Income Declaration Scheme 2016

Observation of Hon’ble Finance Minister as per Finance Bill 2016 (cl 159 & 160)

“We are moving towards a lower tax regime with non-litigious approach. Thus, while compliant taxpayers can expect a supportive interface with the department, tax evasion will be countered strongly. Capability of the tax department to detect tax evasion has improved because of enhanced access to information and availability of technology driven analytical tools to process such information. I want to give an opportunity to the earlier non-compliant to move to the category of compliant.”

“I propose a limited period Compliance Window for domestic taxpayers to declare undisclosed income or income represented in the form of any asset and clear up their past tax transgressions by paying tax at 30%, and surcharge at 7.5% and penalty at 7.5%, which is a total of 45% of the undisclosed income. There will be no scrutiny or enquiry regarding income declared in these declarations under the Income Tax Act or the Wealth Tax Act and the declarants will have immunity from prosecution. Immunity from Benami Transaction (Prohibition) Act, 1988 is also proposed subject to certain conditions. The surcharge levied at 7.5% of undisclosed income will be called Krishi Kalyan surcharge to be used for agriculture and rural economy. We plan to open the window under this Income Disclosure Scheme from 1st June to 30th September, 2016 with an option to pay amount due within two months of declaration.”

Important Dates Under The IDS, 2016

Income Declaration Scheme, 2016 is based on following;

The Income Declaration Scheme, 2016 as per Chapter –IX of Finance Act 2016

The Income Declaration Scheme Rules, 2016 (notification no. 33/2016 dated 19/05/2016)

Notification No. 32/2016 (dated 19/05/2016)

Notification No. 56/2016 (dated 06/07/2016)

CBDT Circular No. 16/2016 (dated 20/05/2016)

CBDT Circular No. 17/2016 (dated 20/05/2016)

CBDT Circular No. 19/2016 (dated 25/05/2016)

CBDT Circular No. 24/2016 (dated 27/06/2016)

CBDT Circular No. 25/2016 (dated 30/06/2016)

CBDT Circular No. 27/2016 (dated 14/07/2016)

Section 49(5) of the Income Tax Act, 1961

Where the capital gain arises from the transfer of an asset declared under the Income Declaration Scheme, 2016, and the tax, surcharge and penalty have been paid in accordance with the provisions of the Scheme on the fair market value of the asset as on the date of commencement of the Scheme, the cost of acquisition of the asset shall be deemed to be the fair market value of the asset which has been taken into account for the purposes of the said Scheme’’.

Who Can Make Declaration?

A declaration would be made in respect of a person for any A.Y. Prior to A.Y. beginnig on 01/04/2017 (Sec 183 of the FA, 2016).-

- for which he has failed to furnish a return under section 139 of the Income-tax Act

- which he has failed to disclose in a return of income furnished by him under the Income-tax Act before the date of commencement of this Scheme

- which has escaped assessment by reason of the omission or failure on the part of such person to furnish a return under the Income-tax Act or to disclose fully and truly all material facts necessary for the assessment or otherwise.

Where income chargeable to tax is declared in the form of investment in any asset, the FMV of such asset on the commencement of this scheme i.e. 01/06/2016 shall be deemed to be the undisclosed income.

No deduction in respect of any expenditure or allowance shall be allowed against the income in respect of which declaration under this section is made.

Who Cannot Make Declaration ?

Scheme not apply to certain persons (Sec 196 of FA, 2016)

- to any person in respect of whom an order of detention has been made under the (COFEPOSA)Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974.

- in relation to prosecution for any offence punishable under Chapter IX or Chapter XVII of the Indian Penal Code, the Narcotic Drugs and Psychotropic Substances Act, 1985, the Unlawful Activities (Prevention) Act, 1967 and the Prevention of Corruption Act, 1988.

- to any person notified under section 3 of the Special Court (Trial of Offences Relating to Transactions in Securities) Act, 1992.

What Can Be Declared?

The undisclosed income & following incomes in the form of investments in assets can be declared in Annexure to Form 1: –

Immovable Property (attach valuation report)

Jewellery (attach valuation report)

- Gold

- Diamond (1 carat or more)

- Diamond (less than 1 carat) & other precious stones

- Other precious metals

Artistic work (attach valuation report)

- archaeological collections, drawings, paintings, sculptures or any work of art.

Shares & Securities

- Quoted Shares Securities

- Unquoted Equity Shares

- Unquoted Shares & Securities other than Equity Shares

Any Other Assets like cash, bank etc.

Ground Rules for Making Declaration

i) Relevant Forms

Form-1, Form-2, Form-3, Form-4 (Rule 4 of IDS Rules, 2016)

ii) Mode of Filing

Online using digital signature

Online through electronic verification code (EVC)

Paper Form

iii)Relevant Proofs

Valuation Report (not mandatory but recommended, refer Q-14 of FAQ, circular no. 17/2016 and Q-6 of Circular no. 24/2016 dtd 27.06.2016)

iv) Other Technicalities

Tax, Surcharge, Penalty has to be paid till 30/11/2016

Declaration to be signed by specified persons only as per sec 186(2) of FA, 2016 etc. [same as per section 140 of the Income Tax Act]

v) Declaration to be addressed to – Jurisdictional PCIT/CIT

(As per CBDT circular no. 19/2016)

Procedure to be followed

- Declaration shall be made to Principal Commissioner or the CIT in such form & manner as may be prescribed in rule 4(1) {Form 1} [[Notification No. 33/2016, dt. 19/05/2016],

- A person may make declaration u/s 183(1) anytime on or after 01/06/2016 but before 30/09/2016[Notification No. 32/2016, dt. 19/05/2016], as the last day for making a declaration under the scheme.

- The declaration may be filed online on the e-filing website of the Income-tax Department using the digital signature of the declarant or through electronic verification code {EVC} or may be in paper form before the jurisdictional Principal CIT/CIT.

- Acknowledgement of the same shall be issue by jurisdiction Principal CIT/CIT in the Form 2 [Notification No. 33/2016, dt. 19/05/2016], {Rule 4(3)} to the declarant within 15 days from the end of the month in which such declaration under Form 1 is made.

- The declarant shall furnish proof of payment made in respect of tax, surcharge & penalty to the jurisdictional Principal CIT/CIT in Form 3 [Notification No. 33/2016, dt. 19/05/2016],

- Afterwards the said authority shall issue a certificate in Form 4 [[Notification No. 33/2016, dt. 19/05/2016], within 15 days of submission of proof of payment by the declarant.

Who Can Sign the Declaration?

| Sl. | Status of the declarant | Declaration to be signed by |

| 1. | Individual | Individual; where individual is absent from India, person authorized by him; where the individual is mentally incapacitated, his guardian or other person competent to act on his behalf. |

| 2. | HUF | Karta; where the karta is absent from India or is mentally incapacitated from attending to his affairs, by any other adult member of the HUF. |

| 3. | Company | Managing Director; where for any unavoidable reason the managing director is not able to sign or there is no managing director, by any director . |

| 4. | Firm | Managing partner; where for any unavoidable reason the managing partner is not able to sign the declaration, or where there is no managing partner, by any partner, not being a minor. |

| 5. | Any other association | Any member of the association or the principal officer. |

| 6. | Any other person | That person or by some other person competent to act on his behalf. |

Rate of Tax

Charge of Tax, Surcharge & Penalty. (Sec 184-185)

- As per sec 184(1) Undisclosed Income declared within stipulated time shall be chargeable to tax @ 30% of such undisclosed income.

- Amount of tax chargeable shall be increased by a surcharge namely “Krishi Kalyan Cess” calculated @ 25% of above tax (i.e. 25% of 30% = 7.5%). Sec 184[2]

- In addition to tax & surcharge person shall also liable for penalty u/s 185 of Finance Bill, 2016 @ 25% of tax on undisclosed income (7.5%).

- Hence, effective tax rate would be 45% (i.e. 30% + 7.5% + 7.5%).

- Effective tax rate is 45% only (not 31%) under this scheme.

- CBDT has clarified in Answer to Q.6 of Circular 27/2016 dated 14/07/2016.

- Further, tax has to be paid out of disclosed income to get immunity under this scheme.

AO can Open the case of any year if income not disclosed

- Time limitation of 6 years (u/s 149 of the Act) is also overruled by sec 197(c) of Finance Act, 2016. Now AO can open the case of any year.

Time for Payment

Time for Payment of Tax (Sec 187).

- The tax and surcharge payable u/s 184 and penalty payable u/s 185 in respect of the undisclosed income, shall be paid on or before 30/11/2016[Notification No. 32/2016, dt. 19/05/2016].

- However as per Press release dated 14.07.2016 Payment can be made in Installments till 30.09.2017.

- The declarant shall file the proof of payment of tax, surcharge and penalty on or before the date notified under sub-section (1), with the Principal Commissioner or the Commissioner, as the case may be, before whom the declaration u/s 183 was made. (Also clarified vide Answer to Q. 7 of Circular no. 27/2016 dated 14.07.2016)

- If the declarant fails to pay the tax, surcharge and penalty in respect of the declaration made u/s 183 on or before the date specified under sub-section (1), the declaration filed by him shall be deemed never to have been made under this Scheme.

- CBDT relaxes time for payment of tax under this scheme. [Press Release by GOI, Department of Revenue, CBDT dated 14/07/2016].

Revise time schedule as follows,

| Particulars | Time limit |

| Minimum 25% of tax, surcharge, penalty | 30/11/2016 |

| Further amount 25% of tax, surcharge, penalty | 31/03/2017 |

| Balance Amount | 30/09/2017 |

Fall Outs of Non- Payment

- Sec 187(3) – If the declarant fails to pay the entire tax, surcharge and penalty upto 30/11/2016, the declaration filed by him shall be deemed NEVER to have been made under this Scheme.

- Sec 197(b)- Where any declaration has been made under section 183 but no tax, surcharge and penalty referred to in section 184 and section 185 has been paid within the time specified under section 187, the undisclosed income shall be chargeable to tax under the Income-tax Act in the previous year in which such declaration is made

Procedure to Electronically file Form-1

In e-Filing portal, only Form for Income Disclosure – Form 1 is available for e-Filing. –

Pre-Requisites for Uploading Form for Income Disclosure – Form 1

- To upload Form for Income Disclosure – Form 1, user should have a valid PAN and should be registered in e-Filing portal

- A valid XML file should be generated using the JAVA Utility available under The JAVA utility of Form for Income Disclosure – Form 1 can be downloaded from the path Downloads – Forms (Other than ITR) – Form for Income Disclosure – Form 1

- A valid XML can be generated by following the process, Extract the JAVA Utility of Form for Income Disclosure – Form 1 – Right click and Open the JAR file of Form for Income Disclosure – Form 1 – Fill all the Mandatory fields – Click on “Generate XML”.

Step 1: Go to Income Tax India E-Filling Site (http://incometaxindiaefiling.gov.in/)

Step 2: Download Form 1 Under the Download Forms section

Step 3: Prepare Form 1 and generate XML.

Step 4: In e-Filing Homepage, Click on “Login Here” –

Step 5: Enter User ID (PAN), Password, DOB/DOI and Captcha. Click Login.

Step 6: Post login, go to e-File ⇒ Upload Form for Income Disclosure – Form 1 (Income Declaration Scheme, 2016).

Step 7: “Upload XML file”: In the upload page, attach a valid XML file generated using the JAVA utility of Form for Income Disclosure – Form 1.“Attach the Valuation Report”: Valuation Report, if any, can be attached. This is not mandatory

Step 8: “Attach the Signature file”: Upload the signature file generated using DSC Management Utility for the uploaded XML file. Navigate to Step by Step Guide for Uploading XML.

Step 9: Click on “Submit” button.

Declaration When invalid ?

- If the declarant fails to pay the entire amount of tax, surcharge and penalty within the specified date 30/11/2016. [sec 197(b)]

- Where the declaration has been made by misrepresentation or suppression of facts or information. [sec 193]

- Where the declaration is held to be void for non payment of Tax, Surcharge or penalty, the income shall be chargeable to tax under the Income Tax Act in the previous year in which such declaration is made [sec 197(b)].

-

Any tax, surcharge or penalty paid in pursuance of the declaration shall, however, not be refundable under any circumstances. [sec 191]

Effect of valid declaration

- Section 188: The amount of undisclosed income declared shall not be included in the total income of the declarant under the Income-tax Act for any assessment year

- Section 189 : Declaration of undisclosed income will not affect the finality of completed assessments. The declarant will not be entitled to claim re-assessment of any earlier year or revision of any order or any benefit or set off or relief in any appeal or proceedings under the Income-tax Act in respect of declared undisclosed income or any tax, surcharge or penalty paid thereon.

- Section 190: Immunity from the Benami Transactions (Prohibition) Act, 1988 shall be available in respect of the assets disclosed in the declarations subject to the condition that the benamidar shall transfer to the declarant or his legal representative the asset in respect of which the declaration of undisclosed income is made on or before 30th September, 2017[Notification No. 32/2016, dt. 19/05/2016].

- Section 192: The contents of the declaration shall not be admissible in evidence against the declarant in any penalty or prosecution proceedings under the Income-tax Act and the Wealth Tax Act.

-

Section 194: The value of asset declared in the declaration shall not be chargeable to Wealth-tax for any assessment year or years

Other Provisions

Applicability of certain provisions of Income-tax Act & Wealth-tax Act (Sec 195).

- The provisions of Chapter XV of the Income-tax Act relating to liability in special cases and of section 119, 138 & 189 of that Act or the provisions of Chapter V of the Wealth-tax Act, 1957 relating to liability in respect of assessment in special cases shall, so far as may be, apply in relation to proceedings under this Scheme as they apply in relation to proceedings under the Income-tax Act or, as the case may be, the Wealth-tax Act, 1957.

Calculation of FMV

Determination of Fair market value:- {Rule 3 of IDS Rules, 2016}

- The value of bullion, jewellery or precious stone, archaeological collections, drawings, paintings, sculptures or any work of art, unquoted share and security other than equity share in a company, immovable property and any other asset shall be the higher of-

- its cost of acquisition; &

- the price such bullion, jewellery or precious stone, artistic work, that share, that property shall ordina rily fetch if sold in the open market as on the 1st day of June, 2016, on the basis of the valuation report obtained by the declarant from a registered valuer {As per Rule 2(1)(d)-Person registered u/s 34AB of the Wealth Tax Act, 1957};

- The value of Quoted shares & securities shall be higher of-

- its cost of acquisition; &

- the price determined by taking:-

- the average of the lowest and highest price of such shares and securities quoted on a recognised stock exchange as on the 1st day of June, 2016; or

- the average of the lowest and highest price of such shares and securities on a recognised stock exchange on a date immediately preceding the 1st day of June, 2016 when such shares and securities were traded on a recognised stock exchange, where on the 1st day of June, 2016 there is no trading in such shares and securities on a recognised stock exchange;

Determination of Fair market value:- {Rule 3(1)(c)(II) of IDS Rules, 2016}

The value of Unquoted Equity Shares shall be higher of-

- its cost of acquisition; &

- the value, on the 1st day of June, 2016, of such equity shares as determined in the following manner, namely:—

the fair market value of unquoted equity shares =

(A+B – L) × (PV)

————————

(PE)

Determination of Fair market value of Unquoted Equity shares:- :- {Rule 3(1)(c)(II) of IDS Rules, 2016}

Where;

A = book value of all the assets in the balance sheet (other than bullion, jewellery, precious stone, artistic work, shares, securities and immovable property) as reduced by,- (i) any amount of income-tax paid, if any, less the amount of income-tax refund claimed, if any, and (ii) any amount shown as asset including the unamortised amount of deferred expenditure which does not represent the value of any asset;

B = fair market value of bullion, jewellery, precious stone, artistic work, shares, securities and immovable property as determined in the manner provided in this rule;

PE = total amount of paid up equity share capital as shown in the balance-sheet;

PV = the paid up value of such equity share;

{Rule 3(1)(c)(II) of IDS Rules, 2016} contd..

Where;

L = book value of liabilities shown in the balance sheet, but not including the following amounts, namely:—

(i) the paid-up capital in respect of equity shares;

(ii)the amount set apart for payment of dividends on preference shares and equity shares;

(iii) reserves and surplus, by whatever name called, even if the resulting figure is negative, other than those set apart towards depreciation;

(iv) any amount representing provision for taxation, other than amount of income-tax paid, if any, less the amount of income-tax claimed as refund, if any, to the extent of the excess over the tax payable with reference to the book profits in accordance with the law applicable thereto;

(v) any amount representing provisions made for meeting liabilities, other than ascertained liabilities;

(vi) any amount representing contingent liabilities other than arrears of dividends payable in respect of cumulative preference shares;

Determination of Fair market value:- {Rule 3(f) of IDS Rules, 2016}

The net asset of the firm, association of persons or limited liability partnership on the 01/06/2016 shall first be determined and the portion of the net asset of the firm, AOP or LLP as is equal to the amount of its capital shall be allocated among its partners or members in the proportion in which capital has been contributed by them and the residue of the net asset shall be allocated among the partners or members in accordance with the agreement of partnership or association or LLP for distribution of assets in the event of dissolution of the firm, association or LLP, or, in the absence of such agreement, in the proportion in which the partners or members are entitled to share profits and the sum total of the amount so allocated to a partner or member shall be treated as the value of the interest of that partner or member in the partnership or association

List of Registered Valuers (as may be required under Rule 3 of IDS Rules, 2016)

Immovable Property

http://incometaxindia.gov.in/Documents/IDS-2016/IMMOVABLE-PROPERTY.pdf

Jewellery

http://incometaxindia.gov.in/Documents/IDS-2016/Jewellery.pdf

Plant and Machinery

http://incometaxindia.gov.in/Documents/IDS-2016/PLANTS-AND-MACHINERY.pdf

Stocks, Shares & Debentures

http://incometaxindia.gov.in/Documents/IDS-2016/STOCKS-SHARES-AND-DEBENTURES.pdf

Agricultural Land

http://incometaxindia.gov.in/Documents/IDS-2016/AGRICULTURAL-LANDS.pdf

Latest from CBDT

Circulars & FAQ’s

Important Notifications

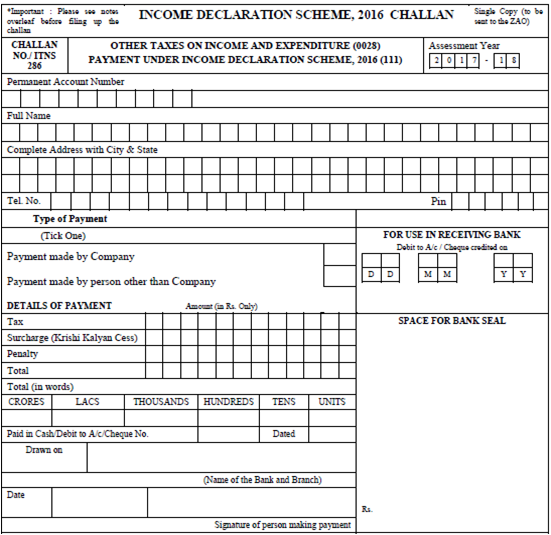

Challan, ITNS 286

Others : –

OM dtd 22.06.16 on secrecy, publicity & monitoring

100% data entry of manual IDS form 1 by PCIT dtd 11.07.2016.

Usage of information such as Non pan AIR, Non filer, Penny Stock cases dtd 05.07.2016.

Leave to the officers to be sanctioned under ‘Pressing Circumstances’ dtd 06.07.2016.

Weekly Video conferencing on Each Saturday.

CBDT Circular no. 17 of 2016 dated 20.05.2016

1 Cost of Acquisition for computation of future capital gains ?

2 Declaration not permissible if notice issued and proceeding pending?

3 How to ascertain pending proceeding in case notice is un-served?

4 How to determine FMV of assets acquired partly out of disclosed and partly out of undisclosed income?

5 Whether declaration permissible of an income before appellate authority?

6 Whether declaration permissible for year in which search/survey conducted?

7 Whether declaration permissible for search/survey case where assessment is completed?

8 Fallout of no declaration wrt undisclosed income prior to 01/06/2016?

9 What if declaration is found ineligible u/s 196? Whether 197( c) attracted?

10 Immunity wrt partly declared undisclosed income?

11 Whether declaration permissible wrt undisclosed income acquired through corruption?

12 Whether enquiry will be made at the time of making declaration?

13 What is the confidentiality of declaration made?

14 Whether mandatory to file valuation report?

CBDT Circular no. 24 of 2016 dated 27.06.2016

1 In case of part payment of tax, what is the status of the declaration?

2 How to make declaration for years prior to amalgamation/conversion?

3 Whether scheme available to non-residents too?

4 Assessment of undisclosed income and/or assets acquired out of it, not declared under the scheme?

5 Whether assessee subjected to enforcement action in april 2016 to make declaration?

6 Whether valuation report not furnished with form 1 can be required lateron by PCIT?

7 Is PAN mandatory?

8 Whether declaration can be made for years for which proceedings pending before ITSC?

9 How to tackle valuation issues of partly disclosed assets?

10 Whether declaration permissible in cases of 133(6), NMS, 131(1A) etc?

11 Status of proceedings u/s 143(2), 142, 148 for which notices are issued after 31/05/2016?

CBDT Circular no. 25 of 2016 dated 30.06.2016

1 Whether information in declaration be shared with other LEA?

2 Whether immunity be provided under other Economic Laws?

3 In cases where the FMV is less than the value u/s 50C/43CA which value will be considered?

4 Whether unclaimed TDS credits be permitted?

5 Whether any enquiry be conducted wrt source of income, tax, penalty etc once a declaration is accepted finally?

6 How to link nature of income qua Form-1 & its annexure?

7 Which value is to be taken, i.e. FMV on 01/06/2016 or cost of acquisition as per registered deed?

8 If investment of undisclosed income in an assets is declared, whether enquiry would be made against seller?

9 Is it advisible to declare past undisclosed income in A.Y. 2017-18?

10 Illustration of past undisclosed income held in original form and in form of asset?

11 Whether investment in undisclosed income in house property not let out, would result in declared income?

Circular no. 27 of 2016 dated 14.07.2016

- Can a declaration made under the Scheme be revised before the date of closure of the Scheme i.e. 30.09.2016?

- Whether the provisions of section 197(c.) would over-rule the time limits laid u/s 149 of the Act?

- Whether cases of the declarants, whose capital had increased due to declaration would be selected for scrutiny under the CASS for this reason?

- Whether section 50C and TDS u/s 194IA be applicable incase of transfer of assets from benamidar to declarant?

- Extent and manner of secrecy of declaration made qua other LEA and within the department.

- Whether any immunity would be available wrt undisclosed income utilized for payment of tax, surcharge & penalty but not included in the declaration filed under the Scheme.

7 Whether there is any time limit for the declarant under the Scheme to file Form-3?

8.Whether immunity from initiation of prosecution would be available to the Directors of the company or the partners of the firm in respect of the undisclosed income declared under the Scheme by the company or partnership firm, as the case may be?

9 Whether a person having undisclosed income in the form of an investment in immovable property in the name of his spouse can declare the fair market value of the property in his own name if the funds for acquisition of the said property were provided by such person?

10. If a share is listed on more than one recognised stock exchange and the quoted price of the share as on 01.06.2016 on the recognised stock exchanges is different, then what shall be the quoted share price for determining the fair market value of such share under the Scheme?

Notification No. 56 /2016, F.No.142/8/2016-TPL dated 6th July, 2016

S.O.2322 (E)- In exercise of the powers conferred by sub-section (2) of section 138 of the Income-tax Act, 1961(43 of 1961), the Central Government having regard to all the relevant factors, hereby directs that no public servant shall produce before any person or authority any such document or record or any information or computerised data or part thereof as comes into his possession during the discharge of official duties in respect of a VALID declaration made under ‘the Income Declaration Scheme, 2016’, contained in Chapter IX of the Finance Act, 2016 (28 of 2016).

Also refer Q.1 of Circular no. 25/206 dtd 30.06.2016 & Q.5 of Circular no. 27/2016 dtd 14.07.2016 on secrecy apart from internal instructions issued by CBDT to Subordinate officers.

Learning from Past Schemes and Judicial Pronouncements

Constitutional Validity of VDIS, 1997 – Held Valid

[1998] 231 ITR 0024- AIFTP v/s UOI (SC)

[1998] 231 ITR 0660- United Credit Investments v. DIT (Inv.) (Kar. HC)- It does not imply that power to search impliedly taken away or suspended till expiry of last date fixed for expiry of scheme.

[1998] 231 ITR 0934- Micro Labs Ltd. v. DCIT (Kar,)

2013] 352 ITR 0028- Jainsons v. ITAT (Jharkhand)

A case for telescoping

Voluntary disclosure of income–existence of stock, cash and amount of sundry debtors accepted in previous years–presumption that stock, cash and amount of sundry debtors continued for a short period–voluntary disclosure not rendered invalid–voluntary disclosure of income scheme, 1997–finance act, 1997, s. 64(2)(II).

262 ITR 0397- Mysore Plantations Ltd. v. CIT (Kar. HC)

Voluntary disclosure of income scheme, 1997–powers of income-tax authorities–incorrect information in declaration under scheme–certificate issued under scheme can be recalled –finance act, 1997, ss. 64(2)(II), 65(1).

“When a power to issue a certificate is available, then the power to recall it in the event of any fraud is always available to the authorities.”

Whether Extention in payment of Tax or making of Declaration permissible ?

Held NO

252 ITR 0233- Smt. Atmjit Singh v. CIT (Kar. HC)

243 ITR 0101- Vyshnavi Appliances Pvt. Ltd. v. CBDT(AP)

Held YES

241 ITR 0457- E. Prahalatha Babu v CIT (Mad.)

229 ITR 0772- CIT v. Vijaya Hirasa Kalamkar (HUF) (Bom.HC)

Voluntary Disclosure Of Income–Limitation–Declaration Under Voluntary Disclosure Scheme Received On 1-1-1976 Was Not Barred By Limitation-

Whether Tax collected beyond prescribed period could be retained by Revenue – Held NO

241 ITR 0287- Patchala Seetharamaiah v. CIT (AP)

Section 67(2) of the Voluntary Disclosure of Income Scheme, 1997, stresses upon the mandatory requirement of payment of tax within the outer limit of time and in the event of any such non-payment of tax the declaration under the scheme will be non-est. When the scheme contemplates that a declaration filed by the assessee was not acted upon the question of retention of tax paid under such declaration does not arise. There is no provision under the scheme whereby the Revenue can retain the tax paid in respect of a declaration which is void and non-est and the retention of the tax contrary to the scheme is against article 265 of the Constitution of India. In such a situation, the provision under section 70 of the scheme will not apply and accordingly the retention of tax by the Revenue is illegal.

Whether Gifts received at the time of marriage are Undisclosed income – Held NO

296 ITR 0529- Snehlata v. Union of India (MP)

According to the provisions of section 64 of the Finance Act, 1997 (Voluntary Disclosure of Income Scheme, 1997), any person could make a declaration in accordance with the provisions of section 65 in respect of any income earned prior to December 31, 1997, chargeable to tax under the Income-tax Act, for any assessment year. In the Income-tax Act, 1961, “income” is defined under section 2(24) and in the definition, the receipt of any cash or coin at the time of marriage by the spouse is not covered.

Note by Author: –

Presently these are not Income u/s 56(2)(vii) of the Act as amended by Finance Act (no.2) of 2009.

COMPARISON Between IDS 2016 and VDIS 1997

Past Amnesty Schemes

| Name of the Scheme | Relevant Year | Black Money Reported (in crores) | Rate of Tax | Tax Collected(in crores) |

| Tyagi Scheme | 1951 | Rs. 70.20 | Rs. 11 | |

| 60-40 Scheme | 1965 | Rs. 52.11 | 60% | Rs. 31 |

| Block Scheme | 1965 | Rs. 145 | Rs. 19 | |

| VDIWO | 1975 | Rs. 1588 | Slab Rate:- 0-25000 = 25% 25000-50000= 40% Above 500000= 60% | Rs. 257 |

| VDIS | 1997 | Rs. 33339 | 35% (Corporates) & 30% (Non-corporates) | Rs. 9584 |

Comparison B/w VDIS 1997 & Scheme u/s 58 of Undisclosed Foreign Income & assets & Imposition of Tax Act, 2015 (Link:-https://factly.in/voluntary-disclosure-of-black-money-comparing-1997-2015/)

Latest Updates on IDS (departmental Prespective)

- IDS discussed and referred in Mann ki Baat by the Hon’ble PM of India on 26.06.2016.

- All PCIT/CIT desired to popularise the scheme and conduct workshops, etc.

- All PCIT/CIT desired to upload contents on national Website (23.06.2016)

- User manual for viewing filled Form-1 released by DG(systems) on 24.06.2016 for viewing by CCIT/PCIT/CIT.

- Incases where there is no PCIT/CIT, instructions issued so that the PCIT/CIT may nominate the range head or other officer to handover the declaration to him under sealed cover so as to avoid hardship to prospective declarants located in far flung areas/moffusil placed (30.06.2016).

- Time to time Deptt. issues different press release & office memorandums to make this scheme successful.

Administrative suggestions

- Provision of Date of Birth of the declarant or person on whose behalf declaration is being made. (to rule out the possibility of declarations for any AY’s prior to Date of Birth).

- Issuance of administrative instructions to bankers to accept taxes in cash and also to the effect that such cash payments and cash deposits (out of undisclosed income declared under the Scheme) in bank accounts would not be put to verification or enquiry during assessments for AY 2017-18.

- Provision of disclosure be made for the years where the proceedings are pending after being set asided by Tribunal or higher appellate authorities or u/s 263 .

- Clarifications required on failure to furnish return of income u/s 139 so as to avoid future harassment to declarant.

- Fate of declarations held void u/s 193.

- Immunity to auditor on account of disclosures by Firms and companies whose accounts are subjected to audit under Income Tax or other Law wrt undisclosed income.

- Question on employment of the declaration or any of his family related being a ‘public servant’ must to avoid confusions lateron.

- 30.09.2016 a case for ‘Due date Extention’.

- If the declaration has been made by a 12AA/ 10(23C) notified body, whether the same would disentitle registration so granted.

DISCLAIMER

The contents of this presentation are solely meant for being circulated for academic discussion & none else. The Law discussed in this presentation is based on Income Tax Act, Rules and also Circulars and Judgements which have been analysed, understood and appreciated to the best of knowledge of the author. All the views expressed in the presentation are personal opinions of the presenter and the presenter disclaims & is not liable for any consequences arising out of reliance on the same, without any formal opinion or referral in this regard. Any one referring the contents of this presentation is presumed to have referred, read and understood this disclaimer, before relying on the contents of this presentation.

PRESENTED BY:

FCA Sidharth Jain, New Delhi, sidhjasso@yahoo.com +919810418700