Notification No 23/2017 Central Tax

Seeks to notify the date and conditions for filing the return in FORM GSTR-3B for the month of July, 2017 vide Notification No 23/2017 Central Tax Dtd 17th August, 2017

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance

Department of Revenue

Central Board of Excise and Customs

Notification No. 23/2017 – Central Tax

New Delhi, the 17th August, 2017

G.S.R. ( )E.:- In exercise of the powers conferred by section 168 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereafter in this notification referred to as “the said Act”) read with sub-rule (5) of rule 61 of the Central Goods and Services Tax Rules, 2017 (hereafter in this notification referred to as “the said Rules”) and notification No. 21/2017- Central Tax dated 08th August, 2017 published in the Gazette of India, Extraordinary, Part II,

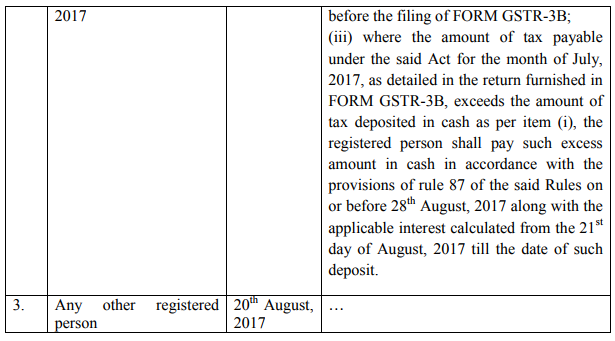

Section 3, Sub-section (i) vide G.S.R. number 997 (E), dated the 08th August, 2017, the Commissioner, on the recommendations of the Council, hereby specifies the conditions in column (4) of the Table below, for furnishing the return in FORM GSTR-3B electronically through the common portal for the month of July, 2017, for such class of registered persons as mentioned in the corresponding entry in column (2) of the said Table, by the date specified

in the corresponding entry in column (3) of the said Table, namely:-

2. Payment of taxes for discharge of tax liability as per GSTR-3B: Every registered person furnishing the return in FORM GSTR-3B shall, subject to the provisions of section 49 of the said Act, discharge his liability towards tax, interest, penalty, fees or any other amount payable under the Act by debiting the electronic cash ledger or electronic credit ledger.

Explanation.- For the purposes of this notification, the expression-

(i) “Registered person” means the person required to file return under sub-section (1) of section 39 of the said Act;

(ii) “tax payable under the said Act” means the difference between the tax payable for the month of July, 2017 as detailed in the return furnished in FORM GSTR-3B and the amount of input tax credit entitled to for the month of July, 2017 under Chapter V and section 140 of the said Act read with the rules made thereunder.

3. This notification shall come into force with effect from the date of publication in the Official Gazette.

[F. No. 349/74/2017-GST(Pt.)]

(Dr. Sreeparvathy S.L.)

Under Secretary to the Government of India

Related Topic on GST

| Topic | Click Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Forms | GST Forms |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | GST Circulars |

| GST Judgments | GST Judgments |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |

| GST History | GST History and Background Material |