11 October 2016

Jenny Wong analyses a recent Federal Court decision regarding Australia’s rights to tax payments to an Indian company in Australia.

The Full Court handed down its decision for Tech Mahindra Limited v Commissioner of Taxation [2016] FCAFC 130 (22 September 2016). The case concerns the Australia and India Treaty and whether Australia had the right to tax payments for services rendered in India as royalties (at a capped rate on the gross amount) or as business profits (net basis taxation).

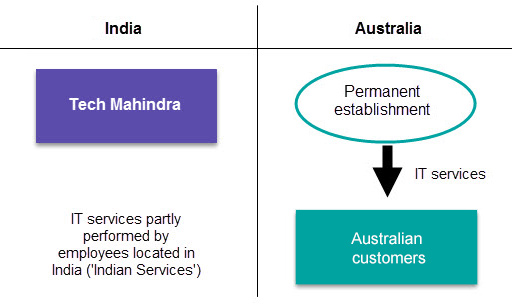

Tech Mahindra is a company resident of India and registered in Australia. Tech Mahindra had offices in Australia through which it provided software products and IT services to Australian customers.

These services were performed in the relevant year partly by employees located in Australia and partly by employees located in India. The issue in dispute is whether the taxpayer is liable to tax in Australia in respect of income earned from services performed by the taxpayer in India.

The taxpayer disputed that Australia had taxing rights in relation to income from services performed by the taxpayer in India. The primary judge held that certain categories of payments referable to the Indian services were ‘royalties’ under Article 12(3)(g) and also held that Article 12(4) was not engaged so that Australia had the right to tax the payments as royalties under Article 12(2) of the Australia/Indian treaty. The result of which is that the payments would be taxed on a gross basis as royalties (as opposed to a net basis as business profits). The taxpayer appealed the primary judge’s decision on Article 12(4) but not the finding that the payments were royalties.

Interestingly, the taxpayer argued in the Full Court that the payment for the Indian services were ‘effectively connected’ to its permanent establishment under Article 12(4). It did so on two basis: the first is the taxpayer said its entitlement to be paid for those services and the contractual rights which gave rise to the payments served to effect the purpose of the permanent establishment; the second is that the Indian services performed were in concert with the services performed through the permanent establishment such that it was only the Indian services in combination with the Australian services that together satisfied the contractual obligations to the Australian customers.

The Commissioner said you need to consider Article 12(4) ‘co-existensively’ with Article 7(1)(a), in other words, these provisions go hand in hand. The Commissioner argued that Article 12(4) gave priority to Article 7 where the criteria in Article 7(1)(a) were met. The primary judge agreed with the Commissioner. The Full Court agreed with the primary judge’s decision, supporting the Commissioner’s construction. The taxpayer’s arguments were rejected, and the Commissioner won the case in the Full Court.

This case provides a good analysis of the interpretation of treaties, the interaction of the royalties and business profits article, and when services are ‘effectively connected’ to a permanent establishment. It demonstrates it can’t be used to disentitle the source state from any taxing rights.

Source .kpmg.com