THE GAZETTE OF INDIA : EXTRAORDINARY [PART III—SEC. 4]

Insurance Regulatory and Development Authority of India

NOTIFICATION

Hyderabad, the 13th November, 2015

Insurance Regulatory Development Authority of India (Other Forms of Capital) Regulations, 2015

F. No. IRDAI/Reg/20/110/2015- In exercise of the powers conferred by Section 6A (1) (i) and Section 114A (2) (db) of the Insurance Act, 1938 read with section 26 of the Insurance Regulatory and Development Authority Act, 1999 (41 of 1999), the Authority, in consultation with the Insurance Advisory Committee, hereby makes the following regulations, namely:-

1. Short title and commencement.–(1) These regulations may be called Insurance Regulatory and Development Authority of India (Other Forms of Capital) Regulations, 2015.

(2)These Regulations shall come into force on the date of their publication in the Official Gazette.

2. (1) Definitions.-In these Regulations, unless the context otherwise requires, –

i. “Act” means the Insurance Act, 1938 (4 of 1938).

ii. “Authority” means the Insurance Regulatory and Development Authority of India established under sub-section (1) of section 3 of the Insurance Regulatory and Development Authority Act, 1999 (41 of 1999).

iii. “Other forms of capital” means the following instruments issued by an Insurer in the manner prescribed herein:

(a)preference share capital; or

(b)Subordinated debts.

iv. “Preference Share Capital” means the preference share capital as defined in explanation (ii) to section 43 of the Companies Act, 2013 and satisfying the criteria laid down in these Regulations.

v. “Subordinated debt” means Debenture as defined in Section 2(30) of the Companies Act, 2013 and satisfying the criteria laid down in these Regulations; and Any other debt instrument as may be permitted by the Authority.

(2)All words and expressions used herein and not defined in these Regulations but defined in the Companies Act, 2013 or Insurance Act, 1938 (4 of 1938), or in the Insurance Regulatory and Development Authority Act, 1999 (41 of 1999) or Rules or Regulations made there under shall have the same meaning respectively assigned to them in those Acts or Rules or Regulations.

Qualification for “Other forms of capital”

3. Preference shares or subordinated debt shall qualify as “Other forms of capital” provided all of the following criteria are met:

i. Fully Paid up: The Instruments must have been issued and paid up in cash;

ii. Seniority of Claims : The seniority of the claims shall be governed by the following order : a)Preference Shares : The claims of the Preference Shareholders shall be superior to the claims of investors holding equity share capital but shall be subordinated to the claims of the policyholders and all other creditors;

b) Subordinated Debt: The claims of the holders of the subordinated debt shall be superior to the claims of the investors in preference shares and equity shares in that order but shall be subordinated to the claims of the policyholders and all other creditors.

iii. The instruments issued under these Regulations shall neither be secured nor covered by a guarantee of the Insurer or other arrangements that legally enhance the seniority of the claims as against the claims of the insurer’s policyholders and creditors;

iv. Maturity Period : The maturity period of the instruments issued by insurers under these Regulations shall be as under:

a. Preference Share Capital : The maturity period or redemption period shall not be less than:

(i) Ten years for Life, General Insurance and Reinsurance Companies; and

(ii) Seven years for Health Insurance Companies.

b. Subordinated Debt : The issue of the subordinated debt shall either be perpetual or the maturity period or redemption period shall not be less than :

(i) Ten years for Life, General and Reinsurance Insurance Companies; and

(ii) Seven years for Health Insurance Companies;

Provided that nothing in this Regulation shall prohibit the insurer from exercising a call option under Regulation 10 of these Regulations.

v. No incentives shall be payable for early redemption.

vi. The rate of dividend / interest payable to the investors may be either a fixed rate or a floating rate. The floating rate shall be with reference to a market determined rupee interest benchmark rate.

vii. Interest on subordinated debt shall be charged to the Profit & Loss Account and Dividend on Preference Shares shall be paid out of the distributable profit of the shareholders

Provided that the solvency of the Insurer remains as per the regulatory stipulations;

Provided further that where the impact of such payment may result in net loss or increase the net loss, prior approval of the Authority for such payment shall be obtained;

viii. Dividend / interest discretion: Cancellation of dividend distribution on preference shares or servicing of the subordinated debt must not impose restrictions on the Insurer except for distribution of dividend to equity shareholders.

Prior Approval of the Authority

4. No Insurer shall issue “Other forms of capital” without the specific prior approval of the Authority under Regulation 6.

Procedure for Issue

5. An Insurer intending to raise “Other forms of capital” shall make an application for obtaining prior approval of the Authority in Form-1. The following documents shall be enclosed with the application:

i. Board resolution and special resolution passed in the general body meeting of the shareholders authorising the issue of the preference shares;

ii. Board resolution authorising the issue of the subordinated debt;

iii. Projected business plan and the projected solvency position for a period of five years;

iv. A copy of the terms and conditions on which the preference share capital or subordinated debt are proposed to be issued;

v. The intended classification of the instruments proposed to be issued for Available Capital purposes for computation of solvency margin;

vi. Rationale for issuing “Other forms of capital” in lieu of raising funds through issue of equity share capital;

vii. Confirmation

a) that the Insurer shall not be liable to pay dividend or interest for any financial year if,

1) The insurer’s solvency is below the minimum regulatory requirements prescribed by the Authority; or 2) The impact of such payment would result in Insurer’s solvency falling below or remaining below the minimum regulatory requirement specified by the Authority.

b) that the dividend or interest, as the case may be, shall not be cumulative i.e., dividend or interest missed in a year will not be paid in future years;

Provided that the interest amount due and remaining unpaid may be allowed to be paid in the subsequent financial years subject to compliance of above mentioned regulation 3 (vii). While paying such unpaid interest, the insurers are allowed to pay compound interest. Such compounding of interest shall be in accordance with the coupon rate of the subordinated debt.

Approval of the Authority

6. The Authority may approve issuance of “Other forms of Capital” on being satisfied of the fulfillment of the following conditions:

i. All instruments shall be fully paid up and unsecured;

ii. Investment in such instruments by foreign investors including Foreign Institutional Investors (FIIs) or foreign portfolio investors (FPIs) shall be subject to the FEMA Regulations;

iii. The Insurer shall comply with the terms and conditions, if any, stipulated by SEBI / other regulatory authorities in regard to issue of the said instruments;

iv. Such other conditions as may be deemed appropriate by the Authority

Reporting requirements

7. The Insurer issuing the instruments under these Regulations shall file a report to the Authority giving the details of the funds raised through issue of these instruments along with a copy of the offer document within 15 days from the date of allotment.

Classification in the Balance Sheet

8. The instruments issued by an Insurer shall be classified as under in the Balance Sheet to be prepared in accordance with IRDA (Preparation of Financial Statements and Auditor’s Report of Insurance Companies) Regulations, 2002 as amended from time to time.

i. In case of preference shares under the head “Share Capital” in the relevant schedule.

ii. In case of subordinated debt under the head “Borrowings” in the relevant schedule.

iii. In case any instrument is issued at a premium, the premium received shall be shown under the head “Securities Premium” in the relevant schedule.

9. The Insurer shall also disclose the amount raised through the issue of instruments under these Regulations along with a gist of the terms of issue and the maturity / redemption period in the Notes to the Accounts forming part of the Annual Financial Statements prepared in accordance with IRDA (Preparation of Financial Statements and Auditor’s Report of Insurance Companies) Regulations, 2002 as amended from time to time.

Call Back of Instruments

10. An Insurer shall not issue any instrument under these Regulations with “put option”. However, an Insurer may issue the instruments with a “call option” subject to the following:

i. Call option may be exercised after the instrument has run for at least a period of five completed years; ii. No Insurer shall exercise the call option without the prior approval of the Authority;

iii. While considering the proposals received from the Insurer for exercising the call option, the Authority shall, amongst other things, take into consideration the Insurer’s solvency position both at the time of exercise of the call option and after exercise of the call option

Provided that the Authority may allow an Insurer to replace the called instrument with the equal or better quality instrument.

Subscribers to the Instruments

11. The issuance of such instruments may be through private placement and may be subscribed to by the following:

i. Indian promoters as defined in IRDAI (Registration of Indian insurance companies) Regulations, 2000;

ii. Indian investors as defined in IRDAI (Registration of Indian Insurance companies) Regulations, 2000;

iii. Foreign investors as defined in Indian Insurance Companies (Foreign Investment) Rules, 2015 Provided the subscription by the foreign investors shall be subject to compliance with the FEMA Regulations issued in this regard.

iv. Any other person as may be approved by the Authority.

Investment by another Insurer in “Other forms of capital”

12. An Insurer may invest in the “Other forms of capital” issued by another Insurer subject to the following:

i. such investments shall only be classified under “Other investments”; and

ii. such instruments shall be subject to the exposure norms as specified in IRDA (Investment) Regulations, 2000.

Grant of Loans against the Instruments

13. Insurers shall not grant any loan against the security of the instruments issued by them.

Limit for Other forms of Capital

14. The total quantum of the instruments taken together shall not exceed 25 percent of total of Paid up Equity Share Capital and Securities premium of an Insurer at any point in time.

Provided that, at any point of time, the total quantum of the “Other forms of Capital” shall not exceed 50 percent of the net worth of an insurer

Amortization of the instruments for the purpose of computing solvency

15. The instruments issued as “Other forms of Capital”, net of hair cut as specified in Regulation 16, shall be counted towards “Available Solvency Margin” of the Insurer.

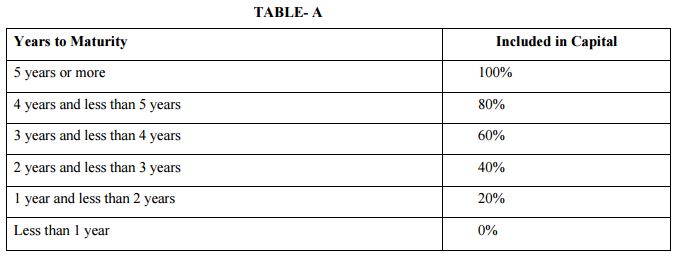

16. The instruments shall be subjected to a progressive hair cut for the purpose of computation of “Available solvency Margin” on straight-line basis in the final five years prior to maturity. Accordingly, as these instruments issued under these Regulations approach maturity, the outstanding balances are to be reckoned for inclusion in capital as indicated in the Table ‘A’ below:

In effect, the amount arrived at after making the above said adjustment alone shall be eligible for inclusion in “Available Solvency Margin”.

Provided that such hair cut shall be applied at the end of each financial quarter based on the “years to maturity”.

Power to Remove Difficulties and Issue Clarifications:

In order to remove any doubts or the difficulties that may arise in the application or interpretation of any of the provisions of these Regulations, the Chairperson of the Authority may issue appropriate clarifications or guidelines as deemed necessary

It is further certified that

(i) The aggregate investment by all Foreign Investors including FIIs and Foreign Portfolio Investors shall not exceed the limit specified in FEMA Act, 1999 or Regulations issued thereunder.

(ii)The issuance of the preference shares and subordinated debts to Foreign investors including FII and Foreign Portfolio Investors is in compliance to the pricing guidelines as applicable .

On receipt of approval from the Authority, we shall ensure compliance with all regulatory requirements, including but not limited to the Corporate Laws and all other stipulations as may be applicable. (Signature )

Chief Executive Officer / Chairman (Name of the Insurer) Place:

Date: T. S. VIJAYAN,Chairman [ADVT. III /4/Exty./161/15 (259)]