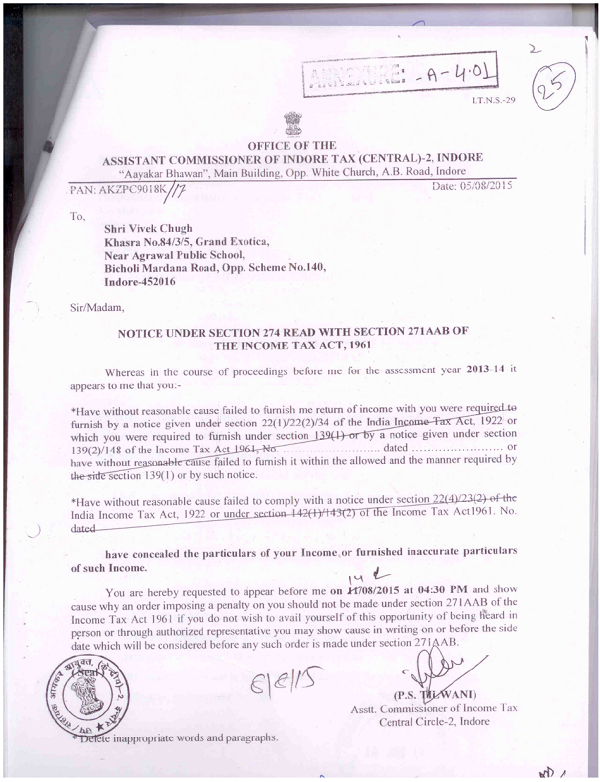

A bare reading of the above notice suggests that the notice has been issued in a casual fashion. The Assessing officer has not applied his mind and no specific charge is mentioned for which the assessee was required to be show caused. In absence of the requisite contents of specific charge the initiation of proceedings cannot be sustained being bad in law.

ITAT Indore

Shri Vivek Chugh Vs ACIT

ITA No.636/Ind/2017

Dated 28/03/2019

Assessment Year : 2013-14

This is an appeal filed by the Assessee against the order of Commissioner of Income Tax(Appeals)-III, Indore dated 31/07/2017 pertaining to assessment year 2013-14. The Assessee has raised following grounds of appeal:

“Grounds of Income-Tax Appeal before the Hon’ble Income-Tax Appellate Tribunal, Indore Bench, Indore, against the Appellate Order passed, under s. 250 of the income Tax Act, 1961, by the learned Commissioner of Income-Tax (Appeals)-III, Indore, pertaining to the A.Y. 2013-14 in response to the appeal filed against the Penalty Order under s. 271AAB of the Act, passed by the learned Assistant Commissioner of Income- Tax (Central)-2, Indore.

1.That, the learned CIT (A) grossly erred in law in confirming the penalty of Rs.3,50,000/- out of total penalty of Rs.7,00,000/- imposed by the Assessing Officer under s.271AAB of the Income-Tax Act, 1961 without considering and appreciating the material fact that the AO imposed the penalty without issuing a proper show-cause notice as contemplated under the provisions of section 274 of the Income-Tax Act, 1961.

2.That, without prejudice to the above, the learned CIT(A) grossly erred in confirming the penalty of Rs.3,50,000/- out of total penalty of Rs.7,00,000/imposed by the Assessing Officer under s.271 AAB of the Income-Tax Act, 1961 without considering and appreciating the material fact that the appellant had fully admitted undisclosed income and also specified the manner, in a very unequivocal and unambiguous way, in which such undisclosed income has been derived during the course of search, in a statement of his father namely Shri Mohanlal Chugh recorded under s. 132(4) of the Act.”

2. Briefly stated facts are that a search and seizure operation u/s 132 was carried out on the business as well as residential premises of the Chugh Group of Indore including the assessee. Thereafter, a notice u/s 153A was issued, in response thereto, the assessee filed his return of income on 22.12.2014 including additional income of Rs.35,00,000/- declared during the search. The assessing officer observed that the assessee could not specify and substantiate the manner in which the said undisclosed income has been derived hence penalty proceedings u/s 271AAB was initiated. Subsequently, the assessing officer imposed a penalty of Rs.7,00,000/- @ 20% of the concealed income.

4. Aggrieved by this the assessee preferred an appeal before the Ld. CIT(A) who however reduced the penalty and restricted the same @10% of the undisclosed income i.e. amounting to Rs.3,50,000/-.

The assessee is in present appeal against the order of the Ld. CIT(A). At the outset, Ld. counsel for the assessee submitted that initiation of penalty u/s 271AAB of the is ex facie bad in law. He drew our attention towards the notice dated 05.08.2015 and enclosed at page no.25 of the paper book. He submitted that the AO initiated penalty proceedings in a casual mechanical manner. That goes to demonstrate that assessing officer has not made a specific charge. Further Ld. counsel for the assessee relied upon the various case laws more particularly in the case of Sandeep Chandak, vs. ACIT in ITANos.416,417 and 418/Lkw/2016 dated 30.01.2017. Further reliance has made on the decision of the Hon’ble Supreme Court rendered in the case of CIT vs. M/s. SSA’s Emerald Meadows (2016) 8 TMI 1145(SC), judgment of the Karnataka High Court in the case of CIT vs. Manjunatha Cotton & Ginning Factory (2012) 83 CCH 282 (Kar. HC). Ld. counsel has also placed reliance on the following decisions of the Tribunal rendered in the cases of:

| S.no. | Citation |

| 1 | Sandeep Chandak & Ors. vs. ACIT (2017) 55 ITR 209 (Luck. Trib.) |

| 2 | ShriAnuj Mathur vs. DCIT 2018 (6) TMI 1311 ITAT Jaipur) |

| 3 | Shri Ravi Mathur vs. DCIT 2018 (6) TMI 1128 ITAT Jaipur) |

| 4 | Shri Suresh Chand Mittal vs. DCIT 2018 (7) TMI 220 (ITAT Jaipur) |

| 5 | DCIT vs. Manish Agarwala 2018 (2) TMI 972 (ITAT Kol.) |

| 6 | DCIT vs. Subhas Chandra Agarwala 2018 (5) TMI 1602 (ITAT Kal.) |

| 7 | Pankaj Jalan vs. DCIT 2018 (5) TMI 1591 (ITAT Kal.) |

| 8 | DCIT vs. Sanwar Mal Agarwala and Adtam Saran Khemka 2018 (5) TMI 422 (ITAT |

| 9 | ACIT vs. MIs. Amrit Hatcheries Pvt. Ltd. 2018 (3) TMI 44 (ITAT K |

| 10 | DCIT vs. Subhas Chandra Agarwala & Sons (HUF) 2018 (3) TMI 214(ITAT Kol.) |

| 11 | MMarvel ssociates vs. ACIT 2018 (3) TMI 946 (ITAT IVishakhapatnam) |

To buttress his contention that notice so issued is illegal and therefore, is not sustainable in the eyes of law.

5. On the contrary Ld. DR opposes the submissions and supported the order of the authorities below. Ld. DR submitted that there no ambiguity under the law in case assessee admits amount being in disclosed then it is to be dealt with in the manner prescribed under 271AAB of the Act. In rejoinder Ld. counsel for the assessee submitted that even the Ld. CIT(A) has sustained penalty u/s 271AAB(1)(a) of the Act while the assessing officer had initiated penalty u/s 271AAB(1)(b) of the Act. No notice of initiating penalty u/s 271AAB(1)(a) was given to the assessee. This fact is sufficient to set aside the impugned order.

6. We have heard the rival submissions and perused the material available on records and gone through the orders of the authorities below. We find that the assessing officer had given a notice which enclosed in the paper book at page 25 for the sake of clarity notice is reproduced as under:

7. A bare reading of the above notice suggests that the notice has been issued in a casual fashion. The Assessing officer has not applied his mind and no specific charge is mentioned for which the assessee was required to be show caused. In absence of the requisite contents of specific charge the initiation of proceedings cannot be sustained being bad in law. Admittedly, Ld. CIT(A) reduced the penalty by applying the provisions of section 271AAB(1)(a). There is no ambiguity under the law so far powers of Ld. CIT(A) is concerned, he can modify the penalty order by enhancing or reducing the penalty. However, where the Act provides for two different rates under different two provisions of law in our considered view, the assessee ought to have been given an opportunity of hearing on this aspect. However, in the present case at the very inception notice initiating penalty is not in accordance with mandates of law. Moreover, it is settled position of law that such defect is not curable u/s 292BB of the Act. Therefore, we hereby quash the penalty order.

8. In the result, the appeal of the Assessee in ITANo.636/Ind/2017 is allowed.

Order was pronounced in the open court on 28.03.2019.

Related Post

Notice U/s. 148 is invalid if issued with Approval of Additional CIT instead of CIT : ITAT

Income Tax Notice u/s 143(2) invalid as issued by ACIT instead of ITO

No penalty if Income Tax notice didn’t specify concealment or furnishing inaccurate income