Payment of Service Tax

(After Finance Act 2016 Amendment w.e.f 01.04.2016)

Read Also Finance Act 2016 Notified by Indian Govt

Date of Payment of Service Tax by HUF / One Person Company

w.e.f. 1-4-2016 ,Rule 6 of the Service Tax Rules, 1994 is being amended by Finance Act 2016 to extend the benefit of quarterly payment of service tax to One Person Company (OPC) whose aggregate value of services provided is up to Rs. 50 lakh in the previous financial year and an HUF. Further, payment of service tax on receipt basis is also extended to such OPC.

However service tax on the service deemed to be provided in the month of March, or the quarter ending in March, as the case may be, shall be paid to the credit of the Central Government by the 31st day of March of the calendar year:

Salient Features of Rule 6 : Payment of Service Tax after Finance Act 2016

- Quarterly Payment of Service tax by One person company whose aggregate value of taxable services provided from one or more premises is fifty lakh rupees or less in the previous financial year w.e.f 01.4.2016

- Quarterly Payment of Service tax by an individual or proprietary firm

- Quarterly Payment of Service tax by partnership firm

- Quarterly Payment of Service tax by Hindu Undivided Family

- Monthly Payment Of service tax in case of Other person (othe than one person company whose aggregate value of taxable services provided from one or more premises is fifty lakh rupees or less in the previous financial year, or is an individual or proprietary firm or partnership firm or Hindu Undivided Family ) e.g Companies , AOP , Trust , One person company whose aggregate value of taxable services provided from one or more premises is more than fifty lakh rupees in the previous financial year

- Payment of Service tax by 6th day of Month/Quarter immediately following the calendar month/Quarter if service tax is deposited electronically through internet banking; and 5th day of the month/Quarter immediately following the calendar month/ quarter in other cases

- Every assessee shall electronically pay the service tax , through internet banking . However Assistant Commissioner or the Deputy Commissioner may allow other mode than internet banking

- If the assessee deposits the service tax by cheque, the date of presentation of cheque to the bank designated by the Central Board of Excise and Customs for this purpose shall be deemed to be the date on which service tax has been paid subject to realization of that cheque.

- Service tax on the service deemed to be provided in the month of March, or the quarter ending in March, as the case may be, shall be paid to the credit of the Central Government by the 31st day of March of the calendar year (By all the person , whether HUF, Individual etc )

- Every person liable to pay service tax, may, on his own volition, pay an amount as service tax in advance and adjust the amount so paid against the service tax which he is liable to pay for the subsequent period. Provided that the assessee shall,

- intimate the details of the amount of service tax paid in advance, to the jurisdictional Superintendent of Central Excise within a period of fifteen days from the date of such payment; and

- indicate the details of the advance payment made, and its adjustment, if any in the subsequent return to be filed under section 70 of the Act.

- Where an assessee has issued an invoice, or received any payment, against a service to be provided which is not so provided by him either wholly or partially for any reason or where the amount of invoice is renegotiated due to deficient provision of service, or any terms contained in a contract, the assessee may take the credit of such excess service tax paid by him, if the assessee,—

a) has refunded the payment or part thereof, so received for the service provided to the person from whom it was received or

b) has issued a credit note for the value of the service not so provided to the person to whom such an invoice had been issued.

- Where an assessee is, for any reason, unable to correctly estimate the actual amount payable for any particular month or quarter, he may make a request in writing to the Assistant Commissioner of Central Excise or the Deputy Commissioner of Central Excise, giving reasons for payment of service tax on provisional basis and they may allow the same. (Note : Assessee is required to file a statement giving details of the difference between the service tax deposited and the service tax liable to be paid for each month in a memorandum in Form ST-3A accompanying the quarterly or half-yearly return, as the case may be. )

- where an assessee has made payment of service tax in excess , the assessee may adjust such excess amount paid by him against his service taxliability for the succeeding month or quarter subject to the condition that the excess amount paid is on account of reasons not involving interpretation of law, taxability, valuation or applicability of any exemption notification.

- Where the person liable to pay service tax in respect of service of renting of immovable property has paid any amount in excess of the amount required to be paid towards service tax liability for a month or quarter, as the case may be, on account of non-availment of deduction of property tax paid in terms of Notification No. 29/2012-Service Tax, dated the 20th June, 2012, from the gross amount charged for renting of the immovable property for the said period at the time of payment of service tax, the assessee may adjust such excess amount paid by him against his service tax liability within one year from the date of payment of such property tax and the details of such adjustment shall be intimated to the Superintendent of Central Excise having jurisdiction over the service provider within a period of fifteen days from the date of such adjustment

- The person liable for paying the service tax in relation to the services of booking of tickets for travel by air provided by an air travel agent, shall have the option, to pay an amount calculated at the rate of 0.7 per cent]of the basic fare in the case of domestic bookings, and at the rate of 1.4 per cent of the basic fare in the case of international bookings, of passage for travel by air, during any calendar month or quarter, as the case may be, towards the discharge of his service tax liability instead of paying service tax at the rate specified in section 66B of Chapter V of the Act and the option, once exercised, shall apply uniformly in respect of all the bookings of passage for travel by air made by him and shall not be changed during a financial year under any circumstances.

An insurer carrying on life insurance business shall have the option to pay tax:

i) on the gross premium charged from a policy holder reduced by the amount allocated for investment, or savings on behalf of policy holder, if such amount is intimated to the policy holder at the time of providing of service;

ia) in case of single premium annuity policies other than (i) above, 1.4 per cent of the single premium charged from the policy holder

iii) in all other cases, 3.5 per cent of the premium charged from policy holder in the first year and 1.75 per cent of the premium charged from policy holder in the subsequent years;

towards the discharge of his service tax liability instead of paying service tax at the rate specified in section 66B of Chapter V of the said Act:

Provided that such option shall not be available in cases where the entire premium paid by the policy holder is only towards risk cover in life insurance

The person liable to pay service tax in relation to purchase or sale of foreign currency, including money changing, shall have the option to pay an amount calculated at the following rate towards discharge of his service tax liability instead of paying service tax at the rate specified in section 66B of Chapter V of the Act, namely

a) 0.14 per cent of the gross amount of currency exchanged for an amount upto rupees 100,000, subject to the minimum amount of rupees 35

b) rupees 140 and 0.07 per cent of the gross amount of currency exchanged for an amount of rupees exceeding rupees 100,000 and upto rupees 10,00,000; and

c) rupees 770 and 0.014 per cent of the gross amount of currency exchanged for an amount of rupees exceeding 10,00,000, subject to maximum amount of rupees 7000:

Provided that the person providing the service shall exercise such option for a financial year and such option shall not be withdrawn during the remaining part of that financial year.

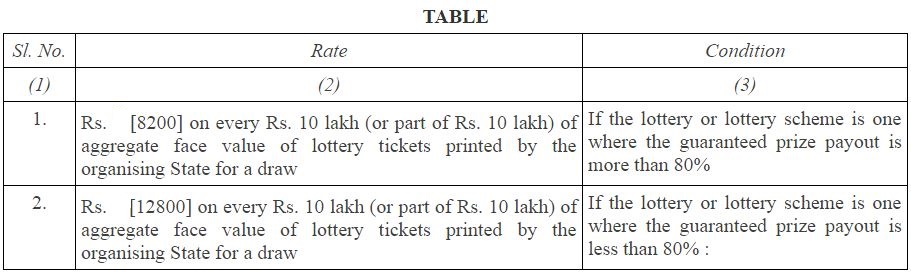

- The distributor or selling agent, liable to pay service tax for the taxable service of promotion, marketing, organising or in any other manner assisting in organising lottery, shall have the option to pay an amount as per Rule 6 (7C)

Dates of Payment of Service Tax : Rule 6

Rule – 6, Service Tax Rules, 1994

Payment of service tax.

6. (1) The service tax shall be paid to the credit of the Central Government,—

(i) by the 6th day of the month, if the duty is deposited electronically through internet banking; and

(ii) by the 5th day of the month, in any other case

immediately following the calendar month in which the service is deemed to be provided as per the rules framed in this regard

Provided that where the assessee is a one person company whose aggregate value of taxable services provided from one or more premises is fifty lakh rupees or less in the previous financial year, or is an individual or proprietary firm or partnership firm or Hindu Undivided Family the service tax shall be paid to the credit of the Central Government by the 6th day of the month if the duty is deposited electronically through internet banking, or, in any other case, the 5th day of the month, as the case may be, immediately following the quarter in which the service is deemed to be provided as per the rules framed in this regard:

Provided further that the service tax on the service deemed to be provided in the month of March, or the quarter ending in March, as the case may be, shall be paid to the credit of the Central Government by the 31st day of March of the calendar year:

Provided also that in case of such individuals, partnership firms and one person companies whose aggregate value of taxable services provided from one or more premises is fifty lakh rupees or less in the previous financial year, the service provider shall have the option to pay tax on taxable services provided or agreed to be provided by him up to a total of rupees fifty lakhs in the current financial year, by the dates specified in this sub-rule with respect to the month or quarter, as the case may be, in which payment is received.

Provided also that in the case of an assessee in the State of Tamil Nadu and the Union Territory of Puducherry (except Mahe & Yanam), the service tax payable for the month of November, 2015, shall be paid to the credit of the Central Government by the 20th day of December, 2015

(1A) Without prejudice to the provisions contained in sub-rule (1), every person liable to pay service tax, may, on his own volition, pay an amount as service tax in advance, to the credit of the Central Government and adjust the amount so paid against the service tax which he is liable to pay for the subsequent period

Provided that the assessee shall,

i) intimate the details of the amount of service tax paid in advance, to the jurisdictional Superintendent of Central Excise within a period of fifteen days from the date of such payment ; and

ii) indicate the details of the advance payment made, and its adjustment, if any in the subsequent return to be filed under section 70 of the Act

(2) Every assessee shall electronically pay the service tax payable by him, through internet banking

Provided that the Assistant Commissioner or the Deputy Commissioner of Central Excise, as the case may be, having jurisdiction, may for reasons to be recorded in writing, allow the assessee to deposit the service tax by any mode other than internet banking.

(2A) For the purpose of this rule, if the assessee deposits the service tax by cheque, the date of presentation of cheque to the bank designated by the Central Board of Excise and Customs for this purpose shall be deemed to be the date on which service tax has been paid subject to realization of that cheque.

(3) Where an assessee has issued an invoice, or received any payment, against a service to be provided which is not so provided by him either wholly or partially for any reason or where the amount of invoice is renegotiated due to deficient provision of service, or any terms contained in a contract, the assessee may take the credit of such excess service tax paid by him, if the assessee,—

a) has refunded the payment or part thereof, so received for the service provided to the person from whom it was received or

b) has issued a credit note for the value of the service not so provided to the person to whom such an invoice had been issued.

(4) Where an assessee is, for any reason, unable to correctly estimate, on the date of deposit, the actual amount payable for any particular month or quarter, as the case may be, he may make a request in writing to the Assistant Commissioner of Central Excise or the Deputy Commissioner of Central Excise, as the case may be, giving reasons for payment of service tax on provisional basis and the Assistant Commissioner of Central Excise or the Deputy Commissioner of Central Excise, as the case may be, on receipt of such request, may allow payment of service tax on provisional basis on such value of taxable service as may be specified by him and the provisions of the Central Excise Rules, 2002 relating to provisional assessment except so far as they relate to execution of bond, shall, so far as may be, apply to such assessment.

4A) Notwithstanding anything contained in sub-rule (4), where an assessee has paid to the credit of Central Government any amount in excess of the amount required to be paid towards service tax liability for a month or quarter, as the case may be, the assessee may adjust such excess amount paid by him against his service taxliability for the succeeding month or quarter, as the case may be.

4B) The adjustment of excess amount paid, under sub-rule (4A), shall be subject to the condition that the excess amount paid is on account of reasons not involving interpretation of law, taxability, valuation or applicability of any exemption notification

(4C) Notwithstanding anything contained in sub-rules (4), (4A) and (4B), where the person liable to pay service tax in respect of service of renting of immovable property has paid to the credit of Central Government any amount in excess of the amount required to be paid towards service tax liability for a month or quarter, as the case may be, on account of non-availment of deduction of property tax paid in terms of Notification No. 29/2012-Service Tax, dated the 20th June, 2012, from the gross amount charged for renting of the immovable property for the said period at the time of payment of service tax, the assessee may adjust such excess amount paid by him against his service tax liability within one year from the date of payment of such property tax and the details of such adjustment shall be intimated to the Superintendent of Central Excise having jurisdiction over the service provider within a period of fifteen days from the date of such adjustment.

(5) Where an assessee under sub-rule (4) requests for a provisional assessment he shall file a statement giving details of the difference between the service tax deposited and the service tax liable to be paid for each month in a memorandum in Form ST-3A accompanying the quarterly or half-yearly return, as the case may be.

(6) Where the assessee submits a memorandum in Form ST-3A under sub-rule (5), it shall be lawful for the Assistant Commissioner of Central Excise or the Deputy Commissioner of Central Excise, as the case may be, to complete the assessment, wherever he deems it necessary, after calling such further documents or records as he may consider necessary and proper in the circumstances of the case.

Explanation.— For the purposes of this rule and rule 7, “Form TR-6” means a memorandum or challan referred to in rule 92 of the Treasury Rules of the Central Government.

(7) The person liable for paying the service tax in relation to the services of booking of tickets for travel by air] provided by an air travel agent, shall have the option, to pay an amount calculated at the rate of 0.7 per cent]of the basic fare in the case of domestic bookings, and at the rate of 1.4 per cent of the basic fare in the case of international bookings, of passage for travel by air, during any calendar month or quarter, as the case may be, towards the discharge of his service tax liability instead of paying service tax at the rate specified in section 66B of Chapter V of the Act and the option, once exercised, shall apply uniformly in respect of all the bookings of passage for travel by air made by him and shall not be changed during a financial year under any circumstances.

Explanation.—For the purposes of this sub-rule, the expression “basic fare” means that part of the air fare on which commission is normally paid to the air travel agent by the airline.

(7A) An insurer carrying on life insurance business shall have the option to pay tax:

i) on the gross premium charged from a policy holder reduced by the amount allocated for investment, or savings on behalf of policy holder, if such amount is intimated to the policy holder at the time of providing of service;

ia) in case of single premium annuity policies other than (i) above, 1.4 per cent of the single premium charged from the policy holder

iii) in all other cases, 3.5 per cent of the premium charged from policy holder in the first year and 1.75 per cent of the premium charged from policy holder in the subsequent years;

towards the discharge of his service tax liability instead of paying service tax at the rate specified in section 66B of Chapter V of the said Act:

Provided that such option shall not be available in cases where the entire premium paid by the policy holder is only towards risk cover in life insurance.

(7B) The person liable to pay service tax in relation to purchase or sale of foreign currency, including money changing, shall have the option to pay an amount calculated at the following rate towards discharge of his service tax liability instead of paying service tax at the rate specified in section 66B of Chapter V of the Act, namely

a) 0.14 per cent of the gross amount of currency exchanged for an amount upto rupees 100,000, subject to the minimum amount of rupees 35

b) rupees 140 and 0.07 per cent of the gross amount of currency exchanged for an amount of rupees exceeding rupees 100,000 and upto rupees 10,00,000; and

c) rupees 770 and 0.014 per cent of the gross amount of currency exchanged for an amount of rupees exceeding 10,00,000, subject to maximum amount of rupees 7000:

Provided that the person providing the service shall exercise such option for a financial year and such option shall not be withdrawn during the remaining part of that financial year.

(7C) The distributor or selling agent, liable to pay service tax for the taxable service of promotion, marketing, organising or in any other manner assisting in organising lottery, shall have the option to pay an amount at the rate specified in column (2) of the Table given below, subject to the conditions specified in the corresponding entry in column (3) of the said Table, instead of paying service tax at the rate specified in section 66B of Chapter V of the said Act

Provided that in case of online lottery, the aggregate face value of lottery tickets for the purpose of this sub-rule shall be taken as the aggregate value of tickets sold, and service tax shall be calculated in the manner specified in the said Table :

Provided further that the distributor or selling agent shall exercise such option within a period of one month of the beginning of each financial year and such option shall not be withdrawn during the remaining part of the financial year :

Provided also that the distributor or selling agent shall exercise such option for financial year 2010-11, within a period of one month of the publication of this sub-rule in the Official Gazette or, in the case of new service provider, within one month of providing of such service and such option shall not be withdrawn during the remaining part of that financial year.

Explanation.—For the purpose of this sub-rule—

i) omitted

ii) “draw” shall have the meaning assigned to it in clause (d) of the rule 2 of the Lottery (Regulation)Rules, 2010 notified by the Government of India in the Ministry of Home Affairs published in the Gazette of India, Part-II, Section 3, Sub-section (i) vide number G.S.R. 278(E), dated 1st April, 2010;

iii)”online lottery” shall have the meaning assigned to it in clause (e) of the rule 2 of the Lottery (Regulation) Rules, 2010 notified by the Government of India in the Ministry of Home Affairs published in the Gazette of India, Part-II, Section 3, Sub-section (i) vide number G.S.R. 278(E), dated 1st April, 2010;

iv) “organising state” shall have the meaning assigned to it in clause (f) of the rule 2 of the Lottery (Regulation) Rules, 2010 notified by the Government of India in the Ministry of Home Affairs published in the Gazette of India, Part II, Section 3, Sub-section (i) vide number G.S.R. 278(E), dated 1st April, 2010.]

[(7D) The person liable for paying the service tax under sub-rule (7), (7A), (7B) or (7C) of rule 6, shall have the option to pay such amount as determined by multiplying total service tax liability calculated under sub-rule(7), (7A), (7B) or (7C) of rule 6 by 0.5 and dividing the product by 14 (fourteen), during any calendar month or quarter, as the case may be, towards the discharge of his liability for Swachh Bharat Cess instead of paying Swachh Bharat Cess at the rate specified in sub-section (2) of section 119 of the Finance Act, 2015 (20 of 2015) read with Notification No. 22/2015-Service Tax, dated the 6th November, 2015, published in the Gazette of India, Extraordinary, Part II, section 3, sub-section (i) vide number G.S.R. 843(E), dated the 6th November, 2015, and the option under this sub-rule once exercised, shall apply uniformly in respect of such services and shall not be changed during a financial year under any circumstances

Related Post

- Delay in Service tax Payment due to Website failure

- Service tax payment on quarterly basis by One Person Company and HUF

- New Interest rates for delay in payment of service tax

- Interest @ 24% on Delayed payment of Collected Service tax

- Education Cess and SHE allowed to be utilized for service tax payment

- Financial difficulties is not an excuse for non payment of Service tax already collected from customers

- FIR can not be filed against assessee due to default in payment of service tax

- Section 80 No penalty if no mala fide intension for non payment of service tax

- Service tax not collected , tax liability by cum tax consideration

- Service Tax Registration not required for availment of CENVAT : High Court

- Service Tax on Commission earned by Amway Distributors

- Service Provided by Govt made Taxable w.e.f 01.04.2016

- SCRUTINY OF SERVICE TAX RETURN