Section 194N TDS on Cash Withdrawal New rules for FY 2025-26

Section 194N TDS on Cash Withdrawal covering its provisions with examples:

Section 194N: TDS on Cash Withdrawals

Section 194N of the Income Tax Act addresses the Tax Deducted at Source (TDS) on cash withdrawals exceeding specified limits. This section aims to discourage large cash transactions and promote digital payments.

Applicability:

- This section applies to cash withdrawals from banks (private, public, and cooperative), post offices.

- TDS is deducted by the bank or post office when the cash payment to a person exceeds the specified limits.

- The section applies to individuals, HUFs, companies, partnership firms, LLPs, AOPs, and BOIs.

Exemptions:

Section 194N is not applicable to withdrawals made by the following persons:

- Central or state government

- Private or public sector bank

- Any cooperative bank

- Post office

- Business correspondent of any bank

- White label ATM operator of any bank

- Central government specified commission agents or traders operating under Agriculture Produce Market Committee (APMC) for making payment to the farmers on account of purchase of agriculture produce

- Authorized dealers and its franchise agent and sub-agent and Full-Fledged Money Changer (FFMC) licensed by RBI and its franchise agents

- Any other person notified by the Government in consultation with RBI.

Notification NO. 68/2019 (F.NO. 370142/12/2019-TPL)], DATED 18-9-2019 provides a specific exemption from TDS under Section 194N for Cash Replenishment Agencies (CRAs) and franchise agents of White Label Automated Teller Machine Operators (WLATMOs).

Key Points:

- Exemption from TDS: CRAs and franchise agents of WLATMOs are exempt from TDS under Section 194N when withdrawing cash for replenishing ATMs operated by the WLATMOs.

- Conditions for Exemption:

- The CRA or franchise agent must maintain a separate bank account exclusively for ATM cash replenishment.

- The WLATMO must furnish a monthly certificate to the bank confirming that the CRA’s or franchise agent’s account has been examined and the withdrawn amount matches the cash deposited in the ATMs.

- Effective Date: The exemption is deemed to have come into force on September 1, 2019.

Rationale:

- Avoids Double TDS: This exemption prevents CRAs and franchise agents from facing TDS on cash withdrawals meant solely for ATM replenishment, as the WLATMO would already be subject to TDS on their cash withdrawals.

- Ensures Smooth ATM Operations: By exempting CRAs and franchise agents, the notification ensures smooth cash flow for ATM replenishment and avoids unnecessary TDS complications.

Implications:

- Reduced Compliance Burden: CRAs and franchise agents benefit from reduced TDS compliance burden and avoid the need to claim refunds.

- Facilitates Cash Management: The exemption simplifies cash management for WLATMOs and their partners.

Important Notes:

- Separate Bank Account: It’s crucial for CRAs and franchise agents to maintain a dedicated bank account for ATM cash replenishment to avail of this exemption.

- Monthly Certification: WLATMOs need to ensure timely submission of the monthly certificate to the bank to comply with the exemption conditions.

NOTIFICATION NO. 123/2024/F. NO. 275/39/2021-IT(B)], DATED 28-11-2024 brings an important exemption under Section 194N of the Income-tax Act, 1961

Key Points:

- Exemption from TDS: Foreign representations, including diplomatic missions, UN agencies, international organizations, consulates, and offices of honorary consuls, are now exempt from TDS under Section 194N.

- Legal Basis: This exemption is granted based on the powers conferred by the fifth proviso to Section 194N, which allows the Central Government to specify exemptions in consultation with the Reserve Bank of India.

- Effective Date: The exemption is deemed to have come into force on December 1, 2024.

- Conditions for Exemption: The exemption applies to entities that are:

- Duly approved by the Ministry of External Affairs.

- Exempt from paying taxes in India as per the Diplomatic Relations (Vienna Convention) Act 1972 and the United Nations (Privileges and Immunities) Act 1947.

Implications:

- No TDS on Cash Withdrawals: These foreign representations can now withdraw cash from their bank accounts in India without TDS being deducted, regardless of the amount.

- Facilitates Operations: This exemption simplifies financial operations for these entities, as they no longer need to worry about TDS on cash withdrawals or claiming refunds.

- Promotes International Relations: By exempting these entities, India reinforces its commitment to facilitating smooth diplomatic relations and international cooperation.

Important Notes:

- Documentation: Banks might still require these entities to provide necessary documentation to prove their eligibility for the exemption.

- Specific Guidelines: Banks and foreign representations should refer to any circulars or guidelines issued by the relevant authorities for detailed implementation instructions.

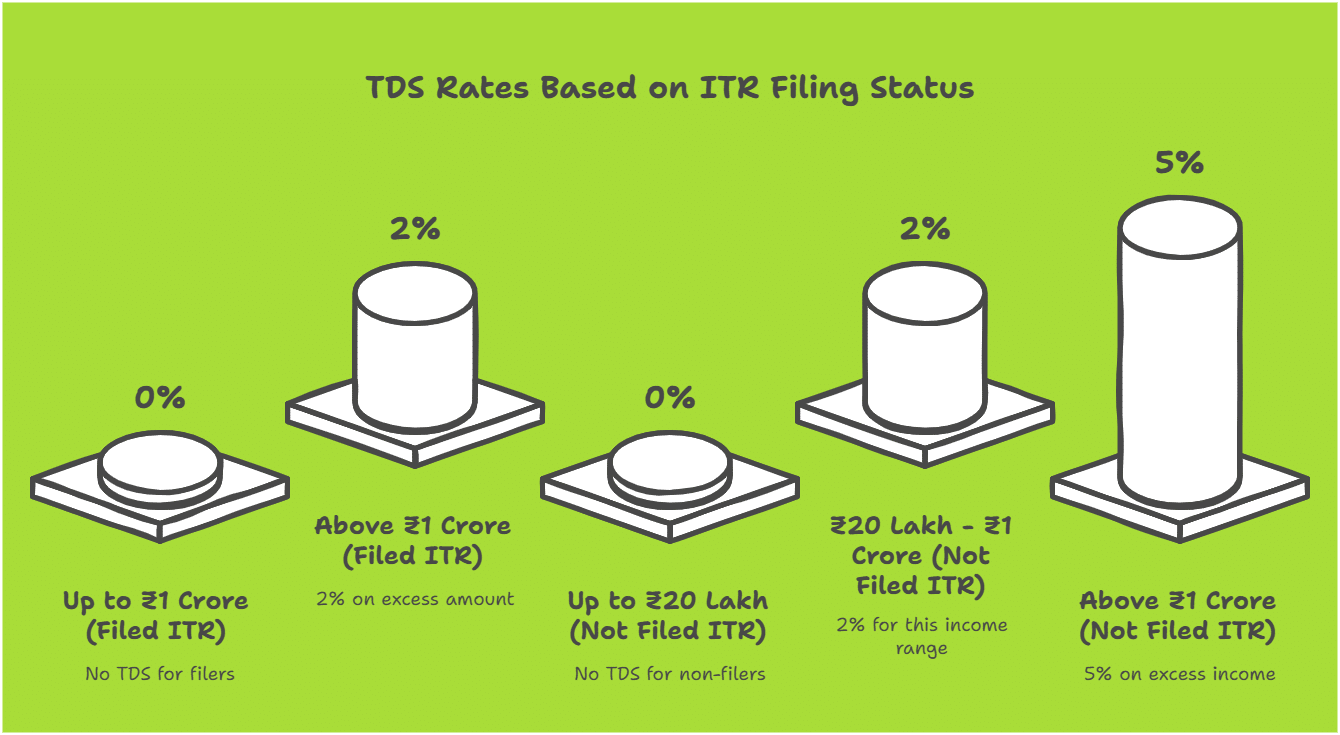

TDS Rates:

The TDS rates under Section 194N depend on whether the individual has filed their Income Tax Returns (ITR) for the past three years:

| Withdrawal Amount (FY) | TDS Rate (ITR filed for the last 3 years) | TDS Rate (ITR not filed for the last 3 years) |

| Up to ₹20 lakh | Nil | Nil |

| ₹20 lakh – ₹1 crore | Nil | 2% |

| Above ₹1 crore | 2% | 5% |

Key Points:

Thresholds and TDS Rates:

- General Rule: 2% TDS on cash withdrawals exceeding ₹1 crore in a financial year.

- Non-filers of ITR (last 3 years):

- 2% TDS on withdrawals exceeding ₹20 lakh up to ₹1 crore.

- 5% TDS on withdrawals exceeding ₹1 crore.

- Co-operative Societies: 3 Crore rupee threshold.

Examples:

- Individual filing ITR regularly: If an individual has filed their ITR for the past three years and withdraws ₹1.2 crore in cash, TDS will be deducted at 2% on ₹20 lakh (amount exceeding ₹1 crore).

- Individual not filing ITR: If an individual hasn’t filed their ITR for the past three years and withdraws ₹50 lakh in cash, TDS will be deducted at 2% on ₹30 lakh (amount exceeding ₹20 lakh). If the same individual withdraws ₹1.5 crore, TDS will be deducted at 2% on ₹80 lakh (₹1 crore – ₹20 lakh) and at 5% on ₹50 lakh (₹1.5 crore – ₹1 crore).

- Multiple bank accounts: The ₹1 crore threshold applies to the aggregate of withdrawals across all accounts held with a particular bank. If a person has accounts in multiple banks, the ₹1 crore limit applies separately to each bank.

Examples of Section 194N TDS

Section 194N TDS on Cash Withdrawals – Examples

| Scenario | ITR Filing Status (Last 3 Years) | Withdrawal Amount (₹) | TDS Applicable? | TDS Calculation | TDS Amount (₹) |

| Individual withdraws ₹90 lakh | Filed | 90,00,000 | No | Below ₹1 crore limit | 0 |

| Cooperative Society withdraws ₹3.5 crore | Filed | 3,50,00,000 | Yes | 2% of (3,50,00,000 – 3,00,00,000) = 2% of 50,00,000 | 1,00,000 |

| Individual withdraws ₹40 lakh | Not Filed | 40,00,000 | Yes | 2% of (40,00,000 – 20,00,000) = 2% of 20,00,000 | 40,000 |

| Individual withdraws ₹1.75 crore | Not Filed | 1,75,00,000 | Yes | 2% of (1,00,00,000 – 20,00,000) + 5% of (1,75,00,000 – 1,00,00,000) = 2% of 80,00,000 + 5% of 75,00,000 | 535000 |

| Individual withdraws From Bank A ₹70 lakh Bank B ₹60 lakh | Filed | 70,00,000 (Bank A) + 60,00,000 (Bank B) | No | Below ₹1 crore limit per bank | 0 |

| Individual withdraws from Bank A ₹15 lakh Bank B ₹30 lakh | Not Filed | 15,00,000 (Bank A) + 30,00,000 (Bank B) | Yes (Bank B) | 2% of (30,00,000 – 20,00,000) = 2% of 10,00,000 (Bank B) | 20,000 (Bank B) |

| Business correspondent of a banking company withdraws ₹2 crore | N/A | 2,00,00,000 | No | Exempt under Section 194N | 0 |

Key to Abbreviations:

- ITR: Income Tax Return

- N/A: Not Applicable

This table should provide a clear and concise overview of how TDS under Section 194N is applied in different scenarios.

Different scenarios with varying withdrawal amounts and ITR filing statuses:

Scenario: An individual who has filed ITR for the past three years withdraws a total of ₹90 lakh in cash from their bank account during the financial year.

- TDS Calculation: Since the withdrawal amount is less than ₹1 crore, no TDS will be deducted.

Scenario: A cooperative society has filed ITR and withdraws ₹3.5 crore in cash.

- TDS Calculation: TDS will be deducted at 2% on ₹50 lakh (₹3.5 crore – ₹3 crore).

Scenario: An individual who has not filed ITR for the past three years withdraws ₹40 lakh in cash.

- TDS Calculation: TDS will be deducted at 2% on ₹20 lakh (₹40 lakh – ₹20 lakh).

Scenario: An individual who has not filed ITR for the past three years withdraws ₹1.75 crore in cash.

- TDS Calculation: TDS will be deducted at 2% on ₹80 lakh (₹1 crore – ₹20 lakh) and at 5% on ₹75 lakh (₹1.75 crore – ₹1 crore).

Scenario: An individual has accounts in two different banks. They have filed ITR. They withdraw ₹70 lakh from Bank A and ₹60 lakh from Bank B.

- TDS Calculation: No TDS will be deducted. The ₹1 crore limit applies per bank.

Scenario: An individual has accounts in two different banks. They have not filed ITR. They withdraw ₹15 lakh from Bank A and ₹30 lakh from Bank B.

- TDS Calculation: TDS will be deducted only for the withdrawal from Bank B. Since the withdrawal from Bank A is less than ₹20 lakh, no TDS will be deducted. For Bank B, TDS will be deducted at 2% on ₹10 lakh (₹30 lakh – ₹20 lakh).

Scenario: A business correspondent of a banking company withdraws ₹2 crore in cash.

- TDS Calculation: No TDS will be deducted as business correspondents are exempt under Section 194N.

Cash Withdrawal from Saving Account and Current Accounts of Same Bank

Facts:

- Withdrawal: ₹20 Lakh from Savings Account + ₹20 Lakh from Current Account = ₹40 Lakh total

- Bank: Same bank (SBI)

- ITR Filing: No returns filed in the last 3 years

Section 194N TDS Example: Multiple Account Withdrawals

| Feature | Details | Amount (₹) |

| Withdrawal 1 | Savings Account Withdrawal (SBI) | 20,00,000 |

| Withdrawal 2 | Current Account Withdrawal (SBI) | 20,00,000 |

| Total Withdrawal | Savings + Current Account (Same Bank) | 40,00,000 |

| ITR Filing Status | No returns filed for the past 3 financial years | N/A |

| Threshold Limit | ₹20,00,000 (due to non-filing of ITR) | 20,00,000 |

| Taxable Amount | Total Withdrawal – Threshold Limit (40L – 20L) | 20,00,000 |

| TDS Rate | 2% | 2% |

| TDS Amount | 2% of Taxable Amount (2% of 20,00,000) | 40000 |

Key Takeaways:

- Because the individual has not filed ITRs for the past three years, the lower ₹20 Lakh threshold applies.

- The withdrawals from both the Savings and Current Accounts are aggregated since they are from the same bank (SBI).

- TDS of ₹40,000 will be deducted by SBI.

Cash Withdrawal from Saving Account and Current Accounts of Different Banks

Facts:

- Withdrawal: ₹20 Lakh from Savings Account of SBI + ₹20 Lakh from Current Account of ICICI = ₹40 Lakh total

- Bank: SBI Bank and ICICI Bank

- ITR Filing: No returns filed in the last 3 years

Section 194N TDS Example: Multiple Banks

| Feature | Details | Amount (₹) |

| Withdrawal 1 | Savings Account Withdrawal (SBI) | 20,00,000 |

| Withdrawal 2 | Current Account Withdrawal (ICICI) | 20,00,000 |

| Total Withdrawal | Savings (SBI) + Current (ICICI) | 40,00,000 |

| ITR Filing Status | No returns filed for the past 3 financial years | N/A |

| Threshold Limit | ₹20,00,000 (per bank due to non-filing of ITR) | 20,00,000 (each) |

| Taxable Amount | SBI: 20L – 20L = 0; ICICI: 20L – 20L = 0 | 0 (each) |

| TDS Rate | 2% | 2% |

| TDS Amount | SBI: 2% of 0 = 0; ICICI: 2% of 0 = 0 | 0 (each) |

Key Takeaways:

- Even though the total withdrawal is ₹40 Lakh, it is split between two different banks.

- The ₹20 Lakh threshold applies per bank due to non-filing of ITR.

- Since neither bank individually crosses the threshold, no TDS will be deducted.

Important Note: This highlights how maintaining accounts with multiple banks can impact TDS under Section 194N, especially for those who haven’t filed ITR in the past 3 years.

Cash Withdrawal from Joint Account

- Account Type: Joint Savings Account held by two individuals (A and B)

- Withdrawal: ₹30 Lakh withdrawn in cash

- ITR Filing:

- A has filed ITR for the last 3 years

- B has not filed ITR for the last 3 years

Analysis:

- Whose ITR matters? This is where it gets tricky. The law doesn’t explicitly address joint accounts.

- Possible Interpretations:

- Stricter: The bank may apply the stricter rule (non-filer) to the entire withdrawal, leading to TDS on ₹10 Lakh.

- Proportionate: The bank might apply TDS proportionately based on each holder’s share and ITR filing status. This would be more complex to calculate.

- Practical Approach: Banks often take the cautious approach and deduct TDS assuming the stricter rule.

Why this is important:

- Awareness: Joint account holders need to be aware of this potential issue.

- Planning: If one holder hasn’t filed ITR, consider filing it to avoid higher TDS.

- Communication: Clear communication with the bank is crucial to understand their TDS deduction policy for joint accounts.

NRI Accounts: How does Section 194N apply to Non-Resident Indian accounts?

This is where things get a bit more complex! The application of Section 194N to Non-Resident Indian (NRI) accounts depends on several factors, and the rules have evolved over time.

General Rule:

- As per the current provisions (amended up to FA 2024), Section 194N generally applies to NRI accounts as well. This means that if an NRI withdraws cash exceeding the specified limits (₹1 crore or ₹20 lakh, depending on ITR filing), TDS will be applicable.

Scenario: NRI withdrawing cash from NRO Account

- Account Type: Non-Resident Ordinary Rupee (NRO) Account

- Withdrawal: ₹80 Lakh withdrawn in cash

- Purpose: Personal expenses in India

- ITR Filing: NRI has filed ITR for the last 3 years

- Residential Status: Non-Resident Indian (NRI)

Analysis:

Applicability of Section 194N:

- Section 194N generally applies to all accounts, including NRO accounts.

- Since the withdrawal is less than ₹1 Crore and the NRI has filed ITR for the last 3 years, the regular threshold applies.

TDS Applicability:

- As the withdrawal amount (₹80 Lakh) is less than the threshold limit of ₹1 Crore, no TDS will be deducted under Section 194N.

Tax Implications:

- While there’s no TDS under Section 194N, the NRI might still have tax liability on the income that was deposited into the NRO account (e.g., rental income, interest income).

- The NRI will need to file their income tax return and pay taxes according to their applicable tax slab.

Exceptions and Considerations:

- Specific Exemptions: The Central Government, in consultation with the RBI, can notify exemptions for certain categories of recipients, which may include NRIs. It’s crucial to check for any specific notifications that might exempt NRIs or provide for reduced TDS rates.

- Residential Status: The residential status of the NRI (RNOR or RNRI) can impact tax liability and TDS applicability.

- Source of Income: The source of the funds in the NRI account (income earned in India or abroad) can also be a factor.

- DTAA: If there’s a Double Taxation Avoidance Agreement (DTAA) between India and the NRI’s country of residence, the provisions of the DTAA might override the domestic TDS provisions.1

- Repatriation: If the cash withdrawal is for repatriation of funds, specific RBI regulations and FEMA guidelines will also apply.

Practical Challenges:

- Determining Applicability: It can be challenging for banks to determine the exact TDS applicability for NRI accounts due to the various factors involved.

- Documentation: NRIs might need to provide additional documentation to prove their residential status, source of income, etc., to claim exemptions or lower TDS rates.

- Tax Implications: NRIs need to be aware of the tax implications of cash withdrawals and plan accordingly to minimize their tax burden.

Recommendations:

- Consult a Tax Advisor: For NRIs, it’s highly advisable to consult a tax advisor specializing in NRI taxation to understand the TDS implications and ensure compliance with all relevant regulations.

- Check for Updates: Tax laws and regulations are subject to change. NRIs should stay updated on the latest rules related to cash withdrawals and TDS.

Scenario: NRI Repatriating Funds from NRE Account

- Account Type: Non-Resident External Rupee (NRE) Account

- Withdrawal: ₹1.2 Crore withdrawn in cash

- Purpose: Repatriation of funds to the NRI’s country of residence

- ITR Filing: NRI has filed ITR for the last 3 years

- Residential Status: Non-Resident Indian (NRI)

Analysis:

Applicability of Section 194N:

- Section 194N applies to all accounts, including NRE accounts.

- Since the withdrawal exceeds ₹1 Crore, TDS at 2% will apply on the amount exceeding ₹1 Crore.

- TDS Amount: 2% of (₹1.2 Crore – ₹1 Crore) = 2% of ₹20 Lakh = ₹40,000

Repatriation and FEMA:

- Repatriation of funds from an NRE account is generally allowed freely under the Foreign Exchange Management Act (FEMA) regulations.

- However, there might be specific documentation requirements or limits depending on the purpose of repatriation and the NRI’s country of residence.

Tax Implications:

- NRE funds are usually tax-free in India. This means the NRI generally doesn’t have to pay income tax on the interest earned on their NRE account.

- However, the TDS deducted under Section 194N will need to be considered while filing the income tax return. The NRI can claim credit for this TDS or request a refund if their total tax liability is lower than the TDS amount.

Key Considerations:

- Documentation: The NRI might need to provide documentation to support the repatriation, such as a reason for repatriation and proof of their overseas bank account.

- Limits: While repatriation from NRE accounts is generally free, there might be limits on the amount that can be repatriated in a single transaction or within a specific period.

- Currency Exchange: The NRI will need to consider currency exchange rates when repatriating funds.

Recommendations:

- Consult with Bank: Contact your bank to understand the specific documentation requirements and any limits related to repatriation from your NRE account.

- Currency Exchange: Compare exchange rates offered by different banks or money changers to get the best deal.

- Tax Advice: If you have complex tax situations or are unsure about the tax implications, it’s always advisable to consult a tax advisor specializing in NRI taxation.

This is a crucial scenario, as it highlights the stricter TDS provisions for non-filers of ITR. Let’s analyze it:

Scenario: NRI Non-Filer Making Cash Withdrawal

- Account Type: NRO Account (though the type matters less in this case)

- Withdrawal: ₹60 Lakh withdrawn in cash

- Purpose: General use

- ITR Filing: NRI has not filed ITR for the past 3 years

- Residential Status: Non-Resident Indian (NRI)

Analysis:

Applicability of Section 194N:

- As always, Section 194N applies.

- Crucial here is that the NRI has not filed ITR. This triggers the lower threshold and higher TDS rate.

TDS Applicability:

- Lower Threshold: ₹20 Lakh applies instead of ₹1 Crore.

- Higher Rate: Since the withdrawal (₹60 Lakh) exceeds ₹20 Lakh, TDS will be deducted.

- TDS Calculation:

- 2% on the amount between ₹20 Lakh and ₹1 Crore: 2% of (₹60 Lakh – ₹20 Lakh) = ₹8,000

- 5% on the amount exceeding ₹1 Crore (not applicable in this case)

- Total TDS: ₹8,000

Key Takeaways for NRIs:

- ITR Filing is Crucial: Even if you don’t have tax liability in India, filing ITR helps avoid higher TDS on cash withdrawals.

- Understand the Rules: Be aware of the different TDS thresholds and rates based on ITR filing status.

- Plan Withdrawals: If you need to withdraw a significant amount and haven’t filed ITR, consider doing so beforehand to minimize TDS.

- Seek Professional Advice: Tax laws for NRIs can be complex. Consult a tax advisor to understand your obligations and optimize your tax position.

How to Check TDS rate on cash withdrawal u/s 194N

you can check on Income Tax India website under Quick Links under the Head ” TDS on Cash Withdrawal”

FAQ’s on TDS on Cash Withdrawal

From when is TDS on cash withdrawal u/s 194N of the Act applicable?

TDS on cash withdrawal u/s 194N of the Act is applicable starting 1st September 2019, or FY 2019-2020 onwards

What are the objectives of Section 194N?

- To discourage excessive cash usage and encourage digital transactions.

- To track high-value cash withdrawals for better accountability.

- To minimize black money circulation by ensuring traceability of transactions.

- To regulate high-value cash withdrawals, reduce dependence on cash transactions, and promote digital payments.

What is the purpose of TDS in Section 194N TDS on Cash Withdrawal ?

- To eradicate big cash withdrawals from bank accounts and eradicate black money in India.

What is the applicability of Section 194N TDS on Cash Withdrawal ?

- Applies to any cash withdrawals made by an individual from a bank account exceeding ₹1 crore during the financial year.

- It applies to the withdrawal of all the sum of money or the aggregate of all sums from a bank,1 cooperative bank, or post office in a financial year.

What is the rate of TDS under Section 194N?

- 2% on cash withdrawals exceeding ₹1 crore in a financial year if you have filed income tax returns.

- If you have not filed ITRs for any of the three preceding assessment years:

- 2% on cash withdrawals between ₹20 lakh and ₹1 crore.

- 5% on cash withdrawals exceeding ₹1 crore.

What are the latest changes in Section 194N?

- On cash withdrawals that exceed the prescribed limits, banks and post offices must deduct TDS (tax deducted at source), which is refundable.

- Non-compliance leads to higher TDS rates, directly affecting liquidity.

What are the latest changes in Section 194N?

- If the assessee has not filed an income tax return for the preceding three fiscal years, TDS will be deducted at the rate of 2% on amounts withheld ranging rom ₹20 lakh to ₹1 crore, and 5% on amounts above ₹1 crore for the fiscal year.

- If the assessee has filed an income tax return for the current year, there is no TDS deduction applicable; however, there is a 2% TDS deduction on amounts of one crore.4

Is TDS under Section 194N refundable?

- Yes, the TDS deducted under Section 194N can be claimed as a refund or adjusted against the total tax liability while filing the income tax return for the corresponding financial year.

- To claim a refund, your annual income must not exceed the basic exemption limit. Also, it is mandatory to file an ITR if you want to claim a refund of TDS under section 194N.

How is TDS under Section 194N calculated?

- Determine the total cash withdrawn: Add up all cash withdrawals made from a single account during the financial year.

- Check compliance history: Determine if the account holder has filed income tax returns for the previous three assessment years.7

- Apply the relevant threshold: Based on the compliance history, apply the appropriate threshold limit (₹1 crore or ₹20 lakh).

- Calculate TDS: If the total withdrawals exceed the threshold, apply the relevant TDS rate (2% or 5%) on the excess amount.

Can exemptions be claimed under Section 194N?

- Yes, exemptions can be claimed. Examples include:

- Government bodies.

- Banks and co-operative banks.

- Specific other entities like business correspondents of banks.

- Yes, exemptions can be claimed. Examples include:

How do I claim my 194N TDS refund?

- While filing your income tax return, you can claim the TDS deducted under Section 194N as a refund or adjust it against your total tax liability for that financial year.

How do I treat Section 194N in income tax?

- According to section 194N of the Act, TDS has to be deducted if a sum or aggregate of sum withdrawn in cash by a person in a particular FY exceeds : ₹ 20 lakh (if no ITR has been filed for all the three previous AYs), or. ₹ 1 crore (if ITRs have been filed for all or any one of three previous AYs).9

How do I avoid TDS under Section 194N?

- Utilizing digital payment methods for transactions to avoid exceeding the cash withdrawal limits.

- Maintaining detailed records of cash withdrawals to accurately report income tax returns.

- Filing ITR’s regualarly.

- exploring investment options to reduce taxable income and optimize tax efficiency.

Form 15G/H: Can these forms be used to avoid TDS under Section 194N?

Form 15G/H cannot be used to avoid TDS under Section 194N.

Here’s why:

- Purpose of Form 15G/H: These forms are used to declare that your income is below the taxable limit and hence, no TDS should be deducted on certain incomes like interest, dividends, or rent.1

- Section 194N is Different: This section deals specifically with TDS on cash withdrawals exceeding specified limits. It’s not related to the nature of your income or whether it’s taxable.

- No Provision for Form 15G/H: The law governing Section 194N doesn’t include any provision for using Form 15G/H to avoid TDS.

Therefore, even if you submit Form 15G/H, the bank is still obligated to deduct TDS under Section 194N if your cash withdrawal exceeds the applicable threshold.

Alternatives to Avoid TDS:

- File ITR: If you’re eligible for a lower TDS threshold (₹1 crore) by filing ITR, ensure you file your returns regularly.

- Reduce Cash Withdrawals: Consider using digital payment methods or other alternatives to minimize cash withdrawals and avoid exceeding the threshold.

Important Note: Always consult with a tax advisor if you have complex tax situations or are unsure about the TDS rules. They can provide personalized guidance based on your specific circumstances.