Notification No. 5/2017 – Integrated Tax Dated 28th June, 2017

Seeks to notify the number of HSN digits required on tax invoice

PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II,

SECTION 3, SUB-SECTION (i)

Government of India

Ministry of Finance

Department of Revenue

Central Board of Excise and Customs

Notification No. 5/2017 – Integrated Tax

New Delhi, the 28th June, 2017

7 Ashadha, 1939 Saka

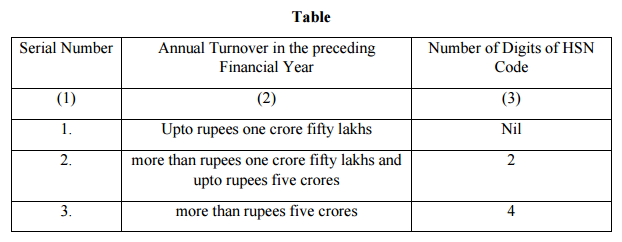

G.S.R. 697(E) .— In pursuance of the first proviso to rule 46 of the Central Goods and Services Tax Rules, 2017 read with notification No. 4/2017-Integrated Tax, dated the 28th June 2017,

the Central Board of Excise and Customs, on the recommendations of the Council, hereby

notifies that a registered person having annual turnover in the preceding financial year as

specified in column (2) of the Table below shall mention the digits of Harmonised System of

Nomenclature (HSN) Codes, as specified in the corresponding entry in column (3) of the said

Table, in a tax invoice issued by such person under the said rules.

2. This notification shall come into force with effect from the 1st day of July, 2017.

[F. No.349/72/2017-GST]

(Dr. Sreeparvathy S.L.)

Under Secretary to the Government of India

Download Notification No. 5/2017 – Integrated Tax Dated 28th June, 2017 in Hindi and English

( Refer Page 1 & 2 of Enclosed PDF)

Related Topic on GST

| Topic | Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | Central Tax Circulars / Orders |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |