RBI/DBR/2015-16/24

Master Direction DBR.PSBD.No. 97/16.13.100/2015-16 May 12, 2016

Master Direction – Ownership in Private Sector Banks, Directions, 2016

In exercise of the powers conferred by the Second proviso to Section12 (B) (2) of the Banking Regulation Act, 1949 the Reserve Bank of India being satisfied that it is necessary and expedient in the public interest so to do, hereby, issues the Directions hereinafter specified.

CHAPTER – I

PRELIMINARY

1. Short Title and Commencement

(a) These Directions shall be called the Reserve Bank of India (Ownership in Private Sector Banks) Directions, 2016.

(b) These directions shall come into effect on the day they are placed on the official website of the Reserve Bank of India (RBI).

2. Applicability

The provisions of these Directions shall apply to all private sector banks licensed by RBI to operate in India.

3. Definitions

(i) In these Directions, unless the context otherwise requires, the terms herein shall bear the meanings assigned to them below –

(a) “Private Sector Banks” means banks licensed to operate in India under Banking Regulation Act, 1949, other than Urban Co-operative Banks, Foreign Banks and banks established under specific Statutes.

(b) “Person” means a natural person or categories of legal persons namely, nonfinancial institutions / entities, non-regulated or non-diversified and non-listed financial institutions, regulated, well diversified and listed financial institutions, supranational institution, public sector undertaking, Government.

(ii) All other expressions unless defined herein shall have the same meaning as have been assigned to them under the Banking Regulation Act, 1949 or the Reserve Bank of India Act, 1934 or SEBI Guidelines or Companies Act, 2013 and Rules made thereunder or as used in commercial parlance, as the case may be.

CHAPTER II

SHAREHOLDING AND VOTING RIGHTS LIMITS IN PRIVATE SECTOR BANKS

Principles for shareholding limits

Promoters

4. The promoter / promoter group shareholding in the bank, during the lock-in period and thereafter, shall be governed by the respective guidelines under which they are licensed.

provided that, in case the promoter / promoter group is eligible for higher shareholding on account of being a financial institution, as specified in the matrix at paragraph 6 below, on expiry of the lock-in period, the shareholding may be maintained at the level prescribed in the matrix for all the shareholders in the long run or maintained at the level permitted by the respective licensing guidelines, whichever is higher. To achieve the permitted shareholding level, a period of 12 years from the date of commencement of business of the bank shall be available for the promoters / promoter group or Non-Operative Financial Holding Company (NOFHC).

All shareholders in the long run

5. Ownership limits for all shareholders in the long run shall be based on categorization of the shareholders under two broad categories viz. (i) natural persons (individuals) and (ii) legal persons (entities/institutions). Further, non-financial and financial institutions, and among financial institutions, diversified and non-diversified financial institutions shall have separate limits for shareholding as under:

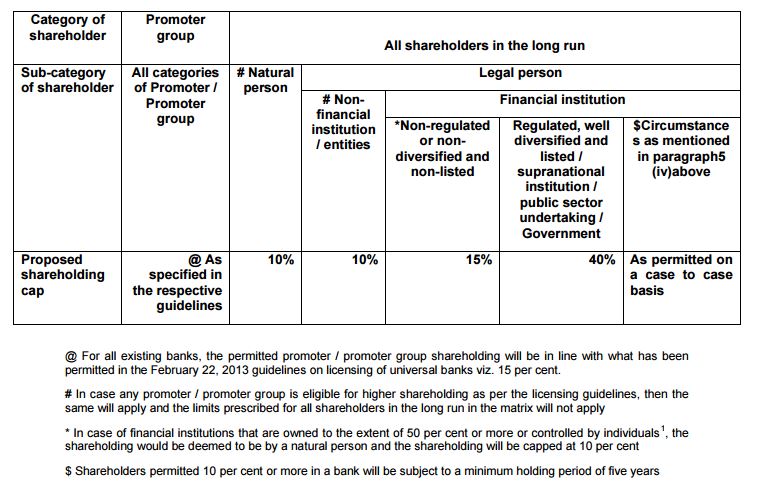

(i) In the case of individuals and non-financial entities (other than promoters / promoter group), the limit shall be 10 per cent of the paid up capital. However, in case of promoters being individuals and non-financial entities in existing banks, the permitted promoter / promoter group shareholding shall be in line with permitted level in the February 22, 2013 guidelines on licensing of universal banks viz. 15 per cent

ii) In the case of entities from the financial sector, other than regulated or diversified or listed, the limit shall be at 15 per cent of the paid-up capital.

(iii) In the case of ‘regulated, well diversified, listed entities from the financial sector’ and shareholding by supranational institutions or public sector undertaking or Government, a uniform limit upto 40 per cent of the paid-up capital is permitted for both promoters / promoter group and non-promoters

(iv) Higher stake / strategic investment by promoters / non-promoters through capital infusion by domestic or foreign entities / institution shall be permitted on a case to case basis under circumstances such as relinquishment by existing promoters, rehabilitation / restructuring of problem / weak banks / entrenchment of existing promotersor in the interest of the bank or in the interest of consolidation in the banking sector, etc.

Matrix of shareholding limits

6. The shareholding ceilings in the private sector banks shall be applicable to various categories of shareholders as per the following shareholding matrix.

Ceiling on voting rights

7. Notwithstanding the shareholding that may be permitted by the RBI, the voting rights shall be limited to the level notified by RBI as per the provisions of sub-section 2 of Section 12 of Banking Regulation Act, 1949, as notified by RBI from time to time, and the current level of ceiling on voting rights is at 15 per cent

- Including relatives as defined in Section 2(77) of the Companies Act, 2013 and rules made there under or persons acting in concert

CHAPTER III

OVERARCHING PRINCIPLES FOR SHAREHOLDING IN PRIVATE SECTOR BANKS

8. Overarching principles

(i) Shareholding limits applicable to group

The shareholding limits shall be applicable to aggregate holding of the group as defined for promoter group in the SEBI (Issue of Capital & Disclosure Requirements) Regulations, 2009.

(ii) Compliance with prior approval requirement

Any acquisition of shareholding / voting rights of 5 per cent or more of the paid-up capital of the bank or total voting rights of the bank shall be subject to obtaining prior approval from the Reserve Bank of India as laid down in Master Direction dated November 19, 2015 on ‘Prior approval for acquisition of shares or voting rights in private sector banks’

(iii) Compliance with “fit and proper” requirement

Even after obtaining the prior approval of the Reserve Bank as indicated in paragraph 8 (ii) above, the major shareholders 2 (including the promoters / promoter group) shall continue to be “fit and proper” on a continuous basis, as laid down in Master Directions dated November 19, 2015 on ‘Prior approval for acquisition of shares or voting rights in private sector banks’.

(iv) Compliance with FDI policy

a) Acquisition of shareholding in a private sector bank shall be subject to the extant Foreign Direct Investment (FDI) policy, subject to specific requirements, if any, in the respective licensing guidelines. In terms of the Government of India FDI policy (of April 2015), the aggregate foreign investment in private sector banks from all sources (Foreign Direct Investment, Foreign Institutional Investors, Non Resident Indians) shall

2. 2 The expression ‘major shareholder shall, mean shareholders having 5 percent or more of the paid-up share capital of the bank or persons exercising voting rights of 5 per cent or more of the voting rights in the bank

not exceed 74 per cent of paid-up capital of the bank. At all times, at least 26 per cent of the paid-up share capital of the private sector banks shall be held by resident Indians. The foreign investment limits and sub-limits and also computation of foreign investment in the private sector banks shall be as specified in the FDI policy of the Government of India and FEMA regulations as amended from time to time.

b) The requirement of prior approval for acquisition of shares/ voting rights of 5 per cent and above in a private sector bank as stipulated in Master Direction dated November 19, 2015 on ‘Prior approval for acquisition of shares or voting rights in private sector banks’, shall equally be applicable for foreign investment. Hence, any foreign investment in private banks by any person (including his relatives and associate enterprises and persons acting in concert) whereby shareholding reaches or exceeds 5 per cent shall require prior approval from RBI for acquisition of shares or voting rights.

c) The RBI shall assess the “fit and proper” status of the foreign investors according to the criteria laid down Master Direction dated November 19, 2015 on ‘Prior approval for acquisition of shares or voting rights in private sector banks’, which will include extensive information on ownership of the investors and beneficial interest in the shares/voting rights being acquired.

(v) Cross holding limits

Banks (including foreign banks having branch presence in India) shall not acquire any fresh stake in a bank’s equity shares, if by such acquisition, the investing bank’s holding is 10 per cent or more of the investee bank’s equity capital. However, in case of exceptional circumstances such as, restructuring of problem / weak banks or in the interest of consolidation in the banking sector, etc., RBI may permit a higher level of shareholding by a bank as specified in paragraph 5 (iv) above.

(vi) Higher shareholding limits

Shareholders may be permitted higher shareholding as per the principles specified in chapter II above subject to the following:

(a) In banks where there are no major regulatory / supervisory concerns, a person may be permitted to acquire higher shareholding, if the same is supported by the Board of the Directors of the concerned bank. In such banks, hostile takeover shall not be permitted.

(b) In banks where there are regulatory / supervisory concerns and, where in the opinion of the RBI, a change in the ownership / management of the bank is necessary in the interests of the depositors of the bank / public interest, RBI may at its discretion permit a person to acquire higher shareholding, even if the concerned bank’s Board does not support the same. Such a person, may or may not be an existing shareholder.

(c) Any such person who has been permitted by RBI to have higher shareholding than the limits specified in the matrix at paragraph 6 above, shall be required to bring down the shareholding to the level as specified in the matrix, within 12 years from the date of such higher shareholding being permitted, unless RBI has advised in writing to the contrary.

(d) Any person who has been permitted by RBI to have a shareholding of 10 per cent or more in a bank, shall be subject to a minimum holding period of five years. Such person shall be free to divest his holdings thereafter, unless otherwise required specifically by the Reserve Bank.

vii) Entrenchment of promoters / promoter group

In case any concerns / information regarding the promoters/promoter group come to the notice of RBI that render them not “fit and proper” to hold such shares or voting rights or if the bank is not functioning efficiently due to the complacency of the promoters / promoter group, Reserve Bank may initiate action as deemed appropriate in exercise of its powers under the Banking Regulation Act, 1949. Further, it would be open for the RBI to look into offers, on a case to case basis, for acquisition by other parties who are “fit and proper”, in the interest of the bank or in public interest. This will pave the way for takeover by a new set of promoters / promoter group subject to RBI approval.

CHAPTER IV

EXCEPTIONS TO THE GENERAL SHAREHOLDING LIMITS

Exceptions – Compliance with licensing guidelines

9. There shall be exceptions to the rules to the extent specified below

(a) In case of setting up of new private sector banks, there is a requirement of minimum shareholding by promoters / promoter group or NOFHC (presently 40 per cent of the paid up capital of the bank), which shall be locked in for a period of five years. The shareholding by promoters shall continue to be at 40 per cent of the paid up capital of the bank during the lock in period, including in cases of raising of further voting equity capital by the bank resulting in enhanced voting equity capital of the bank. On expiry of the lock-in period, the shareholding in excess of 40 per cent shall be brought down to 40 per cent within the timelines as specified in the respective guidelines. Depending on the category of promoters, the shareholding shall be maintained as per the limits prescribed in the matrix for all shareholders in the long run (as at paragraph 6 above) or maintained at the level permitted by the respective licensing guidelines, whichever is higher. However, to achieve the permitted shareholding level as per the shareholding matrix as at paragraph 6 above, a period of 12 years from the date of commencement of business of the bank shall be available for the promoters / promoter group or NOFHC in cases where dilution to a lower level of shareholding is required for compliance with the limits specified in the matrix in paragraph 6 above.

(b) In the case of new banks, the non-promoters will be permitted to have shareholding upto the limits specified in the respective guidelines. However, the non-promoters may be permitted to hold higher shareholding as a strategic investor as per the shareholding matrix as at paragraph 6 above after a period of five years from the date of commencement of banking business. Persons who have been permitted a shareholding of 10 per cent or more in a bank will be subject to a minimum holding period of five years. Such investors will be free to divest their holdings thereafter, unless otherwise required specifically by the Reserve Bank.

CHAPTER V

ISSUE OF AMERICAN DEPOSITORY RECEIPTS (ADRs)/ GLOBAL DEPOSITORY RECEIPTS (GDRs)

10. Issue of ADRs/GDRs

Banks could raise funds through issue of American Depository / Global Depository Receipts. Under such a mechanism, banks shall issue shares to the depositories who in turn issue ADRs / GDRs to the ultimate investors. In such cases, banks shall enter into an agreement with the depository to the effect that the depository shall not exercise voting rights in respect of the shares held by them or they shall exercise voting rights as directed by the Board of Directors of the bank. In this context, banks shall furnish to Reserve Bank a copy each of the Depository Agreements entered into by them with the depositories. Further, to eliminate possibility of any interference of the depositories in the management of the bank, banks shall give an undertaking to Reserve Bank that

(i) they would not give cognizance to voting by the depository, should the depository vote in contravention of its agreement with the bank;

(ii) no change would be made in terms of the Depository Agreement without prior approval of RBI.

CHAPTER VI

TRANSITION ARRANGEMENTS

11. Transition arrangements

In the case of existing private sector banks,

i) Where specific orders have been passed by the Reserve Bank relating to dilution of shareholding by persons / entities / groups, those orders will continue to apply for such shareholding.

ii) Where specific approvals have been granted by the Reserve Bank for promoters / entities / groups to have shareholding in excess of 10 per cent, they could continue to hold such shareholding in the banks upto the specified period.

iii) Where any promoter / promoter group has shareholding in excess of 15 per cent and timelines have already been stipulated by RBI for bringing it down to 10 per cent, such timelines shall continue to apply for bringing the shareholding down to 15 per cent.

CHAPTER – VII

REPEAL AND OTHER PROVISIONS

12. With the issue of these Directions, the instructions / guidelines contained in the following circulars issued by the Reserve Bank stand repealed:

i) Circular DBOD.No.PSBD.BC.99/16.13.100/2004-05 dated February 28, 2005 on Ownership and Governance in Private Sector Banks stand superseded to the extent covered by these Directions.

ii) Circular DBOD.No.PSBD.7269/16.13.100/2006-07 dated February 5, 2007 on Issue of American Depository Receipts (ADRs) / Global Depository Receipts (GDRs) – Depository Agreement.