Rectification Request for Income Tax Return

Rectification request can be filed u/s 154 of the Income Tax Act by the taxpayer in case of any mistake apparent from the record.

To file your Rectification, you should be a registered user in e-Filing application. Below listed e the steps to file Rectification.

Step 1 – Login to e-Filing application and GO TO My Account Rectification Request.

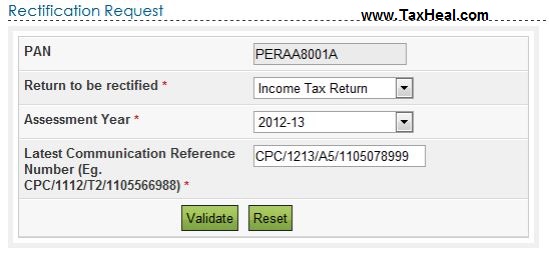

Step 2 – Select Return to be rectified as “Income Tax Return” from the drop down available.

Step 3 – Select the Assessment Year for which Rectification is to be e-Filed. Enter the Latest Communication Reference Number (as mentioned in the CPC Order)

Step 4 – Click “Validate”.

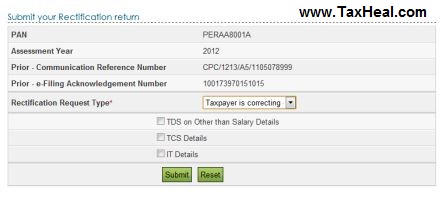

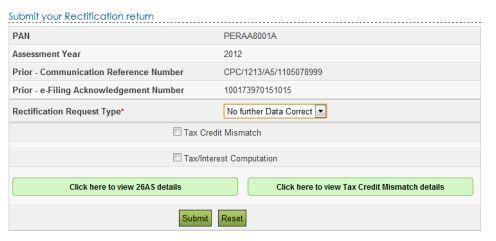

Step 5 – Select the “Rectification Request Type”.

Step 6 – On selecting the option “Taxpayer is correcting data for Tax Credit mismatch only”, three check boxes TCS, TDS, IT are displayed. You may select the checkbox for which data needs to be corrected. Details regarding these fields will be prefilled from the ITR filed. User can add a maximum of 10 entries for each of the selections. No upload of any ITR is required.

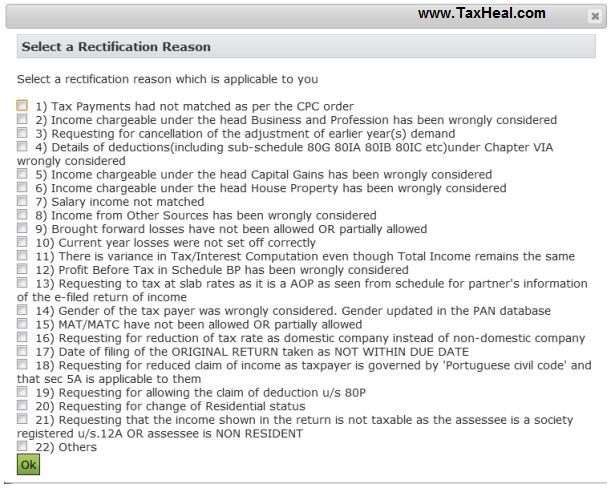

Step 7 – On selecting the option “Taxpayer is correcting Data in Rectification”, select the reason for seeking rectification. Schedules being changed, Donation and Capital gain details (if applicable), upload XML and Digital Signature Certificate (DSC), if available and applicable. You can select a maximum of 4 reasons.

Step 8 – On selecting the option “No further Data Correction Required. Reprocess the case”, checkboxes to select are: Tax Credit Mismatch, Gender Mismatch (Only for Individuals), Tax / Interest Mismatch are displayed. User can select the checkbox for which re-processing is required. No upload of any ITR is required. User can view their 26AS details by clicking on “Click here to view 26AS details” button and view their Tax Credit Mismatch details by clicking on “Click here to view Tax Credit Mismatch details” button.

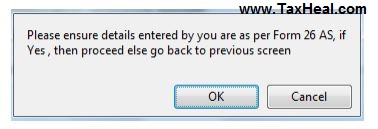

Step 9 – Click the “Submit” button. A popup appears.

Step 10 – Click on “OK” button to submit the rectification.

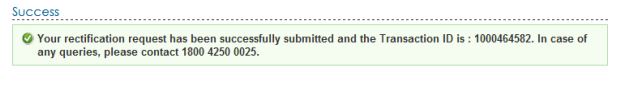

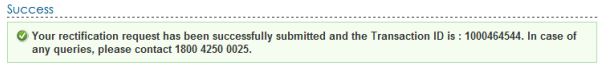

Step 11 – On successful submission, following message is displayed.

Rectification Request for Wealth Tax Return

Rectification request can be filed u/s 154 of the Income Tax Act by the taxpayer in case of any mistake apparent from the record. To file your Rectification, you should be a registered user in e-Filing application. Below listed e the steps to file Rectification.

Step 1 – Login to e-Filing application and GO TO My Account Rectification Request.

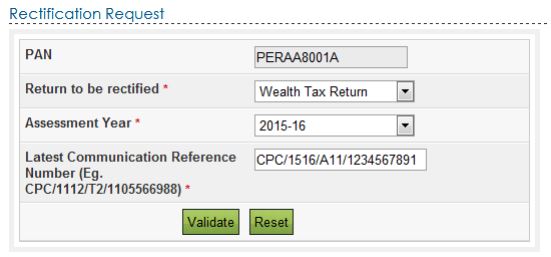

Step 2 – Select Return to be rectified as “Wealth Tax Return” from the drop down available.

Step 3 – Select the Assessment Year for which Rectification is to be e-Filed. Enter the Latest Communication Reference Number (as mentioned in the CPC Order)

Step 4 – Click “Validate”.

Step 5 – Select the “Rectification Request Type”.

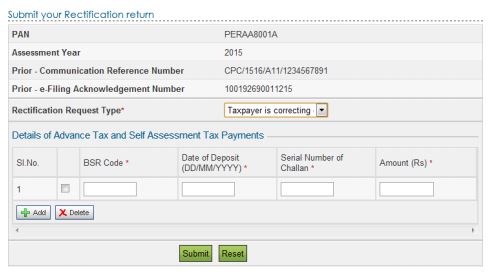

Step 6 – On selecting the option “Taxpayer is correcting Data for Tax Credit mismatch only. User can add a maximum of 10 entries for Details of Advance Tax and Self-Assessment Tax. No upload of any ITR is required.

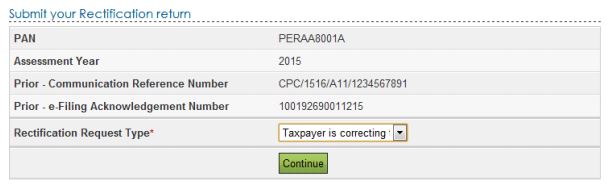

Step 7 – On selecting the option “Taxpayer is correcting Data in Rectification”, Click Continue.

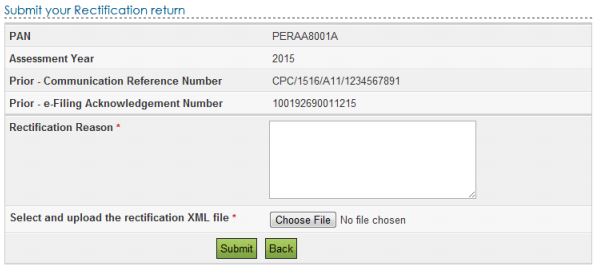

Step 8 – Enter the Rectification Reason in the text area provided. Upload the Rectification XML file. Click Submit.

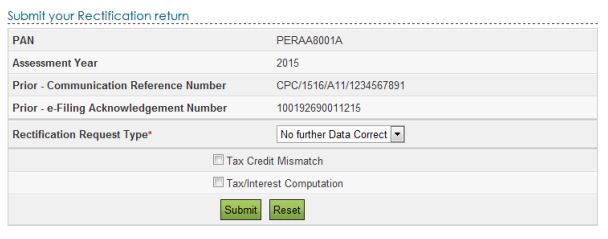

Step 9 – On selecting the option “No further Data Correction Required. Reprocess the case”, checkboxes to select are: Tax Credit Mismatch, Gender Mismatch (Only for Individuals), Tax / Interest Mismatch are displayed. User can select the checkbox for which re-processing is required. No upload of any ITR is required.

Step 10 – Click the “Submit” button

Step 11 – On successful submission, following message is displayed.