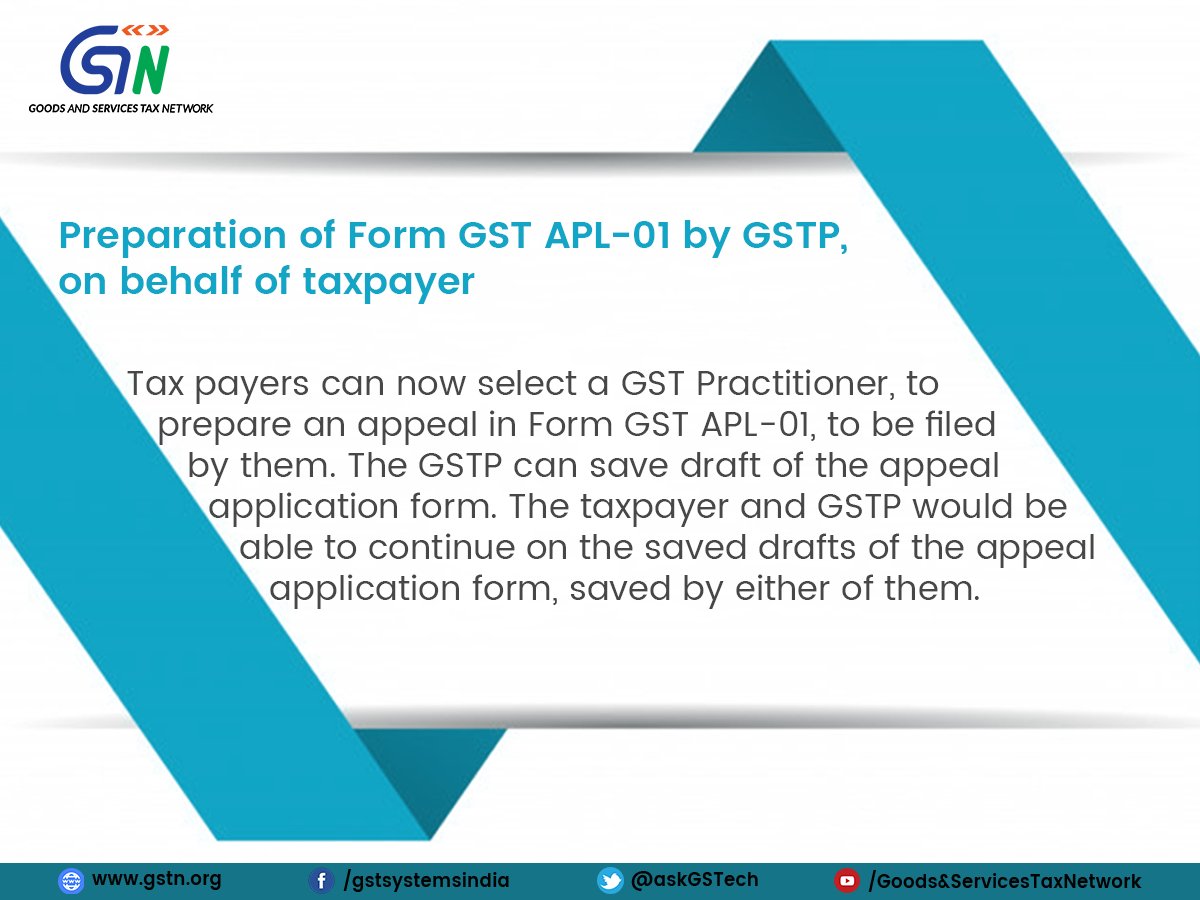

New functionality update on GST Portal: Preparation of Form GST APL-01 by GSTP, on behalf of taxpayer.

Form GST APL 01 is Appeal to Appellate Authority [See rule 108(1) of CGST Rules 2017 ]

Related Post on Appeal under GST

GST Appeal : Free Study Material

How to File Appeal against GST Demand Order :FAQ and User Manual

How to File Appeal against GST Registration Order :FAQ and User Manual

How to file Appeal against GST Refund Order : FAQ and User Manual

How to file Appeal against Other Orders in GST : FAQ and User Manual

Who can appear before GST Officer or in Appeals : Authorized Representative

How to File GST Appeal with Commissioner (Appeal)

[Video] No GST Appeal can be filed against these Orders

GST Appeals, Review and Revision in GST -FAQ&s on GST by CBEC

GST Appeals ; Revision ; Video Tutorial

GST Appeals and Revisions Rules Analysis

Appeals and Review Mechanism under GST

GST judgments on Appeal

Avail alternative remedy of statutory appeal before filing Writ petition in High Court : HC

GST Appeal due to delay couldn’t be dismissed if No Appellate Authority constituted: HC