Reset Income tax efiling Password

Step 1 to reset income tax efiling password

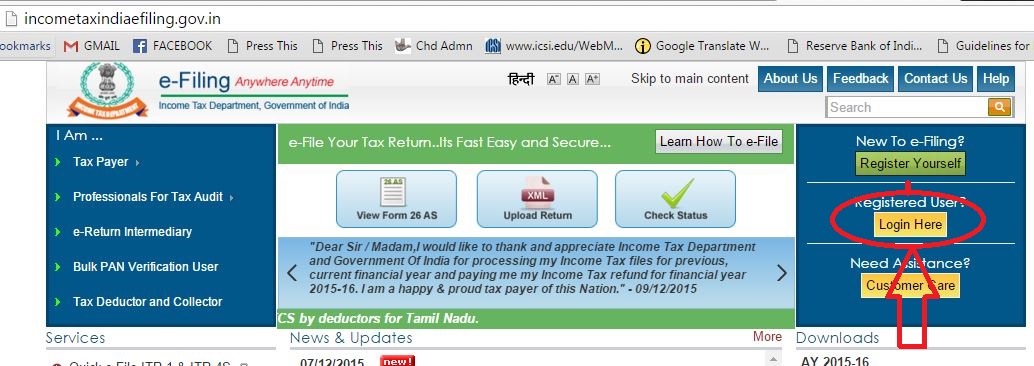

go to the website www.incometaxindiaefiling.gov.in and click on login

Step 2 to reset income tax efiling password

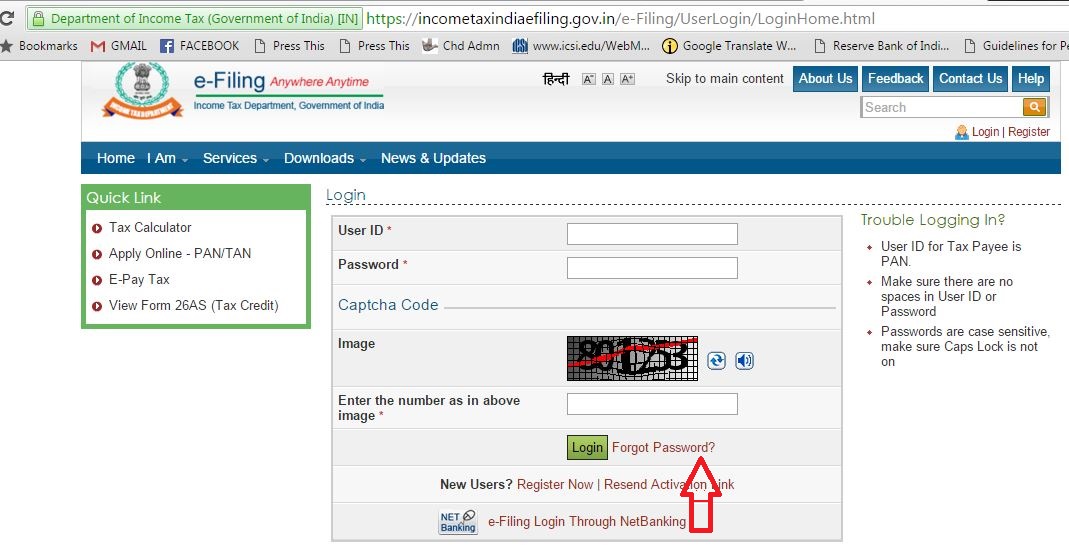

Click on forgot password as highlighted below

Step 3 to reset income tax efiling password

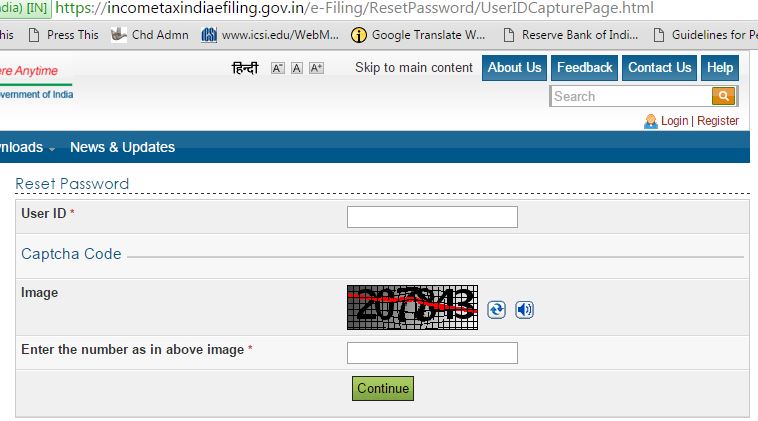

Enter user ID (which is your PAN) and image captcha number

Step 4 to reset income tax efiling password

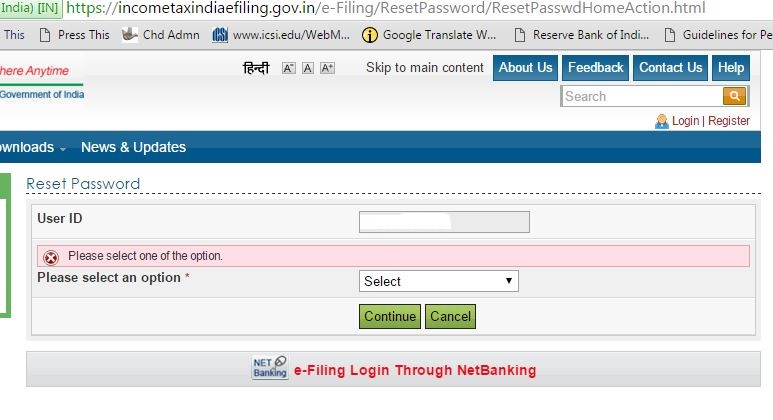

select any one of the following option to reset income tax efiling password

1 Answer Secret question

2 Upload digital Signature certificate

3 Using OTP Pins (SMS is sent on your registered mobile no and E mail ID with income tax department)

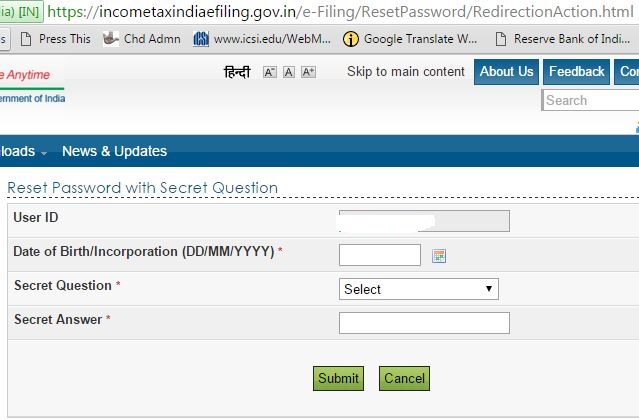

Option No 1 :Answer Secret question

Than you have to fill your Date of Birth and select question (which you have choosen at the time of registration with the income tax efiling website )

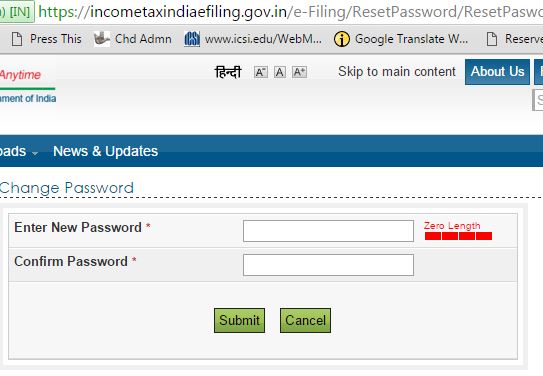

Than it will give you the option to enter new password

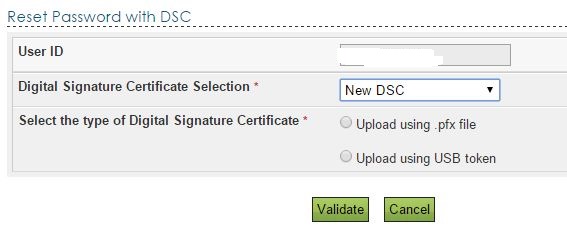

Option No 2 :Digital Signature certificate

It will ask

- New DSC

- Registered DSC (With incometaxefiling website )

Whether you select new DSC or registered DSC the following screen will appear.

If you have token of digital signatures (Its like Pen drive ) than select USB token and upload your Digital signatures. (Note :-You must install DSC drivers on your computer so that your DSC can run)

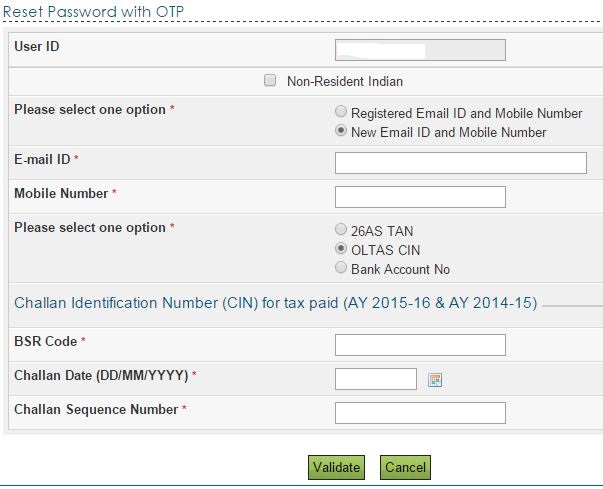

Option No 3 : Using OTP (One time Password ) pins

New screen will open which will ask to select one of the following Option to send one time Passwords at

- Registered E mail ID and Mobile Number (If you have given to the income tax department at the time of registration)

- New E Mail ID and Mobile Number

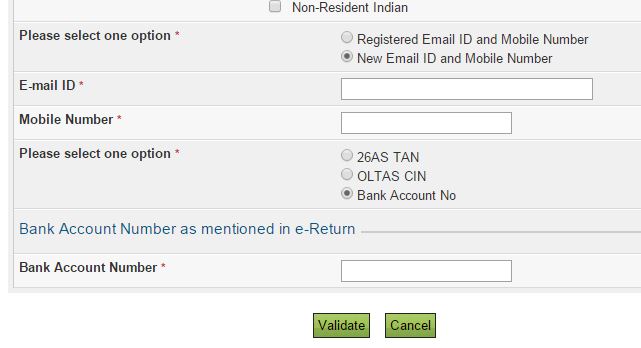

If you select new E Mail ID and Mobile Number than the following screen will appear

which will ask you to select :-

- 26 AS TAN (TAN number of Deductor of Income tax e.g in case of Fixed Deposit Receipts (FDR) normally Banks deduct TDS on Interest and they file TDS return using their TAN and issue your Form No 16A, or in case of Salaried employee , employer deduct TDS and issue you Form No 16. Thus you can trace the TAN of Deductor from form no 16/16A issued by TDS deductor)

- OLTAS CIN [If you have paid income tax (even of Rs 10) than you can use that challan no to generate your new password ]

- you need to enter BSR code mentioned on the challan

- Date of Income tax challan

- Challan Sequence number

- Bank account number ( If you have earlier filed income tax return using online facility on incometaxindiaefiling.gov.in then the bank account number given in that return will be entered here)

Related Post