Safe Harbour Rules under Income tax Act

What is the Power of the CBDT to make safe Harbour Rules ?

As per Section 92CB of Income Tax act:-

(1) The determination of arm’s length price under section 92C or section 92CA shall be subject to safeharbour rules

(2) The Board may, for the purposes of sub-section (1), make rules for safe harbour.

Explanation.—For the purposes of this section, “safe harbour” means circumstances in which the income-tax authorities shall accept the transfer price declared by the assessee.]

What are the rules for Safe Harbour ?

For international transactions: Rules 10TA to 10TG and Form No. 3CEFA

For Domestic transactions : rule 10TH to 10THD and Form No. 3CEFB

What are Definitions for Safe Harbour Rules for International Transactions ?

As per Rule-10TA, Income-tax Rules

For the purposes of rule 10TB to rule 10TG,—

(a) “contract research and development services wholly or partly relating to software development” means the following, namely:—

(i) research and development producing new theorems and algorithms in the field of theoretical computer science;

(ii) development of information technology at the level of operating systems, programming languages, data management, communications software and software development tools;

(iii) development of Internet technology;

(iv) research into methods of designing, developing, deploying or maintaining software;

(v) software development that produces advances in generic approaches for capturing, transmitting, storing, retrieving, manipulating or displaying information;

(vi) experimental development aimed at filling technology knowledge gaps as necessary to develop a software programme or system;

(vii) research and development on software tools or technologies in specialised areas of computing (image processing, geographic data presentation, character recognition, artificial intelligence and such other areas);or

(viii) upgradation of existing products where source code has been made available by the principal;

(b) “core auto components” means,—

(i) engine and engine parts, including piston and piston rings, engine valves and parts cooling systems and parts and power train components;

(ii) transmission and steering parts, including gears, wheels, steering systems, axles and clutches;

(iii) suspension and braking parts, including brake and brake assemblies, brake linings, shock absorbers and leaf springs;

(c) “corporate guarantee” means explicit corporate guarantee extended by a company to its wholly owned subsidiary being a non-resident in respect of any short-term or long-term borrowing.

Explanation.—For the purposes of this clause, explicit corporate guarantee does not include letter of comfort, implicit corporate guarantee, performance guarantee or any other guarantee of similar nature;

(d) “generic pharmaceutical drug” means a drug that is comparable to a drug already approved by the regulatory authority in dosage form, strength, route of administration, quality and performance characteristics, and intended use;

(e) “information technology enabled services” means the following business process outsourcing services provided mainly with the assistance or use of information technology, namely:—

(i) back office operations;

(ii) call centres or contact centre services;

(iii) data processing and data mining;

(iv) insurance claim processing;

(v) legal databases;

(vi) creation and maintenance of medical transcription excluding medical advice;

(vii) translation services;

(viii) payroll;

(ix) remote maintenance;

(x) revenue accounting;

(xi) support centres;

(xii) website services;

(xiii) data search integration and analysis;

(xiv) remote education excluding education content development; or

(xv) clinical database management services excluding clinical trials,

but does not include any research and development services whether or not in the nature of contract research and development services;

(f) “intra-group loan” means loan advanced to wholly owned subsidiary being a non-resident, where the loan—

(i) is sourced in Indian rupees;

(ii) is not advanced by an enterprise, being a financial company including a bank or a financial institution or an enterprise engaged in lending or borrowing in the normal course of business; and

(iii) does not include credit line or any other loan facility which has no fixed term for repayment;

(g) “knowledge process outsourcing services” means the following business process outsourcing services provided mainly with the assistance or use of information technology requiring application of knowledge and advanced analytical and technical skills, namely:—

(i) geographic information system;

(ii) human resources services;

(iii) engineering and design services;

(iv) animation or content development and management;

(v) business analytics;

(vi) financial analytics; or

(vii) market research,

but does not include any research and development services whether or not in the nature of contract research and development services;

(h) “non-core auto components” mean auto components other than core auto components;

(i) “no tax or low tax country or territory” means a country or territory in which the maximum rate of income-tax is less than fifteen per cent;

(j) “operating expense” means the costs incurred in the previous year by the assessee in relation to the international transaction during the course of its normal operations including depreciation and amortisation expenses relating to the assets used by the assessee, but not including the following, namely:—

(i) interest expense;

(ii) provision for unascertained liabilities;

(iii) pre-operating expenses;

(iv) loss arising on account of foreign currency fluctuations;

(v) extraordinary expenses;

(vi) loss on transfer of assets or investments;

(vii) expense on account of income-tax; and

(viii) other expenses not relating to normal operations of the assessee;

(k) “operating revenue” means the revenue earned by the assessee in the previous year in relation to the international transaction during the course of its normal operations but not including the following, namely:—

(i) interest income;

(ii) income arising on account of foreign currency fluctuations;

(iii) income on transfer of assets or investments;

(iv) refunds relating to income-tax;

(v) provisions written back;

(vi) extraordinary incomes; and

(vii) other incomes not relating to normal operations of the assessee.

(l) “operating profit margin” in relation to operating expense means the ratio of operating profit, being the operating revenue in excess of operating expense, to the operating expense expressed in terms of percentage;

(m) “software development services” means,—

(i) business application software and information system development using known methods and existing software tools;

(ii) support for existing systems;

(iii) converting or translating computer languages;

(iv) adding user functionality to application programmes;

(v) debugging of systems;

(vi) adaptation of existing software; or

(vii) preparation of user documentation,

but does not include any research and development services whether or not in the nature of contract research and development services.]

Who are the eligible Assessee for Safe Harbour Rules for International Transactions ?

As per Rule 10TB (Inserted by the IT (Sixteenth Amendment) Rules, 2013, w.e.f. 18-9-2013.)

10TB. (1) Subject to the provisions of sub-rules (2) and (3), the ‘eligible assessee’ means a person who has exercised a valid option for application of safe harbour rules in accordance with rule 10TE, and—

(i) is engaged in providing software development services or information technology enabled services or knowledge process outsourcing services, with insignificant risk, to a non-resident associated enterprise (hereinafter referred as foreign principal);

(ii) has made any intra-group loan;

(iii) has provided a corporate guarantee;

(iv) is engaged in providing contract research and development services wholly or partly relating to software development, with insignificant risk, to a foreign principal;

(v) is engaged in providing contract research and development services wholly or partly relating to generic pharmaceutical drugs, with insignificant risk, to a foreign principal; or

(vi) is engaged in the manufacture and export of core or non-core auto components and where ninety per cent or more of total turnover during the relevant previous year is in the nature of original equipment manufacturer sales.

(2) For the purposes of identifying an eligible assessee, with insignificant risk, referred to in item (i) of sub-rule (1), the Assessing Officer or the Transfer Pricing Officer, as the case may be, shall have regard to the following factors, namely:—

(a) the foreign principal performs most of the economically significant functions involved, including the critical functions such as conceptualisation and design of the product and providing the strategic direction and framework, either through its own employees or through its other associated enterprises, while the eligible assessee carries out the work assigned to it by the foreign principal;

(b) the capital and funds and other economically significant assets including the intangibles required, are provided by the foreign principal or its other associated enterprises, and the eligible assessee is only provided a remuneration for the work carried out by it;

(c) the eligible assessee works under the direct supervision of the foreign principal or its associated enterprise which not only has the capability to control or supervise but also actually controls or supervises the activities carried out through its strategic decisions to perform core functions as well as by monitoring activities on a regular basis;

(d) the eligible assessee does not assume or has no economically significant realised risks, and if a contract shows that the foreign principal is obligated to control the risk but the conduct shows that the eligible assessee is doing so, the contractual terms shall not be the final determinant;

(e) the eligible assessee has no ownership right, legal or economic, on any intangible generated or on the outcome of any intangible generated or arising during the course of rendering of services, which vests with the foreign principal as evident from the contract and the conduct of the parties.

(3) For the purposes of identifying an eligible assessee, with insignificant risk, referred to in items (iv) and (v) of sub-rule (1), the Assessing Officer or the Transfer Pricing Officer, as the case may be, shall have regard to the following factors, namely:—

(a) the foreign principal performs most of the economically significant functions involved in research or product development cycle, including the critical functions such as conceptualisation and design of the product and providing the strategic direction and framework, either through its own employees or through its other associated enterprises while the eligible assessee carries out the work assigned to it by the foreign principal;

(b) the foreign principal or its other associated enterprises provides the funds or capital and other economically significant assets including intangibles required for research or product development and also provides a remuneration to the eligible assessee for the work carried out by it;

(c) the eligible assessee works under the direct supervision of the foreign principal or its other associated enterprise which has not only the capability to control or supervise but also actually controls or supervises research or product development, through its strategic decisions to perform core functions as well as by monitoring activities on a regular basis;

(d) the eligible assessee does not assume or has no economically significant realised risks, and if a contract shows that the foreign principal is obligated to control the risk but the conduct shows that the eligible assessee is doing so, the contractual terms shall not be the final determinant;

(e) the eligible assessee has no ownership right, legal or economic, on the outcome of the research which vests with the foreign principal and is evident from the contract as well as the conduct of the parties.]

What are the eligible international transaction for Safe Harbour Rules ?

As per Rule-10TC, Income-tax Rules, Inserted by the IT (Sixteenth Amendment) Rules, 2013, w.e.f. 18-9-2013.

‘Eligible international transaction’ means an international transaction between the eligible assessee and its associated enterprise, either or both of whom are non-resident, and which comprises of:

(i) provision of software development services;

(ii) provision of information technology enabled services;

(iii) provision of knowledge process outsourcing services;

(iv) advance of intra-group loan;

(v) provision of corporate guarantee, where the amount guaranteed,—

(a) does not exceed one hundred crore rupees; or

(b) exceeds one hundred crore rupees, and the credit rating of the associated enterprise, done by an agency registered with the Securities and Exchange Board of India, is of the adequate to highest safety;

(vi) provision of contract research and development services wholly or partly relating to software development;

(vii) provision of contract research and development services wholly or partly relating to generic pharmaceutical drugs;

(viii) manufacture and export of core auto components; or

(ix) manufacture and export of non-core auto components,

by the eligible assessee.]

What Safe Harbour Rules for International Transactions ?

As per Rule-10TD, Income-tax Rules (Inserted by the IT (Sixteenth Amendment) Rules, 2013, w.e.f. 18-9-2013.)

(1) Where an eligible assessee has entered into an eligible international transaction and the option exercised by the said assessee is not held to be invalid under rule 10TE, the transfer price declared by the assessee in respect of such transaction shall be accepted by the income-tax authorities, if it is in accordance with the circumstances as specified in sub-rule (2).

(2) The circumstances referred to in sub-rule (1) in respect of the eligible international transaction specified in column (2) of the Table below shall be as specified in the corresponding entry in column (3) of the said Table:—

| Sl. No. | Eligible International Transaction | Circumstances | |

| (1) | (2) | (3) | |

| 1. | Provision of software development services referred to in item (i) of rule 10TC. | The operating profit margin declared by the eligible assessee from the eligible international transaction in relation to operating expense incurred is – (i) not less than 20 per cent, where the aggregate value of such transactions entered into during the previous year does not exceed a sum of five hundred crore rupees; or (ii) not less than 22 per cent, where the aggregate value of such transactions entered into during the previous year exceeds a sum of five hundred crore rupees. | |

| 2. | Provision of information technology enabled services referred to in item (ii) of rule 10TC. | The operating profit margin declared by the eligible assessee from the eligible international transaction in relation to operating expense is – (i) not less than 20 per cent, where the aggregate value of such transactions entered into during the previous year does not exceed a sum of five hundred crore rupees; or (ii) not less than 22 per cent, where the aggregate value of such transactions entered into during the previous year exceeds a sum of five hundred crore rupees. | |

| 3. | Provision of knowledge process outsourcing services referred to in item (iii) of rule 10TC. | The operating profit margin declared by the eligible assessee from the eligible international transaction in relation to operating expense is not less than 25 per cent. | |

| 4. | Advancing of intra-group loans referred to in item (iv) of rule 10TC where the amount of loan does not exceed fifty crore rupees. | The Interest rate declared in relation to the eligible international transaction is not less than the base rate of State Bank of India as on 30th June of the relevant previous year plus 150 basis points. | |

| 5. | Advancing of intra-group loans referred to in item (iv) of rule 10TC where the amount of loan exceeds fifty crore rupees. | The Interest rate declared in relation to the eligible international transaction is not less than the base rate of State Bank of India as on 30th June of the relevant previous year plus 300 basis points. | |

| 6. | Providing corporate guarantee referred to in sub-item (a) of item (v) of rule 10TC. | The commission or fee declared in relation to the eligible international transaction is at the rate not less than 2 per cent per annum on the amount guaranteed. | |

| 7. | Providing corporate guarantee referred to in sub-item (b) of item (v) of rule 10TC. | The commission or fee declared in relation to the eligible international transaction is at the rate not less than 1.75 per cent. per annum on the amount guaranteed. | |

| 8. | Provision of contract research and development services wholly or partly relating to software development referred to in item (vi) of rule 10TC. | The operating profit margin declared by the eligible assessee from the eligible international transaction in relation to operating expense incurred is not less than 30 per cent. | |

| 9. | Provision of contract research and development services wholly or partly relating to generic pharmaceutical drugs referred to in item (vii) of rule 10TC. | The operating profit margin declared by the eligible assessee from the eligible international transaction in relation to operating expense incurred is not less than 29 per cent. | |

| 10. | Manufacture and export of core auto components referred to in item (viii) of rule 10TC. | The operating profit margin declared by the eligible assessee from the eligible international transaction in relation to operating expense is not less than 12 per cent. | |

| 11. | Manufacture and export of non-core auto components referred to in item (ix) of rule 10TC. | The operating profit margin declared by the eligible assessee from the eligible international transaction in relation to operating expense is not less than 8.5 per cent. | |

(3) The provisions of sub‐rules (1) and (2) shall apply for the assessment year 2013-14 and four assessment years immediately following that assessment year.

(4) No comparability adjustment and allowance under the second proviso to sub-section (2) of section 92C shall be made to the transfer price declared by the eligible assessee and accepted under sub-rules (1) and (2) above.

(5) The provisions of sections 92D and 92E in respect of an international transaction shall apply irrespective of the fact that the assessee exercises his option for safe harbour in respect of such transaction.]

As per Rule-10TE, Income-tax Rules (Inserted by the IT (Sixteenth Amendment) Rules, 2013, w.e.f. 18-9-2013.)

(1) For the purposes of exercise of the option for safe harbour, the assessee shall furnish a Form 3CEFA, complete in all respects, to the Assessing Officer on or before the due date specified in Explanation 2 below sub-section (1) of section 139 for furnishing the return of income for—

(i) the relevant assessment year, in case the option is exercised only for that assessment year; or

(ii) the first of the assessment years, in case the option is exercised for more than one assessment year:

Provided that the return of income for the relevant assessment year or the first of the relevant assessment years, as the case may be, is furnished by the assessee on or before the date of furnishing of Form 3CEFA.

(2) The option for safe harbour validly exercised shall continue to remain in force for the period specified in Form 3CEFA or a period of five years whichever is less:

Provided that the assessee shall, in respect of the assessment year or years following the initial assessment year, furnish a statement to the Assessing Officer before furnishing return of income of that year, providing details of eligible transactions, their quantum and the profit margins or the rate of interest or commission shown:

Provided further that an option for safe harbour shall not remain in force in respect of any assessment year following the initial assessment year, if—

(i) the option is held to be invalid for the relevant assessment year by the Transfer Pricing Officer under sub-rule (11) or by the Commissioner under sub-rule (8) in respect of an objection filed by the assessee against the order of the Transfer Pricing Officer under sub-rule (11), as the case may be; or

(ii) the eligible assessee opts out of the safe harbour, for the relevant assessment year, by furnishing a declaration to that effect, to the Assessing Officer.

(3) On receipt of Form 3CEFA, the Assessing Officer shall verify whether—

(i) the assessee exercising the option is an eligible assessee; and

(ii) the transaction in respect of which the option is exercised is an eligible international transaction,

before the option for safe harbour by the assessee is treated to be validly exercised.

(4) Where the Assessing officer doubts the valid exercise of the option for the safe harbour by an assessee, he shall make a reference to the Transfer Pricing Officer for determination of the eligibility of the assessee or the international transaction or both for the purposes of the safe harbour.

(5) For the purposes of sub-rule (4) and sub-rule (10), the Transfer Pricing Officer may require the assessee, by notice in writing, to furnish such information or documents or other evidence as he may consider necessary, and the assessee shall furnish the same within the time specified in such notice.

(6) Where—

(a) the assessee does not furnish the information or documents or other evidence required by the Transfer Pricing Officer; or

(b) the Transfer Pricing Officer finds that the assessee is not an eligible assessee; or

(c) the Transfer Pricing Officer finds that the international transaction in respect of which the option referred to in sub-rule (1) has been exercised is not an eligible international transaction,

the Transfer Pricing Officer shall, by order in writing, declare the option exercised by the assessee under sub-rule (1) to be invalid and cause a copy of the said order to be served on the assessee and the Assessing Officer:

Provided that no order declaring the option exercised by the assessee to be invalid shall be passed without giving an opportunity of being heard to the assessee.

(7) If the assessee objects to the order of the Transfer Pricing Officer under sub-rule (6) or sub-rule (11) declaring the option to be invalid, he may file his objections with the Commissioner, to whom the Transfer Pricing Officer is subordinate, within fifteen days of receipt of the order of the Transfer Pricing Officer.

(8) On receipt of the objection referred to in sub-rule (7), the Commissioner shall after providing an opportunity of being heard to the assessee pass appropriate orders in respect of the validity or otherwise of the option exercised by the assessee and cause a copy of the said order to be served on the assessee and the Assessing Officer.

(9) In a case where option exercised by the assessee has been held to be valid, the Assessing officer shall proceed to verify whether the transfer price declared by the assessee in respect of the relevant eligible international transactions is in accordance with the circumstances specified in sub-rule (2) of rule 10 TD and, if it is not in accordance with the said circumstances, the Assessing Officer shall adopt the operating profit margin or rate of interest or commission specified in sub-rule (2) of rule 10TD.

(10) Where the facts and circumstances on the basis of which the option exercised by the assessee was held to be valid have changed and the Assessing Officer has reason to doubt the eligibility of an assessee or the international transaction for any assessment year other than the initial Assessment Year falling within the period for which the option was exercised by the assessee, he shall make a reference to the Transfer Pricing Officer for determination of eligibility of the assessee or the international transaction or both for the purpose of safe harbour.

Explanation.—For purposes of this sub-rule the facts and circumstances include:—

(a) functional profile of the assessee in respect of the international transaction;

(b) the risks being undertaken by the assessee;

(c) the substantive contractual conditions governing the role of the assessee in respect of the international transaction;

(d) the conduct of the assessee as referred to in sub-rule (2) or sub-rule (3) of rule 10TB; or

(e) the substantive nature of the international transaction.

(11) The Transfer Pricing Officer on receipt of a reference under sub-rule (10) shall, by an order in writing, determine the validity or otherwise of the option exercised by the assessee for the relevant year after providing an opportunity of being heard to the assessee and cause a copy of the said order to be served on the assessee and the Assessing Officer.

(12) Nothing contained in this rule shall affect the power of the Assessing Officer to make a reference under section 92CA in respect of international transaction other than the eligible international transaction.

(13) Where no option for safe harbour has been exercised under sub-rule (1) by an eligible assessee in respect of an eligible international transaction entered into by the assessee or the option exercised by the assessee is held to be invalid, the arm’s length price in relation to such international transaction shall be determined in accordance with the provisions of sections 92C and 92CA without having regard to the profit margin or the rate of interest or commission as specified in sub-rule (2) of rule 10TD.

(14) For the purposes of this rule,—

(i) no reference under sub-rule(4) shall be made by an Assessing Officer after expiry of a period of two months from the end of the month in which Form 3CEFA is received by him;

(ii) no order under sub-rule (6) or sub-rule (11) shall be passed by the Transfer Pricing Officer after expiry of a period of two months from the end of the month in which the reference from the Assessing officer under sub-rule(4) or sub-rule (10), as the case may be, is received by him;

(iii) the order under sub-rule (8) shall be passed by the Commissioner within a period of two months from the end of the month in which the objection filed by the assessee under sub-rule (7) is received by him.

(15) If the Assessing Officer or the Transfer Pricing Officer or the Commissioner, as the case may be, does not make a reference or pass an order, as the case may be, within the time specified in sub-rule (14), then the option for safe harbour exercised by the assessee shall be treated as valid.]

What are Definitions for Safe Harbour Rules for Specified Domestic Transactions ?

As per Rule 10TH inserted by the Income-tax (Second Amendment) Rules, 2015, w.e.f. 4-2-2015.

Definitions.— For the purposes of 10TH and rules 10THA to 10THD,—

| (a) | “Appropriate Commission” shall have the same meaning as assigned to it in sub-section (4) of section 2 of the Electricity Act, 2003 (36 of 2003); | |

| (b) | “Government company” shall have the same meaning as assigned to it in sub-section (45) of section 2 of the Companies Act, 2013 (18 of 2013); ] |

What are the circumstances in which safe harbour Rule for International Transactions will not apply ?

As per Rule-10TF, Income-tax Rules, (Inserted by the IT (Sixteenth Amendment) Rules, 2013, w.e.f. 18-9-2013.)

Nothing contained in rules 10TA, 10TB, 10TC, 10TD or rule 10TE shall apply in respect of eligible international transactions entered into with an associated enterprise located in any country or territory notified under section 94A or in a no tax or low tax country or territory.

Can the Assessee invoke mutual agreement procedure under an agreement for avoidance of double taxation after execising the option of safe harbour Rule for International Transactions ?

As per Rule-10TG, Income-tax Rules : (Inserted by the IT (Sixteenth Amendment) Rules, 2013, w.e.f. 18-9-2013.)

Where transfer price in relation to an eligible international transaction declared by an eligible assessee is accepted by the income-tax authorities under section 92CB, the assessee shall not be entitled to invoke mutual agreement procedure under an agreement for avoidance of double taxation entered into with a country or specified territory outside India as referred to in section 90 or 90A

Who are the Eligible assessee for Safe Harbour Rules for Specified Domestic Transactions?

As per Rule 10THA (inserted by the Income-tax (Second Amendment) Rules, 2015, w.e.f. 4-2-2015.)

The ‘eligible assessee’ means a person who has exercised a valid option for application of safe harbour rules in accordance with the provisions of rule 10THC, and

(i) is a Government company engaged in the business of generation, transmission or distribution of electricity; or

(ii) is a co-operative society engaged in the business of procuring and marketing milk and milk products” (Inserted bye Income-tax (19th Amendment) Rules, 2015. w.e.f , the 8th December, 2015)

What are the Eligible specified domestic transaction for Safe Harbour Rules for Specified Domestic Transactions ?

As per Rule-10THB, Income-tax Rules (Rule 10THB inserted by the Income-tax (Second Amendment) Rules, 2015, w.e.f. 4-2-2015.)

The “Eligible specified domestic transaction” means a specified domestic transaction undertaken by an eligible assessee and which comprises of :—

| (i) | supply of electricity by a generating company; or | |

| (ii) | transmission of electricity; or | |

| (iii) | wheeling of electricity. |

(iv) purchase of milk or milk products by a co-operative society from its members.”. (Inserted by Income-tax (19th Amendment) Rules, 2015. w.e.f , the 8th December, 2015)

What is Safe Harbour for Specified Domestic Transactions ?

Rule 10THC inserted by the Income-tax (Second Amendment) Rules, 2015, w.e.f. 4-2-2015.

(1) Where an eligible assessee has entered into an eligible specified domestic transaction in any previous year relevant to an assessment year and the option exercised by the said assessee is treated to be validly exercised under rule 10THD, the transfer price declared by the assessee in respect of such transaction for that assessment year shall be accepted by the income-tax authorities, if it is in accordance with the circumstances as specified in sub-rule (2).

(2) The circumstances referred to in sub-rule (1) in respect of the eligible specified domestic transaction specified in column (2) of the Table below shall be as specified in the corresponding entry in column (3) of the said Table:—

| S.No. | Eligible specified domestic transaction | Circumstances |

| 1 | 2. | 3. |

| 1.

2. | Supply of electricity, transmission of electricity, wheeling of electricity referred to in item (i), (ii) or (iii) of rule 10THB, as the case may be.

Purchase of milk or milk products referred to in clause (iv) of rule 10THB. (Inserted by Income-tax (19th Amendment) Rules, 2015. w.e.f , the 8th December, 2015) | The tariff in respect of supply of electricity, transmission of electricity, wheeling of electricity, as the case may be, is determined by the Appropriate Commission in accordance with the provisions of the Electricity Act, 2003 (36 of 2003).

The price of milk or milk products is determined at a rate which is fixed on the basis of the quality of milk, namely, fat content and Solid Not Fat (SNF) content of milk; and- (a) the said rate is irrespective of,- (i) the quantity of milk procured; (ii) the percentage of shares held by the members in the co-operative society; (iii) the voting power held by the members in the society; and (b) such prices are routinely declared by the cooperative society in a transparent manner and are available in public domain.”. |

(3) No comparability adjustment and allowance under the second proviso to sub-section (2) of section 92C shall be made to the transfer price declared by the eligible assessee and accepted under sub-rule (1).

(4) The provisions of sections 92D and 92E in respect of a specified domestic transaction shall apply irrespective of the fact that the assessee exercises his option for safe harbour in respect of such transaction.]

What are the documents to be maintained by Government company engaged in the business of generation, transmission or distribution of electricity ?

As per rule 10D(2A)of the Income-tax Rules, 1962

the eligible assessee, referred to in clause (i) of rule 10 THA, shall keep and maintain the following information and documents, namely:-

(i) a description of the ownership structure of the assessee enterprise with details of shares or other ownership interest held therein by other enterprises;

(ii) a broad description of the business of the assessee and the industry in which the assessee operates, and of the business of the associated enterprises with whom the assessee has transacted;

(iii) the nature and terms (including prices) of specified domestic transactions entered into with each associated enterprise and the quantum and value of each such transaction or class of such transaction; (iv) a record of proceedings, if any, before the regulatory commission and orders of such commission relating to the specified domestic transaction;

(v) a record of the actual working carried out for determining the transfer price of the specified domestic transaction;

(vi) the assumptions, policies and price negotiations, if any, which have critically affected the determination of the transfer price; and

(vii) any other information, data or document, including information or data relating to the associated enterprise, which may be relevant for determination of the transfer price;

What are the Documents required to be kept by a co-operative society engaged in the business of procuring and marketing milk and milk products ?

As per rule 10D(2A)of the Income-tax Rules, 1962 (Inserted by Income-tax (19th Amendment) Rules, 2015 w.e.f , the 8th December, 2015):-

The eligible assesse, referred to in clause (ii) of rule 10THA, shall keep and maintain the following information and documents, namely:-

(i) a description of the ownership structure of the assessee co-operative society with details of shares or other ownership interest held therein by the members;

(ii) description of members including their addresses and period of membership;

(iii) the nature and terms (including prices) of specified domestic transactions entered into with each member and the quantum and value of each such transaction or class of such transaction;

(iv) a record of the actual working carried out for determining the transfer price of the specified domestic transaction;

(v) the assumptions, policies and price negotiations, if any, which have critically affected the determination of the transfer price;

(vi) the documentation regarding price being routinely declared in transparent manner and being available in public domain; and

(vii) any other information, data or document which may be relevant for determination of the transfer price.”.

What is the procedure in case of exercise of the option for safe harbour by the Assessee ?

As per Rule 10THD inserted by the Income-tax (Second Amendment) Rules, 2015, w.e.f. 4-2-2015.

(1) For the purposes of exercise of the option for safe harbour, the assessee shall furnish a Form 3CEFB, complete in all respects, to the Assessing Officer on or before the due date specified in Explanation 2 to sub-section (1) of section 139 for furnishing the return of income for the relevant assessment year:

Provided that the return of income for the relevant assessment year is furnished by the assessee on or before the date of furnishing of Form 3CEFB:

Provided further that in respect of eligible specified domestic transactions undertaken during the previous year relevant to the assessment year beginning on the 1st day of April, 2013 or beginning on the 1st day of April, 2014, Form 3CEFB can be furnished by the assessee on or before the 31st day of March, 2015.

“Provided also that in respect of eligible specified domestic transactions, referred to in clause (iv) of rule 10 THB, undertaken during the previous year relevant to the assessment year beginning on the 1 st day of April, 2013 or beginning on the 1st day of April, 2014 or beginning on the 1st day of April, 2015, Form 3CEFB may be furnished by the assessee on or before the 31st day of December, 2015.” (Inserted by Income-tax (19th Amendment) Rules, 2015. w.e.f , the 8th December, 2015)

(2) On receipt of Form 3CEFB, the Assessing Officer shall verify whether—

| (i) | the assessee exercising the option is an eligible assessee; and | |

| (ii) | the transaction in respect of which the option is exercised is an eligible specified domestic transaction, |

before the option for safe harbour by the assessee is treated to be validly exercised.

(3) Where the Assessing Officer doubts the valid exercise of the option for the safe harbour by an assessee, he may require the assessee, by notice in writing, to furnish such information or documents or other evidence as he may consider necessary, and the assessee shall furnish the same within the time specified in such notice.

(4) Where—

| (a) | the assessee does not furnish the information or documents or other evidence required by the Assessing Officer; or | |

| (b) | the Assessing Officer finds that the assessee is not an eligible assessee; or | |

| (c) | the Assessing Officer finds that the specified domestic transaction in respect of which the option referred to in sub-rule (1) has been exercised is not an eligible specified domestic transaction; or | |

| (d) | the tariff is not in accordance with the circumstances specified in sub-rule (2) of rule 10THC, |

the Assessing Officer shall, by order in writing, declare the option exercised by the assessee under sub-rule (1) to be invalid and cause a copy of the said order to be served on the assessee:

Provided that no order declaring the option exercised by the assessee to be invalid shall be passed without giving an opportunity of being heard to the assessee.

(5) If the assessee objects to the order of the Assessing Officer under sub-rule (4) declaring the option to be invalid, he may file his objections with the Principal Commissioner or the Commissioner or the Principal Director or the Director, as the case may be, to whom the Assessing Officer is subordinate, within fifteen days of receipt of the order of the Assessing Officer.

(6) On receipt of the objection referred to in sub-rule (5), the Principal Commissioner or the Commissioner or the Principal Director or the Director, as the case may be, shall after providing an opportunity of being heard to the assessee, pass appropriate orders in respect of the validity or otherwise of the option exercised by the assessee and cause a copy of the said order to be served on the assessee and the Assessing Officer.

(7) For the purposes of this rule,—

| (i) | no order under sub-rule (4) shall be made by an Assessing Officer after expiry of a period of three months from the end of the month in which Form 3CEFB is received by him; | |

| (ii) | the order under sub-rule (6) shall be passed by the Principal Commissioner or Commissioner or Principal Director or Director, as the case may be, within a period of two momths from the end of the month in which the objection filed by the assessee under sub-rule (5) is received by him. |

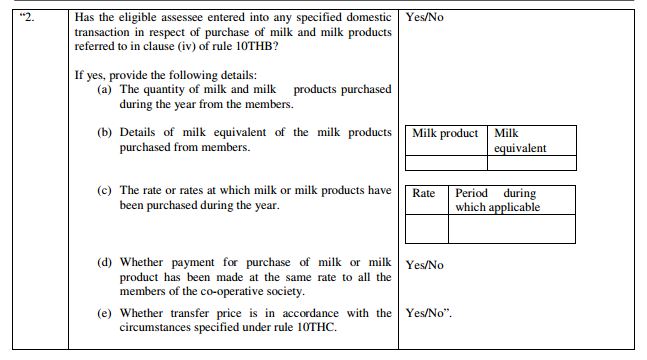

What is the Information required to be given in Form No. 3CEFB in respect of purchase of milk or milk products by a co-operative society from its members.?

As per Appendix II Sr No 2 Inserted by Income-tax (19th Amendment) Rules, 2015 w.e.f , the 8th December, 2015)

Source ; IncometaxIndia.gov.in