Late Fees for GSTR 9 & GSTR 9C

Late Fees for GSTR 9 and GSTR 9C . GST Annual Return Late Fees

Video on Late Fees of GSTR 9 and GSTR 9C

Commentary on Late Fees of GSTR 9

- Late Fees is Charged under Section 47 of CGST Act for delayed filing of GSTR 9 and GSTR 9C

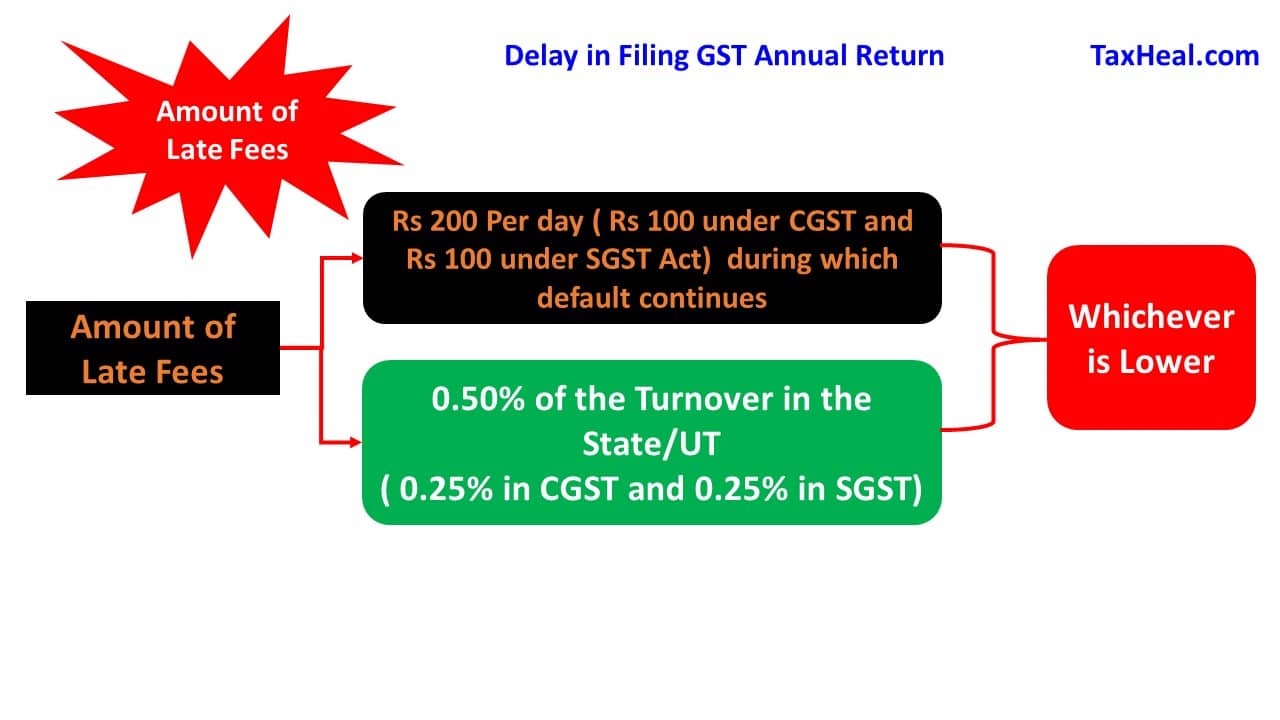

- Late fees for delayed filing of GSTR 9& GSTR 9C is Lower of the Following

- Rs 200 Per day ( Rs 100 under CGST and Rs 100 under SGST Act) during which default continues

- 0.50% of the Turnover in the State/UT ( 0.25% in CGST and 0.25% in SGST)

Example

In the year 2020-21 M/s ABC Enterprises had a turnover of Rs 3 crores in the State of UP, and the last date to file FORM GSTR – 9 was 28th February 2022. The annual return was actually filed on 15th March 2022. What is the amount of late fee that M/s ABC Enterprises is required to pay?

If we calculate the delay in terms of number of days then the delay would be of 15 days and if we multiply it by Rs 200 per day, the total amount of late fee would be Rs 3000/- (Rs 1500/- under the CGST Act and Rs 1500/- under the SGST Act).

Whereas if we calculate the late fee based on the turnover in State then the late fee would be 0.5% of Rs 3,00,00,000, which is Rs 1,50,000/-.

Therefore, in this case the late fee would be Rs 3000/-.

- More than one GSTIN : If a dealer has more than 1 GSTIN then he is under an obligation to file different annual returns for each GSTIN. Thus Late fees will be charged for each GSTIN filing Annual Return after due date

- Can I file Form GSTR-9 return without paying late fee (if applicable)? : Answer No. You can’t file Form GSTR-9 without payment of late fee for Form GSTR-9, if same is filed after the due date.

- Can person applty to High Court declaring Section 47 of Late Fees as uncontitutional : Where two advocates filed writ petition, in nature of public interest, challenging constitutional validity of section 47 as being ultra vires constitution, petition was dismissed on plea that there was no reason why such an issue should be examined in a public interest petition [Held by High Court ]

Related Post

GST Returns : Free study Material

GST Annual Return : Complete Guide

Also Refer Govt Website www.gst.gov.in