ITR Date extension AY 2025-26 for whom date not extended to 10th Dec 2025

we will analyze press release from the Central Board of Direct Taxes (CBDT).

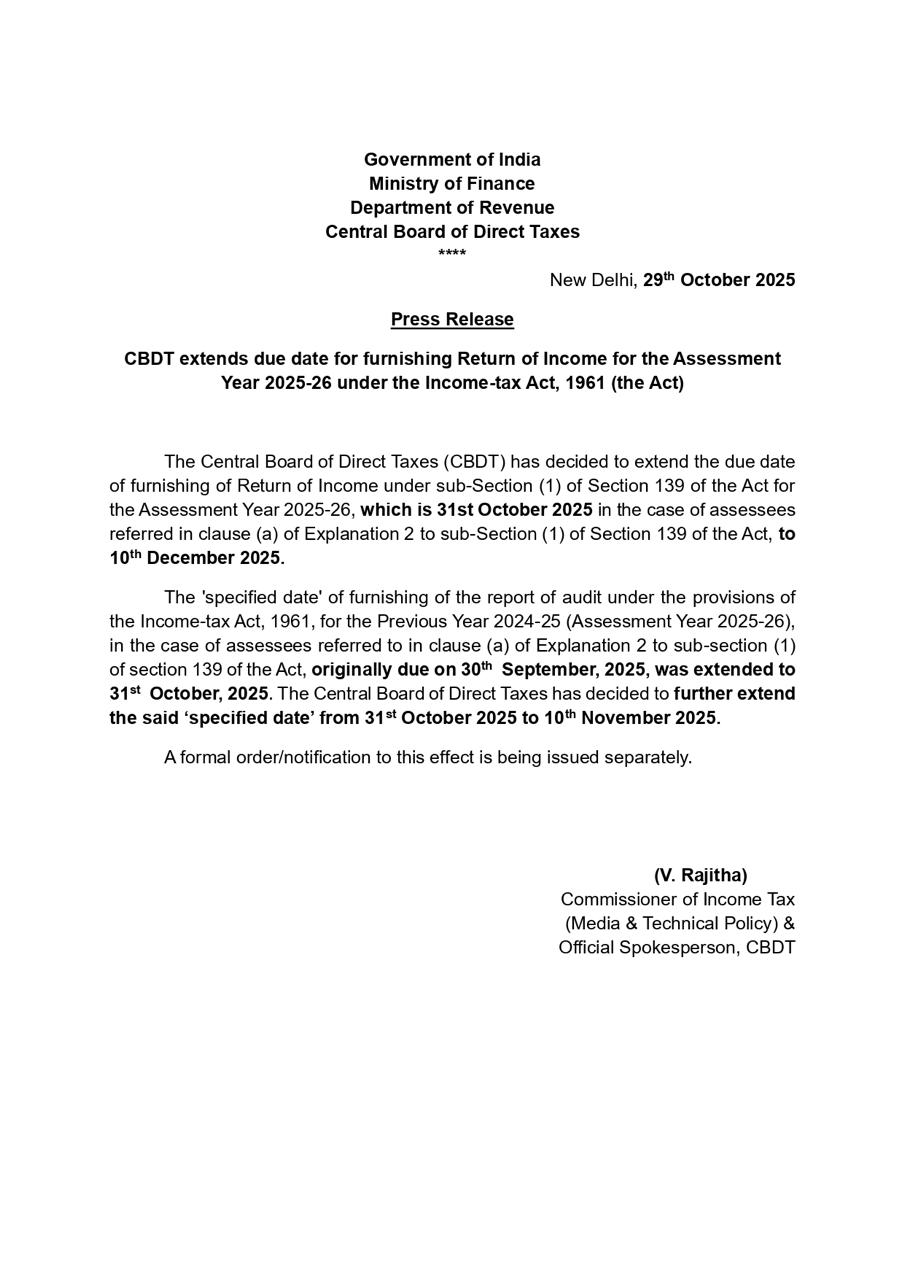

Based o Press Release dated October 29, 2025 , here is the analysis of the Income Tax Return (ITR) and Tax Audit due date extensions for the Assessment Year (AY) 2025-26 and the corresponding Previous Year (PY) 2024-25:

Summary of Due Date Extensions

The extensions announced in the press release apply only to specific categories of taxpayers:

| Document | Original Due Date | Extended Due Date |

| Furnishing of Audit Report (Tax Audit Report) | October 31, 2025 | November 10, 2025 |

| Furnishing of Income Tax Return (ITR) | October 31, 2025 | December 10, 2025 |

For Whom the Dates Are EXTENDED

The extensions apply to the following categories of assesses:

- Extension of ITR Filing Date (to December 10, 2025):

- Assessees referred to in clause (a) of Explanation 2 to sub-section (1) of section 139 of the Income-tax Act, 1961.

- This clause primarily covers companies (and other assessees) whose accounts are required to be audited.

- Extension of Tax Audit Report Furnishing Date (to November 10, 2025):

- Assessees referred to in clause (a) of Explanation 2 to sub-section (1) of section 139 of the Act.

- This is for the furnishing of the Report of Audit (e.g., Form 3CB/3CD or 3CA/3CD) for PY 2024-25 / AY 2025-26.

In simple terms, the extension is for assessees who are liable to get their accounts audited under the Income-tax Act.

For Whom the Dates Are NOT Extended (Regular Due Dates Apply)

The press release does not mention any extension for other categories of taxpayers. Therefore, the original due dates remain applicable for them.

| Category of Assessee | Applicability of Audit | Relevant ITR Due Date (AY 2025-26) |

| Individual / HUF / AOP / BOI (Non-Audit Cases) | Not Applicable | July 31, 2025 (Original Date was extended till 16 Sep 2025) |

| Taxpayers Liable for Tax Audit (Non-Company) | Applicable (e.g., those crossing turnover limits) | October 31, 2025 (Original Date – now extended for this category to 10th Dec 2025) |

| Companies NOT Liable for Tax Audit | Not Applicable | October 31, 2025 (Original Date) |

| Working Partner of a Firm Liable for Audit | Applicable (as per firm’s due date) | October 31, 2025 (Original Date – now extended for this category y to 10th Dec 2025)) |

The most common category for which the extension is NOT applicable is the general public (Individuals/HUF/etc.) whose ITR filing due date for AY 2025-26 remains July 31, 2025.

The extension is narrowly focused on the audit and audit-related ITR deadlines.

Based on the CBDT Press Release dated October 29, 2025 and the subsequent formal notification to be issued by the CBDT, here is the clear analysis of for whom the dates are extended and for whom they are not:

Key Extensions for AY 2025-26 (PY 2024-25)

The extensions are ONLY for assessees who are liable to get their accounts audited under the Income-tax Act, 1961, or any other law.

| Document | Assessee Category | Original Due Date (S. 139(1) Expl. 2(a)) | NEW Extended Due Date |

| Tax Audit Report (e.g., Form 3CD) | All Assessees Liable for Audit | October 31, 2025 | November 10, 2025 |

| Income Tax Return (ITR) | All Assessees Liable for Audit | October 31, 2025 | December 10, 2025 |

1. Due Dates EXTENDED (Assessees Covered by the Extension)

The extension applies to assessees referred to in clause (a) of Explanation 2 to sub-section (1) of section 139 of the Income-tax Act, 1961. This group includes:

| Category | Primary Reason for Coverage |

| Companies (All) | Compulsory audit irrespective of turnover/profit. |

| Firms (Including LLP) | If turnover/gross receipts exceed the specified limit (e.g., ₹1 Cr / ₹10 Cr under Section 44AB). |

| Working Partner of a firm whose accounts are required to be audited. | The due date is linked to the firm’s audit due date. |

| Other Persons (Individual, HUF, etc.) | Whose accounts are required to be audited under Section 44AB (e.g., turnover/receipts exceed limits or are below presumptive limits but income is above basic exemption). |

In short: If a taxpayer needs a Tax Audit (Form 3CD/3CB/3CA), both their Audit Report and ITR deadlines are extended.

2. Due Dates NOT Extended (Assessees on Original Deadlines)

The extensions in this Press Release do not apply to any other category of taxpayer.

| Category | Original Due Date for ITR (AY 2025-26) | Status of Extension |

| Individuals, HUF, AOP, BOI (Non-Audit Cases) | July 31, 2025 (This date was earlier extended to September 16, 2025, for this AY, but that deadline has already passed.) | NOT Extended by this Press Release. |

| Assessees Requiring Transfer Pricing Report (Sec 92E) | November 30, 2025 | NOT Extended by this Press Release (The Press Release only extends the October 31 deadline for non-TP audit cases). |

Specific Example: Companies Not Liable for Tax Audit

Your specific example of “companies not liable for tax audit” is covered under the first bullet point (Companies) above.

- Under the Income-tax Act, every company is required to file its ITR by the due date prescribed in Section 139(1) Explanation 2(a), which is the audit case deadline (even if there is no specific audit requirement under other sections like 44AB).

- Therefore, all companies benefit from the ITR extension to December 10, 2025.

KeyTakeaway & Action Points

- Prioritize Audit Reports: The new Tax Audit Report deadline is November 10, 2025. This is the first critical date to meet, as the ITR cannot be filed without the accepted Audit Report.

- ITR Relief: Taxpayers requiring an audit now have until December 10, 2025, to file their ITR (e.g., ITR-6 for companies, ITR-3 for audit individuals/firms).

- Non-Audit Cases: Individuals and other non-audit taxpayers whose ITR was due on July 31, 2025 (or the extended date of September 16, 2025) are not affected and have already missed the deadline, making their current filing a Belated Return (subject to Sec 234A interest and Sec 234F fee).