Section 194O Income Tax TDS on E Commerce Transactions

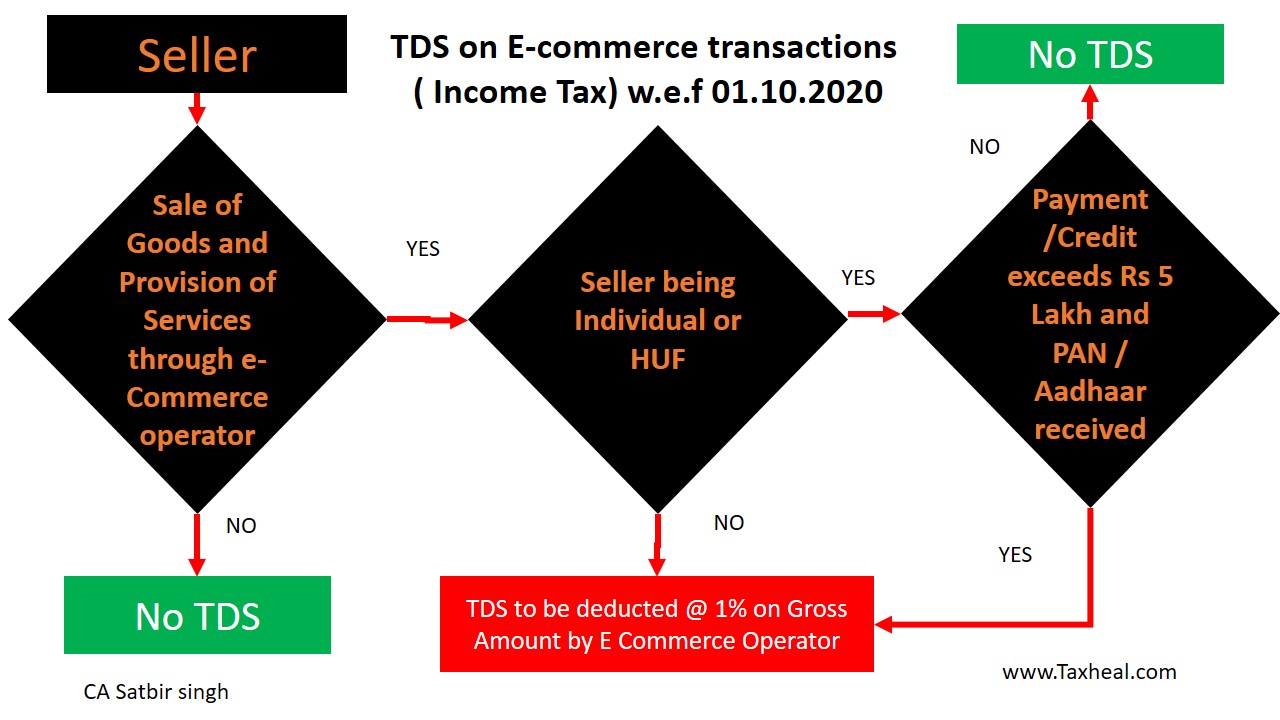

Finance Act 2020 inserted New Section 194O Income Tax w.e.f 01.10.2020 for TDS on Payment of certain sums by e-commerce operator to e-commerce participant. Earlier it was proposed to be implemented from 01.04.2020 by Finance Bill 2020

Video Explanation by CA Satbir singh

Commentary on TDS on E Commerce Transactions

- What is provision in Income Tax for deduction of TDS on E Commerce Transactions ? Section 194O Income Tax Inserted w.e.f 01.10.2020 for TDS on Payment of certain sums by e-commerce operator to e-commerce participant

- What is Date of Applicability of TDS on E Commerce Transactions ? : TDS on E Commerce Transactions from 01.10.2020 As per Finance Act 2020

- Why TDS on E Commerce Transactions ? : where sale of goods or provision of services of an e-commerce participant is facilitated by an e-commerce operator through its digital or electronic facility or platform

- Who will deduct TDS on E Commerce Transactions ? : e-commerce operator will deduct TDS.

- Whose TDS will be deducted by e-commerce operator ? : TDS of e-commerce participant will be deducted by E commerce operator

- When TDS on E Commerce Transactions should be deducted ? : TDS should be deducted at the time of credit of amount of sale or services or both to the account of an e-commerce participant or at the time of payment thereof to such e-commerce participant by any mode, whichever is earlier,

- What is the Rate of TDS on E-Commerce Transactions ? : TDS should be deducted at the rate of 1% . TDS will be deducted @5% if PAN number /Aadhaar Number not given.

- What is the amount on which TDS should be deducted on E-Commerce Transactions ? : TDS should be deducted @ 1% on gross amount of such sales or services or both.

- What is the meaning of Gross Amount for TDS on E-Commerce Transactions ? : Any payment made by a purchaser of goods or recipient of services directly to an e-commerce participant for the sale of goods or provision of services or both, facilitated by an e-commerce operator, shall be deemed to be the amount credited or paid by the e-commerce operator to the e-commerce participant and shall be included in the gross amount of such sale or services for the purpose of deduction of income-tax under this sub-section.

- When no TDS should be deducted on E-Commerce Transactions ? :No deduction shall be made from any sum credited or paid or likely to be credited or paid during the previous year to the account of an e-commerce participant, being an individual or Hindu undivided family, where the gross amount of such sale or services or both during the previous year does not exceed five lakh rupees and such e-commerce participant has furnished his Permanent Account Number or Aadhaar number to the e-commerce operator.

- Whether TDS can be deducted under Other provisions of Income tax if TDS deducted u/s 194O ? : A transaction in respect of which tax has been deducted by the e-commerce operator or which is not liable to deduction under, shall not be liable to tax deduction at source under any other provision of this Chapter:

- When TDS can be deducted under Other Provisions of Income Tax ? : Any amount or aggregate of amounts received or receivable by an e-commerce operator for hosting advertisements or providing any other services which are not in connection with the sale or services.

- What is meaning of electronic commerce ? : electronic commerce means the supply of goods or services or both, including digital products, over digital or electronic network;

- What is meaning of “electronic commerce operator” ? : “e-commerce operator” means a person who owns, operates or manages digital or electronic facility or platform for electronic commerce;

- What is meaning of “e-commerce participant” ? “e-commerce participant” means a person resident in India selling goods or providing services or both, including digital products, through digital or electronic facility or platform for electronic commerce;

- What is meaning of “services” ? : “services” includes ‘‘fees for technical services’’ and fees for ‘‘professional services’’, as defined in the Explanation to section 194J.’

- Lower TDS Certificate can be taken u/s 197

- TDS Credit Claim : Person whose TDS has been deducted, can claim its credit when he will file his Income Tax Return.

- Example 1 :

- MR Ram order Pizza online from PizaHut through Zomato (E commerce Operator ) and makes online Payment of Rs 400 .

- In this e-commerce transaction, the payment of Rs. 400/- being made by an individual Ram ,(recipient of services), directly to PizaHut (e-commerce participant), shall be deemed to be amount credited or paid by Zomato (e-commerce operator) to PizaHut (e-commerce participant) and shall be included in the gross amount of such sales or services for the purpose of deduction of income-tax.

- PizaHut, furnishes its PAN/Aadhar Card to Zomato.

- Zomato (e-commerce operator), shall be required to deduct TDS of Rs. 4/- @ 1 % u/s 194O, on Rs. 400/-, and deposit the said amount of TDS with the Exchequer, just like any other TDS and PizaHut (e-commerce participant) can claim the credit of this TDS u/s 194O in its Return of Income

- Example 2 :

- Mr Ram orders Dosa from Mr Kartik ( Proprietor of Tasty Food ) through Zomato and makes the payment of Rs 400/-.

- Mr Kartik (an individual e-commerce participant) having

annual sales of more than Rs. 5 lakhs - Zomato (e-commerce operator), shall be required to deduct TDS of Rs. 4/- @ 1 % u/s 194O, on Rs. 400/-, and deposit the said amount of TDS with the Exchequer, just like any other TDS.

It is pertinent to mention here that TDS @ 1% is applicable only, if Ms Kartik furnishes his PAN/Aadhar Card Number. In the absence of PAN/Aadhar Card Number the rate of TDS deduction shall be 5% - NO TDS shall be deducted if Mr Kartik (an individual e-commerce participant) having annual sales of less than Rs. 5 lakhs

TDS on E Commerce Transactions by Finance Bill 2020

For Latest Notifications and circulars on Section 194O Income Tax and ” TDS on E Commerce ” refer Govt website Click here

TDS on Ecommerce budget 2020,194O Income Tax,Section 1940,194O TDS ,194-O,new section 194O budget 2020,budget 2020 ecommerce,

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal