of right to subscribe to any financial asset which is renounced in favour of any other person from the date of offer. |

| • | Similarly, Section 55(2)(aa) of the Act deals with a scenario where the person becomes entitled to subscribe to additional financial asset and if such entitlement is in relation to any right to renounce the entitlement, the cost is taken to be NIL. |

“30. The Article does not contain special rules for gains from the alienation of shares in a company (other than shares of a company dealt with in paragraph 4) or of securities bonds debentures and the like. Such gains are therefore taxable only in the State of which the alienator is a resident.”

Before amendment in 2019.

13(4). Gains from the alienation of shares of the capital stock of a company the property of which consists directly or indirectly principally of immovable property situated in a Contracting State may be taxed in that State.

13(5). Gains from the alienation of shares other than those mentioned in paragraph 4 in a company which is a resident of a Contracting State may be taxed in that Contracting State.

After amendment in 2019:

13(4). Gains derived by a resident of a Contracting State from the alienation of shares or comparable interests, such as interests in a partnership or trust, may be taxed in the other Contracting State if at any time during the 365 days preceding the alienation, these shares or comparable interests derived more than 50 per cent of their value directly or indirectly from immovable property (real property) situated in that other Contracting State.

13(5) Gains from the alienation of shares other than those mentioned in paragraph 4 in a company which is a resident of a Contracting State may be taxed in that Contracting State.

“Derivatives and other forms of securities, such as compulsory convertible debentures (CCDs) and optionally convertible debentures (OCDs) will continue to be governed by the existing provision of being taxed in Mauritius, said economic affairs secretary Shaktikanla Das. He said India had gained a sourcebased taxation right only for shares (equity) under the treaty Residence-based taxation will continue for derivatives under the Mauritius pact Meaning nonequity securities would be taxed in Mauritius if routed through there. But Mauritius does not have a short-term capital gains tax which would mean that investors using these instruments would continue to escape paying taxes in both countries. “There are three categories of instruments which arise between two countries-shares, immovable assets, and other instruments, including derivatives,” he explained. “Insofar as shares are concerned, they are covered by the new agreement. As regards immovable property, all along the right to taxation is in India. The right to taxation is in the country where an immovable asset is located. So, if an immovable asset is located in India, we have the taxation right. With regard to other instruments, “the right to tax is always in that country. There cannot be a change that is the position all over the world”. “It is their country’s decision The right to tax is with that country with the US, the UK, Germany, Japan, Mauritius, all the countries (with which India has a Double Taxation Avoidance Agreement), It is for that country to decide whether it wants to tax at 10, 20, or zero per cent (And) Just because some country has made it zero, I can’t say I will tax, he further clarified”

| Sr. No. | Revenue’s Arguments | Appellant’s rebuttal |

| 1 | Rights entitlement and shares are closely related assets. | It has been alleged that shares and rights entitlement pertain to share capital on the basis that the rights entitlements are securities that gives existing shareholders the right to buy additional company shares and increase their ownership in the company and therefore, a rights entitlement is a security that gives existing shareholders the right to buy additional company shares at a discounted price which is bonus for shareholders. The lower authorities have failed to appreciate that Section 62 of the Companies Act, 2013 provides that “unless the articles of the company otherwise provide, the offer aforesaid shall be deemed to include a right exercisable by the person concerned to renounce the shares offered to him or any of them in favour of any other person.” It is evident that a shareholder obtains an exercisable right to subscribe to shares which is different from shares in the Indian company. In terms of section 62 of the Companies Act, 2013, a shareholder obtains an exercisable right to subscribe to shares which is different from shares in the Indian company. |

| 2 | Shares as per Paragraph 5 of Article 13 can be given a broad interpretation to include similar or ‘comparable interests’ [in light of Article 13(4)]. Rights entitlements are linked to shares in origin and also in final conversion upon exercise of subscription. | Article 13(6) of the India-Ireland DTAA between India and Ireland refers to property ‘any property other than that referred to in paragraphs 1, 2, 3, 4 and 5’. We submit that clauses (1) to (5) of Article 13 is not applicable: 13(1) – Not applicable as it deals with alienation of immoveable property. 13(2) – Not applicable as it deals with alienation of movable property forming part of the business property of a permanent establishment. 13(3) – Not applicable as it deals with alienation of ships or aircraft operated in international traffic or movable property pertaining to the operation of such ships or aircraft. 13(4) – Not applicable as it deals with alienation of shares of the capital stock of a company the property of which consists directly or indirectly principally of immovable property 13(5)- Not applicable as it deals with alienation of shares other than those mentioned in paragraph 4 in a company which is a resident of a Contracting State (i.e., India). The AO has sought to allege that rights entitlement is similar to shares of an Indian company and therefore should fall within the purview of Article 13(5). In this regard, reliance is placed on decision of the Hon’ble Supreme Court of India in the case of Navin Jindal v. Assistant Commissioner of Income Tax [2010], wherein it was held that” The right to subscribe to additional offer of shares/debentures on right basis on the strength of existing shareholding in the company comes into existence when the company decides to come out with the rights offer. Prior to that, such right, though embedded in the original shareholding, yet remains inchoate. The same crystallizes only when the rights offer is announced by the company…… The said right to subscribe to additional shares/debentures is a distinct, independent and separate right, capable of being transferred independently of the existing shareholding, on the strength of which such rights are offered.” Based on the above decision, it is clear that rights entitlement is an asset distinct from shares of an Indian company, notwithstanding that the rights entitlement stems from shareholding of an Indian company. The allegation of the learned AO that rights entitlement is not an asset ‘other than’ a share is without merit. Reliance is also placed on the Commentary on Article 13 of the Model Tax Convention on Income and on Capital 2017, issued by the OECD. Relevant extract is provided below: “Paragraph 5 29. As regards gains from the alienation of any property other than referred to in paragraphs 1, 2, 3, and 4, paragraph 5 provides that they are only taxable in the State in which the alienator is resident. History Amended when the 1977 Model Convention was adopted by the OECD Council on 11 April 1977. Until the adoption of the 1977 Model Convention, paragraph 5 read as follows: “5. The Article does not give a detailed definition of capital gains. This is not necessary for the reasons mentioned above. The words “alienation of property” are used to cover in particular capital gains resulting from the sale or exchange of property and also from partial alienation, the expropriation, the transfer to a company in exchange for stock, the sale of a right, the alienation free of charge and even the passing of property on death.” OECD Model Tax Convention on Income & on Capital, 2017-Paragraph 30: “30. The Article does not contain special rules for gains from the alienation of shares in a company (other than shares of a company dealt with in paragraph 4) or of securities, bonds, debentures and the like. Such gains are, therefore, taxable only in the State of which the alienator is a resident.” Further, in 2017, it was decided to adopt the updated provision from the OECD Model Tax Convention, as the concept of a “comparable interests” is broadly equivalent to what was previously covered by paragraph 4 of the United Nations Model Tax Convention. Accordingly, the relevant changes made to the OECD Model Convention made it more aligned with the UN Model Convention. Thereafter the India- Ireland DTAA was amended in 2019 and the reference to comparable interest was only given at Article 13(4) and not at Article 13(5) in the IndiaIreland DTAA. Thus, is clear that no reference to comparable interest was made in Article 13(5) of the IndiaIreland DTAA, evidencing that it only refers to share of a company. |

| 3. | ‘Shares’ have broader connotation and meaning than ‘equity’ capital’ and stand for tradable securities related to the underlying company. Further, separate ISIN is assigned to rights entitlements to distinguish it from the normal equity shares traded in the market. | In terms of section 2(84) of the Companies Act, 2013, ‘share’ means a share in the share capital of a company and includes stock. Further, in terms of section 43 of the Companies Act, 2013, equity share capital, with reference to any company limited by shares, means all share capital which is not preference share capital. Accordingly, it can be appreciated that shares are the means through which equity capital is obtained, so shares cannot be broader than equity capital. Equity capital refers to the total amount invested in the company through the issuance of shares, while shares are the units of ownership that represent this investment. Further, the lower authorities have failed to appreciate that the SEBI Circular provides that “REs with a separate ISIN shall be credited to the demat account of the shareholders before the date of opening of the issue, against the shares held by them as on the record date”. Thus, it is clear that what is credited to the demat account of the investor is an asset, being rights entitlement, which is different from shares of the company. Further, the learned AO has not taken cognizance of the NSE circular referred by the Appellant which specifically clarifies that trading in dematerialized rights entitlements on the stock exchanges shall be chargeable to STT at the rate specified in Finance (No.2) Act, 2004, in respect of ‘Sale of an option in securities’ (i.e. payable by the seller at the rate of 0.05% of the value at which such rights entitlements are traded). Further, the prescribed rate of STT on purchase of equity shares is different, which clearly evidences that rights entitlement is not the same as shares and is instead, an ‘option in securities’. |

“Thus, the application of a treaty can result in the entire (gross) income being not subject to tax in India in a year where a taxpayer claims treaty benefits. Therefore, in a year in which a taxpayer claims benefit of article 13(4) of the India-Mauritius tax treaty, the entire gains he earns will not be taxable at all as India has given up its taxing rights in respect thereof. Thus, the entire amount of gains for the year (before setoff of brought forward losses) will go out of the taxing provisions if assessee has chosen to be assessed as per treaty.

Thus, it is for an assessee to examine whether or not, in the light of the applicable legal provisions and in the light of the precise factual position, the provisions of the Income-tax Act are beneficial to him or that of the applicable double taxation avoidance agreement. Thus, these losses were therefore computed under the provisions of the Act, as in those earlier years, the assessee chose not to be governed by provisions of the treaty for those years but by the provisions of the Act. These provisions included the provisions of section 74 which deal with carry forward and set-off of these losses.

The capital gain as per the Indian Mauritius DTAA is taxable in the resident country and the source country has given up its rights to tax the income. The Question of computation in the source country does not therefore arise. Accordingly, the income from capital gains is not taxable in India as per article 13(4) DTAA and accordingly, the mode of computation income in India as the source country will not arise. If the particular income is not to be taxed at all, the question of including the same under the total income and determining the taxability on the same will not arise and the contention of revenue that the total income as per Act is to be calculated to determine the tax liability and thereafter, the benefit is to be given cannot upheld. Accordingly, it is held that the tosses which have been brought forward from earlier years will be carried forward to the subsequent years without setting off the same against the gains of the previous year relevant to the assessment year in Question for the reason that once the assessee has chosen the benefit of DTAA. then the capital gain is not at all taxable in India and therefore, there is no Question of setting off of loss from the earlier years.

“In Ground Nos.5 and 6 the assessee has objected to the mode of set off adopted by the Assessing Officer in assessing income from short term capital cases. During the year under consideration the assessee earned short term capital gain of Rs.7,29,584/- in transaction in shares where security transaction tax was not paid and income was subject to tax at normal rate. The assessee also earned short term capital gain of Rs.2,27,564/- in transaction in shares where security transaction tax was paid and income was eligible for concessional rate of tax under section 111A. The assessee also suffered short term capital loss of Rs.7,17,660/-in transactions in shares involving payment of security transaction tax. In the impugned order the A.O. computed the capital gain in the following manner without discussing any reasons for adopting such mode of computation.

| Calculation of income/loss from capital gain Short term capital loss with STT Short term capital gain with STT Net Short Term capital loss with STT Short term capital gain without STT Net Short term capital gain Less Brokerage 5,914/- Taxable short term capital gain of normal rate | (-) 7.17,660/- 2,27,564/- (-) 4,90,096/- 7,29,584/- 2,39,488/- 2,33,574/- |

| Long term capital gain at 10% rate (as per computation) | 1,49,431/- |

I have perused the assessment order and have considered submissions of the A/R. In the impugned order the A.O. has not given any reasons for first sitting off short term capital gain with STT against short term capital STT and then allow ofset off of remaining loss of Rs.4,90,096/- against short term capital gain without STT. The mode ofset off adopted by the A.O. shown that be accepted in principle that short term capital loss with STT can be legally set off against short term capital gain without STT. According to the assessee, the chronology for the set off by the A.O. was contrary to chronology adopted by the assessee, only because the assessee’s mode resulted in concessional rate of the tax being applied to higher amount of short term capital gain which resulted more tax benefit to an assessee.

On perusal of the provision of section 70, I find that there is no prohibition nor the Act compels the assessee to first set off short term capital gain with STT against short term capital loss with STT and then allows set off against short term capital gain without STT. In absence of any specific mode of set off provided in the Act and in absence of any prohibition and in absence of any specific chronology for set off prescribed in the Act, the assessee was entitled to exercise his option with regard to the chronology of set off which was most beneficial to the assessee. It is settled proposition of law that when a provision of the Act gives option to the assessee, such option should be exercised which will favour the assessee and not the revenue. The A/R for the assessee was well justified in relying on the decision of the Calcutta High Court and the Circular of the Board dated 7.7.1955 since the principles laid down therein appeared to be fully applicable.”