Rule 88A CGST :ITC Utilization :

Rule 88A of CGST Rules 2017 deals with Order of utilization of input tax credit under CGST Act 2017 . Here is the commentary on Rule 88A of CGST Rules

Commentary on Rule 88A of CGST Rules 2017

- Rule 88A of CGST Rules 2017 is Inserted by Central Goods and Services Tax (Second Amendment) Rules, 2019, w.e.f. 1-4-2019. ( Notification No. 16/2019 central Tax, dated 29-3-2019)

- Rule 88A of CGST Rules 2017 is Inserted in CHAPTER IX : PAYMENT OF TAX of CGST Rules 2017.

- Why Rule 88A of CGST Rules inserted : Section 49 was amended and Section 49A and Section 49B were inserted vide Central Goods and Services Tax (Amendment) Act, 2018 w.e.f 01.02.2019.

- Section 49A of the CGST Act provides that the input tax credit of Integrated tax has to be utilized completely before input tax credit of Central tax / State tax can be utilized for discharge of any tax liability.

- Further, as per the provisions of section 49 of the CGST Act, credit of Integrated tax has to be utilized first for payment of Integrated tax, then Central tax and then State tax in that order mandatorily .

- Thus the issue has arisen on account of order of utilization of input tax credit of integrated tax in a particular order, resulting in accumulation of input tax credit for one kind of tax (say Central tax) in electronic credit ledger and discharge of liability for the other kind of tax (say State tax) through electronic cash ledger in certain scenarios.

- To remove this problem Rule 88A has been inserted in CGST Rules.

- What does Rule 88A of CGST Rules says: Rule 88A of CGST Rules allows utilization of input tax credit of Integrated tax towards the payment of Central tax and State tax, or as the case may be, Union territory tax, in any order subject to the condition that the entire input tax credit on account of Integrated tax is completely exhausted first before the input tax credit on account of Central tax or State / Union territory tax can be utilized.

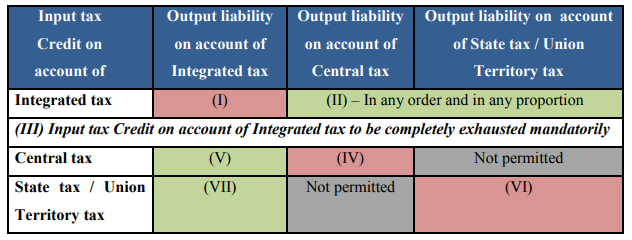

- What is the order of Utilization of Input Tax Credit after Rule 88A of CGST Rules , read with Section 49, Section 49A and Section 49B of CGST Act : As per Circular No 98/18/2019 Dated Dated 23rd April 2019 :-

- Note :

- CBIC Circular No 98/18/2019 Dated Dated 23rd April 2019 Says

Balance IGST ITC remained after paying IGST output tax can be utilized for payment of SGST or CGST ” in any Order and in any proportion” - whereas Rule 88A GST Rules says Balance IGST ITC remained after paying IGST output tax can be utilized for payment of SGST or CGST “in any Order “.

- Thus the words ” in any proportion” are added/clarified by the CBIC circular. Thus Partial set off of IGST ITC is possible for CGST or SGST.

- CBIC Circular No 98/18/2019 Dated Dated 23rd April 2019 Says

- Utilize ITC as per old Provisions even after implementation of Rule 88A of GST : GST Portal is showing utilization as per Old Rules. Till the new order of utilization as per newly inserted Rule 88A of the CGST Rules is implemented on the common portal, taxpayers may continue to utilize their input tax credit as per the functionality available on the common portal. [Circular No 98/18/2019 Dated Dated 23rd April 2019 : GST ITC utilization Clarified : Rules 88A ]

- Rule 88A of CGST Rules 2017 says ” Input tax credit on account of integrated tax shall first be utilised towards payment of integrated tax, and the amount remaining, if any, may be utilised towards the payment of central tax and State tax or Union territory tax, as the case may be, in any order “

- Rule 88A of CGST Rules has a provision which Says “ input tax credit on account of central tax, State tax or Union territory tax shall be utilised towards payment of integrated tax, central tax, State tax or Union territory tax, as the case may be, only after the input tax credit available on account of integrated tax has first been utilised fully”

- As per CGST Amendment Act the order of utilization after the set-off of IGST liability was compulsory CGST and then SGST/UGST. Now the order has been relaxed wherein either CGST or SGST/UGST liability can be set off.

| Input Tax Credit | IGST Liability | CGST liability | SGST/UGST Liability | Remarks |

| ITC-IGST | 1st | 2nd/3rd | 2nd/3rd | IGST liability will be settled off first compulsory and then free to use IGST Input in payment of the CGST or SGST/UGST liability in any order. |

- Whether Registered person cannot off-set the IGST ITC partially towards CGST and SGST. Refer Video below under heading “ITC Utilization Confusion of Rule 88A CGST” . We are of the opinion that partial off-set is possible because

- Rule 88A of CGST Rules says that the balance amount of IGST may be utilized for payment of “CGST and SGST, as the case may be, in any order”.

- word “may” appearing in Rule 88A of CGST Rules gives freedom to the registered person to choose any order (including partial off-set) of utilization of the balance IGST ITC.

- Now there is no Confusion after issue of CBIC Circular No 98/18/2019 Dated Dated 23rd April 2019 which Says Balance IGST ITC remained after paying IGST output tax can be utilized for payment of SGST or CGST ” in any Order and in any proportion”

- Any interpretation done otherwise would have defeated the purpose of the new Rule 88A of CGST Rules 2017

Examples of Rule 88A CGST Rules 2017

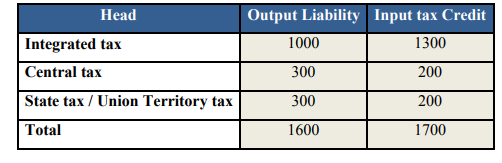

Illustration

Amount of Input tax Credit available and output liability under different tax heads

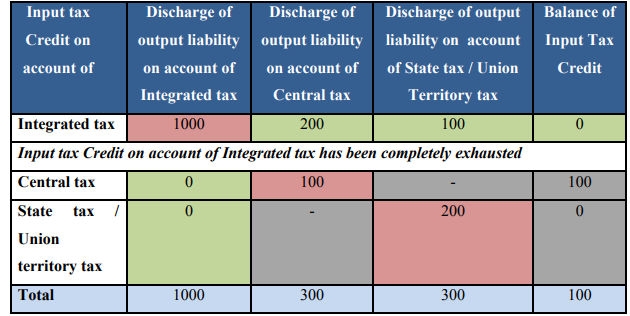

Option 1

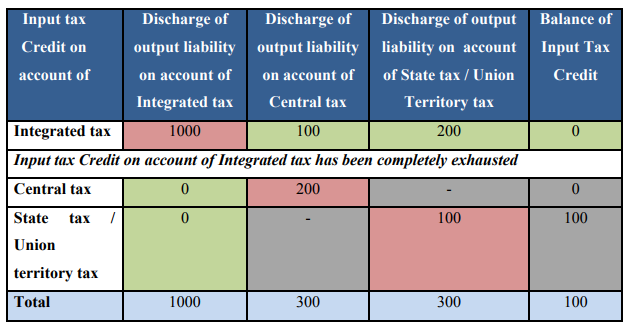

Option 2

Illustration -II

| IGST | CGST | SGST | |

| Output Liability | 250 | 250 | 250 |

| Input Tax Credit (including opening) | 400 | 200 | 200 |

| Utilization (pripority) | |||

| IGST ITC To set of IGST Liability | 250 | ||

| Balance IGST ITC To set off CGST or SGST (in any order) Liability | 100 | 50 | |

| CGST ITC used to set off CGST Liability | 150 | ||

| SGST ITC used to set off SGST liability | 200 | ||

| Total Liability Paid | 250 | 250 | 250 |

| Balance ITC | 0 | 50 | 0 |

ITC Utilization Confusion of Rule 88A CGST

There was confusion that Partial Set of IGST ITC is allowed for CGST or SGST output Tax but now there is no Confusion after issue of CBIC Circular No 98/18/2019 Dated Dated 23rd April 2019 which Says Balance IGST ITC remained after paying IGST output tax can be utilized for payment of SGST or CGST ” in any Order and in any proportion”

Refer Video Turorial on Rule 88A CGST Rules 2017

Abstracts of Rule 88A CGST :ITC Utilization

[Order of utilization of input tax credit.

88A. Input tax credit on account of integrated tax shall first be utilised towards payment of integrated tax, and the amount remaining, if any, may be utilised towards the payment of central tax and State tax or Union territory tax, as the case may be, in any order:

Provided that the input tax credit on account of central tax, State tax or Union territory tax shall be utilised towards payment of integrated tax, central tax, State tax or Union territory tax, as the case may be, only after the input tax credit available on account of integrated tax has first been utilised fully.

Rule 88A CGST, Rule 88A CGST Rules 2017, Rule88A CGST, Rule88A GST, Input Tax Credit, ITC utilization Rules, How to use ITC,How to adjust ITC, Rule 88A CGST with Examples,Download Rule 88A GST,

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal