Notification No 10/2019 Central Tax

Notification No 10/2019 Central Tax Dated 7th March 2019 issued to give exemption from registration for any person engaged in exclusive supply of goods and whose aggregate turnover in the financial year does not exceed Rs 40 lakhs.

Video Explanation of Notification No 10/2019 Central Tax for GST Registration Limit of Rs 40 Lakh

Read Notification No 10/2019 Central Tax

[TO BE PUBLISHED IN THE GAZETTE OF INDIA EXTRAORDINARY, PART II,

SECTION 3, SUB-SECTION (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Notification No. 10/2019-Central Tax

New Delhi, the 7th March, 2019

G.S.R (E).- In exercise of the powers conferred by sub-section (2) of section 23 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereafter referred to as the “said Act”), the Central Government, on the recommendations of the Council, hereby specifies the following category of persons, as the category of persons exempt from obtaining registration under the said Act, namely,-

Any person, who is engaged in exclusive supply of goods and whose aggregate turnover in the financial year does not exceed forty lakh rupees, except, –

(a) persons required to take compulsory registration under section 24 of the said Act;

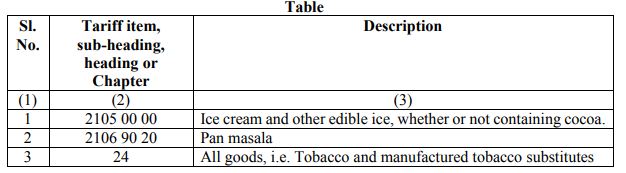

(b) persons engaged in making supplies of the goods, the description of which is specified in column (3) of the Table below and falling under the tariff item, sub-heading, heading or Chapter, as the case may be, as specified in the corresponding entry in column (2) of the said Table;

(iii) persons engaged in making intra-State supplies in the States of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripura, Uttarakhand; and

(iv) persons exercising option under the provisions of sub-section (3) of section 25, or such registered persons who intend to continue with their registration under the said Act.

2. This notification shall come into force on the 1st day of April, 2019.

[F.No.354/25/2019-TRU]

(Gunjan Kumar Verma)

Under Secretary to the Government of India

Download Notification in PDF click here

Related Post

- Change in GST Registration Verification Process

- New GST Registration Limit from 1.4.2019 Notified [Video]

- Separate GST registration for multiple places of business

- New Threshold limit for GST Registration from 01.04.2019

- GST Registration : Analysis

- Suo Moto Registration under GST : FAQs

- How to Apply for GST New Registration – Explained with Screenshots & Examples

- How to Change email and mobile of authorized signatory on GST Portal : Govt Press Release 14.06.2018

- Top 10 states with highest Taxpayer registration under GST

- GST Application submission through DSC , EVC and E Sign – Process

- Is GST reverse Charge applicable if legal service received by supplier of exempt goods ?

- Compulsory Registration under GST ( India )- types

- FAQs on Verification Tab in GST Registration Application

- FAQs on Bank Accounts Tab in GST Registration Application

- FAQs on Goods & Services Tab in GST Registration Application

- FAQ on Additional Places of Business Tab in GST Registration Application

- FAQs on Principal Place of Business Tab in GST Registration Application

- FAQs on Authorized Signatory Tab in GST Registration Application

- FAQs on Promoter/ Partners Tab in GST Registration Application

- FAQs on Business Details Tab of GST Registration Application

- How to download and Install GST Enrolment App on mobile phone

- FAQ’s on Enrollment under GST

- How to lodge complaint on GST Portal (Self Help)

- GST Registration as Tax Deductor on GST Potal : Steps to Register with screenshots

- New GST Registration FAQ’s: What, Who,When, Where, How Explained

- GST Registration as Tax Deductor or collector – FAQ’s

- What are non-core fields in GST Registration Amendment ?

- GST Registration Amendment enabled for NRTP, OIDAR, TDS & TCS taxpayer

- How to Change State Circle name in GST registration Certificate

- How to Amend GST Registration if change of partner in Firm

- How to correct Legal name of Business in GST Registration

- How to amend Authorized Signatory Tab of GST Registration if same person is Promoter as well as Partner

- How to correct name incorrectly printed in GST Provisional Registration Certificate

- How to Amend GST Registration Core and Non-Core Fields

- How to Amend Non core Fields of GST Registration Certificate : Video

- How to Amend Core Fields of GST Registration Certificate Video

- Field Visit by GST Officer after GST Registration : FAQs Video

gst registration limit 40 lakhs notification ,gst 40 lakhs limit notification ,gst exemption limit notification 2019 ,notification 10/2019 gst ,notification no 10/2019 gst,gst notification ,notification no. 10/2019-central tax dated 7th march, 2019 ,40 lakh exemption under gst notification,gst threshold limit 40 lakhs notification