ORDER

Soundararajan K., Judicial Member. – These are the appeals filed by the assessee challenging the orders of the NFAC, Delhi all dated 08/11/2024 in respect of the A.Ys. 2016-17, 2018-19 and 2020-21.

2. All these appeals are related to the same assessee and the issue involved in all the appeals are similar. We decided to take up all the appeals together and pass a common order for the sake of convenience. Since the grounds raised by the assessee in all the appeals are identical, grounds of appeal raised for the A.Y. 2016-17 in ITA No. 25/Bang/2025 is reproduced hereinbelow for reference.

ITA No. 25/Bang/2025

“The Appellant objects to the Assessment Order on the following grounds in so far as it is prejudicial to the Appellant as it is opposed to law and circumstances of the case: –

Ground No 1:

1. The CIT(A) erred in confirming the addition to the extent of Rs 75,69,826 (interest income) relating to interest, earned on deposits with Co – Operative Bank, the Appellant co -operative society is registered under KARNATAKA CO-OPERATIVE SOCIETIES ACT 1959, The Appellant society is into the business of accepting deposits and providing credit facilities to the members, investing funds in Banks is integral part of its Business, the bye law, CHAPTER III, Objectives of the Appellant society includes investing of funds which are not required for use immediately, in Co-Operative Banks as per section 58 of the KARNATAKA CO-OPERATIVE SOCIETIES ACT 1959, the extract of the section 58 of the said act is reproduced below.

58. Investment of funds.- A co-operative society may invest or deposit its funds,— (a) in a Government Savings Bank; or (b) in any of the securities specified in section 20 of the Indian Trusts Act, 1882 (Central Act II of 1882); or (c) in the shares or securities of any other co-operative society; or 11(d) with any Co-operative Bank; or 2[(e) with any scheduled bank 2[XXX]2 regulated by the Reserve Bank of its choice and approved by the 3[general body of that society till the date of the next annual general body meeting]

Further there is an obligation upon the appellant SOCIETY to invest its funds with the Co-Operative banks hence the interest income earned on deposit with Co-Operative bank and Commercial bank is eligible for deduction under section 80P(2)(a)(i) of the Income Tax Act 1961. The extract of the Bye law copy is attached herewith.

Further,

The As per section 57 of the KARNATAKA CO-OPERATIVE SOCIETIES ACT 1959, Every year, A co-operative society shall, out of its net profit in any year transfer an amount not being less than twenty-five per cent of the profits to the reserve fund. And such reserve fund cannot be used as working capital of the society and shall be deposited into the co -operative Bank hence there is a Business nexus to the earning of interest income hence eligible for deduction under section 80P(2)(a)(i)

The reliance is placed on following case laws

a. Lankapalli PACS Ltd V/s ITO, held in Honorable ITAT Vishakapatnam SMC Bench, ITA 364/2024.

b. Ismaila Urban Credit C-Op Society Ltd v. ITO, held in Honorouble ITAT Nagpur Bench ITA 122/2023.

Ground No 2:

2. The CIT was not correct in confirming the addition to the extent of Rs. 75,69,826- relating to interest earned on deposits with Co Operative Bank, as the Appellant cooperative is eligible for the cost incurred to earn the interest income, as per section 57 of the Income Tax Act 1961.

The source of money for the deposit is the funds received from the members, on which the interest is paid to the members, the details of the interest paid to the members is given below,

a. The Appellant earned interest income from deposit with following co -operative society and Banks

I. Tumkur Grain Merchant Co -operative Banks of Rs. 25,00,000/-

II. Karnataka State Co-operative Apex bank Limited of Rs.1,50,00,000/-

III. Hanumanthangara Co-Operative Bank Limited of Rs.1,55,00,000/-

IV. Janata Seva Co-Operative Bank Limited of Rs.7,20,00,000/-

V. Punjab National Bank Rs. 20,000/-

Total Investment’s Rs.10,50,20,000

the source of funds is interest bearing deposit received from members, the interest paid to the member is at 8 percent per annum, the total interest paid to members on the deposit is Rs 84,01,600/-

b. addition to the above, administration cost shall be allowed as per section 57 of the income tax act 1961.

The Audited Balance sheet, Profit and Loss Account is attached herewith, the cost of funds is calculated from the Audited Balance sheet and profit and Loss Account, the respective ledgers accounts are also attached herewith.

The reliance is placed on following case laws Alnavar Credit Souhardha Co-Operative Ltd v. ITO, Honorouble ITAT C bench Bangalore ITA 926/2024.

BSNL Employees Co-Operative Society Ltd v. ITO, Honorouble ITAT C bench. Bangalore ITA 1003/2024.

3. As per the decision of the Various hjudicial authorities, the cooperative Bank is considered as Co-Operative Society bank, because, A reading of the definition as per section 2(19) of Income tax act 1961, would make it clear that ‘Co-operative Society’ means a Co-operative Society registered under Cooperative Societies Act, 1912. Thus, a Co-operative Society referred therein is only a co-operative society as defined under the Act, be it a Co-operative Society carrying on banking business or Co-operative Society carrying on the other businesses or a Cooperative bank, hence Co-operative Bank would fall within the purview of the term ‘Co-operative Society’. Hence the interest earned from deposit made in Co-Operative Bank is eligible for deduction under section 80P(2)(d) of the Income Tax 1961.

The reliance Is placed on following case laws Thorapadi Urban Co-op Credit Society Limited, V/s ITO Virupachipuram Urban Co-op Credit Society Limited V/s ITO

In the Honorable High Court of Madras.

The Appellant craves leave to add, to alter, to amend or to delete any of the grounds that may be urged at the time of hearing of the Appeal Wherefore on the above grounds and on such other grounds the Appellant prays the Appellate Authority to delete the additions as above and may pass such other as the Appellate Authority deems fit.”

3. We will take up the appeal in ITA No. 25/Bang/2025 for A.Y. 2016-17 as the lead case and the result arrived in the said appeal will apply mutatis mutandis to the appeals in ITA Nos. 26 to 27/Bang/2025 for A.Ys. 2018-19 & 2020-21.

4. The brief facts of the case are that the assessee is a co-operative society registered under the provisions of the Karnataka Co-operative Societies Act. The assessee filed its return of income and claimed deduction under Chapter VIA of the Act. The case was selected for scrutiny in order to verify the deductions claimed, investments, advances, loans and for the return filed after 07/11/2016 and cash deposits made during the demonetization period. The assessing officer denied the claim of deduction made u/s. 80P(2)(d) of the Act on the interest income earned from the deposits made with the Co-operative Banks and treated the said income as income from other sources. As against the said order dated 30/12/2018, the assessee filed an appeal before the Ld.CIT(A) and the Ld.CIT(A) had confirmed the said order of the AO and thereafter the assessee filed this appeal before this Tribunal.

5. The Tribunal vide its order dated 10/08/2021 had set aside the order of the Ld.CIT(A) and restored the issue to the AO to re-examine the claim of the assessee. Thereafter the AO made the assessment in which the AO had observed that surplus funds has been invested as deposits with various banks and the assessee had not submitted any break-up of interest received from statutory funds and reserve funds and therefore held that the interest income earned on surplus funds are ineligible for deduction u/s. 80P of the Act and again treated the said income as income from other sources. The AO also granted 25% of the interest income as expenses to earn that interest income and brought to tax the balance interest income of Rs. 75,69,826/-under the head income from other sources.

6. As against the said order, the assessee filed an appeal before the Ld.CIT(A) and contended that the interest income was earned on the deposits of surplus / reserve funds, which can be deposited in any of the modes mentioned in section 58 of the Karnataka Co-operative Societies Act and therefore the said income is also an eligible income for deduction u/s. 80P(2)(a) of the Act. The assessee also disputed the calculation of the expenditure at 25%. The Ld.CIT(A) had dismissed the appeal by holding that the assessee is not entitled for deduction u/s. 80P(2)(d) of the Act since the deposits are made in co-operative bank or scheduled bank. The Ld.CIT(A) also confirmed 25% of the deduction allowed by the AO. As against the said orders, the assessee is in appeals before this Tribunal.

7. At the time of hearing, the Ld.AR submitted that the Ld.CIT(A) had failed to consider the plea that the deposits are made pursuant to the provision contained in the Karnataka Co-operative Societies Act and therefore the assessee had to mandatorily deposits the funds available with them in a co-operative bank. The Ld.AR also took us through the section 58 of the Karnataka Co-operative Societies Act as well as section 57 of the Act. The Ld.AR further submitted that this Tribunal had considered the deposits made by the assessee pursuant to section 57 and 58 of the Karnataka Cooperative Societies Act and held that the interest income earned from the said deposits would be entitled for deduction u/s. 80P(2)(a)(i) of the Act. The Ld.AR also filed two paper books in which the Ld.AR of the assessee had enclosed the byelaw copy of the society, audited financials and orders of the Tribunal in support of their case. Subsequently, the Ld.AR also filed another paper book in which the audited receipts and payment account, profit & loss account and balance sheet for the Financial Years 2015-16 and 2016-17 were enclosed. The assessee also furnished the details of the interest payment made to the members and also relied on the judgment of the Hon’ble Karnataka High Court in the case of Lalitamba Pattina Souharda Sahakari Niyamita v. ITO in [IT Appeal No. 100004 of 2018, dated 19-2-2018] and prayed to allow these appeals.

8. The Ld.DR relied on the orders of the lower authorities and submitted that the interest income received from the co-operative banks are not eligible for deduction u/s. 80P of the Act.

9. We have heard the arguments of both sides and perused the materials available on record.

10. The assessee at the time of filing his objections had specifically contended that the interest is earned on deposit of reserve fund and statutory funds and therefore the assessee is entitled for deduction u/s. 80P(2)(a)(i) of the Act. The assessee also gave the break-up figures of the reserve fund, statutory fund and on the said funds, the interest income was derived. But the AO while dealing with the said contention had observed that the assessee had not submitted any break-up of interest received from statutory funds and reserve funds. The AO mainly relied on the judgment of the Hon’ble Supreme Court in the case of Totgars, Co-operative Sale Society Ltd. v. Income-tax Officer (SC) and the subsequent judgment of the Hon’ble Karnataka High Court in case of Principal Commissioner of Income-tax v. Totagars Co-operative Sale Society ITR 611 (Karnataka) and denied the deduction claimed by the assessee u/s. 80P(2)(a)(i) of the Act. Even before the Ld.CIT(A), the assessee in the statement of facts had submitted that they have to mandatorily deposit the surplus funds in the co-operative banks and therefore the interest income received from the said deposits are nothing but out of compulsion and therefore the said income is also eligible for deduction u/s. 80P(2)(a)(i) of the Act. The Ld.CIT(A) had not considered the said submissions and confirmed the order of the AO by relying on the judgment of the Hon’ble Karnataka High Court as well as the Hon’ble Supreme Court in the case of Totagars Co-operative Sales Society (supra). The Ld.CIT(A) had not considered the submissions made by the assessee that as per sections 57 and 58 of the Karnataka Co-operative Societies Act, they have to necessarily deposits its funds in any of the cooperative bank. When the assessee had relied on the provision of the Karnataka Co-operative Societies Act for depositing the funds with the cooperative banks, it has to be considered as an income received from the profits and gains of business and therefore eligible for deduction u/s. 80P(2)(a)(i) of the Act. If there is no statutory requirement, the assessee would not have deposited the said amount in a co-operative bank and therefore the assessee is eligible for deduction u/s. 80P(2)(a)(i) of the Act.

11. We have also perused the byelaw of the society and the relevant provisions of the Karnataka Co-operative Societies Act and we find in the byelaw, the society is having an authorization to deposit the funds in any of the co-operative banks. Therefore the deposits are done pursuant to the byelaws as well as the provisions in the Karnataka Co-operative Societies Act and therefore it cannot be simply brushed aside that the assessee is not entitled for deduction u/s. 80P(2)(a)(i) of the Act. We have also perused the audited financials submitted by the assessee in which we are not able to find that the deposit amounts are the liabilities of the society and therefore the funds available with the assessee could be taken as an investment made out of its own funds and therefore the assessee is entitled for deduction u/s. 80P(2)(a)(i) of the Act. We have also perused the judgment of the Hon’ble Supreme Court in the case of Totagars Co-operative Sales Society v. ITO in which the facts are different and therefore the said judgment was differentiated by the subsequent orders as well as the judgment of the Tribunal and the Hon’ble High Courts. In the above said judgment, the assessee society received the money on the sale of agricultural produce of the members and the said money of the members were deposited and claimed deduction which was not accepted by the Hon’ble Supreme Court. The facts in the present case are different from the said facts and therefore the disallowance made by the AO by relying on the judgment of the Hon’ble Supreme Court is not correct.

12. The subsequent judgment of the Hon’ble Karnataka High Court in Totagars Co-operative Sale Society (supra), the question arose for the consideration of the Hon’ble High Court is that whether the assessee is entitled for deduction u/s. 80P(2)(d) of the Act when they receive the interest income from the cooperative banks. This judgment of the Hon’ble Karnataka High Court was differentiated by the later judgment of the Hon’ble Jurisdictional High Court dated 19/02/2018 in ITA No. 100004/2018 in the case of Lalitamba Pattina Souharda Sahakari Niyamita (supra) wherein the Division Bench of the Hon’ble Jurisdictional High Court held as follows:

“13. The Co-ordinate Bench of this Court in Tumkur Merchants Souharda Credit Co-operative Limited supra has categorically observed that the interest earned by the society in investing in the Banks is attributable to the activity of carrying on business in the banking or providing credit facilities to its members by a Co-operative Society and is liable to be deducted from the gross total income under Section 80P of the Act. The judgment of the Hon’ble Apex Court in the case of Totgars Co-operative Sale Society Limited supra is also considered and distinguished. The view taken by the Andhra Pradesh High Court in the Commissioner of Income Tax -III, Hyderabad, v. Andhra Pradesh State Co-operative Bank Limited, reported in (2011) is also considered whereby Andhra Pradesh High Court has held that the interest earned by the Co-operative Society by investing the fixed deposits in the Banks is entitled for deduction under Section 80P(2)(i)(a) of the Act. It is also pertinent to note that this judgment of the jurisdictional High Court in Tumkur Merchants Souharda Credit Cooperative Limited supra, has reached finality. As submitted by the learned counsel for the assessee, the applicability of this Tumkur Merchants Souharda Credit Co-operative Limited supra to the facts of the present case is not considered by the authorities in a right perspective. The Tribunal proceeded to hold that the Commissioner of Income Tax (Appeals) has considered the judgment of Tumkur Merchants Souharda Credit Cooperative Limited supra as well as M/s. Totgar’s Cooperative Sale Society Limited supra and given the benefit of deduction under Section 80P on the interest or dividend received in respect of income by way of deposits with the Co- operative Banks from its investment. The Tribunal proceeded to consider the deduction given under Section 80P(2)(d) of the Act as the deduction under Section 80P(2)(a)(i) of the Act or in other words deduction given under Section 80P(2)(d) of the Act would not further entitle the appellant/assessee to claim deduction under Section 80P(2)(a)(i) of the Act. These two provisions being entirely different and distinct, the Tribunal ought to have examined the applicability of Section 80P(2)(a)(i) of the Act in the facts and circumstances of the case. Deduction given under Section 80P(2)(d) of the Act would not disentitle the assessee to claim deduction under Section 80P(2)(a)(i) of the Act. Even assuming as submitted by the learned counsel for the assessee, M/s. Totgar’s Co-perative Sale Society Limited supra is applicable to the facts and circumstances of the present case, it was obligatory on the part of the Tribunal being a last fact finding authority to examine the factual aspect in respect of the proportionate costs and administration expenses to be incurred by the appellant regarding the interest earned under Section 56 of the Act and the availability of deduction under Section 57 of the Act to the assessee. This exercise also not being done by the Tribunal merely upholding the order of the Commissioner of Income Tax as well as the Assessing Officer is wholly unsustainable.

14. The judgment relied upon by the learned counsel for the revenue in the case of Totgar’s Co-perative Sale Society Limited supra, deals with Section 80P(2)(d). As aforesaid, Section 80P(2)(d) and Section 80P(2)(a)(i) of the Act being different, the said judgment is not squarely applicable to the facts of the present case. The applicability of Section 80P(2)(a)(i) of the Act has to be considered in terms of the said section. The authorities mixing up the issue of Section 80P(2)(a)(i) and Section 80P(2)(d) cannot reject the claim of the assessee under Section 80P(2)(a)(i) of the Act without giving a proper finding on the issue.”

13. In the subsequent judgement the Division Bench of the Hon’ble Jurisdictional High Court had relied on the judgment of the earlier Division Bench order dated 28/10/2014 in the case of Tumkur Merchants Souharda Credit Cooperative Ltd. v. ITO ITA No. 307 of 2014 (Karnataka) wherein the Hon’ble Jurisdictional High Court had clearly dealt with the issue in the following terms.

“10. In the instant case, the amount which was invested in banks to earn interest was not an amount due to any members. It was not the liability. It was not shown as liability in their account. In fact this amount which is in the nature of profits and gains, was not immediately required by the assessee for lending money to the members, as there were no takers. Therefore they had deposited the money in a bank so as to earn interest. The said interest income is attributable to carrying on the business of banking and therefore it is liable to be deducted in terms of Section 80P(1) of the Act. In fact similar view is taken by the Andhra Pradesh High Court in the case 12. In that view of the matter, the order passed by the appellate authorities denying the benefit of deduction of the aforesaid amount is unsustainable in law. Accordingly it is hereby set aside. The substantial question of law is answered in favour of the assessee and against the revenue. Hence, we pass the following order:

Appeal is allowed.

The impugned order is hereby set aside. Parties to bear their own cost.”

14. The latest judgment of the Hon’ble Karnataka High Court referring this judgment and its findings and took note of the fact that the said judgment was not challenged by the revenue and held that the interest income earned out of the surplus amount deposited in the co-operative bank would be eligible for deduction u/s. 80P(2)(a)(i) of the Act for the simple reason that the interest income is attributable to the business activities of the assessee.

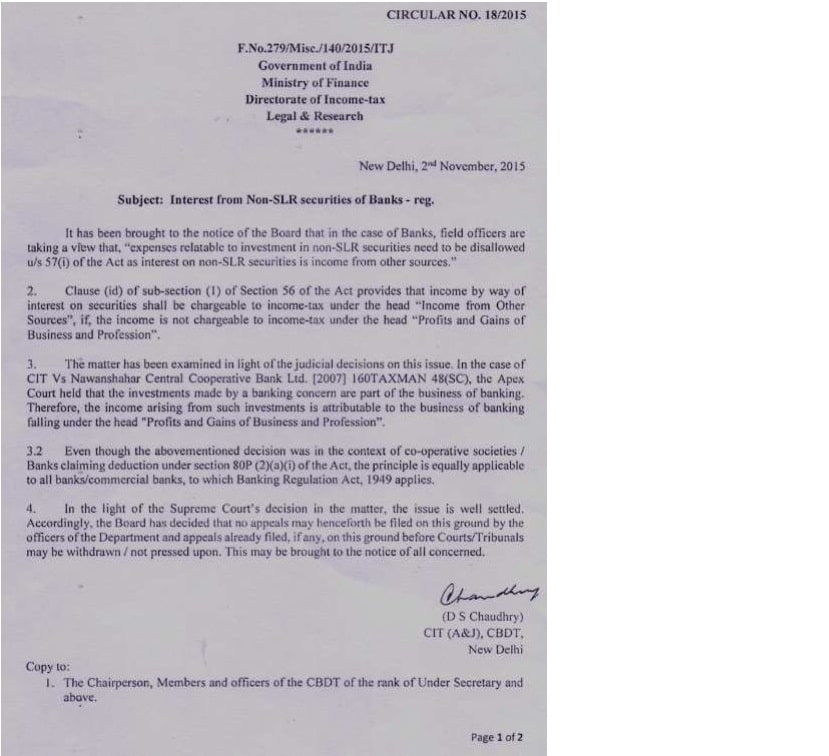

15. We have also perused the Circular No. 18/2015 dated 02/11/2015 issued by the CBDT in which the CBDT relied on the judgment of the Hon’ble Supreme Court in the case of CIT v. Nawanshahar Central Co-operative Bank Ltd. (SC) and held that the income arising from the investments by the banks is attributable to the business of banking falling under the head profits & gains of business and provision. For the sake of clarity, we have extracted this Circular which reads as follows:

16. We have also gone through the order of the ITAT Nagpur Bench in Ismailia Urban Co- op. Society v. ITO [IT Appeal No. 122 (Nag.) of 2023, dated 18-6-2024] wherein the Tribunal had considered the Circular and the judgments of the Hon’ble Supreme Court as well as the Hon’ble Karnataka High Court and held as follows:

“8. The learned authorized representative vehemently submitted that both the lower authorities have seriously misapplied upon law and facts in denying the deduction under Section 80P(2)(a)(i). Even submitted before us Page | 19 the assessment order for the Assessment Year 201617, wherein in the course of assessment under Section 143(3), deduction under Section 80P(2)(a)(i) was allowed. There being no change in the underlying facts and circumstances. He pleaded, the similar deduction should be allowed in the current year also. Upon confronting these facts before the departmental representative, he pleaded that reliance may be made upon the orders of the lower authorities in view of the fact that interest from fund not required immediate for business purposes is not eligible for deduction under Section 80P. “

17. In view of the law laid down by the Hon’ble Jurisdictional High Court in case of Lalitamba Pattina Souharda Sahakari Niyamita (supra), the interest income earned by the assessee out of the surplus funds of the society could not be treated as income from other sources. Further, it is the case of the assessee that the assessee has to deposit its funds with the co-operative banks as per the provisions of the Karnataka Co-operative Societies Act and therefore the interest income earned out of compulsion could be treated as income obtained from the profits and gains of business/profession and they are entitled for deduction u/s. 80P(2)(a)(i) of the Act. The AO as well as the Ld.CIT(A) had not considered the earlier judgment of the Hon’ble Karnataka High Court in the case of Tumkur Merchants Souharda Credit Co-operative Ltd. (supra) and Lalitamba Pattina Souharda Sahakari Niyamita (supra) in order to appreciate the fact whether the interest income earned is attributable to the business of banking activities done by the assessee. Even though in the earlier round, this Tribunal had remitted the issue to the AO to re-examine the plea raised by the assessee that the investments which yielded interest income were all investments that are statutorily required to be maintained under the Karnataka Co-operative Societies Act, the AO had not considered the said direction.

18. In respect of the statutory deposits made by the co-operative societies, the Constitutional Bench of the Hon’ble Supreme Court in the case of CIT v. Karnataka State Co-operative Apex Bank (SC), had held as follows:

“Interest arising from investment made, in compliance with statutory provisions to enable it to carry on banking business, out of reserve fund by a co-operative society engaged in banking business, is exempt under section 80P(2)(a)(i) of the Income-tax Act, 1961. The placement of such funds being imperative for the purpose of carrying on banking business the income there-from would be income from the assessee’s business.

There is nothing in the phraseology of section 80P(2)(a)(i) which makes it applicable only to income derived from working or circulating capital. “

19. Therefore, the interest income received by way of mandatory / statutory deposits would also eligible for deduction u/s. 80P(2)(a)(i) of the Act by treating the said income as business income.

20. In such circumstances, we are of the view that the order of the authorities below are liable to be set aside and again we remit the issue to the AO to consider the statutory deposit plea as well as the judgment of the Hon’ble Karnataka High Court in case of Lalitamba Pattina Souharda Sahakari Niyamita (supra) and thereafter decide the issue afresh, after giving notice to the assessee.

21. In the result, the appeals filed by the assessee are allowed for statistical purposes.