Pradhan Mantri Shram Yogi Maandhan (PM SYM ) lauched in India from 15.02.2019

Scheme Eligibility of PM -SYM

• 18-40 years of age

• Income less than Rs 15000 per month

• Should not be an income tax payer

• Should not be engaged in Organized Sector with membership of EPF/NPS/ESIC

• Should have a Savings Bank Account

• Should have Aadhar Number

Minimum Assured Pension of PM -SYM

Rs 3000 per month life long on attaining age of 60 years

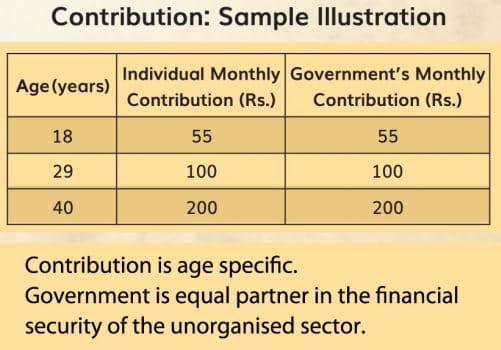

How much needs to be contributed for PM -SYM

Enrolment Process for PM -SYM

1.Interested eligible person shall visit neared CSC centre. Location of CSC centre can be ascertained from the information page on web sites of LIC of India, Ministry of Labour and Employment and CSC.

2.While going to CSC for enrolment, he shall carry with him the following :

a. Aadhar Card

b. Bank Account details along with IFS Code (Bank Passbook or Cheque Leave/book or copy of bank statement as evidence of bank account)

c. Mobile handset for OTP verification

d. Initial contribution amount for enrolment under the scheme

3.Village Level Entrepreneur ( VLE ) present at the CSC will key-in aadhar number, name of subscriber as printed on aadhar card and date of birth as given in aadhar card and the same will be verified with UDAI database through a process of demographic authorization.

4.Further details like Bank Account details, Mobile Number, Email-id, if any, spouse and nominee details will be captured.

5.Self-certification for eligibility conditions will be done.

6.System will auto calculate monthly contribution payable according to age of the subscriber.

7.Subscriber shall also pay the amount of initial contribution under the scheme to the VLE who will generate receipt to handed over to the subscriber. At the same time, a unique SYM number will be generated and SYM Card will be printed at CSC. Enrolment Form cum Auto Debit mandate will also be printed which will then be signed by the subscriber. VLE then shall scan the signed enrolment cum auto debit mandate and upload into the system.

8.With completion of process, subscriber will be having with him SYM card and signed copy of enrolment form for his record.

Click here to locate the nearest CSC Centre

Helpline Number

Toll Free number 18002676888

Related Post

How GST will be paid on commission to insurance agents : CBIC Clarify

GST on Insurance Sector : Free Study Material

How GST will be paid on insurance policies issued to Non-Resident Indians : CBIC Clarify

LUT /Bond required if Life Insurance service is export of service : CBIC

Time of supply of life insurance services under GST : CBIC Clarify

Time of supply of life insurance services under GST : CBIC Clarify

GST : Place of supply if Master Policy issued for group insurance policies : CBIC Clarify

Draft Employees State Insurance (Central) (Amendment) Rules 2019.

Pingback: LIC Phone Helpline Numbers - Tax Heal

Pingback: LIC Premium Calculator - Tax Heal

Pingback: LIC New Money Back Plan 20 years - Tax Heal

Pingback: Insurance in India : Free Study Material - Tax Heal

Pingback: How to Buy LIC Policies Online - Tax Heal