E way Bill FAQs

General Portal

What is the common portal for generation of e-way bill?

I am not getting OTP on my mobile, what should I do?

E-way bill system is slow, how should I proceed?

E-way bill pages or menu list are not being shown properly, what should I do?

[ Download all FAQs on Eway bill in PDF : Click here ]

Registration

I have already registered in GST Portal. Whether I need to register again on the eWay Portal?

Whenever I am trying to register, the system is saying you have already registered, how should I proceed?

Whenever I am trying to register, the system is saying there is no contact (Mobile) number with this GSTIN in GST Common Portal, how should I resolve this issue?

Whenever, I’m trying to register with my GSTIN, the system is saying ‘Invalid GSTIN’ or the details for this GSTIN are not available in GST Common Portal. How should I resolve this issue?

Whenever I am trying to register, the system is showing wrong address or mobile number. How should I resolve this issue?

Enrolment

Why the transporter needs to enroll on the e-way bill system?

What is TRANSIN or Transporter ID?

How does the unregistered transporter get his unique id or transporter id?

I am unable to enrol as transporter as the system is saying ‘ PAN details are not validated’

I am unable to enrol as transporter as the system is saying ‘ Aadhaar details are not validated’

Whenever, I am trying to enrol as transporter, the system is saying you are already registered under GST system and go and register using that GSTIN

Whenever I am trying to enrol as a transporter, the system is saying you have already enrolled.

Login

Whenever, I am trying to login the system says ‘Invalid Login…Please check your username and password. How should I resolve this issue?

Whenever, I am trying to login the system says ‘Your account has been frozen’. How should I resolve this issue?

Whenever, I am trying to login the system says ‘your account has been blocked…Pl try after 5 minutes. How should I resolve this issue?

What should I do, if I am not remembering my username and password?

E-Way Bill

What is an e-way bill?

Why is the e-way bill required?

Who all can generate the e-way bill?

What are pre-requisites to generate the e-way bill?

If there is a mistake or wrong entry in the e-way bill, what has to be done?

Whether e-way bill is required for all the goods that are being transported?

Is there any validity period for e-way bill?

While calculating time validity for e-way bill, how is a day determined?

This can be explained by following examples –(i) Suppose an e-way bill is generated at 00:04 hrs. on 14th March. Then first day would end on 12:00 midnight of 15 -16 March. Second day will end on 12:00 midnight of 16 -17 March and so on.

(ii) Suppose an e-way bill is generated at 23:58 hrs. on 14th March. Then first day would end on 12:00 midnight of 15 -16 March. Second day will end on 12:00 midnight of 16 -17 March and so on.

Which types of transactions that need the e-way bill?

What is the Part-A Slip?

When I enter the details in e-way bill form, the system is not generating e-way bill, but showing Part-A Slip?

How to generate e-way bill from Part-A Slip?

What are the documents that need to be carried along with the goods being transported?

How to generate the e-way bill from different registered place of business?

How does taxpayer enter Part-A details and generate e-way bill, when he is transporting goods himself?

What has to be entered in GSTIN column, if consignor or consignee is not having GSTIN?

When does the validity of the e-way bill start?

How is the validity of the e-way bill calculated?

How the distance has to be calculated, if the consignments are imported from or exported to other country?

Whether e-way bill is required, if the goods are being purchased and moved by the consumer to his destination himself?

Can the e-way bill be modified or edited?

Before submission, the system is not allowing to edit the details. What is the reason?

The system shows the ‘Invalid Format’ when we are trying to enter the vehicle number. What is the reason?

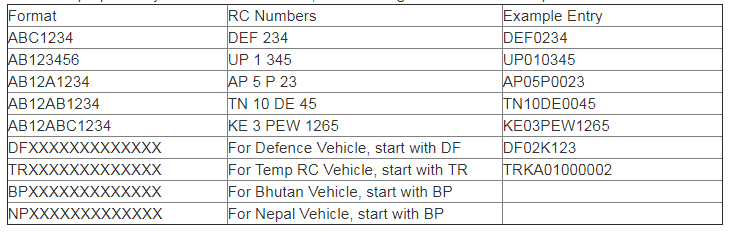

What are the formats of vehicle number entry?

How to enter the vehicle number DL1AB123 as there is no format available for this in e-way bill system?

How can anyone verify the authenticity or the correctness of e-way bill?

How to generate e-way bill for multiple invoices belonging to same consignor and consignee?

What has to be done by the transporter if consignee refuses to take goods or rejects the goods for anyreason?

What has to be done, if the validity of the e-way bill expires?

Can I extend the validity of the e-way bill?

How to extend the validity period of e-way bill?

Who can extend the validity of the e-way bill?

How to handle “Bill from” – “Dispatch from” invoice in e-way bill system?

How the transporter is identified or assigned the e-way bill by the taxpayer for transportation?

How to generate e-way bill, if the goods of one invoice is being moved in multiple vehicles simultaneously?

Where the goods are being transported in a semi knocked down or completely knocked down condition, the EWB shall be generated for each of such vehicles based on the delivery challans issued for that portion of the consignment as per CGST Rule 55 which provides as under:(a) Supplier shall issue the complete invoice before dispatch of the first consignment;

(b) Supplier shall issue a delivery challan for each of the subsequent consignments, giving reference of the invoice;

(c) eachconsignment shall be accompanied by copies of the corresponding delivery challan along with a duly certified copy of the invoice; and

(d) Original copy of the invoice shall be sent along with the last consignment

Please note that multiple EWBs are requiredto be generatedin this situation. That is, the EWB has to be generated for each consignment based on the delivery challan details along with the corresponding vehicle number.

Updating Transportation/vehicle/Part-B details

Whether Part-B is must for e-way bill?

Can I transport the goods with the e-way bill without vehicle details in it?

Whether the e-way bill is required for movement of consignment for weighment to the weighbridge?

Who all can update the vehicle number for the e-way bill?

Can Part-B of e-way bill entered/updated by any other transporter?

If the vehicle, in which goods are being transported, having e-way bill is changed, then what is requiredto be done?

What is to be done(in an EWB) if the vehicle breaks down?

How many times can Part-B or Vehicle number be updated for an e-way bill?

Can the e-way bill entry be assigned to another transporter by authorized transporter?

In case of transportation of goods via rail/air/ship mode, when is user required to enter transport document details, as it is available only after submitting of goods to the concerned authority?

If the goods having e-way bill has to pass through trans-shipment and through different vehicles, how it has to be handled?

Can I use different modes of transportation to carry the goods having ane-way bill? If so, how to update the details?

How to enter multiple modes of transportation, i.e., road, rail, ship, air for the same e-way bill?

One e-way bill can go through multiple modes of transportation before reaching destination. As per the mode of transportation, the EWB can be updated with new mode of transportation by using ‘Update Vehicle Number’.Let us assume the goods are moving from Cochin to Chandigarh through road, ship, air and road again. First, the taxpayer generates the EWB by entering first stage of movement (by road) from his place to ship yard and enters the vehicle number. Next, he will submit the goods to ship yard and update the mode of transportation as Ship and transport document number on the e-way bill system. Next, after reaching Mumbai, the taxpayer or concerned transporter updates movement as road from ship yard to airport with vehicle number. Next the taxpayer or transporter updates, using ‘update vehicle number’ option, the Airway Bill number. Again after reaching Delhi, he updates movement through road with vehicle number. This way, the e-way bill will be updated with multiple mode of transportation.

How does transporter come to know that particular e-way bill is assigned to him?

The transporter comes to know that EWBs are assigned to him by the taxpayers for transportation, in one of the following ways:• After login at EWB portal, the transporter can go to reports section and select ‘EWB assigned to me for trans’ and see the list. He can also see these details in his dashboard, after login to EWB portal.

• The transporter can go to ‘Update Vehicle No’ and select ‘Generator GSTIN’ option and enter taxpayer GSTIN of taxpayer, who has assigned the EWB to him.

How to handle the goods which move through multiple trans-shipment places?

How does the transporter handle multiple e-way bills which pass through transshipment from one place to another in different vehicles, to reach the destinations?

Cancelling e-Way Bill

Can the e-way bill be deleted or cancelled?

Whether the e-way bill can be cancelled? If yes, under what circumstances?

Rejecting e-Way Bill

Who can reject the e-way bill and Why?

How does the taxpayer or recipient come to know about the e-way bills generated on his GSTIN by other person/party?

As per the rule, the taxpayer orrecipient can reject the e-way bill generated on his GSTIN by other parties. The following options are available for him to see the list of e-way bills:

• He can see the details on the dashboard, once he logs into the system.

• He will get one SMS everyday indicating the total e-way bill activities on his GSTIN.

• He can go to reject option and select date and see the e-way bills. Here, system shows the list of e-way bills generated on his GSTIN by others.

• He can go to report and see the ‘EWBs by other parties’.

Consolidated e-Way Bill

What is consolidated e-way bill?

Who can generate the consolidated e-way bill?

What is the validity of consolidated e-way bill?

Consolidated EWB is like a trip sheet and it contains details of different EWBs in respect of various consignments being transported in one vehicleand these EWBs will have different validity periods.

Hence, Consolidated EWB does not have any independent validity period. However, individual consignment specified in the Consolidated EWB should reach the destination as per the validity period of the individual EWB.

What has to be done, if the vehicle number has to be changed for the consolidated e-way bill?

Can the ‘consolidated e-way bill’ (CEWB) have the goods / e-way bills which are going to be delivered before reaching the destination defined for CEWB?

Other modes

What are the modes of e-way bill generation, the taxpayer can use?

The e-way bill can be generated by the registered person in any of the following methods;-

o Using Web based system

o Using SMS based facility

o Using Android App

o Bulk generation facility

o Using Site-to-Site integration

o Using GSP ( Goods and Services Tax Suvidha Provider)

How can the taxpayer use the SMS facility to generate the e-way bill?

How can the taxpayer use the Android App to generate the e-way bill?

How to download mobile app?

What is bulk generation facility and who can use it?

How to use the bulk generation facility?

Bulk generation facility can be used for what activities on e-way bill portal?

One can use bulk generation facility for

o Generation of e-way bills,

o Updation of Part-B of e-way bills

o Generation of Consolidated e-way bills

Pl refer to the user manual of the bulk generation tools on the portal

What are the benefits of the bulk generation facility?

Benefits of the bulk generation facility are as follows:

o Generation of multiple e-way bills in one go.

o It avoids duplicate keying in of the invoices to generate e-way bills.

o It avoids the data entry mistakes while keying in for generation of e-way bills.

How can the registered person integrate his/her system with e-way bill system to generate the e-way bills from his/her system?

What is API Interface?

What are the benefits of API Interface?

What are the pre-requisite for using API interface?

API interface is a site-to-site integration of website of taxpayer with the EWB system. API interface can be used by large taxpayers, who need to generate more than 1000 invoices / e-way bills per day. However, the taxpayer should meet the following criteria to use the API interface:

• His invoicing system should be automated with IT solutions.

• He should be ready to change his IT system to integrate with EWB system as per API guidelines.

• He should be generating at least 1000 invoices/e-way bills per day.

• His system should have SSL based domain name.

• His system should have Static IP Address.

• He should have pre-production system to test the API interface.

Other Options

How does the taxpayer become transporter in the e-way bill system?

Generally, registered GSTIN holder will be recorded as supplier or recipient and he will be allowed to work as supplier or recipient. If registered GSTIN holder is transporter, then he will be generating EWB on behalf of supplier or recipient. He need to enter both supplier and recipient details while generating EWB, which is not allowed as a supplier or recipient.

To change his position from supplier or recipient to transporter, the taxpayer has to select the option ‘Register as Transporter’ under registration and update his profile. Once it is done with logout and re-login, the system changes taxpayer as transporter and allows him to enter details of both supplier and recipient in EWB as per invoice.

How does the taxpayer update his latest business name, address, mobile number or e-mail id in the e-way bill system?

Why do I need sub-users?

Most of the times, the taxpayer or authorized person himself cannot operate and generate EWBs. He may in that case authorize his staff or operator to do that. He would not like to avoid sharing his user credentials with them. In some firms, the business activities will be operational 24/7 and some firms will have multiple branches. Under these circumstances, the main user can create sub-users and assign different roles to them. He can assign generation of EWB or rejection or report generation activities based on requirements to different sub-users.

This facility helps him to monitor the activities done by sub-users. However, the main user should ensure that whenever employee is transferred or resigned, the sub-user account is frozen / blocked to avoid mis-utilisation.

How many sub-users can be created?

Why are the reports available only for a particular day?

Why masters have to be entered?

Can I upload the masters available in my system?

What is a detention report under grievance menu?

When is a detention report to be raised?

Miscellaneous

What is Over Dimensional Cargo?

How the consignor is supposed to give authorization to transporter or e-commerce operator and courier agency for generating PART-A of e-way bill?

In case of Public transport, how to carry e-way bill?

What is the meaning of consignment value?

In case of movement of goods by Railways, is there a requirement for railway to carry e-way bill along with goods?

If the value of the goods carried in a single conveyance is more than 50,000/- though value of all or some of the individual consignments is below Rs. 50,000/-, does transporter need to generate e-way bill for all such smaller consignments?

Does the vehicle carrying goods from CSD to unit run canteens need e-way bill?

Is the e-way bill required for the movement of empty cargo containers?

Does the movement of goods under Customs seal require e-way bill?

No, such movement has been exempted from e-way bill.

Does the movement of goods which are in transit to or from Nepal/Bhutan, require e-way bill for movement?

Is the temporary vehicle number allowed for e-way bill generation?

Whether e-way bill is required for intra -State movement of goods?

I am dealer in tractors. I purchased 20 tractors from the manufacturer. These tractors are not brought on any motorized conveyance as goods but are brought to my premise by driving them. Also, these tractors have not got the vehicle number. Is e-way bill required in such cases?

Who is responsible for EWB generation in case DTA sales from SEZ/FTWZ?

In many cases where manufacturer or wholesaler is supplying to retailers, or where a consolidated shipment is shipped out, and then distributed to multiple consignees, the recipient is unknown at the time the goods are dispatched from shipper’s premises. A very common example is when FMCG companies send a truck out to supply kirana stores in a particular area. What needs to be done in such cases?

What should be the value in e-waybill in case goods are sent on lease basis as the value of machine is much higher than leasing charges?

Expired stock has no commercial value, but is often transported back to the seller for statutory and regulatory requirements, or for destruction by seller himself. What needs to be done for such cases of transportation of the expired stock?

Whether shipping charges charged by E-commerce companies needs to be included in ‘consignment value’ though the same is not mentioned on merchant’s invoice?

Where an invoice is in respect of both goods and services, whether the consignment value should be based on the invoice value (inclusive of value of services) or only on the value of goods. Further, whether HSN wise details of service is also required to be captured in Part A of the e-way bill in such case.