Section 206c(1d) of Income Tax act

Section 206c(1d) of Income-tax Act, 1961 after Amendment by Finance Act , 2016

(1D) Every person, being a seller, who receives any amount in cash as consideration for sale of bullion or jewellery or any other goods (other than bullion or jewellery) or providing any service , shall, at the time of receipt of such amount in cash, collect from the buyer, a sum equal to one per cent of sale consideration as income-tax, if such consideration,—

(i) for bullion, exceeds two hundred thousand rupees; or

(ii) for jewellery, exceeds five hundred thousand rupees; or

(iii) for any goods, other than those referred to in clauses (i) and (ii), or any service, exceeds two hundred thousand rupees:

Provided that no tax shall be collected at source under this sub-section on any amount on which tax has been deducted by the payer under Chapter XVII-B.

Read Also CBDT Circulars :- TCS on Cash Sale , CBDT issued 2nd Circular for Clarification , TCS on sale of Motor Vehicle : CBDT clarify via FAQ

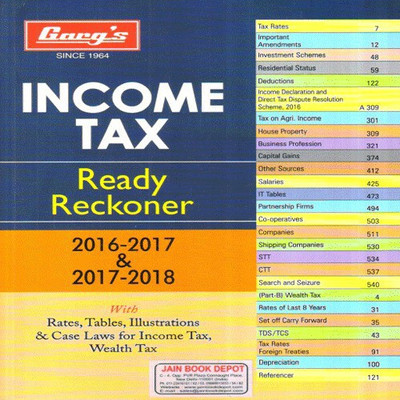

Sponsored Book

Related Post

- TCS on cash sale of goods or services > Rs 2 Lakh wef 1.6.16

- TCS on Sale of motor Vehicle above Rs 10 Lakh w.e.f 01.06.2016

- e-TDS / TCS returns through e-filing portal https://incometaxindiaefiling.gov.in

- TCS Penalty as per Income tax Act

- TCS on Sale of Motor Vehicle above Rs 10 Lakh , Goods or Services in Cash above 2 Lakh

- Penalty deleted as the Assessee was not aware of TCS provisions

- TCS on sale of Imported Timber

- TCS Govt A/c : Revised time and mode of Payment

- TDS Rates and Limit revised w.e.f 01.06.2016

- TDS Statement Upload Online -Procedure

- TDS on Commission paid to agent for rendering services abroad

- No TDS on sum paid for services rendered outside india

- NO TDS on VSAT /lease line charges paid to NSE/BSE

- No tds on sale of agricultural land

- NO TDS on Service tax

- Not liable to Deduct TDS in case amendment with retrospective effect

- TDS can not be demanded from deductor if taxes paid by deductee : SC

- No TDS on leasehold rights payment for long period say 99 years

- Employer not liable to deduct TDS @ 20% for non furnishing of PAN by Employees

- No TDS on payment of transmission charges u/s 194J

- Payer not Liable to Deduct TDS if Payee income is exempt

- No TDS on Rent if declaration in 15G/15H w.e.f 01.06.2016

- No TDS on Service Tax Component of Rent

- No TDS on Provision of Interest u/s194A if provision reversed

- No TDs on interest on FDR made on direction of Courts :CBDT

- No TDS on Reimbursement Expenses if separate bills raised

- No TDS on Interest on FCCB issued to foreign investors and utilized for verseas business

- NO TDS liability under Section 195 if Book entry passed reversed Subsequently

- No TDS Under Secction 194LA as Land Acquired by Mutual negotiation and not compulsory acquisition

- No TDS under section 194LA if land owners surrendered their land to municipal corporation for under development right certificates scheme

- No TDS on Compensation paid to evacuate slum dwellers

- No TDS on purchase of negative rights of films

- Section 194I No TDS on Lease payment for allotment of plot for 80 years

- Purchase of software is not payment for royalty, not liable to TDS

- TDS on Purchase of Property : FAQ’s

- Assessee not to be called for TDS deducted but not Deposited by Deductor : CBDT

- Debenture Interest charged in Profit and Loss A/c but not paid would not attract TDS under Section 193

- Sum paid for internet connection not liable for TDS under section 194J

- Additional amount Paid to Purchaser on cancellation of Flat is not interest under section 2(28A) hence No TDS

- Period of default of TDS for Interest recovery is from date of deductibility till date of actual payment of tax

- CBDT clarify TDS issues on payments made by Television channels, Broadcasters and Newspapers

- TDS on Payment to Contractor : section 194C

- TDS Rates and Limit revised w.e.f 01.06.2016

- TDS on Payment to harvester / transporter of Sugarcane from Farmers field

- Payment to intermediaries for hiring of transport for carriage of goods is also liable for TDS u/s 194C

- Even in case of oral contract with transporters TDS is liable to be deducted u/s 194C

- Purchases made after payment of excise duty and availment of credit can not be held as job work, no TDS under section 194C

- TDS on Provision for Expenses

- Section 194C payments to newspaper publishers

- No TDS on Reimbursement Expenses if separate bills raised

- All About 26AS (TDS, Refund , AIR information )

- 40(a)(ia) TDS default based on opinion of CA was bona fide mistake , No Penalty

- section 40(a)(i) No TDS Disallowance if Expenses Capitalised

- section 40(a)(ia) Payer not liable for TDS default due to retrospective amendments

- 40(a)(ia) Disallowance for TDS default if books rejected by AO

- Apply for non deduction of TDS u/s 195 even if person was subjected to concealment penalty