TDS Credit Must Be Allowed if appearing in 26AS; Assessment Order Remanded for Fresh Adjudication.

Issue:

Whether an Assessing Officer’s assessment order under Section 144 is valid when the officer fails to allow credit for Tax Deducted at Source (TDS) that is reflected in Form 26AS.

Facts:

- The assessee, an employee of Indian Railways, received salary income but did not file an income tax return.

- The Assessing Officer passed an assessment order under Section 144, making an addition to the assessee’s income based on the salary reflected in Form 26AS.

- The assessee contended that TDS was deducted from his salary, as reflected in Form 26AS, and requested that the matter be remanded for verification and credit of TDS.

- The Assessing Officer made additions based on the salary income shown in Form 26AS but did not allow credit for the TDS available in the same form.

Decision:

The court held that the Assessing Officer’s order was perverse because it did not allow the legitimate credit of TDS, despite the information being available in Form 26AS. The matter was remanded to the Assessing Officer for fresh adjudication, with directions to verify the facts and allow the credit of TDS.

Key Takeaways:

- Assessing Officers must consider all information available in Form 26AS, including TDS credits.

- Failure to allow legitimate TDS credit constitutes perversity in the assessment order.

- Assessees are entitled to credit for TDS deducted from their income.

- Remand is appropriate when an assessment order fails to consider crucial evidence like TDS credits.

IN THE ITAT RAIPUR BENCH

Kushal Prashad Sahu

v.

Assistant Commissioner of Income-tax

Ravish Sood, Judicial Member

AND ARUN KHODPIA, Accountant Member

AND ARUN KHODPIA, Accountant Member

IT Appeal Nos. 14 & 15 (RPR) of 2025

[Assessment Year 2012-13]

[Assessment Year 2012-13]

FEBRUARY 7, 2025

G.S. Agrawal, CA for the Appellant. Dr. Priyanka Patel, Sr. DR for the Respondent.

ORDER

1. The captioned appeals are filed by the assessee against the orders of Commissioner of Income Tax (Appeals), NFAC, Delhi, [in short “Ld. CIT(A)”], under section 250 of the Income Tax Act, 1961 (in short “the Act”), both dated 28.10.2024, for the AY 2012-13, which in turn arises from the order passed by Assistant Commissioner of Income Tax, Circle-1(1), Bilaspur, (in short “Ld. AO”), u/s 144/147 of the Act, dated 02.11.2018 and penalty order u/s 271(1)(c) dated 29.05.2019.

2. The grounds of appeal raised in both the aforesaid appeals which pertains to same assessee are as under:

ITA No. 14/RPR/2025

1. That under the facts and the law, the learned Commissioner of Income Tax (Appeals) erred in dismissing the appeal, without considering the written submission & various supporting filed on 05.03.2024 and observing that the appellant has not filed Form 35, Grounds of Appeal, copy of order against which appeal has been preferred. Prayed that the appellant has filed Form 35 along with Statement of facts, Grounds of appeal without which how the appeal could have been taken for hearing. He also filed Order against which appeal has been preferred and prayer for condonation of delay. Order of CIT(A) is unjustified & appeal be admitted & be decided on merits.

2. That under the facts and the law, the learned Commissioner of Income Tax (Appeals) erred in confirming the order passed by the learned AO u/s 144 r.w.s. 147. Prayed that order u/s 144 and proceeding u/s 147 is not according to law. Notices did not come to knowledge of appellant. Further, there does not appear to be approval u/s 151. Prayed to annul Assessment Order.

3. Learned Commissioner of Income Tax (Appeals) further erred in sustaining the order of Ld. AO, wherein credit of TDS of Rs.2,46,660/- was not allowed to the assessee & deduction u/s 80C of Rs.1 Lakh was also not allowed for payment of PF – Rs. 1,29,555/-, GIS – Rs 550/-, UC – Rs 18,950/-. Total – Rs 1,42,975/- (as per Form No 16) which was in the knowledge of Ld.AO. Prayed that income be assessed at Rs 12,91,570/- & credit of TDS – Rs 2,46,660/- and Rs. 6000 u/s 140A, kindly be allowed.

4. The Appellant is working as a Guard, and is staff of Indian Railways viz. South Eastern Central Railway, Bilaspur & due to his nature of employment, he is used to stay outside of his usual residence. The TDS is being made by the employer & because of his unstable place of residence, his Return of Income could not be filed, notices were not received.

ITA No. 15/RPR/2025

1. That under the facts and the law, the learned Commissioner of Income Tax (Appeals) erred in holding that the appellant has not filed Form 35, Grounds of Appeal, copy of order against which appeal has been preferred and application for condonation of delay. Prayed that the appellant has filed Form 35 along with Statement of facts, Grounds of appeal and prayer for Condonation of delay. He also filed order against which appeal has been preferred. Prayed that there was no defect in appeal filed. Order of CIT(A) is unjustified, the appeal kindly be admitted & be decided.

2. That under the facts & the law, the Ld. CIT (A), NFAC, Delhi further erred in confirming the Penalty levied by the learned AO u/s 27l(l)(c) at Rs.2,96,815/- on presumption and surmises and without considering the explanation that the appellant is employed with South Eastern Central Railways of Indian Railway & TDS on it was made which was also appearing in Form No. 26AS, & salary certificate which was filed. Prayed to cancel the penalty levied at Rs.2,96,815/

3. That under the facts & the law, the Ld. CIT (A) further erred in confirming the Order of learned AO levying penalty u/s 271(1)(c) at Rs.2,96,815/- though the employer of the appellant already deducted tax at source on his income from salary and appellant submitted Form 16 at the time of filing of appeal. The Employer filed TDS Return & disclosed the income earned by appellant. Prayed that there is no default u/s 271(1)(c), penalty be cancelled.

4. Learned Commissioner of Income Tax (Appeals) further erred in sustaining the order of Ld. AO, wherein the TDS of Rs 2,46,660/- was not allowed to the assessee & further the deduction of Rs. I Lakh was not allowed for payment of PF – Rs. 1,29,555/-, GIS – Rs 550/-, LIC – Rs 18,950/-. Total – Rs 1,42,975/- (as per Form No 16). Prayed that income be assessed at Rs 12,91,570/- & credit of TDS – Rs 2,46,660/-, kindly be allowed along with payment of Self-Assessment Tax of Rs 6000/-, as is also appearing in Form No 26AS.

5. The Appellant is working as a Guard, staff of Indian Railways viz. South Eastern Central Railway, Bilaspur & due to his nature of employment, he is used to stay outside his usual residence. The TDS is being made by the employer & because of his unstable place of residence, his Return of Income could not be filed, otherwise he is regularly filing ITR.

3. Brief facts of the case as apprised and available on record, are that the assessee is an individual, working as an employee in the capacity of “Goods Train Guard” with South Eastern Central Railway (SECR) of Indian Railways, Bilaspur, during the year under consideration i.e., AY 2012-13. The assessee has received salary income of Rs.14,53,896/- in the relevant year, however, had not filed his Return of Income (ROI). Because of non-filing of ROI by the assessee, the case was picked up for re-opening assessment u/s 147 by the Ld. AO, having the belief that the income earned by the assessee has escaped assessment within the meaning of section 147 of the Act. Notice u/s 148 was issued on 26.03.2018 and as per Ld. AO, the same is duly served upon the assessee. Further notice u/s 142(1) of the Act dated 13.10.2018 along with questionnaire was issues to the assessee, however there was no response by the assessee, accordingly, show cause notice stating that “why your assessment should not be completed u/s 144 of the Act?”, was issued. But again, the assessee remains non-compliant. In view of such non-attentive / non-responsive approach of the assessee, Ld. AO passed an assessment in the manner prescribed u/s 144 of the Act and had made an addition of Rs.14,53,896/- in the income of the assessee, based on figure of salary received by the assessee reflecting in the 26AS.

4. Aggrieved with the aforesaid order, assessee preferred an appeal before the Ld. CIT(A), however, the appeal of assessee is dismissed on account of non-prosecution.

5. At the outset, Shri G.S. Agrawal, CA, Authorized Representative (in short “Ld. AR”) on behalf of the assessee have submitted that the order of Ld. CIT(A) is not justified as the observation of Ld. CIT(A) that the appellant has not filed Form 35 along with statement of facts, grounds of appeal etc., itself was an erroneous observation, therefore, the order of Ld. CIT(A) is liable to be set aside. Another contention raised by the Ld. AR was that the order passed by Ld. AO u/s 144/147 was not in accordance with law, as the notices issued did not came to the knowledge of the assessee also it appears that there was no approval u/s 151 of the Act. Ld. AR further submitted that, Ld. CIT(A)’s order was suffering with the infirmity therein as on account of dismissal of the appeal of assessee confirmed the additions made by the Ld. AO, whereas the legitimate credit of TDS for Rs.2,46,660/- was not allowed by the Ld. AO to the assessee and eligible deduction u/s 80C of Rs. 1,00,000/- were not considered while computing the assessable income of the assessee. Ld. AR submitted that appellant is working as Goods Trains Guard staff of Indian Railways i.e., SECR, Bilaspur and due to his nature of employment, he is used to stay outside of his usual residence. The TDS is being made by the employer & because of his unstable place of residence, his Return of Income could not be filed and the notices for assessment were not received. Considering such facts and circumstances, it was the prayer by Ld. AR that there is no doubt that TDS was deducted from the Salary of the assessee, which is duly reflected in 26AS (copy submitted before us at page no. 1 and 2 of the APB), therefore, the matter may be restored back to the file of Ld. AO for verification of facts and to adjudicate the issue afresh considering the TDS deducted and credit available in Form 26AS of the assessee and to allow deduction u/s 80C of the Act in accordance with the eligible investment made by the assessee.

6. Per contra, Dr. Priyanka Patel, Sr. DR vehemently supported the order of Ld. CIT(A) have submitted that in absence of any response by the assessee, the First Appellate Authority was constrained to pass an order in accordance with law, therefore, the same deserves to be sustained.

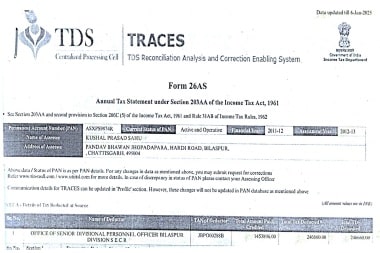

7. We have considered the rival submissions, perused the material available on record including the copies of document furnished before the revenue authorities by the assessee. Under the factual matrix of the present case, it is evident that the assessee had not filed his ROI, however had received Salary of Rs.14,53,896/- during the AY 2012-13 from his employer SECR, Bilaspur. It is also a documented fact that the TDS of Rs.2,46,660/-was deducted from the Salary of the assessee, as evident from the 26AS of the assessee. The relevant portion of 26AS furnished before us is extracted as under:

8. Observation by Ld. CIT(A), that the assessee had not filed Form 35 is incomprehensible and has no substance to concur with, as to how appellate proceedings are initiated by the First Appellate Authority without having Form 35 with him, further it is substantiate before us by the Ld. AR that by submitting copies of Form 35 and statement of facts that such necessary documents are duly furnished by the assessee on 05.03.2024 vide acknowledgment No. 134085880050324. Further, we are surprised to note that the addition in the case of assessee was made by the Ld. AO in absence of any response by the assessee based on income of the assessee reflected in Form 26AS, but the TDS credited available in Form 26AS was not allowed to the assessee, which obviously would have reflected in Form 26AS against the entries of Salary (Amount paid / credited) and recorded as transactions u/s 192 of Act. The contention of Ld. AR that, the assessee is a Goods Train Guard, which is regularly placed on duties outside of his usual residence, and therefore, notices issued by the department could not have found his attention and he was unable to respond on time, cannot be the sole reason to allow the assessee to adopt non-responsive and evasive approach towards the tax compliances, however, as the legitimate credit of TDS was not allowed by the Ld. AO, in spite of having such facts on records, we find perversity in the order of Ld. AO, therefore, the same needs to be set aside and in the interest of substantial justice, we deem it fit to restore this matter back to the file of Ld. AO, by setting aside the impugned order, for verification of the facts of the present case and to re-assess the income of the assessee after allowing the legitimate TDS credited and the eligible deductions available under the mandate of law.

9. Needless to say, reasonable opportunity of being heard shall be provided to the assessee in the set aside assessment proceedings and the assessee would be at liberty to furnish all the necessary evidence, submissions, and explanations before the Ld. AO to support his claims. Consequently, the matter in the present appeal is restored back to the file of Ld. AO for fresh adjudication.

10. In result, appeal of the assessee in ITA No. 14/RPR/2025 is partly allowed for statistical purposes.

ITA No. 15/RPR/2025555

11. Since the quantum appeal of the assessee in ITA No. 14/RPR/2025 is restore back to the file of Ld.AO, therefore, the appeal in ITA No. 15/RPR/2025 against the impugned order assailing penalty levied vide order of Ld. AO u/s 271(1)(c), which is consequential in nature, thus, the impugned appellate order is set aside and the matter is restored back to the file of Ld. AO

12. In result, appeal of the assessee in ITA No. 14/RPR/2025 is partly allowed for statistical purposes.

13. In combined result, ITA No. 14-15/RPR/2025 of the assessee are partly allowed for statistical purposes, in terms of our observations.