TCS on Sale of Goods under Income Tax

New TCS on Sale of Goods was inserted by Finance Act 2020 in Income Tax Act by Section 206c(1H).

Earlier it was proposed by Finance Bill 2020 that it will be effective from 01.04.2020 but by Finance Act 2020 it has been made effective from 01.10.2020.

Video Explanation by CA Satbir Singh As per Finance Bill 2020

Commentary on TCS on Sale of Goods

- What is Provision in Income Tax for TCS on sale of Goods ? : Section 206c(1H) of Income tax Act

- What is the effective Date of Applicability of TCS on Sale of Goods ? Effective date is 1st Oct 2020

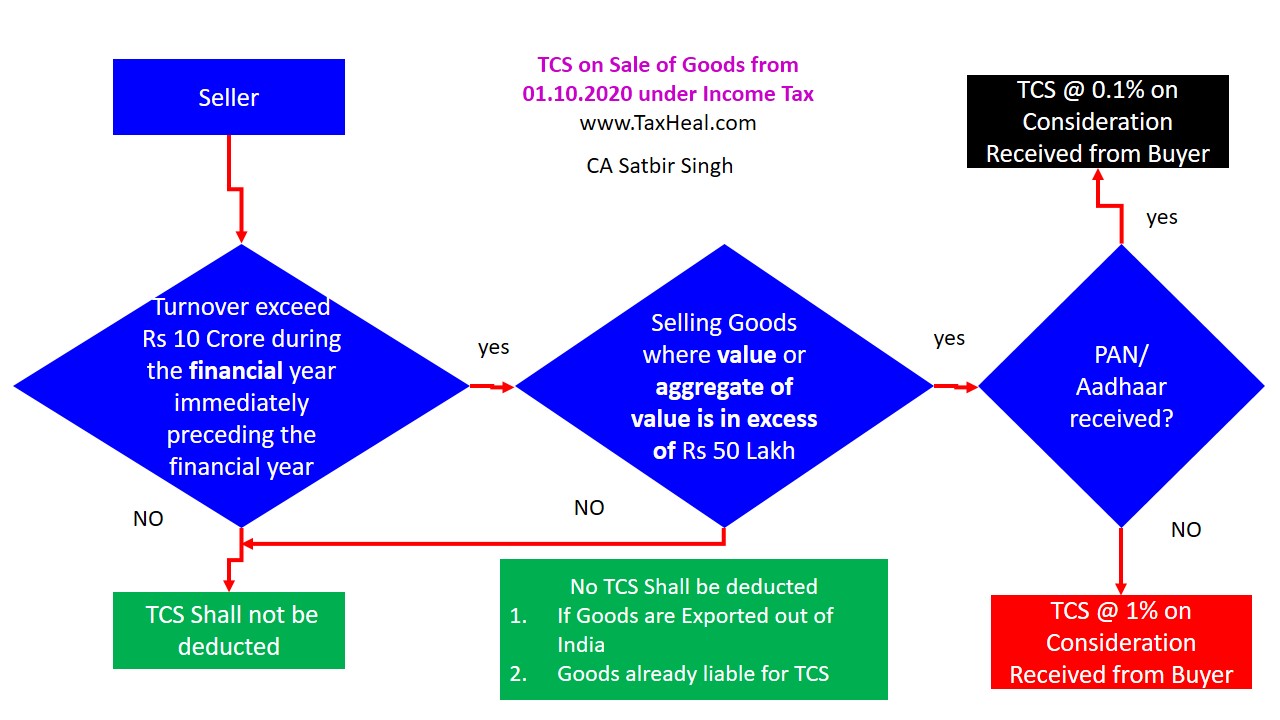

- Who has to collect TCS on Sale of Goods ? : Seller of goods is liable to collect TCS.

- “seller” means a person whose total sales, gross receipts or turnover from the business carried on by him exceed ten crore rupees during the financial year immediately preceding the financial year in which the sale of goods is carried out, not being a person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein.’

- In the case of a newly commenced business, the provision is not applicable, even if the turnover exceeds Rs 10 crores

- In other case, if the turnover of the previous financial year is less than 10 crores, even if the turnover exceeds 10 crores in the current financial year, it is not applicable..

- If the turnover of preceding financial year exceeds Rs 10 crores, the provision is applicable even if the turnover of the current financial year is less than 10 crore

- The Act does not make it mandatory to comply continuously once a seller is obliged to follow. In one year he may be required to deduct TCS on sale of Goods and in other year he may not be required to deduct TCS on sale of goods depending on his turnover of preceding financial year.

- The Section is applicable to every person being a seller and ‘person’ as defined under section 2(31) of the Act includes Individual, HUF, Company, Firm, AOP, BOI, Coop Societies, Local Authority

and Artificial Judicial Person. Thus it is applicable to all sales of goods effected by the Central or State Governments and local authorities as well. - Seller should be engaged in the business carried on by him.

- “seller” means a person whose total sales, gross receipts or turnover from the business carried on by him exceed ten crore rupees during the financial year immediately preceding the financial year in which the sale of goods is carried out, not being a person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein.’

- What is Rate of TCS on Sale of Goods ? TCS should be collected @0.1% . If PAN/ Aadhaar not given then the rate shall be 1%.

- When TCS on Sale of Goods should be collected ? :

- TCS TDS should be collected at the time of receipt of such amount.

- TCS should be collected on consideration received from a buyer in a previous year of the value or aggregate of value in excess of Rs 50 Lakh rupees.

- TCS may be required to be collected on Advance received for sale of Goods . It may be called consideration received from a buyer for sale of goods. [ Note : Practical difficulties may arise where advance is collected for sale of goods and TCS is remitted and subsequently the contract is cancelled and the amount is refundable. However buyer may claim its TCS credit when filing its Income Tax Return]

- Where a buyer is required to keep EMD, security deposit or performance guarantee, and if such amounts are later adjusted towards sale consideration, the seller still will have to

remit TCS even though it is not a receipt in technical language but is a part of the sale consideration deemed to have been received. - Wherever the amount collected from the buyers is an Net

amount, the seller need to gross it up and remit the TCS accordingly. The seller is may be required to pay the portion of GST to the GST authorities. He is also required to remit TCS

under Section 206C(1H). Thus difficulty arises in calculation of the amount. - Seller needs to raise an invoice including the amount of TCS, account in the books as a TCS liability even though not payable. Even though the TCS amount is debited to the buyer, the liability

under Section 206C(1H) does not arise till the time the amount is collected. - when goods are sold and debts are settled in exchange , TCS on sale of goods may be applicable.

- When the sale proceeds are partly paid by Government as

release of subsidy or the costs are funded by a third party payments. All such transactions also amount to receipts on behalf of a buyer and hence the seller will be under obligation to remit TCS.

- When TCS on Sale of Goods not applicable ? No TCS shall apply :

- when goods are being exported out of India

- when person is importing goods into India

- When seller is liable to collect TCS under other provision of section 206C

- When the buyer is liable to deduct tax at source under any other provision of this Act on the goods purchased by him from the seller and has deducted such amount. (Example turn-key projects or composite contracts)

- When the buyer is the ,Central Government, a State Government and an embassy,a High Commission, legation, commission, consulate, the trade representation of a foreign State ,a local authority as defined in Explanation to clause (20) of section 10 or such other persons which are notified by the Govt.

- What is meaning of Goods ? The word “Goods” is not defined in the Income Tax Act . The definition of Goods is given under GST Act . As per Section 2(52) of the GST Act, “Goods’’ means every kind of movable property other than money and securities but includes actionable claims, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply

- Whether sale of immovable Property is Goods ? TDS has to be deducted under Section 194IA on sale of Immovable property if value exceeds Rs. 50 lakhs.

- Whether it is applicable for sale of Services ? This section is not applicable for sale of services.

- Whether Buyer can claim Credit of TCS on Sale of Goods in his ITR?

- Buyer can claim credit of TCS on Sale of Goods in his Income Tax Return

- TCS will be collected when payment will be made by buyer, thus there are timing differences between the year of purchase made by the buyer and the TCS credit amount appearing in Form 26AS. Thus case may be selected for scrutiny.

- Transitional Provisions : since TCS on sale of Goods is applicable from 1st oct 2020 so govt should issue clarifications because there may be legal issues since it is not applicable form 1st April .

Meaning of Sellers

Only those seller whose total sales, gross receipts or turnover from the business carried on by it exceed Rs 10 Crore during the financial year immediately preceding the financial year, shall be liable to collect such TCS.

Who shall not be liable for TCS ?

Central Government may notify person, subject to conditions contained in such notification, who shall not be liable to collect such TCS.

No TCS is to be collected from the

‘-Central Government,

‘-a State Government and

‘-an embassy,a High Commission, legation, commission, consulate, the trade representation of a foreign State,

‘-a local authority as defined in Explanation to clause (20) of section 10 or

-a person importing goods into India

‘-any other person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to conditions as prescribed in such notification.

No such TCS is to be collected, if

- Goods are Exported out of India

- the seller is liable to collect TCS under other provision of section 206C or

- the buyer is liable to deduct TDS under any provision of the Act and has deducted such amount.

Effective Date for TCS on sale of goods over a limit.

These amendments will take effect from 1st Oct 2020

Section 206c(1H) of Income tax Act

Section 206c(1H) of Income Tax is inserted by Clause 95 of Finance Act 2020

In section 206C of the Income-tax Act with effect from the 1st day of October, 2020,—

after sub-section (1G), the following sub-sections shall be inserted, namely:

(1H) Every person, being a seller, who receives any amount as consideration for sale of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, other than the goods being exported out of India or goods covered in sub-section (1) or sub-section (1F) or sub-section (1G) shall, at the time of receipt of such amount, collect from the buyer, a sum equal to 0.1 per cent. of the sale consideration exceeding fifty lakh rupees as income-tax:

Provided that if the buyer has not provided the Permanent Account Number or the Aadhaar number to the seller, then the provisions of clause (ii) of sub-section (1) of section 206CC shall be read as if for the words “five per cent.”, the words “one per cent.” had been substituted:

Provided further that the provisions of this sub-section shall not apply, if the buyer is liable to deduct tax at source under any other provision of this Act on the goods purchased by him from the seller and has deducted such amount.

Explanation.––For the purposes of this sub-section,––

(a) “buyer” means a person who purchases any goods, but does not include,––

(A) the Central Government, a State Government, an embassy, a High Commission, legation, commission, consulate and the trade representation of a foreign State; or

(B) a local authority as defined in the Explanation to clause (20) of section 10; or

(C) a person importing goods into India or any other person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein;

(b) “seller” means a person whose total sales, gross receipts or turnover from the business carried on by him exceed ten crore rupees during the financial year immediately preceding the financial year in which the sale of goods is carried out, not being a person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein.’

As per Finance Bill 2020

93. In section 206C of the Income-tax Act,–– (I) after sub-section (1F), the following sub-sections shall be inserted, namely:––

(1G)….

(1H) Every person, being a seller, who receives any amount as consideration for sale of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, other than the goods covered in sub-section (1) or sub-section (1F) or sub-section (1G) shall, at the time of receipt of such amount, collect from the buyer, a sum equal to 0.1 per cent. of the sale consideration exceeding fifty lakh rupees as income-tax:

Provided that if the buyer has not provided the Permanent Account Number or the Aadhaar number to the seller, then the provisions of clause (ii) of sub-section (1) of section 206CC shall be read as if for the words “five per cent.”, the words “one per cent.” had been substituted:

Provided further that the provisions of this sub-section shall not apply, if the buyer is liable to deduct tax at source under any other provision of this Act and has deducted such amount.

Explanation.––For the purposes of this sub-section,––

(a) “buyer” means a person who purchases any goods, but does not include,–– (A) the Central Government, a State Government, an embassy, a High Commission, legation, commission, consulate and the trade representation of a foreign State; or

(B) a local authority as defined in the Explanation to clause (20) of section 10; or

(C) any other person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein;

(b) “seller” means a person whose total sales, gross receipts or turnover from the business carried on by him exceed ten crore rupees during the financial year immediately preceding the financial year in which the sale of goods is carried out, not being a person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein.’;

For Latest Notifications refer Govt Website of Income Tax Click here

TCS on sale of Goods above 50 Lakh,tcs on sale of goods budget 2020, Section 206C Amendment,new TCS provisions 2020,

Dear Sir,

Can you please explain ” provisions of this sub-section shall not apply, if the buyer is liable to deduct tax at source under any other provision of this Act and has deducted such amount.” in detail.

Example :when goods are sold/transferred during the execution of work contract and TDS is to be deducted by the Buyer. Then TCS will not be deducted by seller on sale of goods under this section

it says save as otherwise provides in act…. section 95 says section 206c is applicable from 1st oct