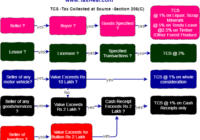

TCS Rates for FY 2018-19 (AY 2019-20)

TCS Rates for FY 2018-19 (AY 2019-20) RATES FOR TAX COLLECTION AT SOURCE Notes on TCS Rates for FY 2018-19 (AY 2019-20) :- During the financial year 2018-19, tax shall be collected under section 206C of Income Tax Act at the rates given in the table (infra). If PAN of collectee is not intimated to the collector, tax will… Read More »