Legal Heir Registration in e-Filing on incometaxindiaefiling.gov.in

User should register as a Legal Heir to e-File on behalf of the deceased. Deceased person’s PAN and Legal Heir’s PAN should be registered in the e-Filing portal. If Deceased person PAN is not registered in the portal then the Legal Heir can register on behalf of the deceased person (This feature is provided for Individual user only)

Steps involved in Legal Heir Registration – New Request

Step 1 – Login to e-Filing portal using Legal Heir Credentials

Step 2 – My Account Register as Legal Heir

Step 3 – Select the Type of Request – New Request

Step 4 – Enter the details of Deceased

PAN

Date of Birth

Surname

Middle Name

First Name

Step 5 – Select the files to upload

Step 6 – Attach a Zip File with the below scanned documents

Copy of the Death Certificate

Copy of PAN card of the deceased

Self-attested PAN card copy and

Legal Heir Certificate Or Affidavit in presence of a Notary Public

Step 7 – Click Submit

Note: Following documents will be accepted as Legal Heir certificate.

The legal heir certificate issued by court of law

The legal heir certificate issued by the Local revenue authorities.

The certificate of surviving family members issued by the local revenue authorities

The registered will

The Family pension certificate issued by the State/Central government.

Approval Process

Step 1 – Legal Heir New request will be sent to the e-Filing Administrator.

Step 2 – The e-Filing Administrator will verify the request and approve / reject as applicable.

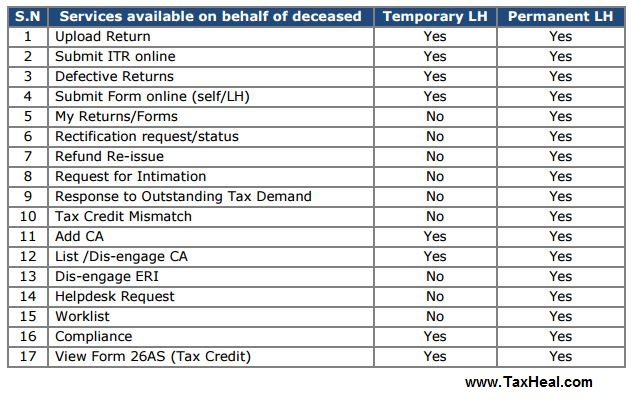

Note: e-Filing Administrator may approve as Temporary Legal Heir or Permanent Legal Heir, based on the documents uploaded. An e-mail is sent to the registered e-mail ID with the details of approval / rejection.

Temporary Legal Heir

A person is treated as a Temporary Legal Heir when fails to submit any one of the five Legal Heir certificates as specified.

Permanent Legal Heir

A person is treated as a Permanent Legal Heir when the person submits any one of the five Legal Heir certificates mentioned above.

Steps involved in Legal Heir Registration – Upgrade to Permanent LH

Step 1 – Login to e-Filing portal using Legal Heir Credentials

Step 2 – My Account Register as Legal Heir

Step 3 – Select the Type of Request – Upgrade to Permanent LH

Step 4 – Select the Legal Heir Certificate

Step 5 – Upload the Scan document of any one of the Legal Heir Certificate.

Step 6 – Click Submit

Upgrade to Permanent Legal Heir request will be sent to the e-Filing Administrator.

The e-Filing Administrator will verify the request and approve / reject as applicable.

To view the status of the request

o Login using Legal Heir Credentials

o My Request List Select Add Legal Heir Request.

The Legal Heir should add his/her PAN in the verification part of the ITR Form, validate and generate the xml of the return (if using offline forms) and upload the return of the deceased using the Legal Heir login.

Key Points to be noted:

Documents in regional language should be translated to Hindi or English. The translated document should be notarized (Both the original and translated document should be uploaded).

The uploaded documents should be scanned in PDF format with 300 dpi.

The zip file attachment should not exceed 1Mb.

Legal Heir Services

Related Post

- Notice issued to Dead person u/s 147 is illegality : High Court

- RBI clarify Legal Guardianship Certificates in case of person with mental disorder

- e-Filing Process of Income Tax Return :FAQ’s

- Trouble Shooting on e-Filing of Income Tax Return

My request for registration as legal heir has been rejected four times. I want to know the reason for rejection. Where will I know the reason,so it can be rectified/complied