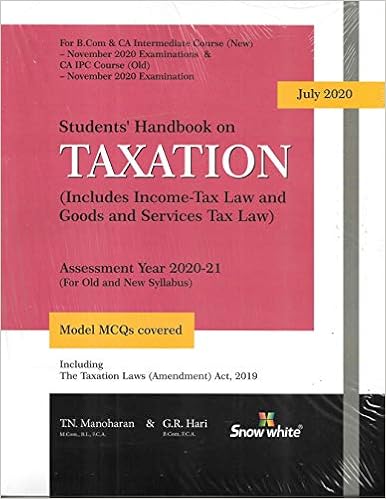

Student’s Handbook on Taxation (Includes Income-Tax Law and Goods and Services Tax Law)

Price Rs 1145 Click here to Buy online

Concise presentation of the provisions of the income-tax law as amended by the Finance Act (no.2), 2019 relevant for CA intermediate course (new) and CA (integrated professional competence) course (old) and B.Com examination broad overview of concepts and General Principles relating to income-tax law and Goods and Services Tax law, with apt illustrations have been given for easy understanding.

Easy approach to learn the principles relating to computation of taxable income under each head of in come together with suitable formats prescribe apt illustrations, case studies and exercises are provided for practice of students’ multiple choice questions (MCQ) have been included at the end of this book.

“Summary of key points” is provided at the end of each Chapter so as to enable the students to comprehend and grasp the subject in an effective manner.

Questions of Past 21 Examinations of the Institute of chartered accountants of India suitably modified and answered on the Basis of law applicable for the Assessment Year 2020-21, are included Chapter wise. Problems on computation of total income and Tax liability are solved exclusively.

Recent amendments, though incorporated at appropriate places, are separately listed in appendix in order to enable effective revision by the students.

Topic wise Exclusions from the CA intermediate course (new) and CA (integrated professional competence) course (old) as per the ICAI study guidelines have been dealt according.