New Rule 138 CGST Rules 2017

( New Rule 138 CGST Rules 2017 explains Information to be furnished prior to commencement of movement of goods and generation of e-way bill and is covered in Chapter XVI – E-Way Rules : substituted by CGST (Second Amendment) Rules 2018 vide Notification No 12/2018 Central Tax dated 7th March, 2018 : refer Note 1 Also]

“138. Information to be furnished prior to commencement of movement of goods and generation of e-way bill.– (1) Every registered person who causes movement of goods of consignment value exceeding fifty thousand rupees—

(i) in relation to a supply; or

(ii) for reasons other than supply; or

(iii) due to inward supply from an unregistered person,

shall, before commencement of such movement, furnish information relating to the said goods as specified in Part A of FORM GST EWB-01, electronically, on the common portal along with such other information as may be required on the common portal and a unique number will be generated on the said portal:

Provided that the transporter, on an authorization received from the registered person, may furnish information in Part A of FORM GST EWB-01, electronically, on the common portal along with such other information as may be required on the common portal and a unique number will be generated on the said portal:

Provided further that where the goods to be transported are supplied through an ecommerce operator or a courier agency, on an authorization received from the consignor, the information in Part A of FORM GST EWB-01 may be furnished by such e-commerce operator or courier agency and a unique number will be generated on the said portal:

Provided also that where goods are sent by a principal located in one State or Union territory to a job worker located in any other State or Union territory, the e-way bill shall be generated either by the principal or the job worker, if registered, irrespective of the value of the consignment:

Provided also that where handicraft goods are transported from one State or Union territory to another State or Union territory by a person who has been exempted from the requirement of obtaining registration under clauses (i) and (ii) of section 24, the e-way bill shall be generated by the said person irrespective of the value of the consignment.

Explanation 1.– For the purposes of this rule, the expression “handicraft goods” has the meaning as assigned to it in the Government of India, Ministry of Finance, notification No. 32/2017-Central Tax dated the 15th September, 2017 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 1158 (E) dated the 15th September, 2017 as amended from time to time.

Explanation 2.- For the purposes of this rule, the consignment value of goods shall be the value, determined in accordance with the provisions of section 15, declared in an invoice, a bill of supply or a delivery challan, as the case may be, issued in respect of the said consignment and also includes the central tax, State or Union territory tax, integrated tax and cess charged, if any, in the document and shall exclude the value of exempt supply of goods

where the invoice is issued in respect of both exempt and taxable supply of goods.

(2) Where the goods are transported by the registered person as a consignor or the recipient of supply as the consignee, whether in his own conveyance or a hired one or a public conveyance, by road, the said person shall generate the e-way bill in FORM GST EWB-01 electronically on the common portal after furnishing information in Part B of FORM GST EWB-01.

(2A) Where the goods are transported by railways or by air or vessel, the e-way bill shall be generated by the registered person, being the supplier or the recipient, who shall, either before or after the commencement of movement, furnish, on the common portal, the information in Part B of FORM GST EWB-01:

Provided that where the goods are transported by railways, the railways shall not deliver the goods unless the e-way bill required under these rules is produced at the time of delivery

(3) Where the e-way bill is not generated under sub-rule (2) and the goods are handed over to a transporter for transportation by road, the registered person shall furnish the information relating to the transporter on the common portal and the e-way bill shall be generated by the transporter on the said portal on the basis of the information furnished by the registered person in Part A of FORM GST EWB-01:

Provided that the registered person or, the transporter may, at his option, generate and carry the e-way bill even if the value of the consignment is less than fifty thousand rupees:

Provided further that where the movement is caused by an unregistered person either in his own conveyance or a hired one or through a transporter, he or the transporter may, at their option, generate the e-way bill in FORM GST EWB-01 on the common portal in the manner specified in this rule:

Provided also that where the goods are transported for a distance of upto fifty kilometers within the State or Union territory from the place of business of the consignor to the place of business of the transporter for further transportation, the supplier or the recipient, or as the case may be, the transporter may not furnish the details of conveyance in Part B of FORM GST EWB-01.

Explanation 1.– For the purposes of this sub-rule, where the goods are supplied by an unregistered supplier to a recipient who is registered, the movement shall be said to be caused by such recipient if the recipient is known at the time of commencement of the movement of goods.

Explanation 2.- The e-way bill shall not be valid for movement of goods by road unless the information in Part-B of FORM GST EWB-01 has been furnished except in the case of movements covered under the third proviso to sub-rule (3) and the proviso to sub-rule (5).

(4) Upon generation of the e-way bill on the common portal, a unique e-way bill number (EBN) shall be made available to the supplier, the recipient and the transporter on the common portal.

(5) Where the goods are transferred from one conveyance to another, the consignor or the recipient, who has provided information in Part A of the FORM GST EWB-01, or the transporter shall, before such transfer and further movement of goods, update the details of conveyance in the e-way bill on the common portal in Part B of FORM GST EWB-01:

Provided that where the goods are transported for a distance of upto fifty kilometers within the State or Union territory from the place of business of the transporter finally to the place of business of the consignee, the details of the conveyance may not be updated in the eway bill.

(5A) The consignor or the recipient, who has furnished the information in Part A of FORM GST EWB-01, or the transporter, may assign the e-way bill number to another registered or enrolled transporter for updating the information in Part B of FORM GST EWB-01 for further movement of the consignment:

Provided that after the details of the conveyance have been updated by the transporter in Part B of FORM GST EWB-01, the consignor or recipient, as the case may be, who has furnished the information in Part A of FORM GST EWB-01 shall not be allowed to assign the e-way bill number to another transporter.

(6) After e-way bill has been generated in accordance with the provisions of sub-rule (1), where multiple consignments are intended to be transported in one conveyance, the transporter may indicate the serial number of e-way bills generated in respect of each such consignment electronically on the common portal and a consolidated e-way bill in FORM GST EWB-02 maybe generated by him on the said common portal prior to the movement of

goods.

(7) Where the consignor or the consignee has not generated the e-way bill in FORM GST EWB-01 and the aggregate of the consignment value of goods carried in the conveyance is more than fifty thousand rupees, the transporter, except in case of transportation of goods by railways, air and vessel, shall, in respect of inter-State supply,

generate the e-way bill in FORM GST EWB-01 on the basis of invoice or bill of supply or delivery challan, as the case may be, and may also generate a consolidated e-way bill in FORM GST EWB-02 on the common portal prior to the movement of goods:

Provided that where the goods to be transported are supplied through an e-commerce operator or a courier agency, the information in Part A of FORM GST EWB-01 may be furnished by such e-commerce operator or courier agency.

(8) The information furnished in Part A of FORM GST EWB-01 shall be made available to the registered supplier on the common portal who may utilize the same for furnishing the details in FORM GSTR-1:

Provided that when the information has been furnished by an unregistered supplier or an unregistered recipient in FORM GST EWB-01, he shall be informed electronically, if the mobile number or the e-mail is available.

(9) Where an e-way bill has been generated under this rule, but goods are either not transported or are not transported as per the details furnished in the e-way bill, the e-way bill may be cancelled electronically on the common portal within twenty four hours of generation of the e-way bill:

Provided that an e-way bill cannot be cancelled if it has been verified in transit in accordance with the provisions of rule 138B:

Provided further that the unique number generated under sub-rule (1) shall be valid for a period of fifteen days for updation of Part B of FORM GST EWB-01.

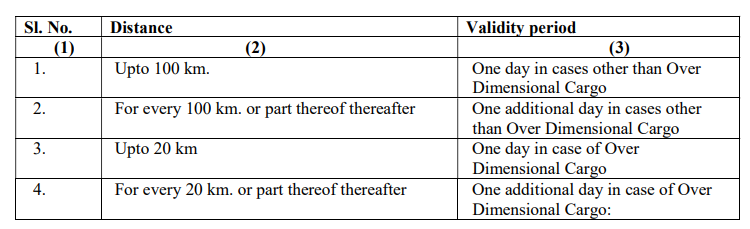

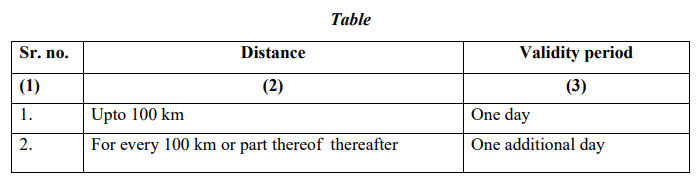

(10) An e-way bill or a consolidated e-way bill generated under this rule shall be valid for the period as mentioned in column (3) of the Table below from the relevant date, for the distance, within the country, the goods have to be transported, as mentioned in column (2) of the said Table:-

Provided that the Commissioner may, on the recommendations of the Council, by notification, extend the validity period of an e-way bill for certain categories of goods as may be specified therein:

Provided further that where, under circumstances of an exceptional nature, including trans-shipment, the goods cannot be transported within the validity period of the e-way bill, the transporter may extend the validity period after updating the details in Part B of FORM GST EWB-01, if required.

Explanation 1.—For the purposes of this rule, the “relevant date” shall mean the date on which the e-way bill has been generated and the period of validity shall be counted from the time at which the e-way bill has been generated and each day shall be counted as the period expiring at midnight of the day immediately following the date of generation of e-way bill.

Explanation 2.— For the purposes of this rule, the expression “Over Dimensional Cargo” shall mean a cargo carried as a single indivisible unit and which exceeds the dimensional limits prescribed in rule 93 of the Central Motor Vehicle Rules, 1989, made under the Motor Vehicles Act, 1988 (59 of 1988).

(11) The details of the e-way bill generated under this rule shall be made available to the

(a) supplier, if registered, where the information in Part A of FORM GST EWB-01 has been furnished by the recipient or the transporter; or

(b) recipient, if registered, where the information in Part A of FORM GST EWB-01 has been furnished by the supplier or the transporter,

on the common portal, and the supplier or the recipient, as the case may be, shall communicate his acceptance or rejection of the consignment covered by the e-way bill.

(12) Where the person to whom the information specified in sub-rule (11) has been made available does not communicate his acceptance or rejection within seventy two hours of the details being made available to him on the common portal, or the time of delivery of goods whichever is earlier, it shall be deemed that he has accepted the said details.

(13) The e-way bill generated under this rule or under rule 138 of the Goods and Services Tax Rules of any State or Union territory shall be valid in every State and Union territory.

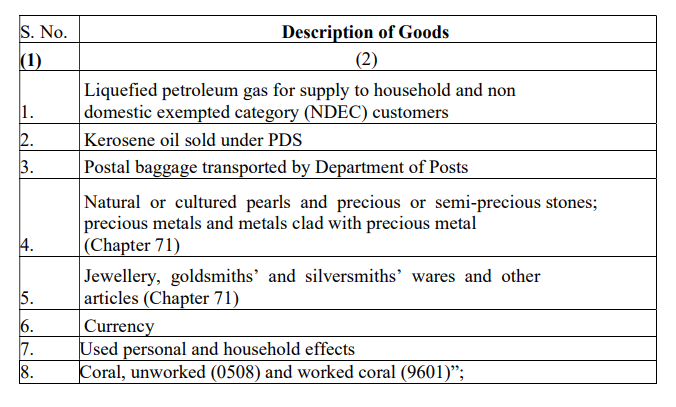

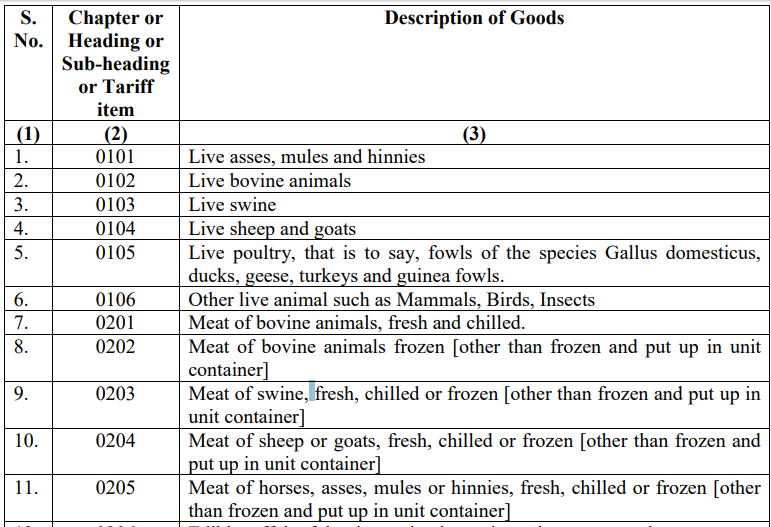

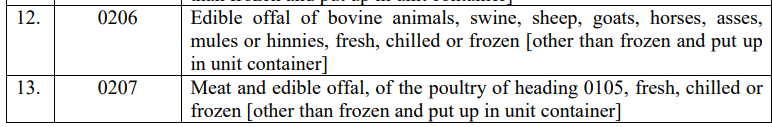

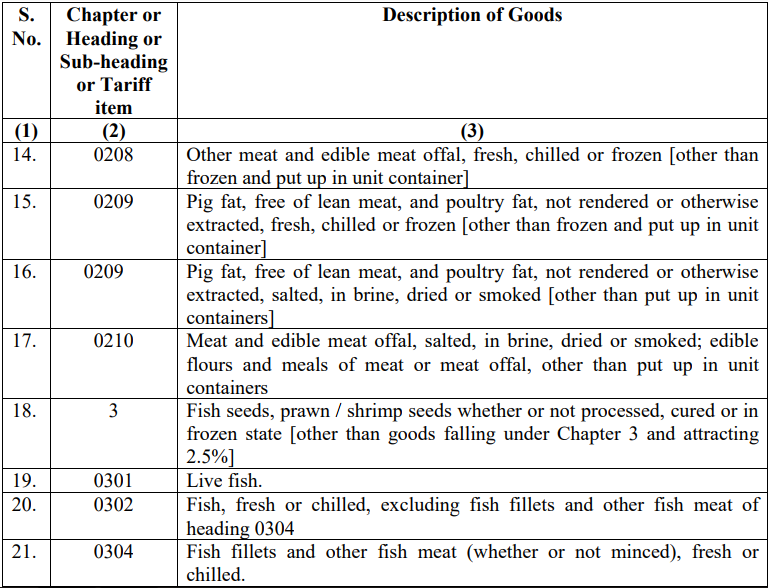

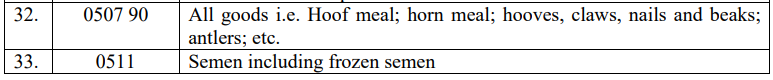

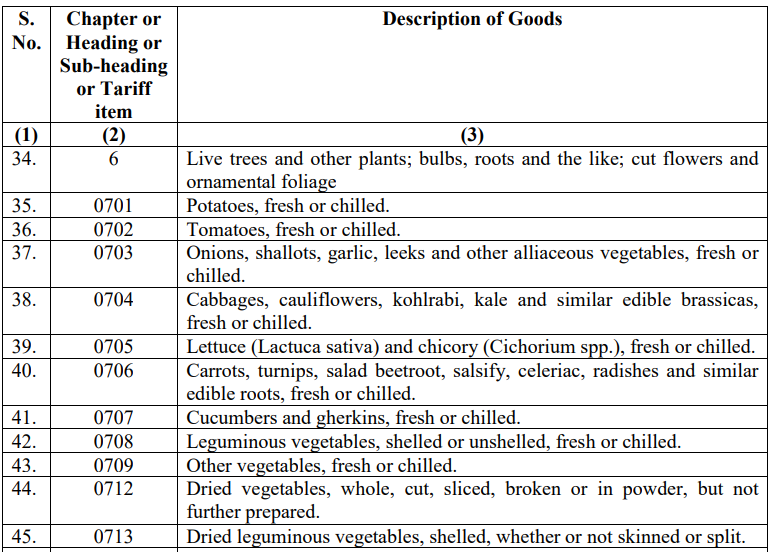

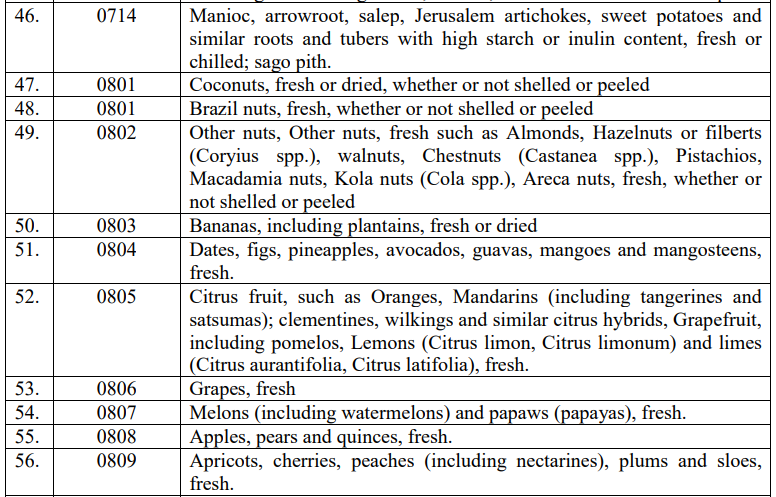

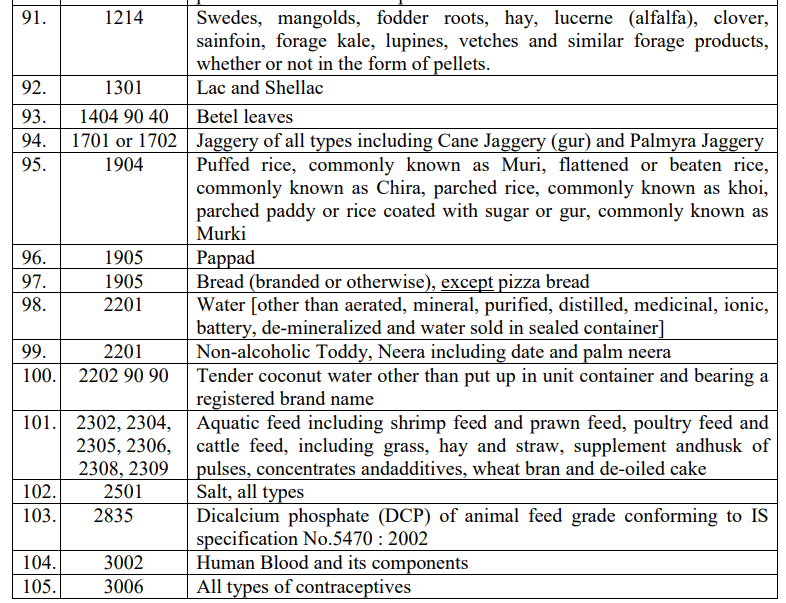

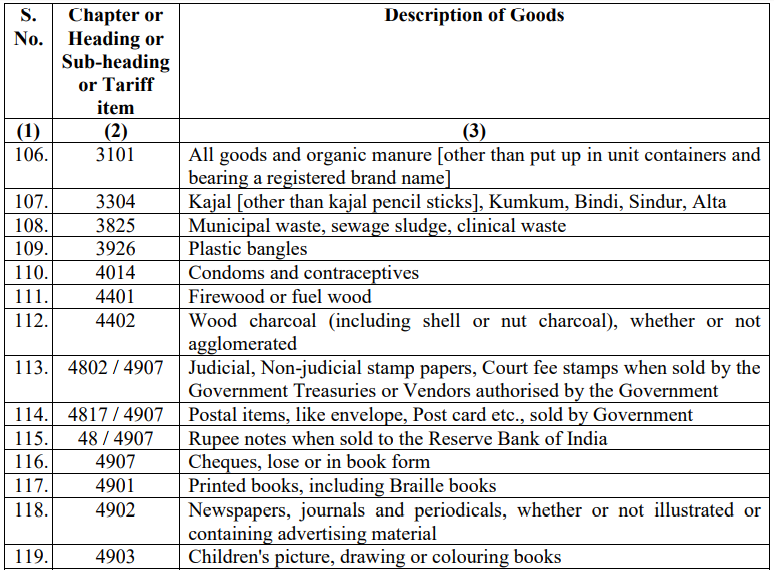

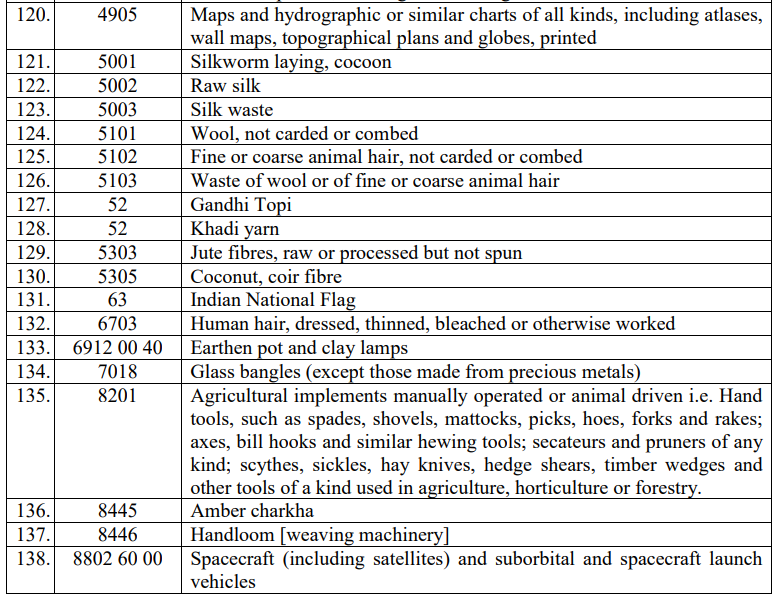

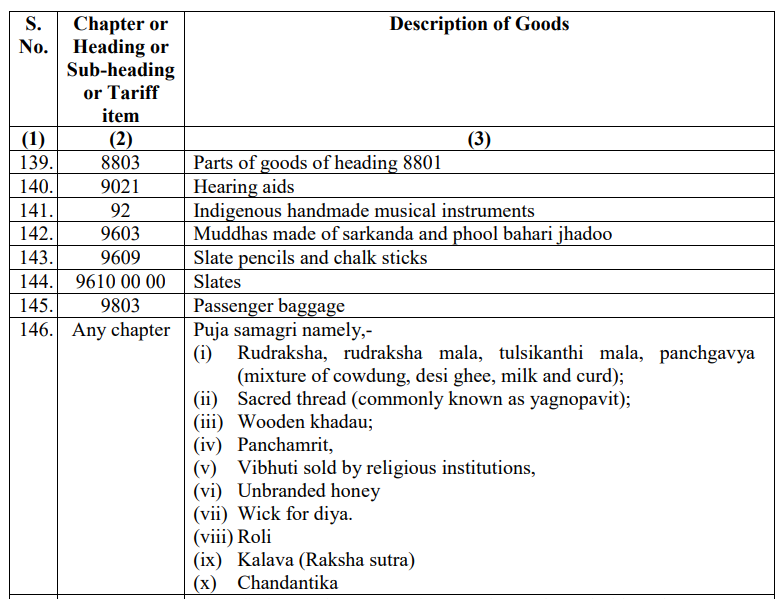

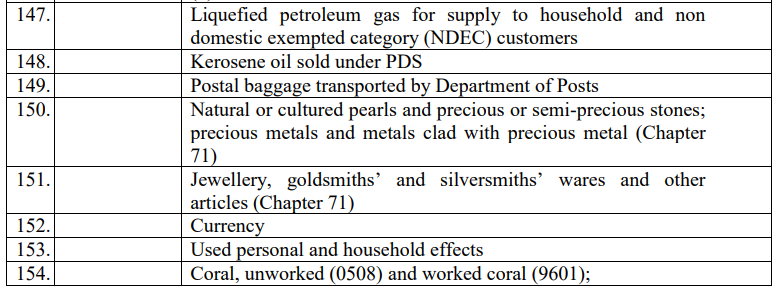

(14) Notwithstanding anything contained in this rule, no e-way bill is required to be generated—

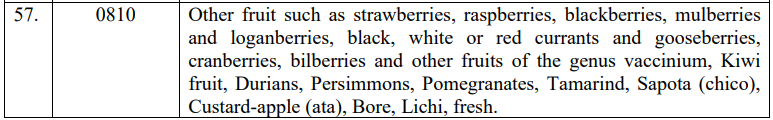

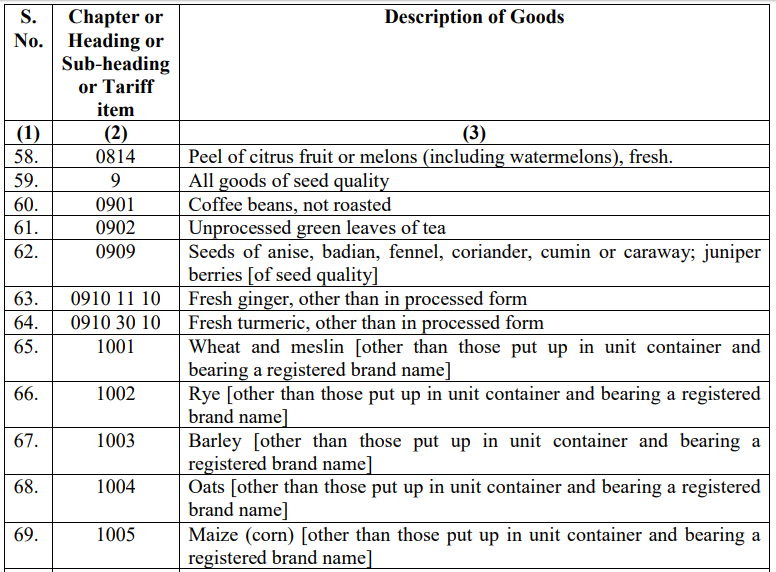

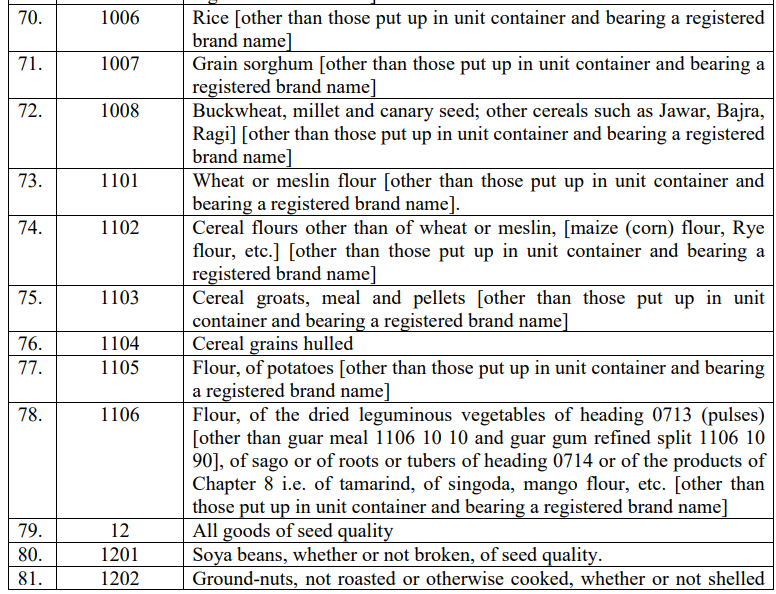

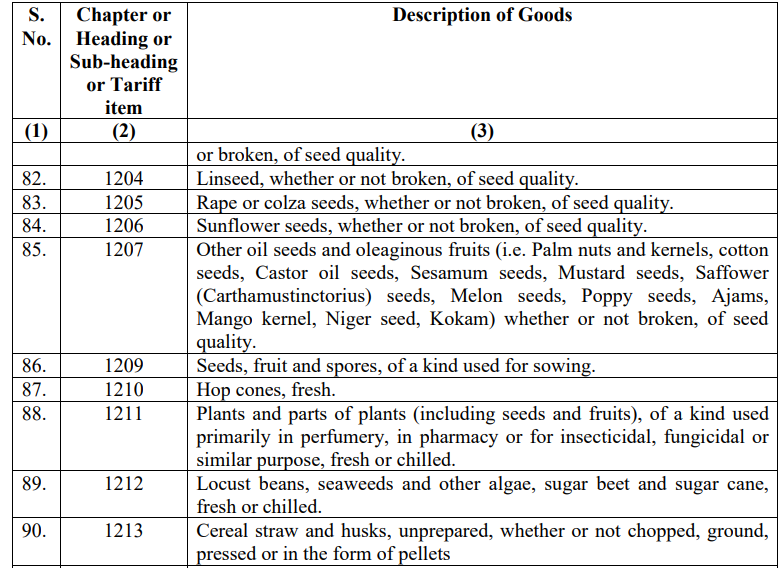

(a) where the goods being transported are specified in Annexure;

(b) where the goods are being transported by a non-motorised conveyance;

(c) where the goods are being transported from the customs port, airport, air cargo complex and land customs station to an inland container depot or a container freight station for clearance by Customs;

(d) in respect of movement of goods within such areas as are notified under clause (d) of sub-rule (14) of rule 138 of the State or Union territory Goods and Services Tax Rules in that particular State or Union territory;

(e) where the goods, other than de-oiled cake, being transported, are specified in the Schedule appended to notification No. 2/2017- Central tax (Rate) dated the 28th June, 2017 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 674 (E) dated the 28th June, 2017 as amended from time to time;

(f) where the goods being transported are alcoholic liquor for human consumption, petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas or aviation turbine fuel;

(g) where the supply of goods being transported is treated as no supply under Schedule III of the Act;

(h) where the goods are being transported—

(i) under customs bond from an inland container depot or a container freight station to a customs port, airport, air cargo complex and land customs station, or from one customs station or customs port to another customs station or customs port, or

(ii) under customs supervision or under customs seal;

(i) where the goods being transported are transit cargo from or to Nepal or Bhutan;

(j) where the goods being transported are exempt from tax under notification No. 7/2017-Central Tax (Rate), dated 28th June 2017 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 679(E)dated the 28th June, 2017 as amended from time to time and notification No. 26/2017- Central Tax (Rate), dated the 21st September, 2017 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R 1181(E) dated the 21st September, 2017 as amended from time to time;

(k) any movement of goods caused by defence formation under Ministry of defence as a consignor or consignee;

(l) where the consignor of goods is the Central Government, Government of any State or a local authority for transport of goods by rail;

(m)where empty cargo containers are being transported; and

(n) where the goods are being transported upto a distance of twenty kilometers from the place of the business of the consignor to a weighbridge for weighment or from the weighbridge back to the place of the business of the said consignor subject to the condition that the movement of goods is accompanied by a delivery challan

issued in accordance with rule 55.

Explanation. – The facility of generation, cancellation, updation and assignment of e-way bill shall be made available through SMS to the supplier, recipient and the transporter, as the case may be.

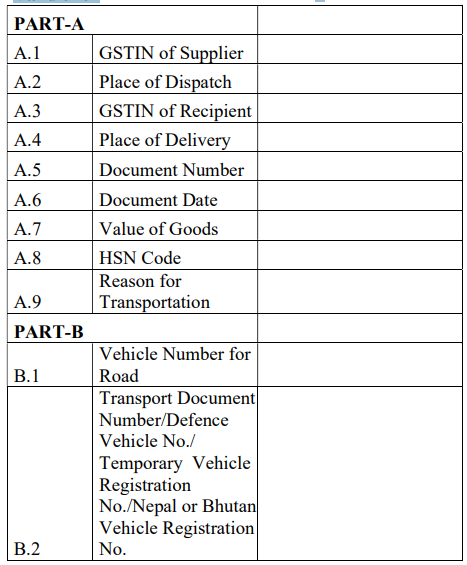

FORM GST EWB-01

(See rule 138)

E-Way Bill

E-Way Bill No. :

E-Way Bill date :

Generator :

Valid from :

Valid until :

Notes:

1. HSN Code in column A.8 shall be indicated at minimum two digit level for taxpayers having annual turnover upto five crore rupees in the preceding financial year and at four digit level for taxpayers having annual turnover above five crore rupees in the preceding financial year.

2. Document Number may be of Tax Invoice, Bill of Supply, Delivery Challan or Bill of Entry.

3. Transport Document number indicates Goods Receipt Number or Railway Receipt Number or Forwarding Note number or Parcel way bill number issued by railways or Airway Bill Number or Bill of Lading Number.

4. Place of Delivery shall indicate the PIN Code of place of delivery.

5. Place of dispatch shall indicate the PIN Code of place of dispatch.

6. Where the supplier or the recipient is not registered, then the letters “URP” are to be filled-in in column A.1 or, as the case may be, A.3.

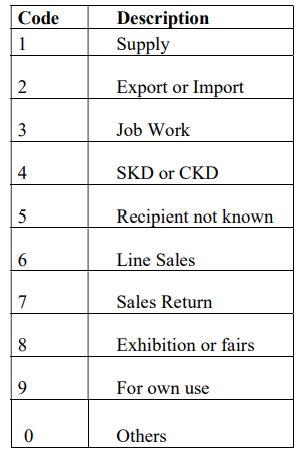

7. Reason for Transportation shall be chosen from one of the following:-

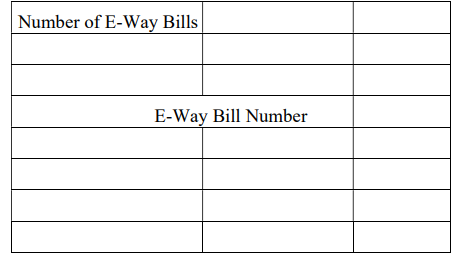

FORM GST EWB-02

(See rule 138)

Consolidated E-Way Bill

Consolidated E-Way Bill No. :

Consolidated E-Way Bill Date :

Generator :

Vehicle Number :

Note –

3. Eway bill for intra UT movement of Goods in Union Territory of Andaman and Nicobar Islands mandatory from 25.05. 2018 vide Notification No 10/2018 Union Territory Tax Dated 21st May, 2018 ]

2. Eway bill for intra UT movement of Goods in Union Territory of Lakshadweep mandatory from 25.05. 2018 vide Notification No 11/2018 Union Territory Tax Dated 21st May, 2018 ]

1 Earlier Rule 138 was substituted by the Central Goods and Services Tax (Amendment) Rules, 2018 vide Notification No. 3/2018 – Central Tax dated 23rd January, 2018 , w.e.f. 1-2-2018.

Prior to its substitution, rule 138, as substituted by Central Goods and Services Tax (Sixth Amendment) Rules 2017. Notification No 27 /2017 Central Tax Dated 30th August, 2017 w.e.f 01.02.2018 ) and later on amended by the Central Goods and Services Tax (Seventh Amendment) Rules, 2017, w.e.f. 15-9-2017

138 Information to be furnished prior to commencement of movement of goods and generation of e-way bill

(1) Every registered person who causes movement of goods of consignment value exceeding fifty thousand rupees—

(i) in relation to a supply; or

(ii) for reasons other than supply; or

(iii) due to inward supply from an unregistered person,

shall, before commencement of such movement, furnish information relating to the said

goods in Part A of FORM GST EWB-01, electronically, on the common portal.

(2) Where the goods are transported by the registered person as a consignor or the recipient of

supply as the consignee, whether in his own conveyance or a hired one or by railways or by

air or by vessel, the said person or the recipient may generate the e-way bill in FORM GST

EWB-01 electronically on the common portal after furnishing information in Part B of

FORM GST EWB-01.

(3) Where the e-way bill is not generated under sub-rule (2) and the goods are handed over to

a transporter for transportation by road, the registered person shall furnish the information

relating to the transporter in Part B of FORM GST EWB-01 on the common portal and the

e-way bill shall be generated by the transporter on the said portal on the basis of the

information furnished by the registered person in Part A of FORM GST EWB-01:

Provided that the registered person or, as the case may be, the transporter may, at his

option, generate and carry the e-way bill even if the value of the consignment is less than fifty

thousand rupees:

Provided further that where the movement is caused by an unregistered person either

in his own conveyance or a hired one or through a transporter, he or the transporter may, at

their option, generate the e-way bill in FORM GST EWB-01 on the common portal in the

manner specified in this rule:

Provided also that where the goods are transported for a distance of less than ten

kilometres within the State or Union territory from the place of business of the consignor to

the place of business of the transporter for further transportation, the supplier or the

transporter may not furnish the details of conveyance in Part B of FORM GST EWB-01.

Explanation 1.– For the purposes of this sub-rule, where the goods are supplied by an

unregistered supplier to a recipient who is registered, the movement shall be said to be caused

by such recipient if the recipient is known at the time of commencement of the movement of

goods

Explanation 2.-The information in Part A of FORM GST EWB-01 shall be

furnished by the consignor or the recipient of the supply as consignee where the goods are

transported by railways or by air or by vessel.

(4) Upon generation of the e-way bill on the common portal, a unique e-way bill number

(EBN) shall be made available to the supplier, the recipient and the transporter on the

common portal

(5) Any transporter transferring goods from one conveyance to another in the course of

transit shall, before such transfer and further movement of goods, update the details of

conveyance in the e-way bill on the common portal in FORM GST EWB-01:

Provided that where the goods are transported for a distance of less than ten

kilometres within the State or Union territory from the place of business of the transporter

finally to the place of business of the consignee, the details of conveyance may not be

updated in the e-way bill

(6) After e-way bill has been generated in accordance with the provisions of sub-rule (1),

where multiple consignments are intended to be transported in one conveyance, the

transporter may indicate the serial number of e-way bills generated in respect of each such

consignment electronically on the common portal and a consolidated e-way bill in FORM

GST EWB-02 maybe generated by him on the said common portal prior to the movement of

goods.

(7) Where the consignor or the consignee has not generated FORM GST EWB-01 in

accordance with the provisions of sub-rule (1) and the value of goods carried in the

conveyance is more than fifty thousand rupees, the transporter shall generate FORM GST

EWB-01 on the basis of invoice or bill of supply or delivery challan, as the case may be, and

may also generate a consolidated e-way bill in FORM GST EWB-02 on the common portal

prior to the movement of goods.

(8) The information furnished in Part A of FORM GST EWB-01 shall be made

available to the registered supplier on the common portal who may utilize the same for

furnishing details in FORM GSTR-1:

Provided that when the information has been furnished by an unregistered supplier in

FORM GST EWB-01, he shall be informed electronically, if the mobile number or the email

is available

(9) Where an e-way bill has been generated under this rule, but goods are either not

transported or are not transported as per the details furnished in the e-way bill, the e-way bill

may be cancelled electronically on the common portal, either directly or through a

Facilitation Centre notified by the Commissioner, within 24 hours of generation of the e-way

bill:

Provided that an e-way bill cannot be cancelled if it has been verified in transit in

accordance with the provisions of rule 138B.

(10) An e-way bill or a consolidated e-way bill generated under this rule shall be valid for

the period as mentioned in column (3) of the Table below from the relevant date, for the

distance the goods have to be transported, as mentioned in column (2) of the said Table:

Provided that the Commissioner may, by notification, extend the validity period of eway

bill for certain categories of goods as may be specified therein:

Provided further that where, under circumstances of an exceptional nature, the goods

cannot be transported within the validity period of the e-way bill, the transporter may

generate another e-way bill after updating the details in Part B of FORM GST EWB-01.

Explanation.—For the purposes of this rule, the “relevant date” shall mean the date on which

the e-way bill has been generated and the period of validity shall be counted from the time at

which the e-way bill has been generated and each day shall be counted as twenty-four hours.

(11) The details of e-way bill generated under sub-rule (1) shall be made available to the

recipient, if registered, on the common portal, who shall communicate his acceptance or

rejection of the consignment covered by the e-way bill.

(12) Where the recipient referred to in sub-rule (11) does not communicate his acceptance or

rejection within seventy two hours of the details being made available to him on the common

portal, it shall be deemed that he has accepted the said details.

(13) The e-way bill generated under this rule or under rule 138 of the Goods and Services

Tax Rules of any State shall be valid in every State and Union territory.

(14) Notwithstanding anything contained in this rule, no e-way bill is required to be

generated—

(a) where the goods being transported are specified in Annexure;

(b) where the goods are being transported by a non-motorised conveyance;

(c) where the goods are being transported from the port, airport, air cargo

complex and land customs station to an inland container depot or a container freight

station for clearance by Customs; and

(d) in respect of movement of goods within such areas as are notified under clause

(d) of sub-rule (14) of rule 138 of the Goods and Services Tax Rules of the concerned State.

Explanation. – The facility of generation and cancellation of e-way bill may also be made

available through SMS.

ANNEXURE

[(See rule 138 (14)]

Related Topic on GST

| Topic | Click Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Forms | GST Forms |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | GST Circulars |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |

| GST History | GST History and Background Material |