Steps to Reset Password /Forgot Password on Income Tax Website

Reset Password Options

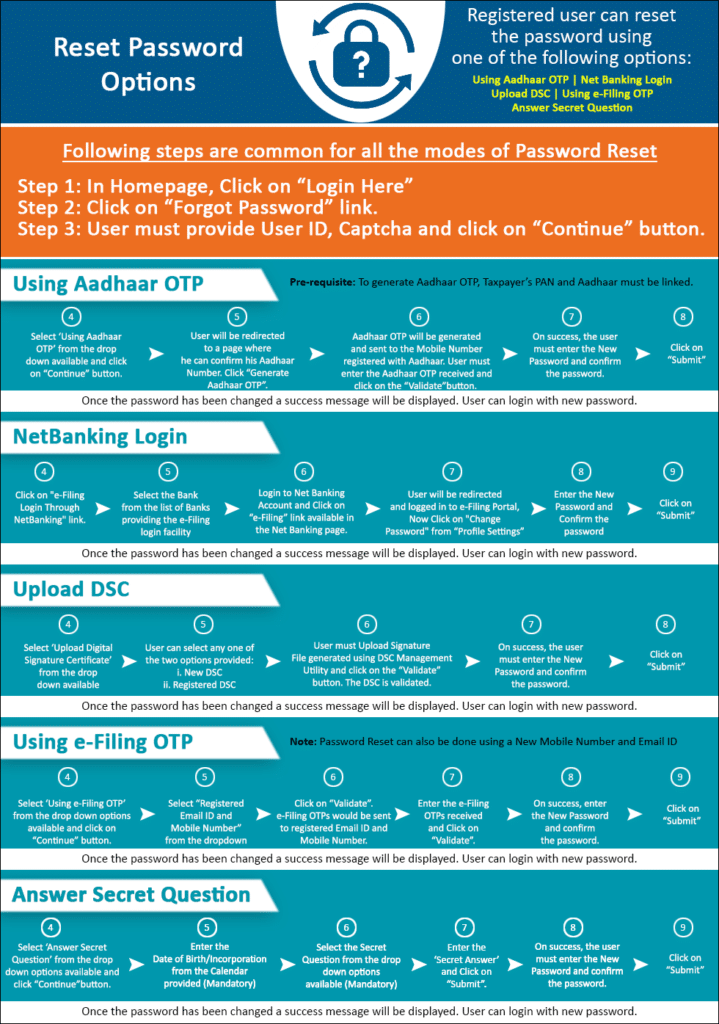

Registered user can reset the password using one of the following options:

Registered user can reset the password using one of the following options:

1. Answer Secret Question.

2. Upload Digital Signature Certificate

3. Using OTP (PINs)

4. Using AAdhaar Card OTP,

5. Ne

t Banking

Answer Secret Question

To Reset Password using the ‘Answer Secret Question’ option, the steps are as below:

Step 1: In Homepage , Click on “LOGIN HERE”

Step 2: Click on “FORGOT PASSWORD” link.

Step 3: User must provide User ID, CAPTCHA and click on CONTINUE button.

Step 4: Select ‘Answer Secret Question’ from the drop down options available.

Step 5: Enter the Date of Birth/Incorporation from the Calendar provided (Mandatory)

Step 6: Select the Secret Question from the drop down options available (Mandatory)

Step 7: Enter the ‘Secret Answer’ and Click on “VALIDATE”.

Step 8: On success, the user must enter the New Password and confirm the password.

Step 9: Click on “SUBMIT”

Once the password has been changed a success message will be displayed. User can login with new password.

Upload Digital Signature Certificate

To Reset Password using the ‘Upload Digital Signature Certificate’ option, the steps are as follows:

Step 1: In Homepage, Click on “LOGIN HERE”

Step 2: Click on “FORGOT PASSWORD” link.

Step 3: User must provide User ID, CAPTCHA and click on CONTINUE button.

Step 4: Select ‘Upload Digital Signature Certificate’ from the drop down available

Step 5: User can select any one of the two options provided:

i. New DSC

ii. Registered DSC

Step 6: User must Upload DSC and click on the “VALIDATE” button. The DSC is validated.

Step 7: On success, the user must enter the New Password and confirm the password.

Step 8: Click on “SUBMIT”

Once the password has been changed a success message will be displayed. User can login with new password.

Using OTP (PINs)

To Reset Password using the ‘Using OTP (PINs)’ option, the steps are as follows:

Step 1: In Homepage, Click on “LOGIN HERE”

Step 2: Click on “FORGOT PASSWORD” link.

Step 3: User must provide User ID, CAPTCHA and click on CONTINUE button.

Step 4: Select ‘One Time Password’ from the drop down options available.

Step 5: The user must select one of the options mentioned below

Registered Email ID and Mobile Number

New Email ID and Mobile Number

Registered Email ID and Mobile Number : steps

Step 1: Registered Email ID and Mobile number will be displayed.

Step 2: Click on “CONTINUE”. PINs would be sent to registered Email ID and Mobile Number.

Step 3: The user must enter the PINs received to the registered Email ID and Mobile Number and Click on “VALIDATE.

Step 4: On success, the user must enter the New Password and confirm the password.

Step 5: Click on “SUBMIT”

Step 6: Once the reset password request has been submitted, a success message will be displayed. User can login with new password after the time specified in communication.

New Email ID and Mobile Number

Step 1: User must enter new Email ID, Mobile number and one of the three options mentioned below( applicable if user has efiled previously)

a. 26AS TAN – The user must TAN of Deductor, as available in 26AS.

b. OLTAS CIN – The user must enter the BSR Code, Challan Date and Challan Identification Number (CIN) as available in 26AS.

c. Bank Account Number – The user must enter the Bank Account number as mentioned in Income Tax Return.

Note: Please enter the details as per any of the e-Filed returns from AY 2012-13 onwards.

Step 2: Click on “CONTINUE”. PINs would be sent to registered Email ID and Mobile Number.

Step 3: The user must enter the PINs received to the provided Email ID and Mobile Number and Click on “VALIDATE.

Step 4: On success, the user must enter the New Password and confirm the password.

Step 5: Click on “SUBMIT”

Step 6: Once the reset password request has been submitted, a success message will be displayed. User can login with new password after the time specified in communication.

Note:

In case, the user has not received the PINs in a reasonable time, user can opt for Resend PINs.

An email along with a link for “Cancellation for the password reset request” will be shared to the registered Email ID and new Email ID. In case the user identifies the request for password reset is un-authorized, then user can click on the Cancellation link provided within 12hours. PAN and DOB validation will be done before aborting the password reset request.

e-Filing Login Through NetBanking

Registered Taxpayer can login through NetBanking and reset the password.

NetBanking Login:

To Reset Password using the ‘NetBanking Login’, the steps are as follows:

Step 1: In Homepage, Click on “Login Here”

Step 2: Click on “Forgot Password” link.

Step 3: Enter User ID (PAN), Captcha and Click on Continue button.

Step 4: Click on “e-Filing Login Through NetBanking” link.

Step 5: Select the Bank from the list of Banks providing the e-Filing login facility

Step 6: After login to NetBanking account, click on the link “Login to the IT e-Filing account” e-Filing user Dashboard screen shall be displayed.

Step 7: Taxpayer can change the password under Profile settings.

List of Banks providing the e-Filing login facility

1. Allahabad Bank 2. Andhra Bank 3. Axis Bank Ltd 4. Bank of Baroda 5. Bank of India 6. Bank of Maharashtra 7. Canara Bank 8. Central Bank of India 9. City Union Bank Ltd 10. Corporation Bank-Corporate Banking 11. Corporation Bank-Retail Banking 12. DENA BANK 13. HDFC Bank 14. ICICI Bank 15. IDBI Bank 16. Indian Bank 17. Indian Overseas Bank 18. Karnataka Bank 19. Kotak Mahindra Bank 20. Oriental Bank of Commerce 21. Punjab National Bank 22. Punjab and Sind Bank 23. State Bank of Bikaner and Jaipur 24. State Bank of Hyderabad 25. State Bank of India 26. State Bank of Mysore 27. State Bank of Patiala 28. State Bank of Travancore 29. Syndicate Bank 30. The Karur Vysya Bank Ltd 31. The Federal Bank Limited 32. UCO Bank 33. Union Bank of India 34. United Bank of India 35. Vijaya Bank

Functions you can perform on Income Tax Efiling Website

Incometaxindiaefiling : Login and List of Other Functions you can perform

Income Tax India Help Desk Number / Income Tax India e-Filing Helpline Numbers

Registration on Income Tax Efiling Website

How to Register on Income Tax Efiling Website

Registration on Income Tax India efiling portal ; FAQ

Add/ Register as Representative on Income Tax India e-Filing portal

Login on Income Tax Efiling Website

How to Login to e Filing Income Tax Website

Reset Password on incometaxindiaefiling.gov.in : steps

Income Tax Profile Checking on Income Tax Efiling Website

How to Manage your Income Tax Profile on Income Tax Efiling Website

Link Aadhar and PAN on Income Tax Efiling Website

How to Link aadhar with PAN to e Verify Income Tax return

AADHAAR Number Linking with PAN : FAQ

Income Tax Return filing on Income Tax Efiling Website

Income Tax Return : Free Study Material

How to secure via E-filing Vault for higher security of Your Income Tax Account

How to e verify ITR (Income Tax Return ) : User Guide

How to request for condonation of Delay in submitting ITR V/ Verification

How to Change Details in e-Filed Income Tax Returns on IncomeTaxIndiaEfiling

Tax Credit Mismatch

How to check TDS Mismatch in income Tax Return

Outstanding Tax Demand on Income Tax Efiling Website

How to View and Respond to Outstanding Tax Demand of Income Tax

How to Submit Request for Rectification of Income Tax Return

Refund Re-issue on Income Tax Efiling Website

How to Request for Refund Re-issue on IncomeTaxIndiaEfiling

Income Tax refund : Free Study Material

Intimation Orders of ITR on Income Tax Efiling Website

How to request Income Tax Intimation Order u/s 143(1)/154/16(1)/35 passed by CPC

Income Tax Assessment : Free Study Material

Certificate of Appreciation on Income Tax Efiling Website

How to View Certificate of Appreciation on IncomeTaxIndiaEfiling

Filing of Tax Audit Reports on Income Tax Efiling Website

How to Add CA and File Tax Audit Reports on IncomeTaxIndiaEfiling

Tax Deductor registration on Incometaxindiaefiling.gov.in

e-TDS / TCS returns through e-filing portal https://incometaxindiaefiling.gov.in

TDS Statement Upload Online -Procedure on incometaxIndiaefiling.gov.in

Process for electronic filing of Form No 60 by person not having PAN : CBDT Notification

Response to Notice of Income Tax Department

How to resolve Mismatch related Information in ITRs on incometaxIndiaefiling.gov.in

How to submit Response if you have not filed your ITR on incometaxIndiaefiling.gov.in

How to respond against Large Value Transaction on incometaxIndiaefiling.gov.in

How to respond to Income Tax notices of High Value Cash Transaction on incometaxIndiaefiling.gov.in

Respond to the notices related to Cash deposit during Nov 9, 2016- Dec 30, 2016

How to submit SFT Preliminary Response to Income Tax Department

Income Tax Assessment

How to opt and Submit response for e-Proceeding on IncomeTaxIndiaEfiling

Income Tax Assessment : Free Study Material

Lodge your Grievance Online : e-Nivaran

How to Submit and Check Grievance on Incometaxindiaefiling.gov.in

Menu Restructuring on Incometaxindiaefiling.gov.in; Income Tax Website of India

income tax password reset ,

forgot user id and password for income tax e filing ,

incometaxindiaefiling forgot user id ,

income tax password ,

income tax forgot password ,

itr password reset

reset password income tax ,

income tax password crack ,

how to change income tax password ,

how to reset income tax password ,

itr return password ,

how to reset efiling password ,

itr login password reset , reset

login credentials of income tax,