Instructions for filling out Form ITR-7

Download ITR-7 -AY 2017-18 PDF English

These instructions are guidelines for filling the particulars in this Return Form. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961 and the Income-tax Rules, 1962.

1. Assessment Year for which this Return Form is applicable

This Return Form is applicable for assessment year 2017-18 only i.e., it relates to income earned in Financial Year 2016-17.

2. Who can use this Return Form?

This Form can be used by persons including companies who are required to furnish return under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D) or section 139(4E) or section 139(4F).

3. Annexure-less Return

Form Tax-payers are advised to match the taxes deducted/collected/paid by or on behalf of them with their Tax Credit Statement (Form 26AS). (Please refer to www.incometaxindia.gov.in)

4. Manner of filing this Return Form

This Return Form can be filed with the Income-tax Department in any of the following ways, –

(i) by furnishing the return electronically under digital signature;

(ii) by transmitting the data in the return electronically under electronic verification code;

(iii) by transmitting the data in the return electronically and thereafter submitting the verification of the return in Return Form ITR-V;

However, a political party shall compulsorily furnish the return in the manner mentioned at (i) above.

From assessment year 2013-14 onwards in case an assessee who is required to furnish a report of audit under section 10(23C)(iv), 10(23C)(v), 10(23C)(vi), 10(23C)(via), 10A, 10AA, 12A(1)(b), 44AB, 44DA, 50B, 80-IA, 80-IB, 80-IC, 80-ID, 80JJAA, 80LA, 92E, 115JB or 115VW he shall file the report electronically on or before the date of filing the return of income.

5. Filling out the acknowledgement

Where the Return Form is furnished in the manner mentioned at 4(iii), the assessee should print out two copies of Form ITR -V. One copy of ITR-V, duly signed by the assessee, has to be sent by ordinary post to Post Bag No. 1, Electronic City Office, Bengaluru–560100 (Karnataka). The other copy may be retained by the assessee for his record.

6. Codes for filling this Return Form

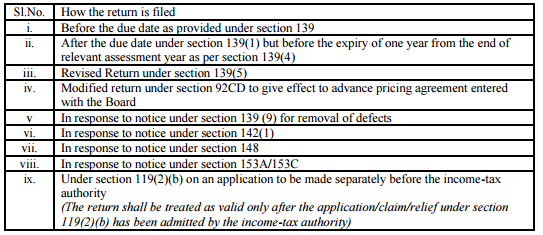

(i) Under the heading ‘Filing Status’ in the Return Form the relevant box needs to be checked regarding section under which the return is being filed on the basis of following

(ii) Under the head Audit Information, if the assessee is liable for Audit u/s 44AB and the accounts have been audited by an accountant, the details of such audit report along with the date of furnishing it (if filed before the return) to the department has to be filled. Further, if the assessee is liable to furnish other audit report, the section under which such audit is required and the date of furnishing it to the department (if audit has been carried out under that section) has to be filled. From A.Y. 2013-14 it has become mandatory to furnish audit reports (if the audit has been carried out) under the following sections electronically on or before the date of filing the return of income.