Section 194N Income Tax : Payment of certain amounts in cash

Notes

“194N. Payment of certain amounts in cash.—Every person, being,—

who is responsible for paying any sum, or, as the case may be, aggregate of sums, in cash, in excess of one crore rupees during the previous year, to any person (herein referred to as the recipient) from one or more accounts maintained by the recipient with it shall, at the time of payment of such sum, deduct an amount equal to two per cent of sum exceeding one crore rupees, as income-tax:

Provided that nothing contained in this sub-section shall apply to any payment made to,—

| (i) | the Government; | |

| (ii) | any banking company or co-operative society engaged in carrying on the business of banking or a post office; | |

| (iii) | any business correspondent of a banking company or co-operative society engaged in carrying on the business of banking, in accordance with the guidelines issued in this regard by the Reserve Bank of India under the Reserve Bank of India Act, 1934 (2 of 1934); | |

| (iv) | any white label automated teller machine operator of a banking company or co-operative society engaged in carrying on the business of banking, in accordance with the authorisation issued by the Reserve Bank of India under the Payment and Settlement Systems Act, 2007 (51 of 2007); | |

| (v) | such other person or class of persons, which the Central Government may, by notification in the Official Gazette, specify in consultation with the Reserve Bank of India.” |

2. Refer also Circular No. 14/2020, dated 20-7-2020 [Clarification in relation to notification issued under clause (v) of proviso to section 194N prior to amendment by Finance Act, 2020].

3. Inserted by the Finance Act, 2023, w.e.f. 1-4-2023.

Finance Act 2019 inserted Section 194N of Income Tax Act with effect from the 1st day of September, 2019: Payment of certain amounts in cash.

This has been amended by Finance Act 2020 from 01.07.2020 (refer 1.6 below)

1.0 Video Explanation of Section 194N Income Tax from 01.09.2019

1.2 Video Explanation of Section 194N Income Tax from 01.07.2020

1.3 Commentary on Section 194N of Income Tax Act

- Effective Date : Section 194N of Income Tax Act effect from the 1st day of September, 2019. It has been amended from 01.07.02020

- Why TDS has to be deducted u/s 194N of Income Tax : If Banks/Post Office pays any sum, or, as the case may be, aggregate of sums, in cash, in excess of one crore rupees during the Financing year, to any person (herein referred to as the recipient) from an account maintained by the recipient with it.

- When TDS has to be deducted u/s 194N of Income Tax : At the time of payment of such sum in cash by Banks/Post Office to recipient

- TDS Rate u/s 194N of Income Tax Act : 2% of sum exceeding one crore rupees

- Who has to Deduct TDS u/s 194N of Income Tax Act :Every person, being,––(i) a banking company to which the Banking Regulation Act, 1949 applies (including any bank or banking institution referred to in section 51 of that Act);(ii) a co-operative society engaged in carrying on the business of banking; or(iii) a post office,

- When TDS will not be deducted u/s 194N of Income Tax : TDS shall not be deducted on any payment made to the Government, any banking company, co-operative society engaged in carrying on the business of banking, post office, business correspondent of a banking company or co-operative society, engaged in carrying the business of banking, any white label automated teller machine operator of a banking company or co-operative society engaged in carrying the business of banking, or such other persons or class of persons, which the Central Government may, specify by notification in consultation with the Reserve Bank of India,.

- After Amendment in Section 194N from 01.07.2020 it will be as follow

1.4 Budget 2019 Speech of Finance Minister on Section 194N of Income Tax Act

Digital Payments

126. Mr. Speaker, Sir, our Government has taken a number of initiatives in the recent past for the promotion of digital payments and less cash economy. To promote digital payments further, I propose to take a slew of measures. To discourage the practice of making business payments in cash, I propose to levy TDS of 2% on cash withdrawal exceeding 1 crore in a year from a bank account. Further, there are low-cost digital modes of payment such as BHIM UPI, UPI-QR Code, Aadhaar Pay, certain Debit cards, NEFT, RTGS etc. which can be used to promote less cash economy. I, therefore, propose that the business establishments with annual turnover more than 50 crore shall offer such low cost digital modes of payment to their customers and no charges or Merchant Discount Rate shall be imposed on customers as well as merchants. RBI and Banks will absorb these costs from the savings that will accrue to them on account of handling less cash as people move to these digital modes of payment. Necessary amendments are being made in the Income Tax Act and the Payments and Settlement Systems Act, 2007 to give effect to these provisions

2.2 TDS on cash withdrawal from banks: In order to discourage large amount of cash withdrawal from bank accounts, it is proposed to provide for tax deduction at source at the rate of 2% on cash withdrawal by a person in excess of Rs. 1 crore in a year from his bank account. Some business models, where large cash withdrawal is a necessity, are proposed to be exempted. It is also proposed that the Central Government may notify the persons to whom these provisions shall not be applicable in consultation with the Reserve Bank of India.

1.5 Section 194N of Income Tax Act :

As per Clause 46 of Finance Bill 2019 ( Dated 05.07.2019) after section 194LD of the Income-tax Act, the following sections shall be inserted with effect from the 1st day of September, 2019,

Payment of certain amounts in cash

194N. Every person, being,––

(i) a banking company to which the Banking Regulation Act, 1949 applies (including any bank or banking institution referred to in section 51 of that Act);

(ii) a co-operative society engaged in carrying on the business of banking; or

(iii) a post office,

who is responsible for paying any sum, or, as the case may be, aggregate of sums, in cash, in excess of one crore rupees during the previous year, to any person (herein referred to as the recipient) from an account maintained by the recipient with it shall, at the time of payment of such sum, deduct an amount equal to two per cent. of sum exceeding one crore rupees, as income-tax:

Provided that nothing contained in this sub-section shall apply to any payment made to,––

(i) the Government;

(ii) any banking company or co-operative society engaged in carrying on the business of banking or a post office;

(iii) any business correspondent of a banking company or co-operative society engaged in carrying on the business of banking, in accordance with the guidelines issued in this regard by the Reserve Bank of India under the Reserve Bank of India Act, 1934;

(iv) any white label automated teller machine operator of a banking company or co-operative society engaged in carrying on the business of banking, in accordance with the authorisation issued by the Reserve Bank of India under the Payment and Settlement Systems Act, 2007;

(v) such other person or class of persons, which the Central Government may, by notification in the Official Gazette, specify in consultation with the Reserve Bank of India.’

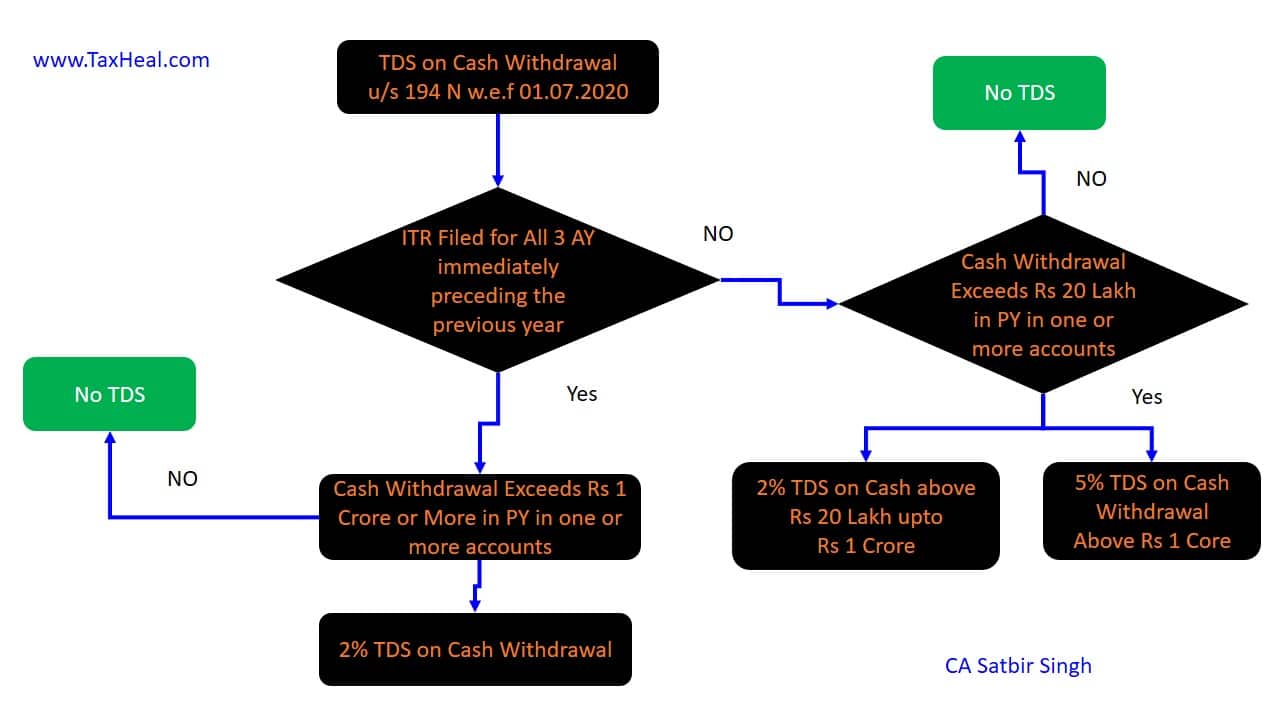

1.6 Amendment in Section 194N w.ef 01.07.2020

As per Finance Act 2020 for section 194N of the Income-tax Act, the following section shall be substituted with effect from the 1st day of July, 2020, namely:—

Payment of certain amounts in cash.

‘194N. Every person, being,—

(i) a banking company to which the Banking Regulation Act, 1949 applies (including any bank or banking institution referred to in section 51 of that Act);

(ii) a co-operative society engaged in carrying on the business of banking;

or

(iii) a post office,

who is responsible for paying any sum, being the amount or the aggregate of amounts, as the case may be, in cash exceeding one crore rupees during the previous year, to any person (herein referred to as the recipient) from one or more accounts maintained by the recipient with it shall, at the time of payment of such sum, deduct an amount equal to two per cent. of such sum, as income-tax

Provided that in case of a recepient who has not filed the returns of income for all of the three assessment years relevant to the three previous years, for which the time limit of file return of income under sub-section (1) of section 139 has expired, immediately preceding the previous year in which the payment of the sum is made to him, the provision of this section shall apply with the modification that-

(i) the sum shall be the amount or the aggregate of amounts, as the case may be, in cash exceeding twenty lakh rupees during the previous year; and

(ii) the deduction shall be—

(a) an amount equal to two per cent. of the sum where the amount or aggregate of amounts, as the case may be, being paid in cash exceeds twenty lakh rupees during the previous year but does not exceed one crore rupees; or (b) an amount equal to five per cent. of the sum where the amount or aggregate of amounts, as the case may be, being paid in cash exceeds one crore rupees during the previous year:

Provided further that the Central Government may specify in consultation with the Reserve Bank of India, by notification in the Official Gazette, the recipient in whose case the first proviso shall not apply or apply at reduced rate, if such recipient satisfies the conditions specified in such notification

Provided also that nothing contained in this section shall apply to any payment made

to—

(i) the Government;

(ii) any banking company or co-operative society engaged in carrying on the business of banking or a post office;

(iii) any business correspondent of a banking company or co-operative society engaged in carrying on the business of banking, in accordance with the guidelines issued in this regard by the Reserve Bank of India under the Reserve Bank of India Act, 1934;

(iv) any white label automated teller machine operator of a banking company or co-operative society engaged in carrying on the business of banking, in accordance with the authorisation issued by the Reserve Bank of India under the Payment and Setllement Systems Act, 2007

Provided also that the Central Government may specify in consultation with the Reserve Bank of India, by notification in the Official Gazette, the recipient in whose case the provision of this section shall not apply or apply at reduced rate, if such recipient satisfies the conditions specified in such notification.

1.7 Explanation of Clause 46 of Finance Bill 2019 on Section 194N

Clause 46 of the Bill seeks to insert new sections 194M relating to payment of certain sums by certain individuals or Hindu undivided family and 194N relating to payment of certain amounts in cash in the Income-tax Act.

The proposed new section 194N provides that a banking company or a co-operative society engaged in carrying on the business of banking or a post office, which is responsible for paying any sum or aggregate of sums, in excess of one crore rupees in cash during the previous year to any person (referred to as the recipient in the section) from an account maintained by the recipient with such banking company or co-operative society or post office shall, at the time of payment of such amount, deduct an amount equal to two per cent. of sum exceeding one crore rupees as income-tax.

The proviso to the said section provides that the provisions of the proposed new section shall not apply to any payment made to the Government, any banking company, co-operative society engaged in carrying on the business of banking, post office, business correspondent of a banking company or co-operative society, engaged in carrying the business of banking, any white label automated teller machine operator of a banking company or co-operative society engaged in carrying the business of banking, or such other persons or class of persons, which the Central Government may, specify by notification in consultation with the Reserve Bank of India,.

These amendments will take effect from 1st September, 2019

1.8 Why Section 194N of Income Tax Act is inserted

As per Memorandum explaining Finance Bill 2019 ( Dated 05.07.2019)

C. MEASURES FOR PROMOTING LESS CASH ECONOMY

TDS on cash withdrawal to discourage cash transactions

In order to further discourage cash transactions and move towards less cash economy, it is proposed to insert a new section 194N in the Act to provide for levy of TDS at the rate of two per cent on cash payments in excess of one crore rupees in aggregate made during the year, by a banking company or cooperative bank or post office, to any person from an account maintained by the recipient.

It is proposed to exempt payment made to certain recipients, such as the Government, banking company, cooperative society engaged in carrying on the business of banking, post office, banking correspondents and white label ATM operators, who are involved in the handling of substantial amounts of cash as a part of their business operation, from the application of this provision. It is proposed to empower the Central Government to exempt other recipients, through a notification in the official Gazette in consultation with the Reserve Bank of India.

This amendment will take effect from 1st September, 2019.

[Clause 46]

For Latest Notification on Income Tax also refer Govt website Click here

1.9 Clarification by CBIC by Press Release on TDS on Cash Withdrawal

CBDT PRESS RELEASE, DATED 30-8-2019

In order to discourage cash transactions and move towards less cash economy, the Finance (No. 2) Act, 2019 has inserted a new section 194N in the Income-tax Act, 1961 (the ‘Act’), to provide for levy of tax deduction at source (TDS) @2% on cash payments in excess of one crore rupees in aggregate made during the year, by a banking company or cooperative bank or post office, to any person from one or more accounts maintained with it by the recipient. The above section shall come into effect from 1st September, 2019.

Since the section provided that the person responsible for paying any sum, or, as the case may be, aggregate of sums, in cash, in excess of one crore rupees during the previous year to deduct income tax @2% on cash payment in excess of rupees one crore, queries were received from the general public through social media on the applicability of this section on withdrawal of cash from 01.04.2019 to 31.08.2019.

The CBDT, having considered the concerns of the people, hereby clarifies that section 194N inserted in the Act, is to come into effect from 1st September, 2019. Hence, any cash withdrawal prior to 1st September, 2019 will not be subjected to the TDS under section 194N of the Act. However, since the threshold of Rs. 1 crore is with respect to the previous year, calculation of amount of cash withdrawal for triggering deduction under section 194N of the Act shall be counted from 1st April, 2019. Hence, if a person has already withdrawn Rs. 1 crore or more in cash upto 31st August, 2019 from one or more accounts maintained with a banking company or a cooperative bank or a post office, the two per cent TDS shall apply on all subsequent cash withdrawals.

2.0 Notified Person to whom Cash Payments Allowed

Payment in Cash to Cash Replenishment Agencies (CRA’s) and franchise agents of White Label Automated Teller Machine Operators

NOTIFICATION NO. SO 3356(E) [NO. 68/2019 (F.NO. 370142/12/2019-TPL)], DATED 18-9-2019

In exercise of the powers conferred by clause (v) of proviso to section 194N of the Income-tax Act, 1961 (43 of 1961), the Central Government after consultation with the Reserve Bank of India, hereby specifies Cash Replenishment Agencies (CRA’s) and franchise agents of White Label Automated Teller Machine Operators (WLATMO’s) maintaining a separate bank account from which withdrawal is made only for the purposes of replenishing cash in the Automated Teller Machines (ATM’s) operated by such WLATMO’s and the WLATMO have furnished a certificate every month to the bank certifying that the bank account of the CRA’s and the franchise agents of the WLATMO’s have been examined and the amounts being withdrawn from their bank accounts has been reconciled with the amount of cash deposited in the ATM’s of the WLATMO’s.

2. The notification shall be deemed to have come into force with effect from the 1st day of September, 2019.

NOTIFICATION NO. SO 3427 (E) [NO. 70/2019 (F.NO. 370142/12/2019-TPL (PART-I)], DATED 20-9-2019

In exercise of the powers conferred by clause (v) of the proviso to section 194N of the Income-tax Act, 1961 (43 of 1961), the Central Government after consultation with the Reserve Bank of India, hereby specifies the commission agent or trader, operating under Agriculture Produce Market Committee (APMC), and registered under any Law relating to Agriculture Produce Market of the concerned State, who has intimated to the banking company or co-operative society or post office his account number through which he wishes to withdraw cash in excess of rupees one crore in the previous year along with his Permanent Account Number (PAN) and the details of the previous year and has certified to the banking company or co-operative society or post office that the withdrawal of cash from the account in excess of rupees one crore during the previous year is for the purpose of making payments to the farmers on account of purchase of agriculture produce and the banking company or co-operative society or post office has ensured that the PAN quoted is correct and the commission agent or trader is registered with the APMC, and for this purpose necessary evidences have been collected and placed on record.

2. The notification shall be deemed to have come into force with effect from the 1st day of September, 2019.

NOTIFICATION NO. S.O. 3719(E) [NO. 80/2019 (F.NO. 370142/12/2019-TPL (PART20))], DATED 15-10-2019

In exercise of the powers conferred by clause (v) of proviso to section 194N of the Income-tax Act, 1961 (43 of 1961), the Central Government, after consultation with the Reserve Bank of India (RBI), hereby specifies,-

| (a) | the authorised dealer andits franchise agent and sub-agent; and | |

| (b) | Full-Fledged Money Changer (FFMC) licensed by the Reserve Bank of Indiaand its franchise agent; |

maintaining a separate bank account from which withdrawal is made only for the purposes of,-

| (i) | purchase of foreign currency from foreign tourists or non-residents visiting India or from resident Indians on their return to India, in cash as per the directions or guidelines issued by Reserve Bank of India; or | |

| (ii) | disbursement of inward remittances to the recipient beneficiaries in India in cash under Money Transfer Service Scheme (MTSS) of the Reserve Bank of India; |

and a certificate is furnished by the authorised dealers and their franchise agentand sub-agent, and the Full-Fledged Money Changers (FFMC) and their franchise agent to the bank that withdrawal is only for the purposes specified above and the directions or guidelines issued by the Reserve Bank of India have been adhered to.

Explanation – For the purposes of this notification, “authorised dealer” means a person authorised as an authorised dealer under sub-section (1) of section 10 of the Foreign Exchange Management Act, 1999 (42 of 1999).

2. The notification shall be deemed to have come into force with effect from the 1st day of September, 2019.

Explanatory Memorandum : It is certified that no person is being adversely affected by giving retrospective effect to this notification.

2.1 Credit of TDS deducted :

Person can adjust this TDS deducted u/s 194N at the time of filing of his Income Tax Return

_______________________________________________

This post helped you in following searches

Section 194N Exemption Income Tax,Amendment in Section 194N,

section 194n exemption ,tds on cash withdrawal section 194n

Notification on Section 194N, 194N TDS Section pdf, 194N of Income Tax Act pdf, tds on cash withdrawal in hindi, 2 percent TDS on Cash withdrawal, cash withdrawal limit for individuals,Notifiation No 70/2019 Income tax

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal