TCS -Tax Collected at Source -Complete Guide

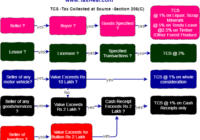

TCS -Tax Collected at Source TCS Tax Collected at Source under Income Tax Act Section 206 Table of Contents on TCS Sr No Contents 1.1 Who is responsible to collect tax at source under section 206C 1.2 Specified goods in Section 206C(1) 1.3 Who is a seller under Section 206C 1.4 Who is a buyer… Read More »