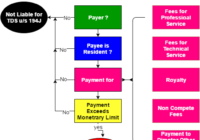

TDS U/s. 194J applicable and Not salary tds u/s 192 on Fees shared between hospital & doctors : HC

Issue :Revenue’s contention that the Respondent Assessee, a trust, running a hospital, had to deduct the tax at source under Section 192 (salary) of the Income Tax Act, 1961 Held ;Significant features of the contractual relationship between the doctors and the hospital in the present case were that the hospital would provide support service where a… Read More »