Non-PAN Transaction

Step-by Step Guide for linking of large value transaction(s) to a valid PAN

Income tax Department has processed AIR transactions without valid PAN which resulted in identification of high risk transaction clusters of non-PAN AIR transactions (with common name and address). Polite letters are being sent by Income Tax Department to the transacting parties communicating the transaction details alongwith unique Transaction Sequence Number (TSN). A new functionality has been developed on e-filing portal wherein the transacting party can own up transactions and provide structured response. The steps involved in submission of online response are as under:

Step 1: Login to e-filing portal at https://incometaxindiaefiling.gov.in. If you are not registered with the e-filing portal, use the ‘Register Yourself’ link to register.

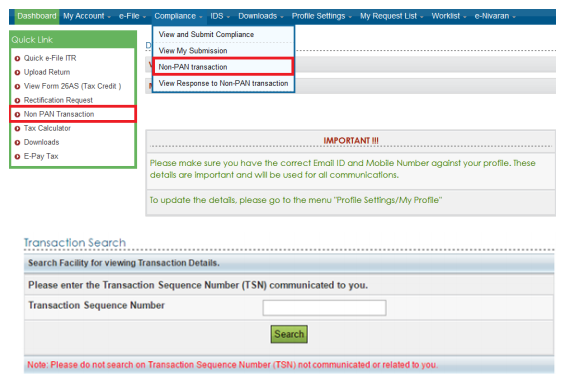

Step 2: Click on “Non-PAN Transaction” link under “Quick Link” or “Compliance” section and search using the Transaction Sequence Number (TSN) communicated to you.

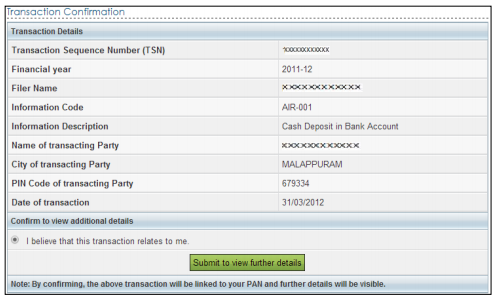

Step 3: Confirm that the transaction relates to you. By confirming, the transaction will be linked to your PAN and further details will be visible.

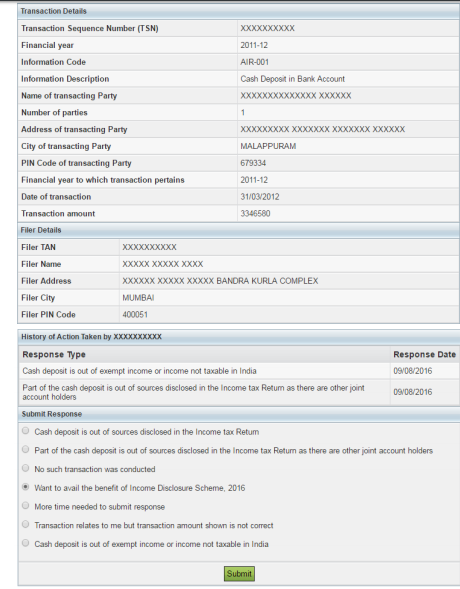

Step 4: View transaction details and submit online response

Note

i. The history of action taken on the transaction by each PAN is maintained separately.

ii. The list of submitted responses is available in the compliance section of the e-filing portal.

iii. The submitted response can be downloaded as pdf for record.

iv. The response can also be revised.